EAPCC_Annual_Report_.. - Investing In Africa

EAPCC_Annual_Report_.. - Investing In Africa

EAPCC_Annual_Report_.. - Investing In Africa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

EAST AFRICAN PORTLAND CEMENT COMPANY LIMITED<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS<br />

2010/2011<br />

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

FOR THE YEAR ENDED 30 JUNE 2011<br />

2. SIGNIFICANT ACCOUNTING POLICIES (continued)<br />

(d) Property, plant and equipment (continued)<br />

Depreciation<br />

No depreciation is provided on freehold land.<br />

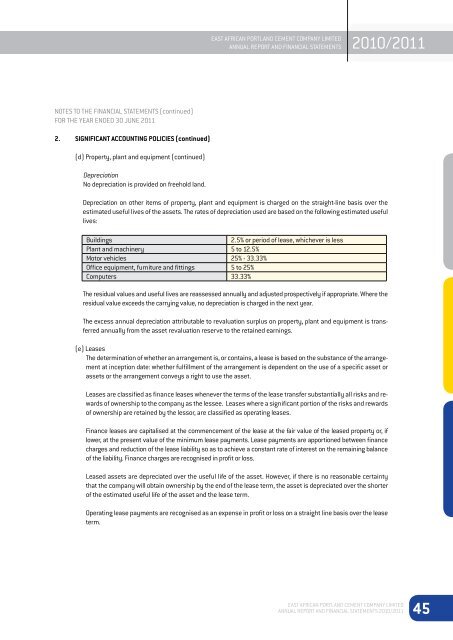

Depreciation on other items of property, plant and equipment is charged on the straight-line basis over the<br />

estimated useful lives of the assets. The rates of depreciation used are based on the following estimated useful<br />

lives:<br />

Buildings<br />

2.5% or period of lease, whichever is less<br />

Plant and machinery 5 to 12.5%<br />

Motor vehicles 25% - 33.33%<br />

Office equipment, furniture and fittings 5 to 25%<br />

Computers 33.33%<br />

The residual values and useful lives are reassessed annually and adjusted prospectively if appropriate. Where the<br />

residual value exceeds the carrying value, no depreciation is charged in the next year.<br />

The excess annual depreciation attributable to revaluation surplus on property, plant and equipment is transferred<br />

annually from the asset revaluation reserve to the retained earnings.<br />

(e) Leases<br />

The determination of whether an arrangement is, or contains, a lease is based on the substance of the arrangement<br />

at inception date: whether fulfillment of the arrangement is dependent on the use of a specific asset or<br />

assets or the arrangement conveys a right to use the asset.<br />

Leases are classified as finance leases whenever the terms of the lease transfer substantially all risks and rewards<br />

of ownership to the company as the lessee. Leases where a significant portion of the risks and rewards<br />

of ownership are retained by the lessor, are classified as operating leases.<br />

Finance leases are capitalised at the commencement of the lease at the fair value of the leased property or, if<br />

lower, at the present value of the minimum lease payments. Lease payments are apportioned between finance<br />

charges and reduction of the lease liability so as to achieve a constant rate of interest on the remaining balance<br />

of the liability. Finance charges are recognised in profit or loss.<br />

Leased assets are depreciated over the useful life of the asset. However, if there is no reasonable certainty<br />

that the company will obtain ownership by the end of the lease term, the asset is depreciated over the shorter<br />

of the estimated useful life of the asset and the lease term.<br />

Operating lease payments are recognised as an expense in profit or loss on a straight line basis over the lease<br />

term.<br />

EAST AFRICAN PORTLAND CEMENT COMPANY LIMITED<br />

ANNUAL REPORT AND FINANCIAL STATEMENTS 2010/2011 45