Retail Cube Prospectus - RCG Corporation

Retail Cube Prospectus - RCG Corporation

Retail Cube Prospectus - RCG Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

to enable <strong>Retail</strong> <strong>Cube</strong> to obtain<br />

finance to fund working capital and<br />

future acquisitions as required;<br />

to establish the Company’s infrastructure as<br />

the holding company of the Groups; and<br />

to place the Company in a position to<br />

acquire new retailing businesses of a similar<br />

size and with similar characteristics to the<br />

Groups should the opportunity arise.<br />

The Directors believe that, on the<br />

successful closing of this Offer, <strong>Retail</strong> <strong>Cube</strong><br />

will have enough working capital to carry out<br />

its objectives stated in this <strong>Prospectus</strong>.<br />

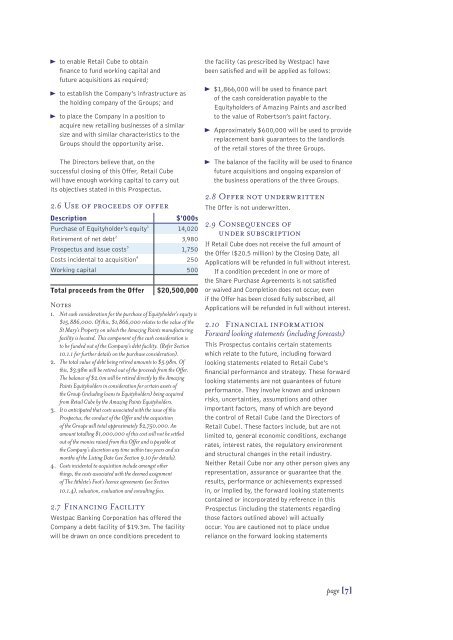

2.6 Use of proceeds of offer<br />

Description $’000s<br />

Purchase of Equityholder’s equity 1<br />

Retirement of net debt 2<br />

<strong>Prospectus</strong> and issue costs 3<br />

14,020<br />

3,980<br />

1,750<br />

Costs incidental to acquisition 4 250<br />

Working capital 500<br />

Total proceeds from the Offer $20,500,000<br />

Notes<br />

1. Net cash consideration for the purchase of Equityholder’s equity is<br />

$15,886,000. Of this, $1,866,000 relates to the value of the<br />

St Mary’s Property on which the Amazing Paints manufacturing<br />

facility is located. This component of the cash consideration is<br />

to be funded out of the Company’s debt facility. (Refer Section<br />

10.1.1 for further details on the purchase consideration).<br />

2. The total value of debt being retired amounts to $5.98m. Of<br />

this, $3.98m will be retired out of the proceeds from the Offer.<br />

The balance of $2.0m will be retired directly by the Amazing<br />

Paints Equityholders in consideration for certain assets of<br />

the Group (including loans to Equityholders) being acquired<br />

from <strong>Retail</strong> <strong>Cube</strong> by the Amazing Paints Equityholders.<br />

3. It is anticipated that costs associated with the issue of this<br />

<strong>Prospectus</strong>, the conduct of the Offer and the acquisition<br />

of the Groups will total approximately $2,750,000. An<br />

amount totalling $1,000,000 of this cost will not be settled<br />

out of the monies raised from this Offer and is payable at<br />

the Company’s discretion any time within two years and six<br />

months of the Listing Date (see Section 9.10 for details).<br />

4. Costs incidental to acquisition include amongst other<br />

things, the costs associated with the deemed assignment<br />

of The Athlete’s Foot’s licence agreements (see Section<br />

10.1.4), valuation, evaluation and consulting fees.<br />

2.7 Financing Facility<br />

Westpac Banking <strong>Corporation</strong> has offered the<br />

Company a debt facility of $19.3m. The facility<br />

will be drawn on once conditions precedent to<br />

the facility (as prescribed by Westpac) have<br />

been satisfied and will be applied as follows:<br />

$1,866,000 will be used to finance part<br />

of the cash consideration payable to the<br />

Equityholders of Amazing Paints and ascribed<br />

to the value of Robertson’s paint factory.<br />

Approximately $600,000 will be used to provide<br />

replacement bank guarantees to the landlords<br />

of the retail stores of the three Groups.<br />

The balance of the facility will be used to finance<br />

future acquisitions and ongoing expansion of<br />

the business operations of the three Groups.<br />

2.8 Offer not underwritten<br />

The Offer is not underwritten.<br />

2.9 Consequences of<br />

under subscription<br />

If <strong>Retail</strong> <strong>Cube</strong> does not receive the full amount of<br />

the Offer ($20.5 million) by the Closing Date, all<br />

Applications will be refunded in full without interest.<br />

If a condition precedent in one or more of<br />

the Share Purchase Agreements is not satisfied<br />

or waived and Completion does not occur, even<br />

if the Offer has been closed fully subscribed, all<br />

Applications will be refunded in full without interest.<br />

2.10 Financial information<br />

Forward looking statements (including forecasts)<br />

This <strong>Prospectus</strong> contains certain statements<br />

which relate to the future, including forward<br />

looking statements related to <strong>Retail</strong> <strong>Cube</strong>’s<br />

financial performance and strategy. These forward<br />

looking statements are not guarantees of future<br />

performance. They involve known and unknown<br />

risks, uncertainties, assumptions and other<br />

important factors, many of which are beyond<br />

the control of <strong>Retail</strong> <strong>Cube</strong> (and the Directors of<br />

<strong>Retail</strong> <strong>Cube</strong>). These factors include, but are not<br />

limited to, general economic conditions, exchange<br />

rates, interest rates, the regulatory environment<br />

and structural changes in the retail industry.<br />

Neither <strong>Retail</strong> <strong>Cube</strong> nor any other person gives any<br />

representation, assurance or guarantee that the<br />

results, performance or achievements expressed<br />

in, or implied by, the forward looking statements<br />

contained or incorporated by reference in this<br />

<strong>Prospectus</strong> (including the statements regarding<br />

those factors outlined above) will actually<br />

occur. You are cautioned not to place undue<br />

reliance on the forward looking statements<br />

page [7]