Dr. Heinz Jörg Fuhrmann - Schau Verlag Hamburg

Dr. Heinz Jörg Fuhrmann - Schau Verlag Hamburg

Dr. Heinz Jörg Fuhrmann - Schau Verlag Hamburg

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A keen eye on the future: <strong>Dr</strong>. Wolfgang Leese working out at the Group’s own gym<br />

performance and that of our competitors<br />

whose figures are significantly less impressive.<br />

The reasons for this lies in the measures<br />

I have already referred to as well as the<br />

profitability improvement programs that<br />

have contributed several hundreds of millions<br />

of euros to our bottom line. Management<br />

and a combination of managers and<br />

employees with good ideas, suggestions for<br />

improvement and personal commitment<br />

have also played a substantial part.<br />

stil Salzgitter has taken some important<br />

steps on the path to growth with the acquisition<br />

of precision tubes manufacturer Vallourec<br />

Précision Étirage and a stake of<br />

around 86 percent in plant and equipment<br />

manufacturer Klöckner-Werke. What were<br />

the intentions behind this?<br />

leese Besides the significant world market<br />

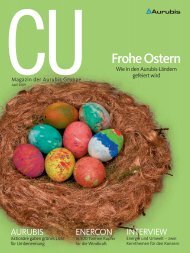

Steel<br />

External sales: � 3, 7 billion<br />

positions in different product segments<br />

that these acquisitions have brought us,<br />

we are creating added value for our shareholders.<br />

stil Klöckner-Werke operates in an industry<br />

in which Salzgitter AG has not previously<br />

been involved. What were the objectives for<br />

this commitment?<br />

leese Klöckner-Werke AG forms the nucleus<br />

of our new Technology Division<br />

which offers the prospect of continuous<br />

growth that will in turn have a stabilizing<br />

effect on the Group.<br />

stil Will there be any further growth of this<br />

kind, maybe at the new Technology Division?<br />

leese Certain rounding-off acquisitions<br />

and expansions are currently under consideration<br />

at this division.<br />

Salzgitter Group<br />

External sales cons.: � 10,1 billion Employees: 24 000<br />

Tubes<br />

External sales: � 2, 04 billion<br />

Trading<br />

External sales: � 5,021 billion<br />

PHOTO: PETER LENKE<br />

stil You took up your present post in the<br />

year 2000 with the motto of “independence<br />

through profitability and growth”. How secure<br />

is the Group’s business independence?<br />

leese In the light of our success in recent<br />

years, the firm position of the State government<br />

and the comments made by<br />

Minister President Christian Wulff, our<br />

other stable shareholders and the buyback<br />

of ten percent of our shares, I am less<br />

concerned about our independence.<br />

stil The process of concentration in the steel<br />

industry continues unabated. Salzgitter regards<br />

itself as a niche player. What opportunities<br />

and risks does this position hold?<br />

leese The continuing concentration process<br />

being played out among the dominant<br />

players in the steel industry offers some<br />

outstanding opportunities for us as a<br />

niche player. It is our high-quality products,<br />

our flexibility, our close ties to our<br />

customers and our reliability that set us<br />

apart.<br />

stil Where do your see Salzgitter AG in<br />

three years’ time?<br />

leese We are quite clear on that: We intend<br />

to continuously increase sales to between<br />

13 and 15 billion euros. And over the cycle<br />

we are targeting an ROCE (return on capital<br />

employed) of on average 15 percent.<br />

In addition to that, we also want to enhance<br />

our already positive image.<br />

stil Since you have been Chairman of the<br />

Executive Board, one of your main concerns<br />

has been to increase the willingness at all<br />

levels of hierarchy to embrace change. Are<br />

we fully up to speed by now?<br />

leese We’re moving, but future competition<br />

will make further demands on us<br />

with the result that we must become progressively<br />

faster and fitter.<br />

Services<br />

External sales: � 1,1 billion<br />

Technology<br />

External sales: � 0,5 billion<br />

The History of the Salzgitter Group<br />

Steel and the climate<br />

Steel is part of the solution, not the problem. New materials for the automotive sector<br />

