pqri measure coding and reporting principles - Indiana Academy of ...

pqri measure coding and reporting principles - Indiana Academy of ...

pqri measure coding and reporting principles - Indiana Academy of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

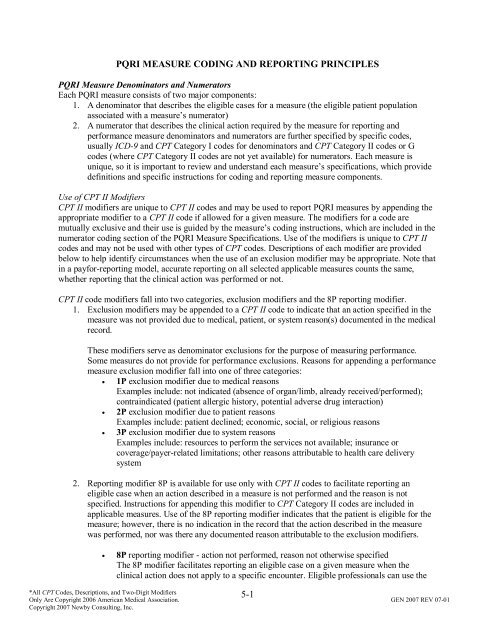

PQRI MEASURE CODING AND REPORTING PRINCIPLES<br />

PQRI Measure Denominators <strong>and</strong> Numerators<br />

Each PQRI <strong>measure</strong> consists <strong>of</strong> two major components:<br />

1. A denominator that describes the eligible cases for a <strong>measure</strong> (the eligible patient population<br />

associated with a <strong>measure</strong>’s numerator)<br />

2. A numerator that describes the clinical action required by the <strong>measure</strong> for <strong>reporting</strong> <strong>and</strong><br />

performance <strong>measure</strong> denominators <strong>and</strong> numerators are further specified by specific codes,<br />

usually ICD-9 <strong>and</strong> CPT Category I codes for denominators <strong>and</strong> CPT Category II codes or G<br />

codes (where CPT Category II codes are not yet available) for numerators. Each <strong>measure</strong> is<br />

unique, so it is important to review <strong>and</strong> underst<strong>and</strong> each <strong>measure</strong>’s specifications, which provide<br />

definitions <strong>and</strong> specific instructions for <strong>coding</strong> <strong>and</strong> <strong>reporting</strong> <strong>measure</strong> components.<br />

Use <strong>of</strong> CPT II Modifiers<br />

CPT II modifiers are unique to CPT II codes <strong>and</strong> may be used to report PQRI <strong>measure</strong>s by appending the<br />

appropriate modifier to a CPT II code if allowed for a given <strong>measure</strong>. The modifiers for a code are<br />

mutually exclusive <strong>and</strong> their use is guided by the <strong>measure</strong>’s <strong>coding</strong> instructions, which are included in the<br />

numerator <strong>coding</strong> section <strong>of</strong> the PQRI Measure Specifications. Use <strong>of</strong> the modifiers is unique to CPT II<br />

codes <strong>and</strong> may not be used with other types <strong>of</strong> CPT codes. Descriptions <strong>of</strong> each modifier are provided<br />

below to help identify circumstances when the use <strong>of</strong> an exclusion modifier may be appropriate. Note that<br />

in a payfor-<strong>reporting</strong> model, accurate <strong>reporting</strong> on all selected applicable <strong>measure</strong>s counts the same,<br />

whether <strong>reporting</strong> that the clinical action was performed or not.<br />

CPT II code modifiers fall into two categories, exclusion modifiers <strong>and</strong> the 8P <strong>reporting</strong> modifier.<br />

1. Exclusion modifiers may be appended to a CPT II code to indicate that an action specified in the<br />

<strong>measure</strong> was not provided due to medical, patient, or system reason(s) documented in the medical<br />

record.<br />

These modifiers serve as denominator exclusions for the purpose <strong>of</strong> measuring performance.<br />

Some <strong>measure</strong>s do not provide for performance exclusions. Reasons for appending a performance<br />

<strong>measure</strong> exclusion modifier fall into one <strong>of</strong> three categories:<br />

• 1P exclusion modifier due to medical reasons<br />

Examples include: not indicated (absence <strong>of</strong> organ/limb, already received/performed);<br />

contraindicated (patient allergic history, potential adverse drug interaction)<br />

• 2P exclusion modifier due to patient reasons<br />

Examples include: patient declined; economic, social, or religious reasons<br />

• 3P exclusion modifier due to system reasons<br />

Examples include: resources to perform the services not available; insurance or<br />

coverage/payer-related limitations; other reasons attributable to health care delivery<br />

system<br />

2. Reporting modifier 8P is available for use only with CPT II codes to facilitate <strong>reporting</strong> an<br />

eligible case when an action described in a <strong>measure</strong> is not performed <strong>and</strong> the reason is not<br />

specified. Instructions for appending this modifier to CPT Category II codes are included in<br />

applicable <strong>measure</strong>s. Use <strong>of</strong> the 8P <strong>reporting</strong> modifier indicates that the patient is eligible for the<br />

<strong>measure</strong>; however, there is no indication in the record that the action described in the <strong>measure</strong><br />

was performed, nor was there any documented reason attributable to the exclusion modifiers.<br />

• 8P <strong>reporting</strong> modifier - action not performed, reason not otherwise specified<br />

The 8P modifier facilitates <strong>reporting</strong> an eligible case on a given <strong>measure</strong> when the<br />

clinical action does not apply to a specific encounter. Eligible pr<strong>of</strong>essionals can use the<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-1

8P modifier to receive credit for successful <strong>reporting</strong> but will not receive credit for<br />

performance.<br />

For example, a patient with diabetes may present to a clinician for reasons that do not involve<br />

glycemic control, hypertension, or cholesterol management. However, the claim for services for<br />

that encounter will contain ICD-9 <strong>and</strong> CPT codes that will draw the patient into the diabetes<br />

<strong>measure</strong>s’ denominator during analysis. The 8P modifier serves to include the patient in the<br />

numerator when <strong>reporting</strong> rates are calculated for PQRI.<br />

Reporting Frequency <strong>and</strong> Performance Timeframes<br />

Each <strong>measure</strong> includes a <strong>reporting</strong> frequency requirement for each denominator-eligible patient seen<br />

during the <strong>reporting</strong> period. The <strong>reporting</strong> frequency is described in the instructions:<br />

• Report one-time only<br />

• Report once for each procedure performed<br />

• Report once for each acute episode<br />

A <strong>measure</strong>’s performance timeframe is defined in the <strong>measure</strong>’s description <strong>and</strong> is distinct from the<br />

