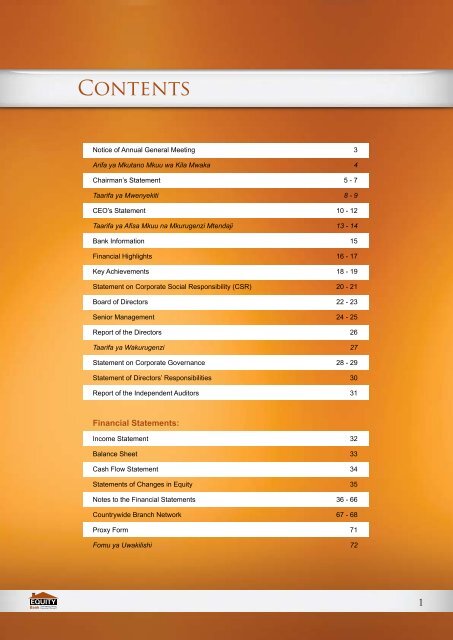

Contents - Equity Bank Group

Contents - Equity Bank Group

Contents - Equity Bank Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notice of Annual General MeetingNotice is hereby given that the Fourth Annual GeneralMeeting (AGM) of the shareholders of <strong>Equity</strong> <strong>Bank</strong>Limited will be held on 25th June 2008 at KenyattaInternational Conference Centre (KICC) Nairobi at10.00 am to transact the following business:1. To read the notice convening the meeting.5. To fix the remuneration of the directors.6 To note that the auditors Messrs Ernst & Young,being eligible and having expressed their willingness,will continue in office in accordance with section159(2) of the Companies Act (Cap 486) and toauthorize the directors to fix their remuneration.2. To receive, consider and if thought fit, adopt theAnnual Report and Financial Statements for theyear ended 31st December 2007 together withthe Chairman’s, Directors’ and Auditors’ reportsthereon.7. Any other business of which notice will have beenduly received.By order of the Board3. To approve a first and final dividend for the yearended 31st December 2007 of Kshs 2.00 perordinary share of Kshs 5.00 par value subject towithholding tax where applicable.4. Election of Directors:a) Mr. Peter Kahara Munga retires in accordancewith Article 100 of the Company’s Articles ofAssociation and being eligible, offers himselffor re-election.Mary Wangari WamaeCompany SecretaryNAIROBI, 22nd May 2008NOTE:b) Mr. Julius Kangogo Kipng’etich retires inaccordance with Article 100 of the Company’sArticles of Association and being eligible, offershimself for re-election.c) Mr. Peter Njeru Gachuba retires in accordancewith Article 100 of the Company’s Articles ofAssociation and being eligible, offers himselffor re-election.d) Mr Babatunde Temitope Soyoye having beenappointed as a director since the date of the lastAnnual General Meeting retires in accordancewith Article 101 of the Company’s Articles andbeing eligible offers himself for election.e) Mr Temitope Olugbeminiyi Lawani having beenappointed as a director since the date of the lastAnnual General Meeting retires in accordancewith Article 101 of the Company’s Articles andbeing eligible offers himself for election.1) A member entitled to attend and vote at themeeting and who is unable to attend is entitledto appoint a proxy to attend and vote on his orher behalf. A proxy need not be a member of theCompany. To be valid, a form of proxy must beduly completed by the member and lodged with theCompany Secretary at the Company’s Head Officesituate in NHIF BUILDING 14TH FLOOR, not laterthan 10.00 am on 23rd June 2008 failing whichit will be invalid. In case of a corporate body, theproxy must be under its common seal.2) Subject to approval of shareholders, the Board ofDirectors has resolved to recommend to membersat the forthcoming Annual General Meeting adividend for the year 2007 of Kshs 2.00 per sharebeing 40% of par value to be paid to shareholderson the register at the close of business on 4th April2008. The dividend will be paid on or about 30thJune 2008. Helios EB Investors will not be eligiblefor the dividend.2007 Annual Report and Financial Statements 3

Chairman’s StatementMr. Peter K. Munga, EBSChairman (Mwenyekiti)2007 Annual Report and Financial Statements 5

Chairman’s Statement continued“...Your bank was also voted the Best <strong>Bank</strong> in Kenya in the prestigious 2007 EuromoneyAwards for Excellence... on the grounds of achievements in lending to the retail sectorand reaching out to the ‘unbanked’, pioneering efforts which bigger banks are tryingto keep up with……(and for exhibiting)… “The ability to innovate, react at speed andmake the best use of the inherent strength…..”INTRODUCTIONIt gives me great pleasure to welcome youto this year’s Annual General Meeting. Isincerely thank you for your support, whichhas translated to yet another successful yearfor your bank.OPERATING ENVIRONMENTEconomic indicators reflect that Kenya’seconomy performed well in the year 2007.Estimates from the Central <strong>Bank</strong> of Kenyaindicate that the annual growth rate wasabout 7% with key sectors such as financialservices, agriculture (horticulture), tourism,transport, construction, telecommunication,energy and manufacturing playing a criticalrole. The average annual underlying inflationrate increased to 5.2% owing to increased costof food and fuel while interest rates rose from6.0% to 7.5% before settling at 6.8% towardsthe end of the year.In the year under review, the shillingappreciated against major world currencieswith US Dollar moving from Kshs 69.36 to63.20; Sterling Pound moving from Kshs136.79to128.45; and the Japanese Yen moving fromKshs 59.47 to 56.52. In the capital marketthe NSE 20-Share Index declined marginallyclosing the year at 5,445 points down from5,646 points in 2006. However, the total marketcapitalization increased by 7.4% to Kshs 851billion from Kshs 792 billion.Under these favourable macroeconomicconditions, the banking sector remainedstable and continued to record impressiveperformance with profitability growing by33.9% and total assets expanding by 20.2%.The stock of non performing loans droppedto Kshs 59.1 billion from Kshs 103.8 billion.Liquidity in the market was relatively highwith a ratio of 40.65%, more than double thestatutory minimum requirement of 20%.EQUITY BANK PERFORMANCESince inception in 1984, your bank hascontinued to achieve its vision ofeconomically empowering Kenyans byoffering affordable financial services.The continued phenomenal growth andoutstanding performance has resulted innational and international recognitions of yourbank’s operations and corporate governance.We have continued to focus on strengtheningyour bank by building a solid institutionalfoundation. This is reflected through strongcredit rating where your bank achieved A+ forlong term and A1 for short term. In addition,the bank has continued to enhance efficiencyand effectiveness in service delivery througha robust information technology bankingplatform. The bank has maintained leadershipin offering innovative products and servicesresulting in increased market share. I amproud to report to you that the bank closedthe year with over 1.8 million bank accountsconstituting over 38% of all bank accounts inKenya.Our business model continues to be validatedthrough recognition and awards both locallyand internationally. During the year, at theinternational level, your bank was awardedthe prestigious 2007 Global Vision Award inMicrofinance as an “Initiator of a concept ofthe future that will shape the world economy.”In recognition of the successful and uniquebusiness model and outstanding leadership,the Kenya Methodist University and KenyattaUniversity awarded our CEO Dr. JamesMwangi with an Honorary Doctorate inBusiness Administration (Honoris Causa) ,Doctor of Humane Letters (Honoris Causa)respectively.Your bank was also voted the Best <strong>Bank</strong> inKenya in the prestigious 2007 EuromoneyAwards for Excellence. While awarding thebank, Euromoney noted:“…. <strong>Equity</strong> <strong>Bank</strong> has been awarded the Best<strong>Bank</strong> in Kenya on the grounds of achievementsin lending to the retail sector and reaching outto the ‘unbanked’, pioneering efforts whichbigger banks are trying to keep up with……(and for exhibiting)… “The ability to innovate,react at speed and make the best use of theinherent strength…..”Further, the US based Micro Capital rankedyour bank as the Best Microfinance Institutionin Africa and 3rd best in the World in 2007.Nationally, your bank won the followingawards at the 2007 Kenya <strong>Bank</strong>ing Survey• Best Retail <strong>Bank</strong>• Best Microfinance <strong>Bank</strong>• Fastest Growing <strong>Bank</strong>• Runners up in Product Innovation62007 Annual Report and Financial Statements

