BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

BEWARE THE PERFECT STORM - FHLBank Topeka

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

HOMEOWNERSHIP IN <strong>THE</strong> HEARTLAND<br />

CENTRAL NATIONAL BANK<br />

MAKING HOMEOWNERSHIP A PRIORITY IN<br />

JUNCTION CITY, KANSAS<br />

Loan originators at Central National<br />

Bank know a good deal when they see<br />

one. They’ve got a great thing going<br />

with <strong>FHLBank</strong> <strong>Topeka</strong>’s Rural First-time<br />

Homebuyer Program (RFHP), which, since<br />

2005, has helped more than 20 Central<br />

National customers get into a home by<br />

providing down payment or closing cost<br />

assistance.<br />

Since 2005, CNB has used $74,239 in <strong>FHLBank</strong><br />

RFHP funds to help its customers realize the<br />

American Dream of homeownership. Tina<br />

Barker, vice president of CNB’s Mortgage<br />

Banking division, said, “The majority of<br />

potential homebuyers in our market don’t<br />

have money saved up for a down payment.<br />

We get calls on a daily basis from consumers<br />

wanting to know if there is any down payment<br />

assistance available. <strong>FHLBank</strong> <strong>Topeka</strong>’s<br />

funds are making a huge difference for new<br />

homebuyers.” CNB has also recently begun<br />

accessing a modified version of RFHP that<br />

assists first-time homebuyers who are disabled<br />

or who have a family member who<br />

is disabled. <strong>FHLBank</strong>’s Targeted Ownership<br />

Program (TOP) offers $4,000 in down payment<br />

assistance and closing costs to disabled<br />

homebuyers.<br />

Debra Lovgren, a native of Junction City,<br />

received TOP funds from CNB and <strong>FHLBank</strong><br />

in 2007. Debra’s mother, Joyce, is nearly completely<br />

blind due to complications from diabetes.<br />

The mother-daughter duo has lived<br />

together since 1996 with Debra lovingly<br />

serving as her mother’s caretaker.<br />

“I’ve always been a mama’s girl,” Debra said.<br />

“They called me her shadow when I was<br />

growing up. Wherever she went, I went.”<br />

Now her mother is often Debra’s shadow,<br />

grasping her daughter’s elbow as she leads<br />

her out to the porch or into the next room<br />

of their new home.<br />

During all the years they’ve lived in rental<br />

properties, Debra has dreamed of sitting<br />

at her own kitchen table in her own home<br />

just looking out the window. Today, she<br />

can do that very thing thanks to the down<br />

payment assistance she’s received. “I sit at<br />

the table and I open up the blinds, and I<br />

just look outside and my mom will be like,<br />

‘What are you doing’ And I’ll say, ‘Oh, I’m<br />

just sitting here looking out the window.’”<br />

Adam Litzinger, a loan originator at CNB,<br />

used to work with Debra at Wal-Mart in<br />

Junction City where Debra still works as a<br />

service manager. When she came through<br />

the doors of Central National looking for a<br />

home loan, Adam immediately thought of<br />

<strong>FHLBank</strong>’s down payment program. “When<br />

I saw Debra, I remembered that her mother<br />

was visually impaired, and I knew she’d be eligible<br />

for <strong>FHLBank</strong>’s TOP funds,” Adam said.<br />

By Laura Maag Lutz<br />

AVP, Congressional and Community Outreach<br />

<strong>FHLBank</strong> <strong>Topeka</strong><br />

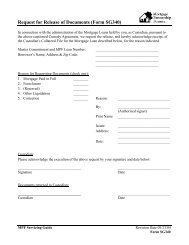

L to R: Michele Carter, <strong>FHLBank</strong> AHP homeowner program supervisor; Central National Bank’s Adam Litzinger, loan<br />

originator; Tina Barker, CNB’s VP/mortgage banking division; Steve Barker, CNB’s VP/mortgage lending; and<br />

Jessie Nikkel, CNB loan originator, have collaborated to provide nearly $75,000 in down payment assistance to CNB<br />

customers since 2005.<br />

Michele Carter, supervisor of <strong>FHLBank</strong>’s<br />

homeowner programs, said, “We hope our<br />

<strong>FHLBank</strong> customers will remember that in<br />

addition to the RFHP, they also have access<br />

to this other program, TOP, to assist disabled<br />

homebuyers.”<br />

Barker says CNB will make an extra effort<br />

in 2008 to promote the availability of TOP<br />

funds in their service areas. “We have plans<br />

to reach out to some of the Special Olympic<br />

groups as well as other groups that have<br />

families that could benefit from these funds<br />

who probably don’t know they’re available.”<br />

On nice days, Debra likes sitting outside on<br />

the porch watching her spirited miniature<br />

Dachsund challenge the big dog next door<br />

to races up and down the fence line. “We<br />

can even sit outside on the porch if it’s raining,<br />

because the roof was redone before we<br />

moved in,” Debra added. Her mom says of<br />

14<br />

<strong>FHLBank</strong> Focus | Winter 2007