pqri measure coding and reporting principles - Indiana Academy of ...

pqri measure coding and reporting principles - Indiana Academy of ...

pqri measure coding and reporting principles - Indiana Academy of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

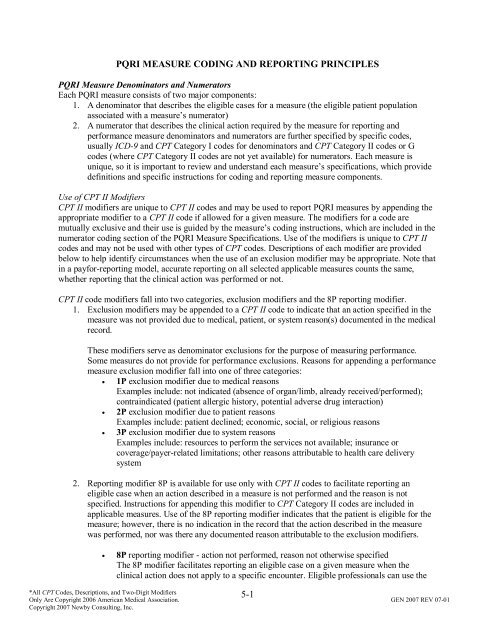

PQRI MEASURE CODING AND REPORTING PRINCIPLES<br />

PQRI Measure Denominators <strong>and</strong> Numerators<br />

Each PQRI <strong>measure</strong> consists <strong>of</strong> two major components:<br />

1. A denominator that describes the eligible cases for a <strong>measure</strong> (the eligible patient population<br />

associated with a <strong>measure</strong>’s numerator)<br />

2. A numerator that describes the clinical action required by the <strong>measure</strong> for <strong>reporting</strong> <strong>and</strong><br />

performance <strong>measure</strong> denominators <strong>and</strong> numerators are further specified by specific codes,<br />

usually ICD-9 <strong>and</strong> CPT Category I codes for denominators <strong>and</strong> CPT Category II codes or G<br />

codes (where CPT Category II codes are not yet available) for numerators. Each <strong>measure</strong> is<br />

unique, so it is important to review <strong>and</strong> underst<strong>and</strong> each <strong>measure</strong>’s specifications, which provide<br />

definitions <strong>and</strong> specific instructions for <strong>coding</strong> <strong>and</strong> <strong>reporting</strong> <strong>measure</strong> components.<br />

Use <strong>of</strong> CPT II Modifiers<br />

CPT II modifiers are unique to CPT II codes <strong>and</strong> may be used to report PQRI <strong>measure</strong>s by appending the<br />

appropriate modifier to a CPT II code if allowed for a given <strong>measure</strong>. The modifiers for a code are<br />

mutually exclusive <strong>and</strong> their use is guided by the <strong>measure</strong>’s <strong>coding</strong> instructions, which are included in the<br />

numerator <strong>coding</strong> section <strong>of</strong> the PQRI Measure Specifications. Use <strong>of</strong> the modifiers is unique to CPT II<br />

codes <strong>and</strong> may not be used with other types <strong>of</strong> CPT codes. Descriptions <strong>of</strong> each modifier are provided<br />

below to help identify circumstances when the use <strong>of</strong> an exclusion modifier may be appropriate. Note that<br />

in a payfor-<strong>reporting</strong> model, accurate <strong>reporting</strong> on all selected applicable <strong>measure</strong>s counts the same,<br />

whether <strong>reporting</strong> that the clinical action was performed or not.<br />

CPT II code modifiers fall into two categories, exclusion modifiers <strong>and</strong> the 8P <strong>reporting</strong> modifier.<br />

1. Exclusion modifiers may be appended to a CPT II code to indicate that an action specified in the<br />

<strong>measure</strong> was not provided due to medical, patient, or system reason(s) documented in the medical<br />

record.<br />

These modifiers serve as denominator exclusions for the purpose <strong>of</strong> measuring performance.<br />