Taarifa ya Mwenyekiti“...Benki ya <strong>Equity</strong> imetunukiwa benki bora zaidi nchini Kenya kwa misingi ya ufanisikatika ukopeshaji kwa sekta ya rejareja na kuwafikia wale waliokuwa hawapati hudumaza benki, na kuanzisha juhudi ambazo benki kubwa zinajaribu kuzifikia…( na kwadhihirisho hilo)…uwezo wa kubuni, kuchukua hatua za haraka na kutumia kwa njiabora zaidi uwezo ilionao…”UTANGULIZINina furaha tele kuwakaribisha kwenyeMkutano Mkuu wa Kila Mwaka.Ninawashukuru kwa dhati kwa usaidizi wenuambao umewezesha kupatikana kwa mwakamwingine wenye mafanikio kwa benki yenu.MAZINGIRA YA UTENDAJIIshara za kiuchumi zinadhihirisha kwambauchumi wa Kenya ulikuwa na matokeo borakatika mwaka wa 2007. Makadirio kutoka kwaBenki Kuu ya Kenya yalidhihirisha kwambakiwango cha ukuaji wa mwaka kilikuwa asilimia7% huku sekta muhimu kama vile huduma zakifedha,kilimo (mboga,matunda na maua),utalii, uchukuzi, ujenzi, mawasiliano ya simu,kawi na utengenezaji bidhaa zikitekelezajukumu muhimu.Kiwango cha wastani kwamwaka cha kupanda kwa gharama ya maishakiliongezeka na kufikia asilimia 5.2% kutokanana kuongezeka kwa gharama ya chakula nakawi ilhali viwango vya riba viliongezekakutoka asilimia 6.0% hadi asilimia 7.5% kablaya kutulia katika asilimia 6.8% kuelekeamwisho wa mwaka.Katika mwaka unaoangaziwa, shilingi iliimarikadhidi ya sarafu kuu ulimwenguni huku Dolaya Marekani ikishuka kutoka shilingi 69.36hadi 63.20; Pauni ya Uingereza kutoka shilingi136.79 hadi 128.45; na Yeni ya Japan kutokashilingi 59.47 hadi 56.52. Kwenye soko lauuzaji hisa, shughuli katika soko la alama 20 laNairobi kiwango cha hisa za kampuni 20 borailipungua kwa kiasi kidogo na kufunga mwakakatika alama 5,445 kutoka kiwango cha pointi5,646 mwaka wa 2006. Hata hivyo, jumla yamtaji wa soko iliongezeka kwa asilimia 7.4%kutoka shilingi bilioni 792 hadi shilingi bilioni851.Kutokana na hali hizi bora za kiuchumi, sektaya benki ilisalia kuwa thabiti na kuendeleakupata matokeo bora huku faida ikikua kwaasilimia 33.9% na jumla ya raslimali ikiimarikakwa asilimia 20.2%. Kiwango cha mikopoisiyolipwa kilipungua na kufikia shilingi bilioni59.1 kutoka shilingi bilioni 103.8. Uwezo wakupata pesa katika soko ulikuwa wa juu ukiwana kiwango cha asilimia 40.65%, zaidi ya maradufu ya kiwango cha chini kinachohitajikakisheria cha asilimia 20%.UTENDAJI WA BENKI YA EQUITYTangu kubuniwa mnamo mwaka wa 1984,benki yenu imeendelea kuafikia maono yakeya kuwapa uwezo wa kiuchumi Wakenya kwakutoa huduma za gharama ya chini za kifedha.Kuendelea kukua na utendaji bora umefanyauendeshaji shughuli na uongozi wa benkiyenu kutambuliwa kitaifa na kimataifa,Tumeendelea kuzingatia uimarishaji wa benkiyenu kwa kujenga msingi thabiti wa jamii. Hiiinadhihirika kwa kupata alama ya juu katikamikopo ambapo benki yenu ilipata A+ kwakipindi cha muda mrefu na A1 kwa kipindi chamuda mfupi. Zaidi ya hayo, benki imeendeleakuimarisha utekelezaji na ufanisi katika utoajihuduma kupitia mfumo madhubuti wa benkiwa tekinolojia ya habari. Benki imedumishauongozi katika kutoa bidhaa mpya na hudumana kusababisha ongezeko katika kiwangocha soko. Ninajivunia kuwatangazia kwambabenki ilimaliza mwaka ikiwa na zaidi ya akauntiza benki milioni 1.8 zikijumuisha asilimia 38%ya akaunti zote za benki nchini Kenya.Mtindo wa biashara yetu unaendeleakuthibitishwa kupitia kutambuliwa na kupatatuzo kitaifa na kimataifa. Katika kipindi chamwaka, katika kiwango cha kimataifa, benkiyenu ilitunukiwa tuzo la heshima la 2007Global Vision Award katika sekta ya kifedhakwa kuwa “mwanzilishi wa dhana ya sikuzijazo ambayo itaunda uchumi wa dunia”.Kwa kutambua ufanisi na mfano wa kipekeewa biashara na uongozi bora, Chuo Kikuu chaKenya Methodist na Chuo Kikuu cha Kenyattavilimtuza Afisa Mkuu Mtendaji wetu Dr. JamesMwangi shahada ya Honorary Doctoratekatika masuala ya usimamizi wa biashara,Business Administration (Honoris Causa), naDoctor of Humane Letters (Honoris Causa)mtawalia.Benki yenu pia ilitajwa kuwa benki bora zaidinchini Kenya katika tuzo la hadhi kuu la 2007Euromoney Awards for Excellence. Ikiituzabenki, Euromoney ilisema:“…Benki ya <strong>Equity</strong> imetunukiwa benki borazaidi nchini Kenya kwa misingi ya ufanisi katikaukopeshaji kwa sekta ya rejareja na kuwafikiawale waliokuwa hawapati huduma za benki,na kuanzisha juhudi ambazo benki kubwazinajaribu kuzifikia…( na kwa dhihirishohilo)…uwezo wa kubuni, kuchukua hatua zaharaka na kutumia kwa njia bora zaidi uwezoilionao…”82007 Annual Report and Financial Statements

Taarifa ya Mwenyekiti inaendeleaZaidi ya hayo, Kampuni ya Micro Capital yenyemakao yake Marekani iliiorodhesha benkiyenu kama taasisi bora zaidi ya kifedha baraniAfrika na ya tatu kwa ubora ulimwengunimwaka 2007.Kitaifa, benki yenu ilishinda tuzo zifuatazokwenye uchunguzi wa benki nchini Kenyamwaka wa 2007• Benki bora zaidi ya rejareja• Benki bora zaidi ya shughuli za kifedha• Benki inayokua kwa haraka zaidi• Mshindi katika uvumbuzi wa bidhaa• Mshindi katika shughuli za benki ndogo naza kiwango cha kadri (SME)• Benki ya pili kwa ubora kwa ujumlaTunatoa mafanikio haya yote kwa heshimayenu wanahisa wetu, wafanyakazi, watejawetu na washika dau wetu wote kwanihayangepatikana bila usaidizi wenu.MTAJI WA SOKOBenki yenu imeorodheshwa kwenye sehemumuhimu ya soko, Main Investment MarketSegment (MIMS) kwenye soko la hisa la Nairobi(NSE). Tangu kuorodheshwa mwezi Agostimwaka 2006, hisa za benki zimeendeleakudhihirisha ufanisi bora kutoka kiwango chamwanzo cha mtaji wa soko cha shilingi bilioni6.2 hadi shilingi bilioni 54 kufikia tarehe 31Disemba 2007. Hii iliinua benki kuwa katikakiwango cha kampuni saba bora nchini Kenyakulingana na mtaji wa soko. Tumejitoleakutimiza lengo letu la kuboresha thamani kwawashikadau wetu.UWEKEZAJI WA HELIOS EB INVESTORS,L.P (HELIOS EB)Mnamo tarehe 21 Disemba 2007 mliidhinishauwekezaji wa mtaji wa shilingi bilioni 11 naHelios EB uliobadilishana na hisa 90,516,255 zakawaida ambazo ni sawa na asilimia 24.99% yamtaji wa hisa za kampuni zilizotolewa. Ukuajimkubwa uliopatikana na benki katika nyanjazote za uendeshaji shughuli, ukuaji na ufanisiunadhihirisha umuhimu wa kudumisha mtajiwa kutosha wa shughuli muhimu.Uwekezajihuu uliongeza fedha za wenyehisa na kufikiashilingi bilioni 15 kutoka shilingi bilioni 2.2na kuifanya benki kuwa mojawapo ya benkiyenye mtaji bora zaidi katika kanda hii.UWEKEZAJI KATIKA HOUSING FINANCECOMPANY OF KENYA (HF)Mnamo tarehe 11 Julai 2007, benki ya <strong>Equity</strong>na kampuni ya British-American InvestmentCompany (Kenya) Limited (BAICL) zilinunuakiwango cha asilimia 24.99% cha hisa za CDC<strong>Group</strong> PLC katika HF. Benki yenu ilipata hisamilioni 23 kwa gharama ya shilingi milioni433 ilhali BAICL ilipata hisa 5,635,000. Ununuzihuu uliifanya benki yenu na BAICL kuwawashirika wa kimkakati na wenyehisa dhabitiwa HF, na hivyo kupanua msingi wa wateja nakufungua uwezekano mpya wa kutoa hudumambalimbali za kifedha.DENI LA MUDA MREFU NA WA KADRIWakati wa kipindi cha mwaka, Halmashauriiliidhinisha ukopaji mkopo wa muda mrefuwa shilingi bilioni 4.52 kutoka kwa taasisimbalimbali za kimataifa za maendeleo yakifedha ili kupanua msingi wa utoaji fedha wabenki. Pamoja na hayo, mkopo wa kiwangocha kadri wa shilingi milioni 100 ulipatikanakutoka kwa wizara ya masuala ya vijana ilikukopeshwa wafanyibiashara vijana.UONGOZI WA KAMPUNIWakati wa mwaka unaoangaziwa, Bi BeatriceSabana alistaafu kutoka kwa Halmashauri yaWakurugenzi ilhali Bw. Babatunde Soyoyena Bw. Temitope Lawani , wote wa Helios EBwaliteuliwa kuhudumu katika Halmashauri.Huku nikiwakaribisha wakurugenzi hao wawiliwapya kwa niaba ya Halmashauri, ningependakumshukuru Beatrice kwa mchango wake nakumtakia kila na heri katika yote afanyayo.Taarifa yenye maelezo zaidi kuhusiana naUsimamizi wa Kampuni na Jukumu kwa Jamiiimewekwa kwingineko kwenye ripoti hii.MGAO WA FAIDAHalmashauri inapendekeza mgao wa faidawa shilingi 2.00 kwa kila hisa ya kawaida yashilingi 5.00 kwa mwaka uliomalizika 2007ikiwa mtaidhinisha kwenye mkutano huu.Wawekezaji wa Helios EB hawajahitimu.MATARAJIO YA BAADAYEKama mnavyofahamu, mwaka huu, wa2008 ulianza kwa huzuni wakati nchi hiiilipokumbwa na ghasia baada ya uchaguzina kutatiza uendeshaji shughuli za kawaidanchini. Kwa bahati nzuri, hii haikuathiri sanashughuli za benki isipokuwa kule kukokotakwa uchumi. Hatubashiri madhara makubwakwa biashara kwani makubaliano ya kisiasatayari yameshaafikiwa.Benki yenu imejiandaa kwa ukuaji zaidi mwakahuu. Tutaendelea kuzingatia ukuaji na upanuzinchini Kenya na katika kanda hii.HITIMISHOKwa niaba yangu na ile ya Halmashauri,wasimamizi na wafanyakazi wa benkitunawashukuru kwa usaidizi mliotoa kwabenki kwa mwaka huo wote. Tunaendeleakutegemea usaidizi wenu na kukariri kujitoleakwetu kutimiza malengo ya benki hukutukiendelea kutilia maanani mahitaji ya watejawetu na kujitolea kudumisha maadili yafaayoya uongozi.ASANTEBw. Peter K. Munga, EBSMwenyekitiHalmashauri ya Wakurugenzi2007 Annual Report and Financial Statements 9