Words like natural resources<br />

and energy efficiency are<br />

on everyone’s lips<br />

nowadays. Hardly a day<br />

passes without climate change featuring<br />

in news broadcasts, talk shows and documentaries.<br />

Only the emphasis varies, from<br />

cutting emission budgets in the context of<br />

CO 2 certificate trading, to missed trends<br />

in the automotive industry or attempts to<br />

ban light bulbs.<br />

The steel industry finds itself squarely involved<br />

in this irreversible process of discussion<br />

and development. On the one hand,<br />

there is the question of the CO 2 released by<br />

our production processes. On the other hand,<br />

however, it is also essential to consider the<br />

contribution that the use of our steels can<br />

make towards increasing our customers’<br />

energy efficiency.<br />

Input materials such as ore and scrap, reduction<br />

agents and energy account for up to<br />

three quarters of the cash cost of steel production<br />

in Germany. For this reason alone,<br />

there is of necessity a sustained economic<br />

pressure at all levels of our undertaking to<br />

conserve resources wherever possible in the<br />

production of steel. For example, iron effi-<br />

ciency has been increased to 0 percent to<br />

date. Similarly, the reduction of around 40<br />

percent since 1 0 in our specific primary energy<br />

consumption per ton of crude steel demonstrates<br />

the successful efforts we have made.<br />

But does this mean that, given the successes<br />

already achieved, the steel industry feels no<br />

further obligation to increase the resource and<br />

energy efficiency of its own production processes?<br />

Indeed not, for at Salzgitter the issue of<br />

efficiency is also an indicator of innovation.<br />

Our continuing achievements in the development<br />

of new materials for the automotive sector<br />

are a prime example. With the production<br />

here in Salzgitter of high- and ultra-highstrength<br />

steels for automotive applications we<br />

are already making a significant contribution<br />

towards protecting the climate. It has been<br />

shown that the development and use of these<br />

steels compensates for a good 15 percent of<br />

the process-dependent non-reducible emissions<br />

during manufacture. This is a great opportunity<br />

for steel products to prove themselves<br />

in the climate debate. Developments in<br />

the field of final-size casting offer the prospect<br />

of new steel grades for the automobile industry<br />

that will allow even greater scope for lightweight<br />

autobody designs. It is becoming very<br />

1923<br />

Foundation<br />

Klöckner Werke AG<br />

clear that in the debate on climate change,<br />

steel as a material is less a part of the problem<br />

than a future-oriented element in the endeavors<br />

by the economy as a whole to increase resource<br />

and energy efficiency.<br />

In future the companies that lead the field<br />

will be those that make most effective use of<br />

their employees’ skills and knowledge, not<br />

least in matters of resource-efficiency. An<br />

analysis of our profitability improvement<br />

program, as well as our employee suggestion<br />

scheme shows that almost a third of the<br />

achievements made concern the consumption<br />

of energy and resources. Climate change<br />

can only be overcome through the knowledge-based<br />

networking of processes and<br />

products. Hysteria and scaremongering will<br />

most certainly not resolve the problem. However,<br />

one-dimensional approaches such as<br />

curtailing highly efficient production as a result<br />

of emissions trading are equally unlikely<br />

to bring us any closer to the desired result.<br />

Making the most of the available opportunities<br />

on a global scale is dependent on deploying<br />

technically intelligent solutions as a helping<br />

hand to enable the developing economies<br />

to use resources and energy efficiently in their<br />

pursuit of growth.<br />

stil stil<br />

1858<br />

Foundation<br />

Ilseder Hütte<br />

1970<br />

Stahlwerke<br />

Peine-Salzgitter AG<br />

1989<br />

Preussag Stahl AG<br />

1998<br />

Salzgitter AG<br />

Steel and<br />

Technology<br />

1937<br />

Foundation<br />

“Reichswerke”<br />

1945<br />

Salzgitter<br />

Hüttenwerk AG<br />

1992/95<br />

Privatization<br />

and Integration<br />

1597<br />

Foundation<br />

Ilsenburger Kupferhammer<br />

1945<br />

Nationalization<br />

since 1946<br />

Production of heavy plate<br />

2000<br />

Acquisition MRW<br />

2007<br />

Acquisition KWAG<br />

1890<br />

Foundation<br />

Mannesmannröhren-<br />

Werke AG (MRW)<br />

1970<br />

Cooperation<br />

Thyssen (steel) /<br />

Mannesmann (tubes)<br />

2000<br />

Takeover by Vodafone<br />

1979<br />

Acquisition<br />

Holstein und Kappert<br />

1994<br />

Divestiture of the steel<br />

production