Some <strong>measure</strong>s do not provide for performance exclusions. Reasons for appending a performance<br />

<strong>measure</strong> exclusion modifier fall into one <strong>of</strong> three categories:<br />

• 1P exclusion modifier due to medical reasons<br />

Examples include: not indicated (absence <strong>of</strong> organ/limb, already received/performed);<br />

contraindicated (patient allergic history, potential adverse drug interaction)<br />

• 2P exclusion modifier due to patient reasons<br />

Examples include: patient declined; economic, social, or religious reasons<br />

• 3P exclusion modifier due to system reasons<br />

Examples include: resources to perform the services not available; insurance or<br />

coverage/payer-related limitations; other reasons attributable to health care delivery<br />

system<br />

2. Reporting modifier 8P is available for use only with CPT II codes to facilitate <strong>reporting</strong> an<br />

eligible case when an action described in a <strong>measure</strong> is not performed <strong>and</strong> the reason is not<br />

specified. Instructions for appending this modifier to CPT Category II codes are included in<br />

applicable <strong>measure</strong>s. Use <strong>of</strong> the 8P <strong>reporting</strong> modifier indicates that the patient is eligible for the<br />

<strong>measure</strong>; however, there is no indication in the record that the action described in the <strong>measure</strong><br />

was performed, nor was there any documented reason attributable to the exclusion modifiers.<br />

• 8P <strong>reporting</strong> modifier - action not performed, reason not otherwise specified<br />

The 8P modifier facilitates <strong>reporting</strong> an eligible case on a given <strong>measure</strong> when the<br />

clinical action does not apply to a specific encounter. Eligible pr<strong>of</strong>essionals can use the<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-1

8P modifier to receive credit for successful <strong>reporting</strong> but will not receive credit for<br />

performance.<br />

For example, a patient with diabetes may present to a clinician for reasons that do not involve<br />

glycemic control, hypertension, or cholesterol management. However, the claim for services for<br />

that encounter will contain ICD-9 <strong>and</strong> CPT codes that will draw the patient into the diabetes<br />

<strong>measure</strong>s’ denominator during analysis. The 8P modifier serves to include the patient in the<br />

numerator when <strong>reporting</strong> rates are calculated for PQRI.<br />

Reporting Frequency <strong>and</strong> Performance Timeframes<br />

Each <strong>measure</strong> includes a <strong>reporting</strong> frequency requirement for each denominator-eligible patient seen<br />

during the <strong>reporting</strong> period. The <strong>reporting</strong> frequency is described in the instructions:<br />

• Report one-time only<br />

• Report once for each procedure performed<br />

• Report once for each acute episode<br />

A <strong>measure</strong>’s performance timeframe is defined in the <strong>measure</strong>’s description <strong>and</strong> is distinct from the<br />

<strong>reporting</strong> frequency requirement. The performance timeframe, unique to each <strong>measure</strong>, delineates the<br />

timeframe in which the clinical action described in the numerator may be accomplished.<br />

Performance timeframes may be stated as “within 12 months,” or “most recent.” This means that:<br />

1. The clinical action in the numerator need be performed only once during a 12-month period for<br />

each patient seen during the <strong>reporting</strong> period<br />

2. The quality code need be reported only one time for each patient by each eligible pr<strong>of</strong>essional<br />

caring for the patient who has chosen to report that <strong>measure</strong> during the <strong>reporting</strong> period<br />

If the <strong>measure</strong> calls for a clinical test result, then the most recent test result only needs to be obtained,<br />

assessed, <strong>and</strong> reported one time per <strong>reporting</strong> period. A test does not need to have been performed within<br />

the <strong>reporting</strong> period, nor does it need to have been performed by the same eligible pr<strong>of</strong>essional.<br />

Performance timeframes may also be tied to a specific clinical event that requires <strong>reporting</strong> each time the<br />

event occurs within the <strong>reporting</strong> period. The following are examples <strong>of</strong> <strong>measure</strong>s reported each time the<br />

clinical action described by the <strong>measure</strong> numerator is taken:<br />