<strong>reporting</strong> frequency requirement. The performance timeframe, unique to each <strong>measure</strong>, delineates the<br />

timeframe in which the clinical action described in the numerator may be accomplished.<br />

Performance timeframes may be stated as “within 12 months,” or “most recent.” This means that:<br />

1. The clinical action in the numerator need be performed only once during a 12-month period for<br />

each patient seen during the <strong>reporting</strong> period<br />

2. The quality code need be reported only one time for each patient by each eligible pr<strong>of</strong>essional<br />

caring for the patient who has chosen to report that <strong>measure</strong> during the <strong>reporting</strong> period<br />

If the <strong>measure</strong> calls for a clinical test result, then the most recent test result only needs to be obtained,<br />

assessed, <strong>and</strong> reported one time per <strong>reporting</strong> period. A test does not need to have been performed within<br />

the <strong>reporting</strong> period, nor does it need to have been performed by the same eligible pr<strong>of</strong>essional.<br />

Performance timeframes may also be tied to a specific clinical event that requires <strong>reporting</strong> each time the<br />

event occurs within the <strong>reporting</strong> period. The following are examples <strong>of</strong> <strong>measure</strong>s reported each time the<br />

clinical action described by the <strong>measure</strong> numerator is taken:<br />

• Procedure-related <strong>measure</strong>s require <strong>reporting</strong> each time the procedure is performed <strong>and</strong> have<br />

distinct performance timeframes tied to them. The date <strong>of</strong> service is the date that is used to report<br />

the <strong>measure</strong>. Examples are perioperative care or imaging <strong>measure</strong>s.<br />

• Chronic care <strong>measure</strong>s, such as those that call for prescribing a medication, require the eligible<br />

pr<strong>of</strong>essional to verify whether the medication is current <strong>and</strong> being taken by the patient. A new<br />

prescription is not required to meet the <strong>measure</strong> requirement unless it is clinically indicated.<br />

• Acute care <strong>measure</strong>s are tied to specific episodes <strong>of</strong> acute care <strong>and</strong> require <strong>reporting</strong> each time an<br />

acute event occurs. Examples are <strong>measure</strong>s related to hospitalizations, fractures <strong>and</strong> osteoporosis<br />

management, or stroke <strong>measure</strong>s.<br />

Claims-Based Reporting Principles<br />

The following <strong>principles</strong> apply to the <strong>reporting</strong> <strong>of</strong> quality-data codes for PQRI <strong>measure</strong><br />

• The CPT Category II code, which supplies the numerator, must be reported on the same claim<br />

form as the payment codes, usually ICD-9 <strong>and</strong> CPT Category I codes, which supply the<br />

denominator.<br />

• Quality-data codes must be submitted with a line item charge <strong>of</strong> zero dollars ($0.00) at the time<br />

the associated covered service is performed.<br />

! The submitted charge field cannot be blank.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-2

! The line item charge should be $0.00.<br />

! If a system does not allow a $0.00 line item charge, use a small amount such as $0.01<br />

! Entire claims with a zero charge will be rejected. (Total charge for the claim cannot be<br />

$0.00)<br />

! Quality data code line items will be denied for payment, but are then passed through the<br />

claims processing system for PQRI analysis.<br />

• Multiple eligible pr<strong>of</strong>essionals’ quality-data codes can be reported on the same claim.<br />

• Multiple CPT Category II codes for multiple <strong>measure</strong>s that are applicable to a patient visit can be<br />

reported on the same claim, as long as the corresponding denominator codes are also line items<br />

on that claim.<br />

• The individual NPI <strong>of</strong> the participating eligible pr<strong>of</strong>essional(s) must be properly used on the<br />

claim.<br />

Timeliness <strong>of</strong> Quality Data Submission<br />

Claims processed by the Carrier/MAC must reach the national Medicare claims system data warehouse<br />

(National Claims History file) by February 29, 2008 to be included in the analysis. Claims for services<br />

furnished toward the end <strong>of</strong> the <strong>reporting</strong> period should be filed promptly. Claims that are resubmitted<br />

only to add quality-data codes will not be included in the analysis.<br />

Successful Reporting<br />

The 2007 PQRI incentive payment is an all-or-nothing bonus (subject to cap) based on successful<br />

<strong>reporting</strong>.<br />

Eligible pr<strong>of</strong>essionals need not enroll or file an intent to participate for the PQRI. Eligible pr<strong>of</strong>essionals<br />

can participate by <strong>reporting</strong> the appropriate quality <strong>measure</strong> data on claims submitted to their Medicare<br />

claims processing contractor.<br />

In order to satisfactorily meet the requirements <strong>of</strong> the program <strong>and</strong> receive the bonus payment, certain<br />

<strong>reporting</strong> thresholds must be met. When four or more <strong>measure</strong>s are applicable to the services provided by<br />

an eligible pr<strong>of</strong>essional, the 80% threshold must be met on at least three <strong>of</strong> the <strong>measure</strong>s reported.<br />

Good news for those physicians practicing in a group practice, not all physicians in the group must<br />

participate in PQRI to be eligible for the bonus payment. Individual analysis will be done using the<br />

individual physician’s national provider identifier (NPI) to determine satisfactory <strong>reporting</strong> <strong>and</strong> the bonus<br />

payment calculation. Thus, physicians must bill with an NPI to participate in PQRI. The potential 1.5<br />

percent incentive payment will be paid in mid-2008 as a lump-sum bonus payment made to the practice at<br />

the Taxpayer Identification Number (TIN) level. According to the CMS website, the NPI is the only<br />

unique provider enumerator that can be used by the CMS PQRI analysis contractor to properly identify<br />

eligible physicians at the individual-physician level.<br />

The performing pr<strong>of</strong>essional’s NPI must be used for the quality-data codes <strong>and</strong> related services. For<br />

claims submitted via the ASC X12N 837 pr<strong>of</strong>essional health care claim transaction, the group practice<br />

NPI is placed in the provider billing segment, loop 2010AA, <strong>and</strong> the performing pr<strong>of</strong>essional’s NPI is<br />

placed in loop 2420A. For claims submitted via the CMS 1500 form, the performing pr<strong>of</strong>essional’s NPI is<br />

placed on the individual line item. Placing the performing eligible pr<strong>of</strong>essional’s NPI on the individual<br />

line item will allow the analysis <strong>of</strong> successful <strong>reporting</strong> <strong>and</strong> the bonus payment calculation to be<br />

performed at the individual level, though payment will be made at the TIN level.<br />

Bonus Payment<br />

Participating eligible pr<strong>of</strong>essionals who successfully report may earn a 1.5% bonus, subject to cap. The<br />

potential 1.5% bonus will be based on allowed charges for covered pr<strong>of</strong>essional services:<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-3