Ceo’s StatementDr. James Mwangi, MBSChief Executive Officer & Managing Director(Afisa Mkuu na Mkurugenzi Mtendaji)102007 Annual Report and Financial Statements

Ceo’s Statement“ … the annual cumulative pre-tax profit for the year 2007 grew by 116% toKshs2.38 billion compared to Kshs1.10 billion reported in 2006. The growth inprofitability is attributed to a 73 % increase in total operating income to Kshs 5.82billion compared to Kshs3.37 billion realized in 2006.…”Iam delighted and privileged to present toyou the bank’s report for year 2007. Theimpressive performance recorded duringthe year scaled the bank to new heightsleading to local and international recognition.The business grew in in all spheres translatinginto better prospects for all stakeholders.FocusThe bank remained focused and aligned to itsvision of being the preferred financial servicesprovider contributing to the economicprosperity of Africa. Greater emphasis onfocused customer service was taken to ahigher level in pursuit of our mission ofmobilising resources and offering credit to ourcustomers.Financial ReviewThe bank’s unmatched growth trajectory inthe banking industry is attributable to yoursupport and the unique business model whichfocuses on high volumes and low marginswhile simplifying and demystifying financialintermediation. I am pleased to note thatthe annual cumulative pre-tax profit for theyear 2007 grew by 116% to Kshs 2.38 billioncompared to Kshs 1.10 billion reported in2006. The growth in profitability is attributedto a 73 % increase in total operating income toKshs 5.82 billion compared to Kshs 3.37 billionrealized in 2006. The cost to income ratio hasreduced significantly to 59.4% from 67% as aresult of significant improvement in operatingefficiency.In the year under review, our total assetsexpressed through the bank’s total balancesheet grew by 166% to close at Kshs 53.22billion from Kshs 20.02 billion as at December2006. The growth in assets was supported byincrease in funding via a core capital injectionof Kshs11billion and additional long-termsubordinated debt of Kshs 4 billion.Our deposit base rose by 93% to 31.53 billionfrom Kshs 16.33 billion in 2006. The growthin deposits was driven by an 81% increase innumber of customers’ accounts to stand at1.8 million from 1.0 million accounts as at thebeginning of the year. The branches openedduring the year contributed 14% of these newaccounts.To facilitate economic activities by ourcustomers, the bank increased its lendingto Kshs 21.84 billion from Kshs 10.93 billionin the previous year. This growth in the loanbook was evidenced by the number of loanaccounts that grew to 392,822 from 252,147.I am happy to report that the bank achieved areduction in the ratio of gross non-performingloans and advances from 6.95% to 5.39%.During the year under review, total shareholdersfunds have increased considerably to Ksh 15billion from Ksh 2.2 billion. This phenomenalgrowth was replicated at the Nairobi StockExchange with our market capitalizationrising to approximately Kshs 54 billion fromKshs 12.6 billion. I would like to congratulatethe shareholders for their wise decision ofapproving 24.99% shareholding investmentby Helios EB for an additional Kshs 11 billioncapitalization.The <strong>Bank</strong>’s phenomenal growth andperformance has been recognized both locallyand internationally. The accolades accordedthe bank include, conferment of the GlobalVision award at the June 2007 Vision Summit,voted the Best <strong>Bank</strong> in Kenya by EuromoneyAwards for Excellence in July 2007 andscooped 6 awards at the 2007 Kenya Annual<strong>Bank</strong> Awards in November.Operations ReviewThe bank’s expansion program in terms ofadditional branches, ATMs and Point of Saleterminals, the growth in customer base andgrowth in our loan book have all contributedto the impressive performance. To enable easyand affordable access to financial services bymore Kenyans, the bank has been carryingout a strategic planned expansion program.In 2007, the bank opened 29 new branches,installed an additional 150 ATMs to bring thetotal to 350 ATMs and recruited an additional1,029 staff to ensure effective servicedelivery. These heavy investments have beenundertaken without slowing down the bankreturns.In addition to new branches and ATMs, thebank entered into a partnership with leadingretail stores such as Nakumatt, Tuskys andUchumi rolling out 660 Points of Sale (POS)terminals. This has enabled the <strong>Bank</strong> to2007 Annual Report and Financial Statements 11

Ceo’s Statement continuedincrease its outreach, with a footprint of over1,000 channels and outlets nationwide easingcustomers’ access to various services andproducts.To better serve our customers, the bankinghours were extended to between 8.00 am to4.30pm on weekdays and 8.00am to 12.00pmon all Saturdays.Business DevelopmentDuring the year, as part of our continuouseffort to deliver innovative financial servicesto our customers, we launched new productsand services which include; “Cash Back”;“Fanikisha”, and “Hekima Milele”. The “CashBack” product allows customers to use theirATM cards to pay for their shopping and at thesame time withdraw cash from retail storesand petrol stations. We continue to roll outthe service to more outlets increasing ouravailability and accessibility.In recognition of the pivotal role that womenplay in our society, we launched “Fanikisha”loan products marketed as; Shaba, Imara,Fedha, Dhahabu, Almasi and Platini. These allinclusiveproducts target women in business,enabling them to access affordable loans fromKshs1, 000 to over Kshs10 million.“Hekima Milele” is a mortgage and investmentproduct developed as a result of the strategiccollaboration between Housing Finance (HF),British-American Insurance Company (Kenya)Limited (BAICL) and the <strong>Bank</strong>, leveragingon the competitive advantages of the threeinstitutions.Agriculture forms the back bone of oureconomy. As a bank we have special ties withthe agricultural sector as we owe our existenceto it. To ensure that farming is commercialised,the bank launched Kilimo Biashara,(commercialising agriculture) and WarehouseReceipt System aimed at economicallysupporting players in the agricultural sector.Uvuvi Biashara (commercialising fishing) willtarget the fisheries sector. These productsprovide affordable credit facilities to farmersand fishermen.I am also proud to report that during thelatter part of the year, we obtained principlemembership to VISA (the largest internationalcard association). This is another majormilestone for the <strong>Bank</strong>, as it has enabled thebank to issue VISA cards and to use our ATMsand Points Of Sale (POS) to acquire VISAtransactions. This will enable our customers totransact anywhere in the world.Staff DevelopmentThe <strong>Bank</strong> continued with its aggressive staffcapacity building through hiring of new staffwith specialised skills and competenciesas well as staff training and development.The <strong>Bank</strong> continued with its very successfulleadership development program which sawa number of staff attend training at HarvardBusiness School, IESE Business School inSpain, Strathmore Business School andBoulder Microfinance Leadership Program.The organisational culture that values peopleand supports business, grounded on corevalues of Professionalism, Integrity, Creativity,Teamwork, Unity of purpose, respect anddedication to customer delight and effectivecorporate governance continue to bestrengthened.Future OutlookThe year 2008 started on a low note dueto the post election crisis that impacted onour business momentum. However we arepleased to note there was no physical damageto any of our business premises and all ourstaff are safe. We have undertaken a review ofthe impact of the crisis on our business and donot expect any material impact. Despite this,we are optimistic that we will achieve our settargets for the year 2008. The critical successfactors for our business which include, people,systems and products are well grounded toassure resilience.Looking into the future, we intend to continuewith the planned expansion strategy toincrease our presence nationwide and withinthe East African region. To support the growthstrategy, the <strong>Bank</strong> will continue to invest intechnology optimization to meet the newmarket needs and challenges. In addition, thebank will continue to invest in the requisiteinternal capacity in terms of human capitalto effectively deliver products and services tomanage the <strong>Bank</strong> into the future.ConclusionI take this opportunity to thank the Board,our customers, staff, development partners,shareholders and other stakeholders who havecontributed toward these great achievements.I am confident that the <strong>Bank</strong> is adequatelypositioned for the next phase of growth andexpansion both locally and in the region inline with our vision “To be the preferred Micro-Finance services provider contributing to theeconomic prosperity of Africa….”Thank you.Dr. James Mwangi, MBSChief Executive Officer and ManagingDirector.122007 Annual Report and Financial Statements