• Procedure-related <strong>measure</strong>s require <strong>reporting</strong> each time the procedure is performed <strong>and</strong> have<br />

distinct performance timeframes tied to them. The date <strong>of</strong> service is the date that is used to report<br />

the <strong>measure</strong>. Examples are perioperative care or imaging <strong>measure</strong>s.<br />

• Chronic care <strong>measure</strong>s, such as those that call for prescribing a medication, require the eligible<br />

pr<strong>of</strong>essional to verify whether the medication is current <strong>and</strong> being taken by the patient. A new<br />

prescription is not required to meet the <strong>measure</strong> requirement unless it is clinically indicated.<br />

• Acute care <strong>measure</strong>s are tied to specific episodes <strong>of</strong> acute care <strong>and</strong> require <strong>reporting</strong> each time an<br />

acute event occurs. Examples are <strong>measure</strong>s related to hospitalizations, fractures <strong>and</strong> osteoporosis<br />

management, or stroke <strong>measure</strong>s.<br />

Claims-Based Reporting Principles<br />

The following <strong>principles</strong> apply to the <strong>reporting</strong> <strong>of</strong> quality-data codes for PQRI <strong>measure</strong><br />

• The CPT Category II code, which supplies the numerator, must be reported on the same claim<br />

form as the payment codes, usually ICD-9 <strong>and</strong> CPT Category I codes, which supply the<br />

denominator.<br />

• Quality-data codes must be submitted with a line item charge <strong>of</strong> zero dollars ($0.00) at the time<br />

the associated covered service is performed.<br />

! The submitted charge field cannot be blank.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-2

! The line item charge should be $0.00.<br />

! If a system does not allow a $0.00 line item charge, use a small amount such as $0.01<br />

! Entire claims with a zero charge will be rejected. (Total charge for the claim cannot be<br />

$0.00)<br />

! Quality data code line items will be denied for payment, but are then passed through the<br />

claims processing system for PQRI analysis.<br />

• Multiple eligible pr<strong>of</strong>essionals’ quality-data codes can be reported on the same claim.<br />

• Multiple CPT Category II codes for multiple <strong>measure</strong>s that are applicable to a patient visit can be<br />

reported on the same claim, as long as the corresponding denominator codes are also line items<br />

on that claim.<br />

• The individual NPI <strong>of</strong> the participating eligible pr<strong>of</strong>essional(s) must be properly used on the<br />

claim.<br />

Timeliness <strong>of</strong> Quality Data Submission<br />

Claims processed by the Carrier/MAC must reach the national Medicare claims system data warehouse<br />

(National Claims History file) by February 29, 2008 to be included in the analysis. Claims for services<br />

furnished toward the end <strong>of</strong> the <strong>reporting</strong> period should be filed promptly. Claims that are resubmitted<br />

only to add quality-data codes will not be included in the analysis.<br />

Successful Reporting<br />

The 2007 PQRI incentive payment is an all-or-nothing bonus (subject to cap) based on successful<br />

<strong>reporting</strong>.<br />

Eligible pr<strong>of</strong>essionals need not enroll or file an intent to participate for the PQRI. Eligible pr<strong>of</strong>essionals<br />

can participate by <strong>reporting</strong> the appropriate quality <strong>measure</strong> data on claims submitted to their Medicare<br />

claims processing contractor.<br />

In order to satisfactorily meet the requirements <strong>of</strong> the program <strong>and</strong> receive the bonus payment, certain<br />

<strong>reporting</strong> thresholds must be met. When four or more <strong>measure</strong>s are applicable to the services provided by<br />

an eligible pr<strong>of</strong>essional, the 80% threshold must be met on at least three <strong>of</strong> the <strong>measure</strong>s reported.<br />