1. Furnished during the <strong>reporting</strong> period <strong>of</strong> July 1 through December 31, 2007,<br />

2. Received into the CMS National Claims History (NCH) file by February 29, 2008 (Joy’s<br />

comment: claim should be received by the Carrier no later than February 28, 2008), <strong>and</strong><br />

3. Paid under the Medicare Physician Fee Schedule (Joy’s comment: HCPCS “J” codes for drugs<br />

are not subject to the bonus).<br />

Because claims processing times may vary by time <strong>of</strong> the year <strong>and</strong> Medicare Carrier/Medicare<br />

Administrative Contractor (MAC), physicians should submit claims from the end <strong>of</strong> 2007 promptly, so<br />

that those claims will reach the NCH file by February 29, 2008. Bonuses will be paid as a lump sum in<br />

mid-2008. There is no beneficiary copayment or notice to the beneficiary regarding the bonus payments.<br />

A payment cap that would reduce the potential bonus below 1.5% <strong>of</strong> allowed charges may apply in<br />

situations where a physician reports relatively few instances <strong>of</strong> quality <strong>measure</strong> data. The physician’s cap<br />

will be calculated by multiplying: (1) the physician’s total instances <strong>of</strong> <strong>reporting</strong> quality data for all<br />

<strong>measure</strong>s (not limited only to <strong>measure</strong>s meeting the 80% threshold), by (2) a constant <strong>of</strong> 300%, <strong>and</strong> by (3)<br />

the national average per <strong>measure</strong> payment amount.<br />

The national average per <strong>measure</strong> payment amount is one value for all <strong>measure</strong>s <strong>and</strong> all participants that<br />

is calculated by dividing: (1) the total amount <strong>of</strong> allowed charges under the Physician Fee Schedule for all<br />

covered pr<strong>of</strong>essional services furnished during the <strong>reporting</strong> period on claims for which quality <strong>measure</strong>s<br />

were reported by all participants in the program by (2) the total number <strong>of</strong> instances for which data were<br />

reported by all participants in the program for all <strong>measure</strong>s during the <strong>reporting</strong> period. (Note that the<br />

national average per <strong>measure</strong> payment amount calculation only takes into account the charges on claims<br />

for which quality <strong>measure</strong>s were reported, whereas the individual bonus calculation takes into account<br />

charges for all services furnished during the <strong>reporting</strong> period.) While the purpose <strong>of</strong> the cap is clear, it is<br />

not possible to determine the impact <strong>of</strong> the cap until the national average per <strong>measure</strong> payment amount<br />

can be calculated after the end <strong>of</strong> the <strong>reporting</strong> period.<br />

CMS recommends that physicians report on every quality <strong>measure</strong> that is applicable to their patient<br />

populations to: (1) increase the likelihood that they will reach the 80% satisfactorily <strong>reporting</strong><br />

requirement for the requisite number <strong>of</strong> <strong>measure</strong>s <strong>and</strong> (2) increase the likelihood that they will not be<br />

affected by the bonus payment cap.<br />

2007 Physician Quality Reporting Initiative Measures - Not All Inclusive<br />

1) Hemoglobin A1c Poor Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent hemoglobin A1c greater than 9.0% - This <strong>measure</strong> is to<br />

be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. The performance<br />

period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the primary<br />

management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong><br />

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit) (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit);<br />

99304-99310 (nursing facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Most recent hemoglobin A1c level > 9.0% (3046F)<br />

Most recent hemoglobin A1c level < 7.0% (3044F)<br />

Most recent hemoglobin A1c level 7.0% to 9.0% (3045F)<br />

Hemoglobin A1c not performed during last 12 months reason not specified (3046F-8P)<br />

2) Low Density Lipoprotein Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent LDL-C level in control (less than 100 mg/dl) - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. The<br />

performance period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the<br />

primary management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong>.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-4

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit) (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit);<br />

99304-99310 (nursing facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Most recent LDL-C < 100 mg/dL (3048F)<br />

Most recent LDL-C 100-129 mg/dL (3049F)<br />

Most recent LDL-C ≥ 130 mg/dL (3050F)<br />

LDL-C level not performed during last 12 months reason not specified (3048F-8P)<br />

3) High Blood Pressure Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent blood pressure in control (less than 140/80 mm Hg) -<br />

This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period.<br />

The performance period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the<br />

primary management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong>.<br />

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit); 99304-99310 (nursing<br />

facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

Systolic codes<br />

_____ Most recent systolic blood pressure < 130 mm Hg (3074F)<br />

_____ Most recent systolic blood pressure 130 to 139 mm Hg (3075F)<br />

_____ Most recent systolic blood pressure > 140 mm Hg (3077F)<br />

AND<br />

Diastolic codes<br />

_____ Most recent diastolic blood pressure < 80 mm Hg (3078F)<br />

_____ Most recent diastolic blood pressure 80-89 mm Hg (3079F)<br />

_____ Most recent diastolic blood pressure > 90 mm Hg (3080F)<br />

OR<br />

_____<br />

Blood pressure <strong>measure</strong>ment not performed, reason not specified (2000F-8P)<br />

4) Screening for Future Fall Risk - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older who were screened for<br />

future fall risk (patients are considered at risk for future falls if they have had 2 or more falls in the past year or any<br />

fall with injury in the past year) at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once<br />

per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in all nonacute<br />

settings (excludes emergency departments <strong>and</strong> acute care hospitals). It is anticipated that clinicians who<br />

provide primary care for the patient will submit this <strong>measure</strong>.<br />

ICD-9: None specified - CPT: 97001-97004 (PT eval); 99201-99215 (<strong>of</strong>fice/outpatient visit), 99304-99310 (nursing facility), 99324-99328<br />

(domiciliary), 99334-99337 (domiciliary), 99341-99350 (home visits), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive counseling),<br />

Definition: A fall is defined as a sudden, unintentional change in position causing an individual to l<strong>and</strong> at a lower<br />

level, on an object, the floor, or the ground, other than as a consequence <strong>of</strong> sudden onset <strong>of</strong> paralysis, epileptic<br />

seizure, or overwhelming external force (Tinetti).<br />

_____<br />

_____<br />

_____<br />

_____<br />

Screening for future fall risk; documentation <strong>of</strong> 2 or more falls in the past year or any fall with injury in the<br />

past year (1100F)<br />

Screening for future fall risk; documentation <strong>of</strong> no falls in the past year or only 1 fall without injury in the<br />

past year (1101F)<br />

Screening for future fall risk not performed for medical reasons (1100F-1P)<br />

Screening for future fall risk not performed, reason not specified (1100F-8P)<br />