Taarifa ya Afisa Mkuu na Mkurugenzi Mtendaji“ Faida ya mwaka kwa jumla kabla ya kutozwa ushuru kwa mwaka wa 2007 ilikuakwa asilimia 116% na kufika shilingi bilioni 2.38 ikilinganishwa na shilingi bilioni1.10 zilizopatikana mwaka wa 2006. Ukuaji katika faida umetokana na ongezekola asilimia 73% katika jumla ya mapato ya uendeshaji kufikia shilingi bilioni 5.82ikilinganishwa na shilingi bilioni 3.37 zilizopatikana mwaka wa 2006.”Ni furaha na heshima kuu kwangukuwasilisha kwenu ripoti ya benkiya mwaka 2007. Ufanisi borauliopatikana wakati wa kipindi cha mwakahuo ulipandisha benki katika viwango vipyana kuifanya kutambuliwa nchini na kimataifa.Biashara ilikua katika nyanja zote na kuleteawashika dau matumaini bora zaidi.UzingativuBenki iliendelea kuzingatia na kulinganishamaono yake ya kuwa mtoaji huduma zakifedha anayependelewa na kuchangia katikaufanisi wa kiuchumi wa Afrika. Uzingatiaji zaidiwa huduma kwa mteja uliimarishwa na kufikiakiwango cha juu zaidi katika kutafuta kutimizalengo letu la kukusanya rasilimali na kutoamikopo kwa wateja wetu.UCHUNGUZI WA KIFEDHAUkuaji wa benki hii ambao haujashuhudiwakatika sekta ya benki umetokana na usaidiziwenu na mfano wa kipekee wa biasharaambao unazingatia kiwango kikubwa nafaida finyu huku ikirahisisha na kuweka wazihuduma za mashirika ya kifedha. Nina furahakusema kwamba faida ya mwaka ya jumlakabla ya kutozwa ushuru kwa mwaka wa 2007ilikua kwa asilimia 116% na kufika shilingibilioni 2.38 ikilinganishwa na shilingi bilioni1.10 zilizopatikana mwaka wa 2006. Ukuajikatika faida umetokana na ongezeko la asilimia73% katika jumla ya mapato ya uendeshajikufikia shilingi bilioni 5.82 ikilinganishwa nashilingi bilioni 3.37 zilizopatikana mwaka wa2006. Kiwango cha gharama kikilinganishwana mapato kimepungua kwa kiasi kikubwana kufikia asilimia 59.4% kutoka asilimia 67%kutokana na kuimarika kwa kiwango kikubwakwa utendaji bora katika uendeshaji shughuli.Katika mwaka unaoangaziwa, jumla yarasilimali zetu zilizoonyeshwa kupitia kwamizania ya jumla ya benki zilikua kwa asilimia166% na kufikia shilingi bilioni 53.22 kutokashilingi bilioni 20.02 mnamo Disemba 2006.Ukuaji katika rasilimali ulisaidiwa na ongezekola ufadhili kupitia kuwekwa kwa mtaji washilingi bilioni 11 na kuongezwa kwa denisaidizi la muda mrefu la shilingi bilioni 4.Msingi wetu wa akiba uliongezeka kwa asilimia93% na kufikia bilioni 31.53 kutoka shilingibilioni 16.33 mwaka wa 2006.Ukuaji katikaakiba ulitokana na ongezeko la asilimia 81%la idadi ya akaunti za wateja na kufikia milioni1.8 kutoka akaunti milioni 1.0 mwanzoni mwamwaka huo. Matawi mapya yaliyofunguliwawakati wa kipindi cha mwaka huo yalichangiaasilimia 14% ya akaunti hizo mpya.Ili kusaidia shughuli za kiuchumi za watejawetu, benki iliongeza mikopo hadi shilingibilioni 21.84 kutoka shilingi bilioni 10.93 katikamwaka uliotangulia. Ukuaji huu katika daftariya mikopo ulidhihirishwa na idadi ya akauntiza mikopo ambazo ziliongezeka na kufikia392,822 kutoka 252,147.Nina furaha kutangaza kwamba benki iliafikiaupunguaji katika kiwango cha jumla chamikopo isiyolipwa kutoka asilimia 6.95% hadi5.39%.Wakati wa kipindi cha mwaka unaoangaziwa,jumla ya fedha za wenyehisa imeongezekakwa kiwango kikubwa kufikia shilingi bilioni15 kutoka shilingi bilioni 2.2. Ukuaji huumkubwa ulidhihirika pia kwenye soko la hisa laNairobi huku mtaji wetu wa hisa ukiongezekana kufikia takriban shilingi bilioni 54 kutokashilingi bilioni12.6.Ningependa kuwapongezawenyehisa kwa uamuzi wao wa busara wakuidhinisha uwekezaji wa hisa wa asilimia24.99% na Helios EB kwa mtaji wa shilingibilioni 11 zaidi.Ukuaji wa kiwango kikubwa wa benki hiiumetambuliwa humu nchini na kimataifa.Sifa kuu zilizotunukiwa benki hii ni pamoja nakutuzwa tuzo la Global Vision Award katikamkutano uliofanywa Juni 2007, kutajwa kuwabenki bora zaidi nchini Kenya na EuromoneyAwards for Excellence mnamo Julai 2007 nakuzoa tuzo sita katika sherehe ya Kenya Annual<strong>Bank</strong> Awards mnamo mwezi Novemba.Uchunguzi wa UendeshajiShughuliMpango wa upanuzi kwa kuongeza matawi,mitambo ya ATM, na vituo vya uuzaji, ukuajikatika idadi ya wateja na ukuaji kwenye daftariya mikopo , yote yamechangia utendaji bora.Ili kurahisisha na kuwezesha kufikiwa kwahuduma za kifedha na Wakenya zaidi, benkiimekuwa ikitekeleza mpango wa kimkakatiwa upanuzi.Katika mwaka wa 2007, benki ilifungua matawi29 mapya, kuweka mitambo 150 zaidi ya ATM2007 Annual Report and Financial Statements 13

Taarifa ya Afisa Mkuu na Mkurugenzi Mtendaji Inaendeleana kuifanya mitambo hiyo kufikia 350 nakuajiri wafanyakazi 1,029 zaidi ili kuhakikishahuduma zinatolewa ipasavyo. Uwekezaji huuumefanywa bila kutatiza mapato ya benki.Mbali na matawi mapya na mitambo ya ATM,benki ilianzisha ushirika na maduka makubwaya rejareja kama vile Nakumatt, Tuskys naUchumi na kusambaza vituo 660 vya uuzaji(POS). Hii imewezesha benki kuongeza uwezowa kuwafikia wateja zaidi huku kukiwa navituo zaidi ya 1,000 nchini kote vinavyosaidiawateja kupata kwa urahisi huduma mbalimbalina bidhaa.Ili kuwahudumia wateja wetu kwa njia borazaidi masaa ya benki yaliongezwa kutoka saambili asubuhi hadi saa kumi unusu siku zakatikati ya wiki na saa mbili asubuhi hadi saasita adhuhuri siku za jumamosi.Ustawi wa BiasharaWakati wa kipindi cha mwaka, kama sehemuya juhudi zetu zisizo na kikomo za kutoahuduma bunifu kwa wateja wetu, tulianzishabidhaa mpya na huduma zikiwemo “CashBack”, “Fanikisha”, na “Hekima Milele”. Bidhaaya “Cash Back” inawawezesha wateja kutumiakadi zao za ATM kulipia vifaa wanavyonunuana wakati huo huo kutoa pesa kutoka kwamaduka yao rejareja na vituo vya mafuta.Tunaendelea kusambaza huduma hii kwavituo zaidi huku tukiimarisha kupatikana nakufikiwa kwetu.Katika kutambua wajibu unaotekelezwa nawanawake katika jamii, tulianzisha bidhaaza mkopo za “Fanikisha”zinazohamasishwakama; Shaba, Imara, Fedha, Dhahabu, Almasina Platini.Bidhaa hizi zote zinawalengawanawake katika biashara, na kuwawezeshakupata mikopo ya gharama nafuu kutokashilingi 1000 hadi zaidi ya milioni 10.na Benki hii, na kunufaika na fursa ya ushindaniya taasisi zote tatuKilimo ni uti wa mgongo wa uchumi wetu.Kama benki, tuna uhusiano maalum na sektaya kilimo kwani kuwepo kwetu kunatokana nasekta hiyo. Ili kuhakikisha kilimo kinafanywakibiashara, benki ilianzisha kilimo biashara,na upokezi kwenye bohari za uhifadhi kwalengo la kusaidia wahusika katika sekta yakilimo. Uvuvi biashara unalenga sekta ya uvuviwa samaki. Bidhaa hizo zinatoa mikopo yagharama nafuu kwa wakulima na wavuvi.Najivunia kutangaza kwamba katika sehemuya mwisho mwisho ya mwaka, tulipokeauwanachama wa VISA (chama kikubwa zaidicha kimataifa cha kadi). Hii ni hatua nyinginemuhimu kwa benki hii, kwani imewezeshabenki kutoa kadi za VISA na kutumia mitamboyetu ya ATM na vituo vya uuzaji kutekelezashughuli za VISA. Hii itawawesha wateja wetukuendesha shughuli zao za kibiashara popoteulimwenguni.Ustawi wa WafanyakaziBenki iliendelea na mpango wake madhubutiwa kuimarisha wafanyakazi kupitia uajiri wawafanyakazi wapya wenye taaluma mahsusina maarifa pamoja na kutoa mafunzo nakuwastawisha wafanyakazi. Benki iliendeleana mpango wake uliofanikiwa wa kustawishauongozi ambao ulipelekea wafanyakazikadhaa kuhudhuria mafunzo katika HarvardBusiness School, IESE Business School hukoUhispania, Strathmore Business School naMpango wa Boulder Microfinance Leadership.Utamaduni wa mfumo ambao unathaminiwatu na kuunga mkono biashara, uliojikitakatika maadili muhimu ya kitaaluma, uadilifu,ubunifu, ushirikiano, lengo moja, heshima nakujitolea kuridhisha wateja na uongozi ufaaounaendelea kuimarishwa.hakukuwa na uharibifu wa vifaa katika maeneoyoyote ya biashara yetu na wafanyakazi wetuwote walikuwa salama. Tumechunguzaathari ya mzozo huo kwenye biashara yetuna hatutarajii madhara makubwa. Licha yahayo, tuna matumaini kwamba tutaafikiamalengo tuliyoweka kwa mwaka wa 2008.Mambo muhimu kwa ufanisi wa biashara yetuambayo ni watu, mifumo na bidhaa ni imarakutuhakikishia udhabiti.Tukiangazia hali ya siku zijazo, tunanuiakuendelea na mikakati ya upanuzi iliyopangwakuimarisha huduma zetu kote nchini na katikaeneo la Afrika Mashariki. Ili kuunga mkonomfumo wa ukuaji, benki itaendelea kuwekezakatika uimarishaji wa tekinolojia ili kutimizamahitaji ya soko mpya. Zaidi ya hayo, benkiitaendelea kuwekeza katika uimarishaji wautendaji kazi ili kutoa bidhaa na hudumaipasavyo kuisimamia benki kuelekea sikuzijazo.HitimishoNachukua nafasi hii kuishukuru Halmashauri,wateja wetu, wafanyakazi, washirika wamaendeleo, wenyehisa na wahusika wengineambao wamechangia katika mafanikio hayamakubwa. Nina imani kwamba benki hii ikokatika nafasi inayofaa kwa awamu ijayo yaukuaji na upanuzi humu nchini na katikakanda hii kuambatana na maono yetu “Kuwamtoaji huduma za kifedha anayependelewana kuchangia katika ufanisi wa kiuchumi waAfrika….”Asante“Hekima Milele” ni bidhaa ya mkopowa kugharamia nyumba na uwekezajiiliyostawishwa kutokana na ushirikiano bainaya Housing Finance (HF), British-AmericanInsurance Company (Kenya) Limited (BAICL),Hali ya BaadayeMwaka wa 2008 ulianza polepole bila shughulinyingi kutokana na mzozo uliotokea baadaya uchaguzi ambao uliathiri kasi ya biasharayetu. Hata hivyo tunafurahi kusema kwambaDr. James Mwangi, MBSAfisa Mkuu na Mkurugenzi Mtendaji142007 Annual Report and Financial Statements