Good news for those physicians practicing in a group practice, not all physicians in the group must<br />

participate in PQRI to be eligible for the bonus payment. Individual analysis will be done using the<br />

individual physician’s national provider identifier (NPI) to determine satisfactory <strong>reporting</strong> <strong>and</strong> the bonus<br />

payment calculation. Thus, physicians must bill with an NPI to participate in PQRI. The potential 1.5<br />

percent incentive payment will be paid in mid-2008 as a lump-sum bonus payment made to the practice at<br />

the Taxpayer Identification Number (TIN) level. According to the CMS website, the NPI is the only<br />

unique provider enumerator that can be used by the CMS PQRI analysis contractor to properly identify<br />

eligible physicians at the individual-physician level.<br />

The performing pr<strong>of</strong>essional’s NPI must be used for the quality-data codes <strong>and</strong> related services. For<br />

claims submitted via the ASC X12N 837 pr<strong>of</strong>essional health care claim transaction, the group practice<br />

NPI is placed in the provider billing segment, loop 2010AA, <strong>and</strong> the performing pr<strong>of</strong>essional’s NPI is<br />

placed in loop 2420A. For claims submitted via the CMS 1500 form, the performing pr<strong>of</strong>essional’s NPI is<br />

placed on the individual line item. Placing the performing eligible pr<strong>of</strong>essional’s NPI on the individual<br />

line item will allow the analysis <strong>of</strong> successful <strong>reporting</strong> <strong>and</strong> the bonus payment calculation to be<br />

performed at the individual level, though payment will be made at the TIN level.<br />

Bonus Payment<br />

Participating eligible pr<strong>of</strong>essionals who successfully report may earn a 1.5% bonus, subject to cap. The<br />

potential 1.5% bonus will be based on allowed charges for covered pr<strong>of</strong>essional services:<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-3

1. Furnished during the <strong>reporting</strong> period <strong>of</strong> July 1 through December 31, 2007,<br />

2. Received into the CMS National Claims History (NCH) file by February 29, 2008 (Joy’s<br />

comment: claim should be received by the Carrier no later than February 28, 2008), <strong>and</strong><br />

3. Paid under the Medicare Physician Fee Schedule (Joy’s comment: HCPCS “J” codes for drugs<br />

are not subject to the bonus).<br />

Because claims processing times may vary by time <strong>of</strong> the year <strong>and</strong> Medicare Carrier/Medicare<br />

Administrative Contractor (MAC), physicians should submit claims from the end <strong>of</strong> 2007 promptly, so<br />

that those claims will reach the NCH file by February 29, 2008. Bonuses will be paid as a lump sum in<br />

mid-2008. There is no beneficiary copayment or notice to the beneficiary regarding the bonus payments.<br />

A payment cap that would reduce the potential bonus below 1.5% <strong>of</strong> allowed charges may apply in<br />

situations where a physician reports relatively few instances <strong>of</strong> quality <strong>measure</strong> data. The physician’s cap<br />

will be calculated by multiplying: (1) the physician’s total instances <strong>of</strong> <strong>reporting</strong> quality data for all<br />

<strong>measure</strong>s (not limited only to <strong>measure</strong>s meeting the 80% threshold), by (2) a constant <strong>of</strong> 300%, <strong>and</strong> by (3)<br />

the national average per <strong>measure</strong> payment amount.<br />

The national average per <strong>measure</strong> payment amount is one value for all <strong>measure</strong>s <strong>and</strong> all participants that<br />

is calculated by dividing: (1) the total amount <strong>of</strong> allowed charges under the Physician Fee Schedule for all<br />

covered pr<strong>of</strong>essional services furnished during the <strong>reporting</strong> period on claims for which quality <strong>measure</strong>s<br />

were reported by all participants in the program by (2) the total number <strong>of</strong> instances for which data were<br />

reported by all participants in the program for all <strong>measure</strong>s during the <strong>reporting</strong> period. (Note that the<br />

national average per <strong>measure</strong> payment amount calculation only takes into account the charges on claims<br />

for which quality <strong>measure</strong>s were reported, whereas the individual bonus calculation takes into account<br />

charges for all services furnished during the <strong>reporting</strong> period.) While the purpose <strong>of</strong> the cap is clear, it is<br />

not possible to determine the impact <strong>of</strong> the cap until the national average per <strong>measure</strong> payment amount<br />

can be calculated after the end <strong>of</strong> the <strong>reporting</strong> period.<br />