5) Heart Failure: Angiotensin-Converting Enzyme (ACE) Inhibitor or Angiotensin Receptor<br />

Blocker (ARB) Therapy for Left Ventricular Systolic Dysfunction (LVSD) - Percentage <strong>of</strong> patients aged<br />

18 years <strong>and</strong> older with a diagnosis <strong>of</strong> heart failure <strong>and</strong> left ventricular systolic dysfunction (LVSD) who were<br />

prescribed ACE inhibitor or ARB therapy - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period<br />

for all heart failure patients seen during the <strong>reporting</strong> period. The left ventricular systolic dysfunction may be<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-5

determined by quantitative or qualitative assessment. Examples <strong>of</strong> a quantitative or qualitative assessment may<br />

include an echocardiogram: 1) that provides a numerical value <strong>of</strong> left ventricular systolic dysfunction or 2) that uses<br />

descriptive terms such as moderately or severely depressed left ventricular dysfunction. It is anticipated that<br />

clinicians who provide primary management <strong>of</strong> patients with heart failure will submit this <strong>measure</strong>.<br />

ICD-9: 402.01, 402.11, 402.91; 404.01, 404.03, 404.11, 404.13, 404.91, 404.93; 428.0, 428.1, 428.20-428.23, 428.30-428.33, 428.40-428.43,<br />

428.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99238, 99239 (discharge), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99304-99310<br />

(nursing facility), 99324-99337 (domiciliary), 99341-99350 (home visit)<br />

_____<br />

OR<br />

_____<br />

_____<br />

_____<br />

AND<br />

_____<br />

_____<br />

_____<br />

ACE inhibitor or ARB therapy prescribed <strong>and</strong> left ventricular ejection fraction (LVEF)

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Beta-blocker therapy prescribed (4006F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing beta-blocker therapy (4006F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing beta-blocker therapy (4006F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not prescribing beta-blocker therapy (4006F-3P)<br />

Beta-blocker therapy not prescribed, reason not specified (4006F-8P)<br />

8) Heart Failure: Beta-blocker Therapy for Left Ventricular Systolic Dysfunction - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> heart failure who also have left ventricular systolic dysfunction<br />

(LVSD) <strong>and</strong> who were prescribed beta-blocker therapy - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per<br />

<strong>reporting</strong> period for all heart failure patients seen during the <strong>reporting</strong> period. The left ventricular systolic<br />

dysfunction may be determined by quantitative or qualitative assessment. Examples <strong>of</strong> a quantitative or qualitative<br />

assessment may include an echocardiogram: 1) that provides a numerical value <strong>of</strong> left ventricular systolic<br />

dysfunction or 2) that uses descriptive terms such as moderately or severely depressed left ventricular dysfunction. It<br />

is anticipated that clinicians who provide primary management <strong>of</strong> patients with heart failure will submit this<br />

<strong>measure</strong>.<br />

ICD-9: 402.01, 402.11, 402.91; 404.01, 404.03, 404.11, 404.13, 404.91, 404.93; 428.0, 428.1, 428.20-428.23, 428.30-428.33, 428.40-428.43,<br />

428.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99341-99350 (home visit), 99304-99310<br />

(nursing facility), 99324-99337 (domiciliary)<br />

_____<br />

Beta blocker therapy prescribed <strong>and</strong> left ventricular ejection fraction (LVEF) < 40% or documentation <strong>of</strong><br />

moderately or severely depressed left ventricular systolic function (4006F <strong>and</strong> 3021F)<br />

OR<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing beta-blocker therapy (4006F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing beta-blocker therapy (4006F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not prescribing beta-blocker therapy (4006F-3P)<br />

AND<br />

_____<br />

_____<br />

_____<br />

Left ventricular ejection fraction (LVEF) < 40% or documentation <strong>of</strong> moderately or severely depressed left<br />

ventricular systolic function (3021F)<br />

Left ventricular ejection fraction (LVEF) ≥ 40% or documentation as normal or mildly depressed left<br />

ventricular systolic function (3022F)<br />

Left ventricular ejection fraction (LVEF) was not performed or documented, reason not otherwise specified<br />

(3021F-8P)<br />

OR<br />

_____<br />

Beta-blocker therapy was not prescribed, reason not otherwise specified <strong>and</strong> left ventricular ejection<br />

fraction (LVEF) < 40% or documentation <strong>of</strong> moderately or severely depressed left ventricular systolic<br />

function (4006F-8P <strong>and</strong> 3021F)<br />

9) Antidepressant Medication During Acute Phase for Patients with New Episode <strong>of</strong> Major<br />

Depression - Percentage <strong>of</strong> patients aged 18 years <strong>and</strong> older diagnosed with new episode <strong>of</strong> major depressive<br />

disorder (MDD) <strong>and</strong> documented as treated with antidepressant medication during the entire 84-day (12 week) acute<br />

treatment phase - This <strong>measure</strong> is to be reported for each occurrence <strong>of</strong> MDD during the <strong>reporting</strong> period. It is<br />

anticipated that clinicians who provide the primary management <strong>of</strong> patients with major depressive disorder (MDD)<br />

will submit this <strong>measure</strong>.<br />

ICD-9: 296.20-296.24, 296.30-296.34, 298.0, 300.4, 309.1, 311 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit); 90801, 90802, 90804-90809,<br />

90862 (psychiatry)<br />

Definition: A “new episode” is defined as a patient with major depression who has not been seen or treated for<br />

major depression by any practitioner in the prior 4 months. A new episode can either be a recurrence for a patient<br />

with prior major depression or a patient with a new onset <strong>of</strong> major depression.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-7

Report G8126: 1) For all patients with a diagnosis <strong>of</strong> Major Depression, New Episode who were prescribed a full<br />

12 week course <strong>of</strong> antidepressant medication OR 2) At the completion <strong>of</strong> a 12 week course <strong>of</strong> antidepressant<br />

medication.<br />

_____<br />

_____<br />

_____<br />

Patient with new episode <strong>of</strong> MDD documented as being treated with antidepressant medication during the<br />

entire 12 week acute treatment phase (G8126)<br />

Patient with new episode <strong>of</strong> MDD not documented as being treated with antidepressant medication during<br />

the entire 12 week acute treatment phase (G8127)<br />

Clinician documented that patient with a new episode <strong>of</strong> MDD was not an eligible c<strong>and</strong>idate for<br />

antidepressant medication treatment or patient did not have a new episode <strong>of</strong> MDD (G8128)<br />