Financial HighlightsGROWTH IN GROSS OPERATING INCOMEUKUAJI KATIKA FAIDA YA JUMLAYA UENDESHAJI SHUGHULIGROWTH IN PRE-TAX PROFITUKUAJI KATIKA FAIDA KABLA YAKUTOZWA USHURU6,0005,8212,5002,378KShs (millions) / Shilingi (milioni)5,0004,0003,0002,0001,00003685361,0361,8033,3712002 2003 2004 2005 2006 2007KShs (millions) / Shilingi (milioni)2,0001,5001,000500074972185011,1032002 2003 2004 2005 20062007GROWTH IN CUSTOMER DEPOSITSUKUAJI KATIKA AKIBA ZA WATEJAGROWTH IN GROSS LOAN PORTFOLIOUKUAJI KATIKA JUMLA YA MIKOPOKShs (millions) / Shilingi (milioni)35,00030,00025,00020,00015,00010,0005,0002,1923,3695,0819,04816,33731,536KShs (millions) / Shilingi (milioni)25,00020,00015,00010,0005,0001,1891,7343,0995,88511,42922,22802002 2003 2004 2005 2006 200702002 2003 2004 2005 2006 2007GROWTH IN TOTAL ASSETSUKUAJI KATIKA JUMLA YA RASIMALIGROWTH IN SHAREHOLDER’S FUNDSUKUAJI KATIKA FEDHA ZA WENYEHISA60,00053,07616,00014,00014,917KShs (millions) / Shilingi (milioni)50,00040,00030,00020,00010,00002,5763,9246,70711,45720,0242002 2003 2004 2005 2006 2007KShs (millions) / Shilingi (milioni)12,00010,0008,0006,0004,0002,00003344781,2711,5942,2002002 2003 2004 2005 2006 2007162007 Annual Report and Financial Statements

Financial HighlightscontinuedGROWTH IN CUSTOMER NUMBERSUKUAJI KATIKA IDADI YA WATEJAGROWTH IN STAFF NUMBERSUKUAJI KATIKA IDADI YA WAFANYIKAZINumber (thousands) / Idadi (Elfu)2,0001,8001,6001,4001,2001,00080060040020001552524135561,0141,8402002 2003 2004 2005 2006 2007Number / Idadi3,0002,5002,0001,500100050002103545308841,3942,4182002 2003 2004 2005 2006 2007DISTRIBUTION OF LIABILITIES (UGAWAJI GHARAMA)Shareholders funds 28%(Fedha za wenyehisa 28%)Borrowings 9%(Ukopaji 9%)Customers’ deposits 59%(Akiba za wateja 59%)Other liabilities 4%(Gharama nyingine 4%)DISTRIBUTION OF ASSETS (UGAWAJI RASLIMALI)Government securities 26%(Dhamana za serikali 26%))Loans and advances to customers 41%(Mikopo kwa wateja 41%Cash and bank balances 23%(Pesa taslimu na pesa zilizomokwenye akaunti 23%)Other assets 5%(Rasilimali nyingine 5%)Fixed assets 5%(Rasilimali za kudumu 5%)2007 Annual Report and Financial Statements 17

Key AchievementsAugust 2007 - Our unique banking model wasrecognized once again when we were votedthe Best <strong>Bank</strong> in Kenya in the Euromoney 2007Awards for excellence. Euromoney Awards forexcellence define banking excellence in globalcategories and across 110 countries. The awardsset the standards for banking and capital marketexcellence amongst the top ranking financialinstitutions around the world.“...Euromoney Awards is to banking what Oscars is to film...”Global Credit Rating-2007RatingShort-term: A 1Long-term: A+<strong>Equity</strong> <strong>Bank</strong> was rated by Global Credit Rating (GCR) in 2007short term A1 and long term A+. This was in recognition ofthe bank’s performance in deposit growth, good profitabilityunderpinned by high quality and strategic management ofthe business.Contributing FactorsThe <strong>Bank</strong>ing Awards 2007<strong>Equity</strong> <strong>Bank</strong> emerged as the 2nd Best<strong>Bank</strong> overall in the country in 2007 animprovement from 3rd Best <strong>Bank</strong> theprevious year. The bank won the Best Retail<strong>Bank</strong>, Best Micro-Finance <strong>Bank</strong>, FastestGrowing <strong>Bank</strong>, Runners up in ProductInnovation & SME <strong>Bank</strong>ing.

<strong>Equity</strong> <strong>Bank</strong> CEO, Dr. James Mwangi (with microphone) makes a point in Germany 2007, on the far left is Prof. Muhammad YunusNoble Peace Prize Winner 2006.2007 Global Vision AwardJune 2007 – <strong>Equity</strong> <strong>Bank</strong> made major strides in the month of June, when it was awarded the 2007 Global Vision Award at theVision Summit in Germany. The award recognizes outstanding people/groups who have developed “concepts of the future”that serve to drive change in globalization, climate change and aid for Africa. Microfinance has been recognized as a “conceptof the future.” <strong>Equity</strong> <strong>Bank</strong>’s unique business model that encompasses inclusive banking has been a good example for manyfinancial institutions the world over. The bank aims to provide microfinance services to its 2 million plus customers, most ofwhom are low income earners poorly banked by the multinational banks. Dr. Mwangi dedicated the award to <strong>Equity</strong> <strong>Bank</strong>’scustomers and staff noting the critical role they had played in supporting the business model hence becoming an “initiator ofa concept of the future that will shape the world economy”.

Statement on Corporate Social Responsibility (CSR)The bank partnered with UNEP during the 2007 WorldEnvironmental Day in tree planting and communitysensitization on the importance of environmentalconservation.security while at the same time providingan opportunity to residents and businesscommunity in Gikomba to carry out trade lateinto the evening. The bank sponsored twohigh mast flood lights for Kenyatta Universityto light up the university compound andenhance security.Poverty Eradication - Stand UpCampaignIn 2007, <strong>Equity</strong> <strong>Bank</strong> proactively involvedstakeholders by forming strategicpartnerships to carry out corporate socialresponsibility programmes with far reachingresults. The bank was at the forefront duringthe ‘Stand up against poverty’ campaignorganized under the United NationsMillennium Development Goals.In addition, the bank has spent resourcesin the health sector. Through ‘OperationsEardrop’, in Garissa over 200 people receivedtreatment and obtained free hearing aids. Theproject was carried out in partnership with ateam of local medics and visiting doctors fromEurope.Humanitarian Response<strong>Equity</strong> bank partnered with the MethodistChurch of Kenya , the Anglican Church ofKenya, the Presbyterian Church of East Africaand the Kenya Broadcasting Corporationand launched the ‘Tumaini na Undugu’humanitarian response initiative. This was aresponse to the post-election violence thatleft many people displaced from their homesand in desperate need for food, shelter andclothing. The bank contributed a seed fund ofKshs 10 million to the initiative that distributedover Kshs 75 million worth of food, clothing,medicine, water and counseling services.The CEO <strong>Equity</strong> <strong>Bank</strong> Dr James Mwangi together withBishop Dena-ACK (from left), Rev.S.Muriguh-PCEA,Rev.S.Kanyaru-Methodist & Archibishop B.Nzimbi-ACKflag off the Tumaini na Undugu Initiative in Rift Valley.SOCIAL INVESTMENTWomen Empowerment<strong>Equity</strong> <strong>Bank</strong> invested heavily in an array ofinitiatives aimed at empowering womenin business through access to affordablecredit. In a joint venture with United NationsDevelopment Program (UNDP), <strong>Equity</strong> <strong>Bank</strong>launched ‘Fanikisha’, a financial product thatequips women in business as well as givesthem quality business training to enable themto run their businesses successfully.H. E. President Mwai Kibaki (left) launching the <strong>Equity</strong><strong>Bank</strong> Fanikisha Loan product. Looking on (fromRight) is the UNDP Resident Representative in Kenya,Elizabeth Lwanga, <strong>Equity</strong> <strong>Bank</strong> Board Chairman,Peter Munga and Chief Executive Officer Dr. JamesMwangi.Initiating Kenyan GreenRevolutionThe bank has been at the forefront ofsupporting agricultural developments in thecountry. The bank rolled out a communitybasedinitiative enabling grain farmersto deposit their produce with appointedwarehousing agents. This allows farmers toaccess funds from the bank by discountingthe warehouse receipts which act ascollateral. In addition, the warehouse systemprovides storage facilities enabling farmersto reduce wastage associated with poor andlack of proper storage facilities. For instance,the collaboration between <strong>Equity</strong> and theNational Cereals and Produce Board, NCPB,has seen NCPB increase its procurement ofmaize from one million to four million bagsduring the last harvest season in 2007. Thiscame in handy in averting massive famine asa result of the disruption to farmers followingthe post election violence.The bank launched Kilimo Biashara and‘Uvuvi Biashara’ initiatives which providevalue chain players with affordable creditfacilities and business training enhancingtheir management and operational skills. Thenoble involvement of the bank against themarket practice where the sector is viewedas high risk is driven by the commitment oftransforming rural communities and theirbusiness undertakings.The bank has made a deliberate move tosupport agriculture in partnership with otheractors such as Alliance for a Green Revolutionin Africa (AGRA), International Fund forAgricultural Development (IFAD) throughMinistry of Agriculture as part of promotingGreen Revolution in Africa.The bank is committed to promoting foodsecurity and it participated in the 2007 WorldFood Day by donating trophies to variousoutstanding farmers.<strong>Equity</strong> <strong>Bank</strong> in partnership with the Alliance for aGreen Revolution in Africa (AGRA), International Fundfor Agricultural Development (IFAD) through Ministryof Agriculture launched Kilimo Biashara.2007 Annual Report and Financial Statements 21

