Retail Cube Prospectus - RCG Corporation

Retail Cube Prospectus - RCG Corporation

Retail Cube Prospectus - RCG Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10. Material contracts<br />

10.1 Material contracts<br />

The Directors consider the material contracts<br />

described below and elsewhere in this <strong>Prospectus</strong><br />

are the contracts which an investor would<br />

reasonably regard as material and which<br />

investors and their professional advisors<br />

would reasonably expect to find described in<br />

this <strong>Prospectus</strong> for the purpose of making<br />

an informed assessment of the Offer.<br />

This is only a summary of the material<br />

contracts and their substantive terms. To obtain<br />

a complete understanding of the contracts, it<br />

is necessary to read them in full. Full copies<br />

of the material contracts will be available for<br />

inspection at the registered office of the Company<br />

without charge during normal office hours after<br />

the lodgement of this <strong>Prospectus</strong> with ASIC.<br />

10.1.1 Share Purchase Agreements<br />

The principal purpose of the Offer is to finance<br />

the Company’s acquisition of the Groups. The<br />

Company has entered into a separate Share<br />

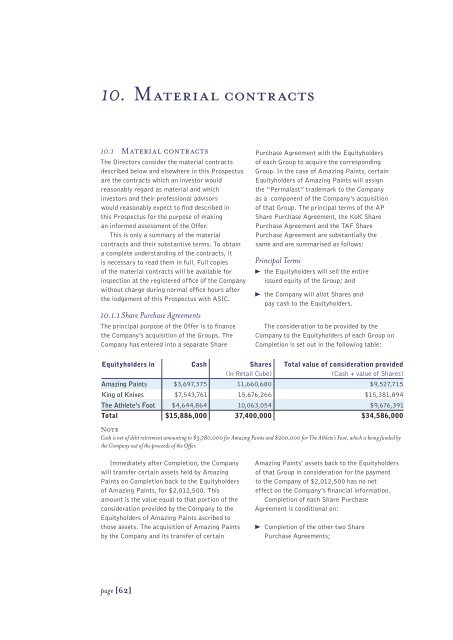

Equityholders in Cash Shares<br />

(in <strong>Retail</strong> <strong>Cube</strong>)<br />

Immediately after Completion, the Company<br />

will transfer certain assets held by Amazing<br />

Paints on Completion back to the Equityholders<br />

of Amazing Paints, for $2,012,500. This<br />

amount is the value equal to that portion of the<br />

consideration provided by the Company to the<br />

Equityholders of Amazing Paints ascribed to<br />

those assets. The acquisition of Amazing Paints<br />

by the Company and its transfer of certain<br />

Purchase Agreement with the Equityholders<br />

of each Group to acquire the corresponding<br />

Group. In the case of Amazing Paints, certain<br />

Equityholders of Amazing Paints will assign<br />

the “Permalast” trademark to the Company<br />

as a component of the Company’s acquisition<br />

of that Group. The principal terms of the AP<br />

Share Purchase Agreement, the KoK Share<br />

Purchase Agreement and the TAF Share<br />

Purchase Agreement are substantially the<br />

same and are summarised as follows:<br />

Principal Terms<br />

the Equityholders will sell the entire<br />

issued equity of the Group; and<br />

the Company will allot Shares and<br />

pay cash to the Equityholders.<br />

The consideration to be provided by the<br />

Company to the Equityholders of each Group on<br />

Completion is set out in the following table:<br />

Total value of consideration provided<br />

(Cash + value of Shares)<br />

Amazing Paints $3,697,375 11,660,680 $9,527,715<br />

King of Knives $7,543,761 15,676,266 $15,381,894<br />

The Athlete’s Foot $4,644,864 10,063,054 $9,676,391<br />

Total $15,886,000 37,400,000 $34,586,000<br />

Note<br />

Cash is net of debt retirement amounting to $3,780,000 for Amazing Paints and $200,000 for The Athlete’s Foot, which is being funded by<br />

the Company out of the proceeds of the Offer.<br />

page [62]<br />

Amazing Paints’ assets back to the Equityholders<br />

of that Group in consideration for the payment<br />

to the Company of $2,012,500 has no net<br />

effect on the Company’s financial information.<br />

Completion of each Share Purchase<br />

Agreement is conditional on:<br />

Completion of the other two Share<br />

Purchase Agreements;