39) Screening or Therapy for Osteoporosis for Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong><br />

female patients aged 65 years <strong>and</strong> older who have a central dual-energy X-ray absorptiometry (DXA) <strong>measure</strong>ment<br />

ordered or performed at least once since age 60 or pharmacologic therapy prescribed within 12 months - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once during the <strong>reporting</strong> period for patients seen during the <strong>reporting</strong><br />

period. Female patients aged 65 years <strong>and</strong> older should have a central DXA <strong>measure</strong>ment ordered or performed at<br />

least once since the time they turned 60 years or have pharmacologic therapy prescribed to prevent or treat<br />

osteoporosis. It is anticipated that clinicians who provide primary care or care for treatment <strong>of</strong> fracture or<br />

osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Central Dual-energy X-Ray Absorptiometry (DXA) ordered (3096F)<br />

Central Dual-energy X-Ray Absorptiometry (DXA) results documented (3095F)<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not ordering or performing central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not ordering or performing central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-3P)<br />

Central dual energy X-ray absorptiometry (DXA) <strong>measure</strong>ment was not ordered or performed <strong>and</strong> a<br />

pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (3096F-8P)<br />

40) Osteoporosis: Management Following Fracture - Percentage <strong>of</strong> patients aged 50 years <strong>and</strong> older with<br />

fracture <strong>of</strong> the hip, spine, or distal radius who had a central dual-energy X-ray absorptiometry (DXA) <strong>measure</strong>ment<br />

ordered or performed or pharmacologic therapy prescribed - This <strong>measure</strong> is to be reported after each occurrence <strong>of</strong><br />

a fracture during the <strong>reporting</strong> period. Patients with a fracture <strong>of</strong> the hip, spine, or distal radius should have a central<br />

DXA <strong>measure</strong>ment ordered or performed or pharmacologic therapy prescribed. The management (DXA ordered or<br />

performed or pharmacologic therapy prescribed) should occur within three months <strong>of</strong> the initial visit with the<br />

<strong>reporting</strong> clinician following the fracture. Patients with documentation <strong>of</strong> prior central DXA <strong>measure</strong>ment or already<br />

receiving pharmacologic therapy would automatically meet the intent <strong>of</strong> this <strong>measure</strong>. It is anticipated that clinicians<br />

who manage the primary or ongoing care for osteoporosis or osteoporosis related fracture(s) will submit this<br />

<strong>measure</strong>.<br />

ICD-9: 733.12-733.14, 805.00-805.08, 805.10-805.18, 805.2, 805.4, 805.6, 805.8, 813.40-813.42, 813.44, 813.45, 813.50-813.52, 813.54,<br />

820.00-820.03, 820.09-820.11, 820.20-820.22, 820.13. 820.8, 820.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice<br />

consult)<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-8

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Central dual energy X-ray absorptiometry (DXA) ordered (3096F)<br />

Central dual energy X-ray absorptiometry (DXA) results documented (3095F)<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-3P)<br />

Central dual energy X-ray absorptiometry (DXA) <strong>measure</strong>ment was not ordered or performed <strong>and</strong> a<br />

pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (3096F-8P)<br />

41) Osteoporosis: Pharmacologic Therapy - Percentage <strong>of</strong> patients aged 50 years <strong>and</strong> older with a diagnosis<br />

<strong>of</strong> osteoporosis who were prescribed pharmacologic therapy within 12 months - This <strong>measure</strong> is to be reported a<br />

minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. Patients with a diagnosis <strong>of</strong><br />

osteoporosis should be prescribed pharmacologic therapy to treat osteoporosis. It is anticipated that clinicians who<br />

provide services for patients with the diagnosis <strong>of</strong> osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: 733.00-733.03, 733.09 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99386-99387 <strong>and</strong><br />

99396- 99397 (preventive), 99401-99404 (preventive counseling)<br />

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

1P)<br />

_____<br />

_____<br />

_____<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing pharmacologic therapy for osteoporosis (4005F-<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing pharmacologic therapy for osteoporosis (4005F-2P)<br />

Documentation <strong>of</strong> system reason for not prescribing pharmacologic therapy for osteoporosis (4005F-3P)<br />

Pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (4005F-8P)<br />

42) Osteoporosis: Counseling for Vitamin D, Calcium Intake, <strong>and</strong> Exercise - Percentage <strong>of</strong> patients,<br />

regardless <strong>of</strong> age, with a diagnosis <strong>of</strong> osteoporosis who are either receiving both calcium <strong>and</strong> vitamin D or have<br />

been counseled regarding both calcium <strong>and</strong> vitamin D intake, <strong>and</strong> exercise at least once within 12 months - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period.<br />

Patients with a diagnosis <strong>of</strong> osteoporosis should be receiving both calcium <strong>and</strong> vitamin D or had counseling<br />

regarding their use <strong>and</strong> counseled on exercise. It is anticipated that clinicians who provide services for patients with<br />

the diagnosis <strong>of</strong> osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: 733.00-733.03, 733.09 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99385-99387 <strong>and</strong><br />

99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> receipt <strong>of</strong> counseling on exercise AND either both calcium <strong>and</strong> vitamin D use or<br />

counseling regarding both calcium <strong>and</strong> vitamin D use (4019F)<br />

Documentation <strong>of</strong> medical reason(s) for patient not receiving both calcium <strong>and</strong> vitamin D or <strong>and</strong> not<br />

needing counseling regarding both calcium <strong>and</strong> vitamin D intake, <strong>and</strong> exercise (e.g., patient has dementia<br />

<strong>and</strong> is unable to receive counseling) (4019F-1P)<br />

Receipt <strong>of</strong> counseling on exercise AND either both calcium <strong>and</strong> vitamin D use or counseling regarding<br />

both calcium <strong>and</strong> vitamin D use was not documented reason not otherwise specified (4019F-8P)<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-9

46) Medication Reconciliation - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older discharged from any inpatient<br />

facility (e.g., hospital, skilled nursing facility, or rehabilitation facility) <strong>and</strong> seen within 60 days following discharge<br />

in the <strong>of</strong>fice by the physician providing on-going care who had a reconciliation <strong>of</strong> the discharge medications with<br />

the current medication list in the medical record documented - This <strong>measure</strong> is to be reported at an <strong>of</strong>fice visit<br />

occurring within 60 days <strong>of</strong> each inpatient facility discharge during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate<br />

for use in the ambulatory setting only. It is anticipated that clinicians who provide primary on-going care will submit<br />

this <strong>measure</strong> when a patient is seen in the <strong>of</strong>fice within 60 days following discharge from any inpatient facility. If a<br />

patient has not been discharged within the 60-day timeframe from an inpatient facility, there are no <strong>reporting</strong><br />

requirements for this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis code <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

_____<br />

_____<br />

Patient discharged from an inpatient facility within the last 60 days <strong>and</strong> discharge medications reconciled<br />

with the current medication list in outpatient medical record (1110F <strong>and</strong> 1111F)<br />