Board of DirectorsPeter Munga, ChairmanMr. Munga is a Certified Public Secretarywith vast experience in both public andprivate sector management. He holds adiploma in Human Resources and FinancialManagement. Mr. Munga is a retiredDeputy Secretary. He is the Chairman ofNational Oil Corporation and a directorin Micro-Enterprise Support ProgrammeTrust (MESPT), British American InsuranceCompany, Rockfeller Foundation andEquatorial Nut Processors.DR. James Mwangi, CEO & MDDr. Mwangi holds an Honorary Doctoratein Business Administration (HonorisCausa), from Kenya Methodist University,Doctor of Humane Letters (Honoris Causa)Kenyatta University and a Bachelor ofCommerce degree (Accounting Option)from the University of Nairobi and is aCertified Public Accountant (CPA (K).Dr. Mwangi is a graduate of AdvancedManagement Programme (Strathmore-IESE Business School, Barcelona Spain).He has wide experience in the bankingindustry spanning over 18 years.Benson Wairegi,Vice ChairmanMr. Wairegi holds a Masters of BusinessAdministration degree and Bachelor ofCommerce (Accounting option) degreefrom University of Nairobi and is a CertifiedPublic Accountant – CPA (K). He is the <strong>Group</strong>Managing Director of British-AmericanInvestments Company (Kenya) Ltd. the parentcompany to British-American InsuranceCompany (K) Ltd and British-American AssetManagers Limited He is also a Director ofAgricultural Finance Corporation.DR. Julius Kipng’etichDr. Kipng’etich holds a Masters of BusinessAdministration degree and a Bachelors ofCommerce (Accounting option) degreefrom University of Nairobi. He is the ChiefExecutive Officer of Kenya Wildlife Serviceand was previously the Managing Directorof Investment Promotion Centre.TEMITOPE LAWANIMr. Lawani holds a Masters of BusinessAdministration degree and a Bachelorof Science - Chemical Engineering. Heis a co-founder of Helios InvestmentPartners, a Board member of First CityMonument <strong>Bank</strong> PLC, Africatel HoldingsB.V., Corporate Development Analystat Walt Disney Co and member of theHarvard Law School Dean’s advisoryBoard.Fredrick MuchokiMr. Muchoki is a businessman withvast commercial experience. He is theManaging Director of Continental BusinessSystems and Presta Office EquipmentLimited.222007 Annual Report and Financial Statements

Board of DirectorscontinuedPeter GachubaMr. Gachuba holds a Masters of Sciencedegree in International Business anda Bachelor of Science degree fromUniversity of Southern New Hampshire inthe USA. He is an Investment <strong>Bank</strong>er and isAfriCap’s Partner responsible for East andSouth Africa.Wagane Diouf(Alternate to Peter Gachuba)Mr. Diouf holds a Masters of BusinessAdministration degree from GeorgiaInstitute of Technology (Atlanta) andBachelor of Science degree in ComputerScience and Finance from EcoleSuperieure de Gestion (Paris). He is theManaging Partner of Africap, based inDakar Senegal.BABATUNDE SOYOYEMr. Soyoye holds a Masters in BusinessAdministration degree and a Bachelorsdegree in Electrical Engineering. He is aco-founder of Helios Investment Partners,a Board member of Africatel Holdings B.V.,and Manager of Business Development atSingapore Telcom International.ernest nzovuMr. Nzovu holds a Bachelor of Arts degree inEconomics from the University of Navarra,Spain and a Diploma in International Affairsfrom the University of Ife, Nigeria. He hasfor many years been a consultant in humanresources and is a Director of Hawkins &Associates, Know How International Limitedand KHI Training.Linus GitahiMr. Gitahi holds a Masters of BusinessAdministration degree from The UnitedStates International University (USIU)and Bachelors of Commerce (Accountingoption) degree from University of Nairobi.He also holds a diploma in Managementfrom the Kenya Institute of Management.He is the Chief Executive Officer of NationMedia <strong>Group</strong> and was previously theManaging Director, GlaxoSmithKline, WestAfrica.Mary WamaeSECRETARY TO THE BOARD &COMPANY SECRTARYMrs. Wamae holds a LLB degree fromthe University of Nairobi, a Diplomain Law from the Kenya School of Lawand is a Certified Public Secretary(Kenya). She is a graduate of AdvancedManagement Programme ( Strathmore-IESE Business School, Barcelona Spain )She is an Advocate of the High Courtof Kenya and holds a Post GraduateDiploma in Gender and Developmentand has over 13 years private practiceexperience.23

Senior ManagementDr. James Mwangi, MBS Chief Executive Officer & Managing DirectorJames holds an Honorary Doctorate in Business Administration (Honoris Causa), from Kenya Methodist University,Doctor of Humane Letters (Honoris Causa) Kenyatta university and a Bachelor of Commerce degree (AccountingOption) from the University of Nairobi and is a Certified Public Accountant (CPA (K). James is a graduate of AdvancedManagement Programme (Strathmore-IESE Business School, Barcelona Spain). He has wide experience in thebanking industry spanning over 18 years.Gerald Warui, Director of Operations & Customer ServiceGerald is a Certified Public Accountant (Kenya) and a graduate of Advanced Management Programme(Strathmore-IESE Business School, Barcelona Spain). He has over 14 years experience in the banking sector havingpreviously worked with Fidelity <strong>Bank</strong> and 10 years at <strong>Equity</strong> <strong>Bank</strong>.Winnie Kathurima-Imanyara, Director of Change and Corporate AffairsWinnie holds a degree in Business Administration (Kenya), Bachelors of Science in Industrial Psychology from Canadaand Postgraduate Diploma in Human Resources (Kenya). Winnie has over 21 years experience in senior managementin different institutions across the globe. She has worked for Reckitt and Colman, SmithKline Beecham, SafaricomKenya and Kenya Petroleum Refineries. Her international experience spans across continents; she has undertakenassignments in South Africa, Singapore and Pakistan. Winnie is also the Chief Executive of <strong>Equity</strong> Consulting <strong>Group</strong>and <strong>Equity</strong> <strong>Group</strong> Foundation which undertakes consulting and corporate social responsibilities of <strong>Equity</strong> <strong>Bank</strong>respectively.Henry Karugu, Director of Marketing & Product DevelopmentHenry holds a Bachelors degree in Pharmacy from the University of Nairobi, a Post Graduate Diploma in Marketingfrom the Chartered Institute of Marketing (CIM). He has over 15 years working experience in marketing, havingpreviously worked as Marketing Director, GlaxoSmithKline for East and West Africa having risen from Brand Managerand Marketing Manager of the same company.John Njoroge, Finance DirectorJohn holds a Master degree in Business Administration and is a member of ICPAK, and KIM. He has over 20 years ofbanking experience, having worked for Standard Chartered <strong>Bank</strong> as Head of Finance, Systems & Processes- AfricaRegion, Head of Finance, Shared Services Centre - East & Southern Africa Region, and Finance Director in Tanzania &Botswana .Mary Wamae, Director of Corporate Strategy & Company SecretaryMary holds a LLB degree from the University of Nairobi, a Diploma in Law from the Kenya School of Lawand is a Certified Public Secretary (Kenya). She is a graduate of Advanced Management Programme(Strathmore-IESE Business School, Barcelona Spain). She is an Advocate of the High Court of Kenya and holds a PostGraduate Diploma in Gender and Development and has over 14 years of private practice experience.242007 Annual Report and Financial Statements

Senior ManagementPeter Makau, Director of Corporate <strong>Bank</strong>ingPeter is an Associate of the Chartered Institute of <strong>Bank</strong>ers (London) and a career banker with over 20 years experienceat senior level with major local and international banks including Citibank N.A., ABN Amro <strong>Bank</strong> N.V., StandardChartered <strong>Bank</strong> Kenya Limited, Stanbic <strong>Bank</strong> Kenya Limited, and NIC <strong>Bank</strong> Limited. He is well versed in bankingbusiness with a bias in Corporate <strong>Bank</strong>ing and has responsibility for driving and managing the bank’s Corporate<strong>Bank</strong>ing business.Allan Waititu, Director of ProjectsAllan is a Microsoft Certified Systems Engineer, a Novell Certified Network Engineer and a graduate of AdvancedManagement Programme (Strathmore-IESE Business School, Barcelona Spain). He has over 17 years experience in theinformation technology industry having previously worked for Trade <strong>Bank</strong>, Daima <strong>Bank</strong> and Phoenix Assurance.Ben Nyutho, General Manager, Community RelationsBen is a qualified banker and a member of the Institute of <strong>Bank</strong>ers. He previously worked for the Muranga CooperativeUnion and Continental <strong>Bank</strong> in senior positions. Ben has over 37 years of banking experience.Peter Gachau , General Manager, ITPeter holds a Bachelor of Education (Science) degree from Kenyatta University and a Post Graduate Diploma inComputer Science. He has over 14 years experience in IT having previously worked for ABC <strong>Bank</strong>, ABN AMRO <strong>Bank</strong>among others.Mbaabu Muchiri , General Manager, CreditMbaabu holds a Master in Business Administration (MBA) from the United Stated International University(USIU), aBachelor of Education degree and is a Certified Public Accountant (Kenya), a Certified Public Secretary (Kenya) and aCertified Information Systems Auditor (CISA). He is a graduate of Advanced Management Programme ( Strathmore-IESE Business School, Barcelona Spain ). He has over 16 years of management experience having previously workedwith Central <strong>Bank</strong> of Kenya and Coca-Cola Africa.Samuel Kamiti , General Manager, Alternate Business ChannelsSam holds a Bachelor of Science (Hons) degree in Mathematics and Computer Science and Post Graduate Diploma inComputer Science from the University of Nairobi. He is a Certified Information Security Manager (CISM) and CertifiedInformation Systems Auditor (CISA). He has 27 years experience in the information and communication technology fieldand 19 years experience in banking IT and operations having worked with CRDB in Tanzania, Central <strong>Bank</strong> of Kenya andStandard Chartered <strong>Bank</strong> Kenya Limited.25

