annual review 2008 - Westchester Jewish Community Services

annual review 2008 - Westchester Jewish Community Services

annual review 2008 - Westchester Jewish Community Services

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

12<br />

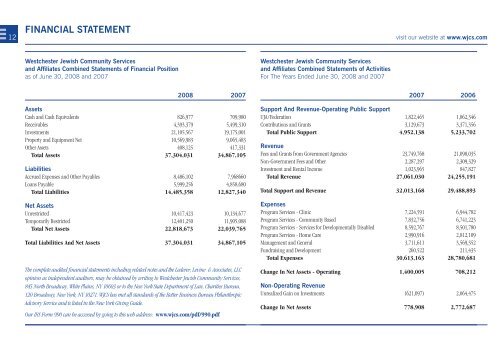

FINANCIAL STATEMENT<br />

visit our website at www.wjcs.com<br />

<strong>Westchester</strong> <strong>Jewish</strong> <strong>Community</strong> <strong>Services</strong><br />

and Affiliates Combined Statements of Financial Position<br />

as of June 30, <strong>2008</strong> and 2007<br />

<strong>Westchester</strong> <strong>Jewish</strong> <strong>Community</strong> <strong>Services</strong><br />

and Affiliates Combined Statements of Activities<br />

For The Years Ended June 30, <strong>2008</strong> and 2007<br />

<strong>2008</strong> 2007<br />

Assets<br />

Cash and Cash Equivalents 826,977 709,980<br />

Receivables 4,393,379 5,499,310<br />

Investments 21,105,567 19,175,001<br />

Property and Equipment Net 10,569,983 9,065,483<br />

Other Assets 408,125 417,331<br />

Total Assets 37,304,031 34,867,105<br />

Liabilities<br />

Accrued Expenses and Other Payables 8,486,102 7,968660<br />

Loans Payable 5,999,256 4,858,680<br />

Total Liabilities 14,485,358 12,827,340<br />

Net Assets<br />

Unrestricted 10,417,423 10,134,677<br />

Temporarily Restricted 12,401,250 11,905,088<br />

Total Net Assets 22,818,673 22,039,765<br />

Total Liabilities And Net Assets 37,304,031 34,867,105<br />

The complete audited financial statements including related notes and the Lederer, Levine & Associates, LLC<br />

opinion as independent auditors, may be obtained by writing to <strong>Westchester</strong> <strong>Jewish</strong> <strong>Community</strong> <strong>Services</strong>,<br />

845 North Broadway, White Plains, NY 10603 or to the New York State Department of Law, Charities Bureau,<br />

120 Broadway, New York, NY 10271. WJCS has met all standards of the Better Business Bureau Philanthropic<br />

Advisory Service and is listed in the New York Giving Guide.<br />

Our IRS Form 990 can be accessed by going to this web address: www.wjcs.com/pdf/990.pdf<br />

2007 2006<br />

Support And Revenue-Operating Public Support<br />

UJA/Federation 1,822,465 1,862,346<br />

Contributions and Grants 3,129,673 3,371,356<br />

Total Public Support 4,952,138 5,233,702<br />

Revenue<br />

Fees and Grants from Government Agencies 23,749,768 21,098,035<br />

Non-Government Fees and Other 2,287,297 2,309,329<br />

Investment and Rental Income 1,023,965 847,827<br />

Total Revenue 27,061,030 24,255,191<br />

Total Support and Revenue 32,013,168 29,488,893<br />

Expenses<br />

Program <strong>Services</strong> - Clinic 7,224,591 6,944,782<br />

Program <strong>Services</strong> - <strong>Community</strong> Based 7,832,756 6,741,223<br />

Program <strong>Services</strong> - <strong>Services</strong> for Developmentally Disabled 8,592,767 8,501,780<br />

Program <strong>Services</strong> - Home Care 2,990,916 2,812,109<br />

Management and General 3,711,611 3,569,352<br />

Fundraising and Development 260,522 211,435<br />

Total Expenses 30,613,163 28,780,681<br />

Change In Net Assets - Operating 1,400,005 708,212<br />

Non-Operating Revenue<br />

Unrealized Gain on Investments (621,097) 2,064,475<br />

Change In Net Assets 778,908 2,772,687