Patient discharged from an inpatient facility within the last 60 days <strong>and</strong> discharge medication not<br />

reconciled with current medication list in the medical record, reason not specified (1110F <strong>and</strong> 1111F-8P)<br />

47) Advance Care Plan - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older with documentation <strong>of</strong> a surrogate<br />

decision-maker or advance care plan in the medical record - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per<br />

<strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in all healthcare<br />

settings. It is anticipated that clinicians who provide primary care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99218-99220 (observation services), 99221-99223 (initial<br />

inpatient), 99231-99233 (subsequent inpatient), 99234-99236 (admit <strong>and</strong> discharge on the same day), 99281-99285 (ED services), 99291<br />

(critical care), 99304-99310 (nursing facility), 99324-99337 (domiciliary/rest home), 99341-99350 (home visits), 99387 <strong>and</strong> 99397<br />

(preventive services), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Surrogate decision maker or advance care plan documented in the medical record (1080F)<br />

Surrogate decision maker or advance directive not documented for patient reasons (1080F-2P)<br />

Surrogate decision maker or advance directive not documented, reason not specified (1080F-8P)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, primary care physicians will have to report on this<br />

<strong>measure</strong> at least one time for every Medicare patient.)<br />

48) Assessment <strong>of</strong> Presence or Absence <strong>of</strong> Urinary Incontinence in Women Aged 65 Years <strong>and</strong><br />

Older - Percentage <strong>of</strong> female patients aged 65 years <strong>and</strong> older who were assessed for the presence or absence <strong>of</strong><br />

urinary incontinence within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for<br />

patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting only. It is<br />

anticipated that clinicians who provide primary care for the patient will submit this <strong>measure</strong>.<br />

ICD-9: No specific codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

Definition: Urinary incontinence is defined as any involuntary leakage <strong>of</strong> urine.<br />

_____<br />

_____<br />

_____<br />

Presence or absence <strong>of</strong> urinary incontinence assessed (1090F)<br />

Presence or absence <strong>of</strong> urinary incontinence not assessed for medical reasons (1090F-1P)<br />

Presence or absence <strong>of</strong> urinary incontinence not assessed reason not specified (1090F-8P)<br />

49) Characterization <strong>of</strong> Urinary Incontinence in Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong><br />

female patients aged 65 years <strong>and</strong> older with a diagnosis <strong>of</strong> urinary incontinence whose urinary incontinence was<br />

characterized at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong><br />

period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting<br />

only. It is anticipated that clinicians who provide services for patients with the diagnosis <strong>of</strong> urinary incontinence will<br />

submit this <strong>measure</strong>.<br />

ICD-9: 307.6, 625.6, 788.30-788.39 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99387 <strong>and</strong> 99397<br />

(preventive), 99401-99404 (preventive counseling)<br />

5-10<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

Definition: Characterization includes, but is not limited to, (frequency, volume, timing, type <strong>of</strong> symptoms, how<br />

bothersome)<br />

_____<br />

_____<br />

Urinary incontinence characterized (1091F)<br />

Urinary incontinence not characterized reason not specified (1091F-8P)<br />

50) Plan <strong>of</strong> Care for Urinary Incontinence in Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong> female<br />

patients aged 65 years <strong>and</strong> older with a diagnosis <strong>of</strong> urinary incontinence with a documented plan <strong>of</strong> care for urinary<br />

incontinence at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period<br />

for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting only. It is<br />

anticipated that clinicians who provide services for patients with the diagnosis <strong>of</strong> urinary incontinence will submit<br />

this <strong>measure</strong>.<br />

ICD-9: 307.6, 625.6, 788.30-788.39 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99387 <strong>and</strong> 99397<br />

(preventive), 99401-99404 (preventive counseling)<br />

Definition: Plan <strong>of</strong> care may include behavioral interventions (e.g., bladder training, pelvic floor muscle training,<br />

prompted voiding), referral to specialist, surgical treatment, reassess at follow-up visit, lifestyle interventions,<br />

addressing co-morbid factors, modification or discontinuation <strong>of</strong> medications contributing to urinary incontinence,<br />

or pharmacologic therapy.<br />

_____<br />

_____<br />

Urinary incontinence plan <strong>of</strong> care documented (0509F)<br />

Plan <strong>of</strong> care for urinary incontinence not documented reason not specified (0509F-8P)<br />

51) Chronic Obstructive Pulmonary Disease (COPD): Spirometry Evaluation - Percentage <strong>of</strong> patients<br />

aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> COPD who had spirometry evaluation results documented - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period using the most recent spirometry results in the<br />

patient record for patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary care<br />

services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 491.0, 491.1, 491.20-491.22, 491.8, 491.9, 492.0, 492.8, 496 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245<br />

(<strong>of</strong>fice/outpatient consult), 99385-99387, 99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

Instructions: Look for most recent documentation <strong>of</strong> spirometry evaluation results in the medical record; do not<br />

limit the search to the <strong>reporting</strong> period.<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Spirometry results documented <strong>and</strong> reviewed (3023F)<br />

Spirometry results not documented medical reason(s) (3023F-1P)<br />

Spirometry results not documented for patient reasons (3023F-2P)<br />

Spirometry results not documented for system reasons (3023F-3P)<br />

Spirometry results not documented, reason not specified (3023F-8P)<br />

52) Chronic Obstructive Pulmonary Disease (COPD): Bronchodilator Therapy - Percentage <strong>of</strong> patients<br />

aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> COPD <strong>and</strong> who have an FEV1/FVC less than 70% <strong>and</strong> have symptoms<br />

who were prescribed an inhaled bronchodilator - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong><br />

period for all COPD patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary<br />

care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 491.0, 491.1, 491.20-491.22, 491.8, 491.9, 492.0, 492.8, 496 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245<br />

(<strong>of</strong>fice/outpatient consult), 99385-99387, 99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Inhaled bronchodilator prescribed <strong>and</strong> spirometry test results demonstrate FEV 1 /FVC < 70% with COPD<br />

symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F <strong>and</strong> 3025F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test<br />

results demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing)<br />

(4025F-1P <strong>and</strong> 3025F)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test results<br />

demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-2P<br />

<strong>and</strong> 3025F)<br />

5-11<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

_____<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> system reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test results<br />

demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-3P<br />

<strong>and</strong> 3025F)<br />

Spirometry results demonstrate FEV 1 /FVC ≥ 70% or patient does not have COPD symptoms (3027F)<br />

Spirometry test not performed or documented (3025F-8P)<br />

Inhaled bronchodilator not prescribed, reason not specified <strong>and</strong> spirometry test results demonstrate<br />

FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-8P <strong>and</strong> 3025F)<br />

53) Asthma: Pharmacologic Therapy - Percentage <strong>of</strong> patients aged 5 to 40 years with a diagnosis <strong>of</strong> mild,<br />

moderate, or severe persistent asthma who were prescribed either the preferred long-term control medication<br />

(inhaled corticosteroid) or an acceptable alternative treatment - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once<br />

per <strong>reporting</strong> period for all asthma patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who<br />

provide primary care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 493.00-493.02, 493.10-493.12, 493.20-493.22, 493.81, 493.82, 493.90, 493.92 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-<br />

99245 (<strong>of</strong>fice/outpatient consult), 99383-99386, 99393-99396 (preventive), 99401-99404 (preventive counseling)<br />

Definition: acceptable alternative treatment (leukotriene modifiers, cromolyn sodium, nedocromil sodium, or<br />

sustained-released methylxanthines)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long term control medication or acceptable<br />

alternative treatment prescribed (4015F <strong>and</strong> 1038F)<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long-term control medication or acceptable<br />

alternative treatment not prescribed for patient reasons (4015F-2P <strong>and</strong> 1038F)<br />

Intermittent asthma (1039F)<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long-term control medication or acceptable<br />

alternative treatment not prescribed, reason not specified (4015F-8P <strong>and</strong> 1038F)<br />

60) Gastroesophageal Reflux Disease (GERD): Assessment for Alarm Symptoms - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial evaluation, who were assessed for the<br />

presence or absence <strong>of</strong> the following alarm symptoms: involuntary weight loss, dysphagia, <strong>and</strong> GI bleeding - This<br />

<strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong> period. Patients seen for an initial<br />

evaluation <strong>of</strong> GERD should have documentation in the medical record <strong>of</strong> the presence or absence <strong>of</strong> alarm<br />

symptoms. If the initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period, report the proper CPT Category<br />

II code with modifier indicated in the numerator <strong>coding</strong> indicating this is not the initial evaluation. It is anticipated<br />

that clinicians who provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definition: Patients assessed for the presence or absence <strong>of</strong> the following alarm symptoms: involuntary weight loss,<br />

dysphagia, <strong>and</strong> GI bleeding<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Alarm symptoms assessed; none present (1070F)<br />

Alarm symptoms assessed; one or more present (1071F)<br />

Patient does not meet denominator inclusion because the initial evaluation <strong>of</strong> GERD occurred prior to the<br />

<strong>reporting</strong> period (1070F-8P)<br />

Alarm symptoms not assessed for medical reasons (1070F-1P)<br />

Alarm symptoms not assessed, reason not specified (1071F-8P)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> at least<br />

one time for every Medicare patient with GERD.)<br />

61) Gastroesophageal Reflux Disease (GERD): Upper Endoscopy for Patients with Alarm<br />

Symptoms - Percentage <strong>of</strong> patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial<br />

evaluation, with at least one alarm symptom who were either referred for upper endoscopy or had an upper<br />

endoscopy performed - This <strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong> period.<br />

Patients seen for an initial evaluation <strong>of</strong> GERD <strong>and</strong> at least one alarm symptom will be referred for upper endoscopy<br />

or have an upper endoscopy performed. If the initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period,<br />

5-12<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

eport the proper CPT II Category II code with modifier indicated in the numerator <strong>coding</strong> indicating this is not the<br />

initial evaluation. It is anticipated that clinicians who provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definition: Alarm symptoms for GERD include involuntary weight loss, dysphagia, <strong>and</strong> GI bleeding.<br />

_____ Upper gastrointestinal endoscopy performed (3130F)<br />

_____ Documentation <strong>of</strong> referral for upper gastrointestinal endoscopy (3132F <strong>and</strong> 1071F)<br />

_____ Patient does not have alarm symptoms (1070F)<br />

_____ Initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period (1071F-8P)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for medical reasons (e.g.,<br />

patient has already had the procedure) (3130F-1P <strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for patient reasons (3130F-2P<br />

<strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for system reasons (3130F-3P<br />

<strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy, reason not specified (3130F-<br />

8P <strong>and</strong> 1071F)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> <strong>and</strong><br />

<strong>measure</strong> #60 at least one time for every Medicare patient with GERD.)<br />

63) Gastroesophageal Reflux Disease (GERD): Barium Swallow- Inappropriate Use - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial evaluation, who did not have a<br />

Barium swallow test ordered - This <strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong><br />

period. Patients being seen for an initial evaluation <strong>of</strong> GERD should not receive a barium swallow test. If the initial<br />

evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period, report the proper CPT Category II with modifier<br />

indicated in the numerator <strong>coding</strong> indicating this is not the initial evaluation. It is anticipated that clinicians who<br />

provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definitions: This is an overuse <strong>measure</strong>. For performance, the numerator will be calculated as the difference<br />

between patients in the denominator <strong>and</strong> patients for whom a CPT Category II code was reported for barium<br />

swallow test ordered. A higher score indicates appropriate treatment <strong>of</strong> patients with GERD (i.e., the proportion for<br />

whom a barium swallow test was not ordered).<br />

_____<br />

_____<br />

_____<br />

_____<br />

Barium swallow test ordered (3142F)<br />

Patient does not meet denominator inclusion because the initial evaluation <strong>of</strong> GERD occurred prior to the<br />

<strong>reporting</strong> period (3200F-8P)<br />

Barium swallow test ordered for medical reasons (3142F-1P)<br />

Barium swallow test not ordered (3200F)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> <strong>and</strong><br />

<strong>measure</strong> #60 at least one time for every Medicare patient with GERD.)<br />

64) Asthma Assessment - Percentage <strong>of</strong> patients aged 5 to 40 years with a diagnosis <strong>of</strong> asthma who were<br />

evaluated during at least one <strong>of</strong>fice visit within 12 months for the frequency (numeric) <strong>of</strong> daytime <strong>and</strong> nocturnal<br />

asthma symptoms - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during<br />

the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary care services for the patient with a<br />

diagnosis <strong>of</strong> asthma will submit this <strong>measure</strong>.<br />

ICD-9: 493.00-493.02, 493.10-493.12, 493.20-493.22, 493.81, 493.82, 493.90, 493.92 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-<br />

99245 (<strong>of</strong>fice/outpatient consult), 99383-99386, 99393-99396 (preventive), 99401-99404 (preventive counseling)<br />

Definitions: To be counted in calculations <strong>of</strong> this <strong>measure</strong>, symptom frequency must be numerically quantified.<br />

Measure may also be met by clinician documentation or patient completion <strong>of</strong> an asthma assessment<br />