Report of the DirectorsAs at 31st December 2007The directors have pleasure in submitting their report together with,the audited financial statements for the year ended 31 December2007 in accordance with Section 22 of the <strong>Bank</strong>ing Act and Section157 of the Kenyan Companies Act, which discloses the state of affairsof the <strong>Bank</strong>.1. ACTIVITIESThe <strong>Bank</strong> is engaged in the business of banking and provisionof financial services and is licensed by the Central <strong>Bank</strong> of Kenyaunder the <strong>Bank</strong>ing Act.2. RESULTSThe results for the year are set out on page 32.* Senegalese – Alternate to Peter Gachuba** Retired by rotation on 30th March 2007 and werere-elected*** Retired by rotation on 30th March 2007 and did not seekre- election**** British - Appointed on 21st December 2007Article 100 of the Articles of Association of the <strong>Bank</strong> provides forretirement of directors by rotation.6. AUDITORSThe auditors, Ernst & Young, have indicated their willingness tocontinue in office in accordance with Section 159(2) of the KenyanCompanies Act and subject to Section 24(1) of the <strong>Bank</strong>ing Act.3. RESERVESBy order of the BoardThe reserves of the <strong>Bank</strong> are set out on page 61, note 29 of thisreport.4. DIVIDENDSThe Board has recommended a dividend of 40% of par value(KShs 2.00 per share) subject to the approval of shareholders atthe Annual General Meeting. Helios EB Investors who becameshareholders on 21st December 2007 will not be entitled to anydividend for the year 2007.Mary Wangari WamaeCompany Secretary22nd May 20085. DIRECTORSThe directors who served during the year and to the date of thisreport are set out below:Peter Kahara Munga - ChairmanJames Njuguna Mwangi - Chief Executive/ManagingDirectorBenson Irungu Wairegi ** - Vice-chairmanFredrick Mwangi Muchoki **Peter Njeru GachubaWagane Diouf *Beatrice Makanga Sabana***Julius Kangogo Kipng’etichLinus Wang’ombe GitahiErnest Mattho NzovuBabatunde Temitope Soyoye****Temitope Olugbeminiyi Lawani****262007 Annual Report and Financial Statements

Ripoti ya WakurugenziKwa mwaka uliomalizika tarehe 31 Disemba 2007Wakurugenzi wanafuraha kuwasilisha ripoti yao pamoja na Taarifa yaHesabu za Pesa iliyokaguliwa kwa mwaka uliomalizika 31 Disemba2007 kulingana na kifungu cha 22 cha sheria za Benki na kifungu 157cha sheria za Makampuni nchini Kenya, ambazo zinabainisha hali yakifedha ya benki.1. SHUGHULIBenki inajishughulisha na biashara ya benki na utoaji hudumaza kifedha na imepewa leseni na Benki Kuu ya Kenya chini yakifungu cha sheria cha Benki.2. MATOKEOLinus Wang’ombe GitahiErnest Mattho NzovuBabatunde Temitope Soyoye****Temitope Olugbeminiyi Lawani***** Msenegalese – Anayebadilishana na Peter Gachuba** Alistaafu kwa zamu mnamo 30 Machi 2007 nakuchaguliwa upya*** Alistaafu kwa zamu mnamo30 Machi 2007 nahakujiwasilisha kuchaguliwa tena**** Mwingereza – Aliteuliwa tarehe 21 Disemba 2007Kifungu cha sheria cha 100 cha Katiba na Sheria za Kampunikinawezesha wakurugenzi kustaafu kwa zamu.Matokeo ya mwaka yamewekwa katika ukurasa wa 23.6. WAKAGUZI3. AKIBAAkiba za Benki zimewekwa katika ukurasa wa 61, ukumbusho 29wa ripoti hii.Wakaguzi wa hesabu za pesa, Ernst & Young, wamedhihirisha niayao ya kuendelea kufanya kazi hii kulingana na Sehemu 159(2) yaSheria za Makampuni nchini Kenya na kuambatana na Sehemu24(1) ya Sheria za Benki.4. MGAO WA FAIDAHalmashauri imependekeza mgao wa faida wa asilimia 40%kuambatana na thamani (ya shilingi 2 kwa kila hisa) iwapowenyehisa wataidhinisha kwenye Mkutano Mkuu wa Mwaka.Wawekezaji wa Helios EB ambao walijiunga kuwa wanachamamnamo tarehe 21 Disemba 2007 hawatapata mgao wowote wafaida wa mwaka wa 2007.5. WAKURUGENZIWakurugenzi ambao walihudumu wakati wa kipindi cha mwakahuo hadi wakati wa kutolewa ripoti hii wameorodheshwa hapochini:Kwa Amri ya HalmashauriMary Wangari WamaeKatibu wa Kampuni22 Mei 2008Peter Kahara MungaJames Njuguna MwangiBenson Irungu Wairegi **Fredrick Mwangi Muchoki **Peter Njeru GachubaWagane Diouf *Beatrice Makanga Sabana***Julius Kangogo Kipng’etich- Mwenyekiti- Afisa Mkuu Mtendaji/Mkurugenzi Mkuu- Naibu-Mwenyekiti2007 Annual Report and Financial Statements 27

Statement on Corporate GovernanceFor the year ended 31st December 2007<strong>Equity</strong> <strong>Bank</strong>’s corporate governance is a culture built on the bank’score values. The <strong>Bank</strong> is managed under the direction of the Board ofDirectors that is responsible for the long term strategic direction toensure maximization of economic value for all stakeholders. This goal ispursued whilst being accountable to the shareholders for maintaininghigh standards of corporate governance and business ethics. It is alsocharacterized by transparency and openness, fairness, good corporatecitizenship , compliance with regulatory and prudential requirements.The bank has created an elaborate governance structure comprisingshareholders (AGM), Board of Directors, and Board Committeestogether with an effective management structure that enhances theseparation of duties and dual control system.OVERSIGHT ROLE OF THE BOARD OF DIRECTORSThe Board of Directors has supervised the delivery of dramatic growthover the years, with the bank continuing to deliver strong financialperformance. The Board has provided leadership to the <strong>Bank</strong> resultingin the <strong>Bank</strong> being able to take its services to the furthest reach of theKenyan society and generate of great shareholder wealth.Audit Committee ensures that the bank has and adheres to soundpolicies, processes and procedures that deliver business strategic planseffectively and further reviews the financial performance of the <strong>Bank</strong>,internal controls, performance and findings of internal auditors. Thesame is comprised of three non-executive directors.Credit Committee reviews and oversees the overall lending policyof the <strong>Bank</strong>, ensures lending systems and procedures are adequateand adhered to.In addition it also ensures there is full compliancewith Central <strong>Bank</strong> of Kenya prudential guidelines, <strong>Bank</strong>ing Act andinternational accounting standards to guarantee high quality assetportfolio.Risk Management Committee ensures quality, integrity and reliabilityof the <strong>Bank</strong>s’ management. The committee also discharges dutiesrelating to corporate accountability and associated risks in termsof management assurance and reporting. The committee monitorscompliance with the <strong>Bank</strong>s’ risk policies and procedures and regularlyreviews the adequacy of the Risk Management framework in relationto the risks faced by the <strong>Bank</strong>.The Board has attracted directors who have shown great commitmentand enthusiasm in involving themselves in the affairs of the <strong>Bank</strong> andwho have demonstrated the spirit and ethos of the organization. TheDirectors have passed resolutions barring them from trading with thebank or obtaining credit facilities from the bank. Each of the directorshas subscribed to the Code of Corporate Practices which guide themin the fulfillment of their duties and responsibilities to shareholders,customers, employees and the community.During the year, eight non-executive Directors and one executivedirector served on the Board, nine meetings were held, four of whichwere scheduled and all directors attended at least 75% of all the Boardmeetings.During the year 2007, the Board commissioned and successfullycompleted a self evaluation exercise. It was conducted in keeping withhighest international standards. The evaluation focused on the roleand responsibility of the Board, structure, composition, functions andprocesses, information, meetings among other critical areas.Strategy and Investment Committee supervises the developmentof corporate strategy and monitors implementation of the same. Itmanages the process of resource allocation to increase shareholdervalue in pursuit of the vision of the bank. It also reviews and considersthe proposed strategic investments, makes recommendations to theBoard and advises the management accordingly.Tendering and Procurement Committee oversees and keeps the Boardappraised on issues pertaining to the tendering and procurement ofgoods and services for the bank including regularly reviewing thetendering and procurement procedures.Governance, Board Nominations and Staff Remuneration Committeeensures implementation and compliance with Human ResourcePolicies, makes recommendations to the board for policy on executiveand senior management remuneration formulated to attract and retainhigh caliber staff and motivate them to implement the bank’s strategy.The committee also ensures the board appointments maintain a goodmix of skills, experience and competence in various field of expertise.BOARD COMMITTEESThe Board has established seven board committees which are allgoverned by charters.Board Executive Committee provides coaching and mentoring forthe Chief Executive and provides the link between the Board and themanagement . The committee provides a first line of support andresponse to management.282007 Annual Report and Financial Statements

Statement of Directors ResponsibilitiesFor the year ended 31st December 2007The Kenyan Companies Act requires the directors to prepare financial statements for each financial year which give a true and fair view of thestate of affairs of the <strong>Bank</strong> as at the end of the financial year and of its operating results for that year. It also requires the directors to ensure the<strong>Bank</strong> keeps proper accounting records which disclose, with reasonable accuracy, the financial position of the <strong>Bank</strong>. They are also responsiblefor designing, implementing and maintaining internal controls relevant to the preparation and fair presentation of financial statements that arefree of material misstatements, whether due to fraud or error, selecting and applying appropriate accounting policies; and making accountingestimates that are reasonable in the circumstances. The directors are also responsible for safeguarding the assets of the <strong>Bank</strong>.The directors accept responsibility for the annual financial statements, which have been prepared using appropriate accounting policiessupported by reasonable and prudent judgements and estimates, in conformity with International Financial Reporting Standards and in themanner required by the Kenyan Companies Act. The directors are of the opinion that the financial statements give a true and fair view of the stateof the financial affairs of the <strong>Bank</strong> and of its operating results.The directors further accept responsibility for the maintenance of accounting records which may be relied upon in the preparation of financialstatements, as well as adequate systems of internal control.Nothing has come to the attention of the directors to indicate that the <strong>Bank</strong> will not remain a going concern for at least the next twelve monthsfrom the date of this statement.DirectorDirectorSecretary6th March 2008302007 Annual Report and Financial Statements

