BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MORE ON CENTRAL NATIONAL BANK<br />

MORE ON CENTRAL NATIONAL BANK<br />

Central National Bank has been an <strong>FHLBank</strong><br />

member since 1996. With more than $800<br />

million in assets, CNB is a cornerstone<br />

to 20 small- to mid-sized communities<br />

throughout Kansas, and also has a branch in<br />

Superior, Neb.<br />

FHLBANK MEMBERSHIP<br />

VALUE<br />

Ed Meekins, Central National’s EVP and COO<br />

recalled, “When we first joined <strong>FHLBank</strong><br />

<strong>Topeka</strong> in 1996, we joined for two reasons.<br />

One was to have a backup source of liquidity<br />

beyond our traditional relationships with<br />

correspondent banks to meet our short-term<br />

borrowing needs. The second was for the<br />

ability to match fund long-term loans.”<br />

Now, 11 years later, CNB’s line of credit with<br />

<strong>FHLBank</strong> <strong>Topeka</strong> has become much more<br />

important as its balance sheet has grown<br />

and liquidity volatility has come into play.<br />

“We went through a period in September<br />

where we went from $10 million in excess<br />

funds available for overnight investing to<br />

$30 million in overnight borrowing in the<br />

course of two weeks,” said Jim Van Slyke,<br />

CNB’s CFO. “The largest source of borrowing<br />

we tapped into at the time was our<br />

<strong>FHLBank</strong> line of credit. It’s very nice to have<br />

that available without having to pledge<br />

securities as collateral. And to be able to tap<br />

into that with a simple phone call!”<br />

While CNB’s primary value in its membership<br />

comes in the form of its line of credit<br />

with <strong>FHLBank</strong>, Jim also takes <strong>FHLBank</strong>’s<br />

stock into consideration. “The dividends<br />

we receive from our stock investment with<br />

<strong>FHLBank</strong> <strong>Topeka</strong> make it a good asset to<br />

have,” he said. “The returns that we’re getting<br />

on our <strong>FHLBank</strong> stock compares very favorably<br />

to our other investments right now, so<br />

we see it as an extra bonus.”<br />

ON COMMUNITY<br />

As participating financial institutions in the<br />

Mortgage Partnership Finance Program;<br />

frequent users of the Rural First-time<br />

Homebuyer and Targeted Ownership<br />

programs as illustrated in the previous<br />

pages and participation in the Community<br />

Housing Program, CNB clearly understands<br />

how to meet the needs of their mortgage<br />

customers. A recent $25,000 Joint<br />

Opportunities for Success grant for a loan<br />

pool in Minneapolis, Kan. is also bolstering<br />

that community’s economic growth.<br />

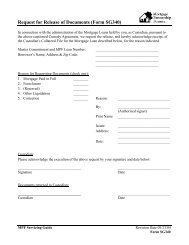

L to R: Ed Meekins, CNB EVP; Terry Wright, <strong>FHLBank</strong> account manager; and Jim Van Slyke, CNB CFO, in the<br />

lobby of Central National Bank’s facility in <strong>Topeka</strong>.<br />

“<strong>THE</strong> RETURNS<br />

WE’RE GETTING<br />

ON OUR FHLBANK<br />

STOCK COMPARE<br />

FAVORABLY TO OUR<br />

O<strong>THE</strong>R INVEST-<br />

MENTS RIGHT NOW,<br />

SO WE SEE IT AS AN<br />

EXTRA BONUS.”<br />

- JIM VAN SLYKE, CFO<br />

CENTRAL NATIONAL<br />

BANK<br />

FHLBANK PRODUCTS<br />

AND SERVICES USED:<br />

Advances<br />

Line of Credit<br />

Overnight Deposits<br />

Safekeeping Services<br />

MPF® Program<br />

Rural First-time Homebuyer<br />

Program<br />

Targeted Ownership Program<br />

Community Housing Program<br />

Joint Opportunities for Building<br />

Success grant<br />

16<br />

<strong>FHLBank</strong> Focus | Winter 2007