5-13<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

tool/survey/questionnaire. Assessment tool may include the Quality Metric Asthma Control Test, National Asthma<br />

Education & Prevention Program (NAEPP) Asthma Symptoms <strong>and</strong> Peak Flow Diary.<br />

_____<br />

_____<br />

Asthma symptoms evaluated (includes physician documentation <strong>of</strong> numeric frequency <strong>of</strong> symptoms or<br />

patient completion <strong>of</strong> an asthma assessment tool/survey/questionnaire) (1005F)<br />

Asthma symptom frequency not evaluated, reason not specified (1005F-8P)<br />

PAYMENT FOR EVALUATION AND MANAGEMENT SERVICES<br />

PROVIDED DURING GLOBAL PERIOD OF SURGERY<br />

Medicare Claims Processing Manual Chapter 12 §30.6.6 (Rev. 954, Issued: 05-19-06, Effective: 06-01-<br />

06, Implementation: 08-20-06)<br />

CPT Modifier -24 - Unrelated Evaluation <strong>and</strong> Management Service by Same Physician during<br />

Postoperative Period<br />

Carriers pay for an evaluation <strong>and</strong> management service other than inpatient hospital care before discharge<br />

from the hospital following surgery (CPT codes 99221-99238) if it was provided during the postoperative<br />

period <strong>of</strong> a surgical procedure, furnished by the same physician who performed the procedure, billed with<br />

CPT modifier -24, <strong>and</strong> accompanied by documentation that supports that the service is not related to the<br />

postoperative care <strong>of</strong> the procedure. They do not pay for inpatient hospital care that is furnished during<br />

the hospital stay in which the surgery occurred unless the doctor is also treating another medical condition<br />

that is unrelated to the surgery. All care provided during the inpatient stay in which the surgery occurred<br />

is compensated through the global surgical payment.<br />

CPT Modifier -25 - Significant Evaluation <strong>and</strong> Management Service by Same Physician on Date <strong>of</strong><br />

Global Procedure<br />

Medicare requires that Current Procedural Terminology (CPT) modifier -25 should only be used on<br />

claims for evaluation <strong>and</strong> management (E/M) services, <strong>and</strong> only when these services are provided by the<br />

same physician (or same qualified nonphysician practitioner) to the same patient on the same day as<br />

another procedure or other service. Carriers pay for an E/M service provided on the day <strong>of</strong> a procedure<br />

with a global fee period if the physician indicates that the service is for a significant, separately<br />

identifiable E/M service that is above <strong>and</strong> beyond the usual pre- <strong>and</strong> post-operative work <strong>of</strong> the<br />

procedure. Different diagnoses are not required for <strong>reporting</strong> the E/M service on the same date as the<br />

procedure or other service. Modifier -25 is added to the E/M code on the claim.<br />

Both the medically necessary E/M service <strong>and</strong> the procedure must be appropriately <strong>and</strong> sufficiently<br />

documented by the physician or qualified nonphysician practitioner in the patient’s medical record to<br />

support the claim for these services, even though the documentation is not required to be submitted with<br />

the claim.<br />

CPT Modifier -57 - Decision for Surgery Made Within Global Surgical Period<br />

Carriers pay for an evaluation <strong>and</strong> management service on the day <strong>of</strong> or on the day before a procedure<br />

with a 90-day global surgical period if the physician uses CPT modifier -57 to indicate that the service<br />

resulted in the decision to perform the procedure. Carriers may not pay for an evaluation <strong>and</strong> management<br />

service billed with the CPT modifier -57 if it was provided on the day <strong>of</strong> or the day before a procedure<br />

with a 0 or 10-day global surgical period.<br />

Payment for Evaluation <strong>and</strong> Management Services Provided During Global Period <strong>of</strong> Surgery<br />

• The Centers for Medicare & Medicaid Services (CMS) has clarified the documentation<br />

requirements <strong>and</strong> policy requirements for the use <strong>of</strong> CPT modifier -25 used with E/M services.<br />

Please refer to the manual attachment to CR5025, The Medicare Claims Processing Manual,<br />

Chapter 12, §30.6.6, for revisions regarding the use <strong>of</strong> CPT modifier -25<br />

5-14<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

• Physicians <strong>and</strong> qualified nonphysician practitioners (NPP) should use CPT modifier -25 to<br />

designate a significant, separately identifiable E/M service provided by the same<br />

physician/qualified NPP to the same patient on the same day as another procedure or other<br />

service with a global fee period.<br />

• Common Procedural Terminology (CPT) modifier -25 identifies a significant, separately<br />

identifiable evaluation <strong>and</strong> management (E/M) service. It should be used when the E/M service is<br />

above <strong>and</strong> beyond the usual pre- <strong>and</strong> postoperative work <strong>of</strong> a procedure with a global fee period<br />

performed on the same day as the E/M service.<br />

• Different diagnoses are not required for <strong>reporting</strong> the E/M service on the same date as the<br />

procedure or other service with a global fee period. Modifier -25 is added to the E/M code on the<br />

claim.<br />

• Both the medically necessary E/M service <strong>and</strong> the procedure must be appropriately <strong>and</strong><br />

sufficiently documented by the physician or qualified NPP in the patient’s medical record to<br />

support the need for modifier -25 on the claim for these services, even though the documentation<br />

is not required to be submitted with the claim.<br />

• Your Carrier will not retract payment for claims already paid or retroactively pay claims<br />

processed prior to the implementation <strong>of</strong> CR5025. But, they will adjust claims brought to their<br />

attention.<br />

• Carriers will not pay for an E/M service reported with a procedure having a global fee period<br />

unless CPT modifier -25 is appended to the E/M service to designate it as a significant <strong>and</strong><br />

separately identifiable E/M service from the procedure.<br />

PREOPERATIVE SERVICES<br />

§1862(a)(1)(A) <strong>of</strong> the Social Security Act requires that in order to qualify for Medicare coverage, a<br />

service must be reasonable <strong>and</strong> necessary for the diagnosis <strong>and</strong> treatment <strong>of</strong> illness or injury, or to<br />

improve the functioning <strong>of</strong> a malformed body member. A preoperative service performed due to hospital<br />

or malpractice protocol cannot supercede this guideline for Medicare coverage purposes. Medicare will<br />

pay for preoperative evaluation <strong>and</strong> management services, <strong>and</strong> diagnostic tests if they are medically<br />

necessary <strong>and</strong> meet the documentation requirements <strong>of</strong> the service rendered.<br />

CMS Transmittal #1707 – May 31, 2001<br />

A. General--This manual instruction addresses payment for preoperative services that are not included in<br />

the global surgery payment.<br />