Report of the Independent Auditorsto the Members of <strong>Equity</strong> <strong>Bank</strong> Ltd. For the year ended 31st December 2007REPORT ON THE FINANCIAL STATEMENTSWe have audited the accompanying financial statements of <strong>Equity</strong> <strong>Bank</strong> Limited, set out on pages 32 to 66, which comprise the balance sheetas at 31December 2007, income statement, statement of changes in equity and cash flow statement for the year then ended and a summary ofsignificant accounting policies and other explanatory notes.DIRECTORS’ RESPONSIBILITY FOR THE FINANCIAL STATEMENTSThe directors are responsible for the preparation and fair presentation of these financial statements in accordance with International FinancialReporting Standards and in the manner required by the Kenyan Companies Act. This responsibility includes: designing, implementing andmaintaining internal controls relevant to the preparation and fair presentation of financial statements that are free of material misstatement,whether due to fraud or error; selecting and applying appropriate accounting policies; and making accounting estimates that are reasonable inthe circumstances.AUDITOR’S RESPONSIBILITYOur responsibility is to express an independent opinion on these financial statements based on our audit. We conducted our audit in accordancewith International Standards on Auditing. Those standards require that we comply with ethical requirements and plan and perform the audit toobtain reasonable assurance as to whether the financial statements are free of material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The proceduresselected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whetherdue to fraud or error. In making those risk assessments, the auditor considers internal controls relevant to the entity's preparation and fairpresentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose ofexpressing an opinion on the effectiveness of the entity's internal controls. An audit also includes evaluating the appropriateness of accountingpolicies used and the reasonableness of accounting estimates made by the directors, as well as evaluating the overall presentation of the financialstatements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.OPINIONIn our opinion, the accompanying financial statements give a true and fair view of the state of financial affairs of <strong>Equity</strong> <strong>Bank</strong> Limited as at 31December 2007 and of its profit and cash flows for the year then ended in accordance with International Financial Reporting Standards and therequirements of the Kenyan Companies Act.REPORT ON OTHER LEGAL REQUIREMENTSAs required by the Kenyan Companies Act, we report to you, based on our audit, that:i) we have obtained all the information and explanations which, to the best of our knowledge and belief, were considered necessary for thepurposes of our audit;ii) in our opinion, proper books of account have been kept by the <strong>Bank</strong>, so far as appears from our examination of those books; andiii) the <strong>Bank</strong>’s balance sheet and income statement are in agreement with the books of account.Nairobi12th March 20082007 Annual Report and Financial Statements 31

Balance SheetAs at 31st December 2007In millions of Kenya Shillings Note 2007 2006AssetsCash and cash equivalents 21 11,996 4,709Loans and advances to customers 22 21,836 10,930Investment securities 23 13,543 1,656Investment in associate 17 442 -Property and equipment 14 2,607 1,469Intangible assets 15 224 161Other assets 24 2,428 1,099Total assets 53,076 20,024LiabilitiesDeposits from customers 25 31,536 16,337Current tax liabilities 18 209 147Deferred tax liabilities 26 45 11Long term borrowings 27 4,521 485Other liabilities 28 1,848 844Total liabilities 38,159 17,824<strong>Equity</strong>Share capital 29 1,811 453Share premium 29 10,543 480Fair value reserve 29 13 1Statutory reserve 29 253 -Retained earnings 1,754 1,085Proposed dividends 29 543 181Total equity 14,917 2,200Total liabilities and equity 53,076 20,024The financial statements were approved by the Board of Directors on 6th March 2008 and signed on its behalf by:-Director Director SecretaryThe notes on pages 36 to 66 are an integral part of these financial statements.2007 Annual Report and Financial Statements 33

Cashflow StatementFor the year ended 31st December 2007In millions of Kenya Shillings Note 2007 2006Cash flows from operating activitiesProfit before income tax 2,378 1,103Adjustments for:Depreciation of property and equipment 14 353 242Amortisation of intangible assets 15 70 38Profit on disposal of property and equipment - (2)2,801 1,381Change in loans and advances to customers (10,906) (5,405)Change in other assets (1,329) (1,553)Change in deposits from customers 15,199 7,289Change in other liabilities and provisions 1,004 2026,769 1,914Income tax paid 18 (392 ) (355 )Net cash used in operating activities 6,377 1,559Cash flows from investing activitiesPurchase of investment securities (11,887) (307)Investment in associate 17 (427) -Purchase of property and equipment 14 (1,493) (667)Purchase of intangible assets 14 (133) (109)Proceeds from the sale of property and equipment 2 2Net cash used in investing activities (13,938 ) (1,081 )Cash flows from financing activitiesIncrease in subordinated liabilities 4,033 485Proceeds from issue of new shares 10,996 -Dividends paid 20 (181) (181)Net cash from financing activities 14,848 304Net increase in cash and cash equivalents 7,287 782Cash and cash equivalents at 1 January 21 4,709 3,927Cash and cash equivalents at 31 December 21 11,996 4,709The notes on pages 36 to 66 are an integral part of these financial statements342007 Annual Report and Financial Statements

Statement of Changes in <strong>Equity</strong>For the year ended 31st December 2007In millions of Kenya ShillingsFor the year ended 31 December 2006 Share Share Revenue Statutory Fair value Proposedcapital premium reserves loan reserve reserves dividend TotalAt 1 January 2006 453 480 512 - (33) 181 1,593Profit for the year - - 754 - - - 754Revaluation of treasury bonds - - - - 34 - 34Dividends:Final for 2005 paid - - - - - (181) (181)Proposed for 2006 - - (181) - - 181 -At 31 December 2006 453 480 1,085 - 1 181 2,200For the year ended 31 December 2007At 1 January 2007 453 480 1,085 - 1 181 2,200Capitalisation from share premium 480 (480) - - - - -Capitalisation from revenue reserve 425 - (425) - - - -Share capital issued 453 10,543 - - - - 10,996Profit for the year - - 1,890 - - - 1,890Revaluation of treasury bonds - - - - 12 - 12Statutory loan reserve - - (253) 253 - - -Dividends:Final for 2006 paid - - - - - (181) (181 )Proposed for 2007 - - (543) - - 543 -At 31 December 2007 1,811 10,543 1,754 253 13 543 14,917The notes on pages 36 to 66 are an integral part of these financial statements.2007 Annual Report and Financial Statements 35

Notes to the Financial StatementsFor the year ended 31st December 20071. Reporting entity<strong>Equity</strong> <strong>Bank</strong> Limited (The “<strong>Bank</strong>”) is a company domiciled in Kenya. The address of the <strong>Bank</strong>’s registered office is P. O. Box 75104-00200Nairobi. The principal activity of the bank is to offer retail banking and microfinance services.2. Basis of preparation(a) Statement of complianceThe financial statements have been prepared in accordance with International Financial Reporting Standards (IFRSs).The financial statements were approved by the Board of Directors on 6th March 2008.(b) Basis of measurementThe financial statements have been prepared on the historical cost basis except for the following:• Financial instruments at fair value with profit or loss measured at fair value• Available-for-sale financial assets are measured at fair value• Investment property is measured at fair value(c) Functional and presentation currencyThe financial statements are presented in Kenya Shillings, which is the <strong>Bank</strong>’s functional currency and have been rounded off to thenearest million.(d) Use of estimates and judgementsThe preparation of financial statements requires management to make judgements, estimates and assumptions that affect the applicationof accounting policies and the reported amounts of assets, liabilities, income and expenses.Estimates and underlying assumptions are reviewed on an on-going basis. Revisions to accounting estimates are recognised in the yearin which the estimate is revised and in any future years affected.In particular, information about significant areas of estimation uncertainty and critical judgements in applying accounting policies thathave the most significant effect on the amount recognised in the financial statements are described in notes 4 and 5.3. Significant accounting policiesThe accounting policies set out below have been applied consistently to all years presented in these financial statements (except asotherwise disclosed).(a) AssociatesAn associated company is that in which the <strong>Bank</strong> has significant influence, but not control, over the financial and operating policies. Thefinancial statements include the <strong>Bank</strong>’s share of the total recognised gains and losses of the associated company on an equity accountingbasis, from the date that significant influence commences until the date that significant influence ceases. At the company level, associatesare recognised using the equity method.362007 Annual Report and Financial Statements

Notes to the Financial StatementsFor the year ended 31st December 2007(b) Foreign currency transactionsTransactions in foreign currencies are translated to the functional currency of the <strong>Bank</strong> at exchange rates ruling on the transaction dates.Monetary assets and liabilities denominated in foreign currencies at the reporting date are retranslated to the functional currency at themean exchange rate as at that date. The foreign currency gain or loss on monetary items is the difference between amortised cost in thefunctional currency at the beginning of the year, adjusted for effective interest and payments during the year, and the amortised costin foreign currency translated at the exchange rate at the end of the year. Non-monetary assets and liabilities denominated in foreigncurrencies that are measured at fair value are retranslated to the functional currency at the exchange rate at the date that the fair valuewas determined.(c) Interest income and interest expenseInterest income and expense are recognised in the income statement on accrual basis.Interest income and expense presented in the income statement include:• Interest on financial assets and liabilities on accrual basis taking into account the effective interest rate basis• Interest on available-for-sale investment securities on an effective interest basisInterest income and expense on all trading assets and liabilities are considered to be incidental to the <strong>Bank</strong>’s trading operations and arepresented together with all other changes in the fair value of trading assets and liabilities in net trading income.(d) Fees and commissionFees and commission income and expenses, other fees and commission income, including account servicing fees, investment managementfees, placement fees and syndication fees, are recognised as the related services are performed.Other fees and commission expense relates mainly to transaction and service fees, which are expensed as the services are received.(e) Net trading incomeNet trading income comprises gains less losses related to trading assets and liabilities, and includes all realised and unrealised fair valuechanges, interest, and foreign exchange differences.(f) Lease paymentsPayments made under operating leases are recognised in profit or loss on a straight-line basis over the term of the lease. Lease incentivesreceived are recognised as an integral part of the total lease expense, over the term of the lease.(g) Income tax expenseIncome tax expense comprises current and deferred tax. Income tax expense is recognised in the income statement except to the extentthat it relates to items recognised directly in equity, in which case it is recognised in equity.Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at the balancesheet date, and any adjustment to tax payable in respect of previous years.Deferred tax is provided using the balance sheet method, providing for temporary differences between the carrying amounts of assetsand liabilities for financial reporting purposes and the amounts used for taxation purposes. Deferred tax is measured at the tax rates that2007 Annual Report and Financial Statements 37