CMS recommends that physicians report on every quality <strong>measure</strong> that is applicable to their patient<br />

populations to: (1) increase the likelihood that they will reach the 80% satisfactorily <strong>reporting</strong><br />

requirement for the requisite number <strong>of</strong> <strong>measure</strong>s <strong>and</strong> (2) increase the likelihood that they will not be<br />

affected by the bonus payment cap.<br />

2007 Physician Quality Reporting Initiative Measures - Not All Inclusive<br />

1) Hemoglobin A1c Poor Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent hemoglobin A1c greater than 9.0% - This <strong>measure</strong> is to<br />

be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. The performance<br />

period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the primary<br />

management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong><br />

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit) (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit);<br />

99304-99310 (nursing facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Most recent hemoglobin A1c level > 9.0% (3046F)<br />

Most recent hemoglobin A1c level < 7.0% (3044F)<br />

Most recent hemoglobin A1c level 7.0% to 9.0% (3045F)<br />

Hemoglobin A1c not performed during last 12 months reason not specified (3046F-8P)<br />

2) Low Density Lipoprotein Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent LDL-C level in control (less than 100 mg/dl) - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. The<br />

performance period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the<br />

primary management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong>.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-4

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit) (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit);<br />

99304-99310 (nursing facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Most recent LDL-C < 100 mg/dL (3048F)<br />

Most recent LDL-C 100-129 mg/dL (3049F)<br />

Most recent LDL-C ≥ 130 mg/dL (3050F)<br />

LDL-C level not performed during last 12 months reason not specified (3048F-8P)<br />

3) High Blood Pressure Control in Type 1 or 2 Diabetes Mellitus - Percentage <strong>of</strong> patients aged 18-75<br />

years with diabetes (type 1 or type 2) who had most recent blood pressure in control (less than 140/80 mm Hg) -<br />

This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period.<br />

The performance period for this <strong>measure</strong> is 12 months. It is anticipated that clinicians who provide services for the<br />

primary management <strong>of</strong> diabetes mellitus will submit this <strong>measure</strong>.<br />

ICD-9: 250.00-250.93, 648.00-648.04 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit); 99341-99350 (home visit); 99304-99310 (nursing<br />

facility); 99324-99337 (domiciliary); 97802-97804 <strong>and</strong> G0270-G0271 (nutrition therapy)<br />

Systolic codes<br />

_____ Most recent systolic blood pressure < 130 mm Hg (3074F)<br />

_____ Most recent systolic blood pressure 130 to 139 mm Hg (3075F)<br />

_____ Most recent systolic blood pressure > 140 mm Hg (3077F)<br />

AND<br />

Diastolic codes<br />

_____ Most recent diastolic blood pressure < 80 mm Hg (3078F)<br />

_____ Most recent diastolic blood pressure 80-89 mm Hg (3079F)<br />

_____ Most recent diastolic blood pressure > 90 mm Hg (3080F)<br />

OR<br />

_____<br />

Blood pressure <strong>measure</strong>ment not performed, reason not specified (2000F-8P)<br />

4) Screening for Future Fall Risk - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older who were screened for<br />

future fall risk (patients are considered at risk for future falls if they have had 2 or more falls in the past year or any<br />

fall with injury in the past year) at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once<br />

per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in all nonacute<br />

settings (excludes emergency departments <strong>and</strong> acute care hospitals). It is anticipated that clinicians who<br />

provide primary care for the patient will submit this <strong>measure</strong>.<br />

ICD-9: None specified - CPT: 97001-97004 (PT eval); 99201-99215 (<strong>of</strong>fice/outpatient visit), 99304-99310 (nursing facility), 99324-99328<br />

(domiciliary), 99334-99337 (domiciliary), 99341-99350 (home visits), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive counseling),<br />

Definition: A fall is defined as a sudden, unintentional change in position causing an individual to l<strong>and</strong> at a lower<br />

level, on an object, the floor, or the ground, other than as a consequence <strong>of</strong> sudden onset <strong>of</strong> paralysis, epileptic<br />

seizure, or overwhelming external force (Tinetti).<br />

_____<br />

_____<br />

_____<br />

_____<br />

Screening for future fall risk; documentation <strong>of</strong> 2 or more falls in the past year or any fall with injury in the<br />

past year (1100F)<br />

Screening for future fall risk; documentation <strong>of</strong> no falls in the past year or only 1 fall without injury in the<br />

past year (1101F)<br />

Screening for future fall risk not performed for medical reasons (1100F-1P)<br />

Screening for future fall risk not performed, reason not specified (1100F-8P)<br />

5) Heart Failure: Angiotensin-Converting Enzyme (ACE) Inhibitor or Angiotensin Receptor<br />

Blocker (ARB) Therapy for Left Ventricular Systolic Dysfunction (LVSD) - Percentage <strong>of</strong> patients aged<br />

18 years <strong>and</strong> older with a diagnosis <strong>of</strong> heart failure <strong>and</strong> left ventricular systolic dysfunction (LVSD) who were<br />

prescribed ACE inhibitor or ARB therapy - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period<br />

for all heart failure patients seen during the <strong>reporting</strong> period. The left ventricular systolic dysfunction may be<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-5

determined by quantitative or qualitative assessment. Examples <strong>of</strong> a quantitative or qualitative assessment may<br />

include an echocardiogram: 1) that provides a numerical value <strong>of</strong> left ventricular systolic dysfunction or 2) that uses<br />

descriptive terms such as moderately or severely depressed left ventricular dysfunction. It is anticipated that<br />

clinicians who provide primary management <strong>of</strong> patients with heart failure will submit this <strong>measure</strong>.<br />

ICD-9: 402.01, 402.11, 402.91; 404.01, 404.03, 404.11, 404.13, 404.91, 404.93; 428.0, 428.1, 428.20-428.23, 428.30-428.33, 428.40-428.43,<br />

428.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99238, 99239 (discharge), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99304-99310<br />

(nursing facility), 99324-99337 (domiciliary), 99341-99350 (home visit)<br />

_____<br />

OR<br />

_____<br />

_____<br />

_____<br />

AND<br />

_____<br />

_____<br />

_____<br />

ACE inhibitor or ARB therapy prescribed <strong>and</strong> left ventricular ejection fraction (LVEF)

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Beta-blocker therapy prescribed (4006F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing beta-blocker therapy (4006F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing beta-blocker therapy (4006F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not prescribing beta-blocker therapy (4006F-3P)<br />

Beta-blocker therapy not prescribed, reason not specified (4006F-8P)<br />

8) Heart Failure: Beta-blocker Therapy for Left Ventricular Systolic Dysfunction - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> heart failure who also have left ventricular systolic dysfunction<br />

(LVSD) <strong>and</strong> who were prescribed beta-blocker therapy - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per<br />

<strong>reporting</strong> period for all heart failure patients seen during the <strong>reporting</strong> period. The left ventricular systolic<br />

dysfunction may be determined by quantitative or qualitative assessment. Examples <strong>of</strong> a quantitative or qualitative<br />

assessment may include an echocardiogram: 1) that provides a numerical value <strong>of</strong> left ventricular systolic<br />

dysfunction or 2) that uses descriptive terms such as moderately or severely depressed left ventricular dysfunction. It<br />

is anticipated that clinicians who provide primary management <strong>of</strong> patients with heart failure will submit this<br />

<strong>measure</strong>.<br />

ICD-9: 402.01, 402.11, 402.91; 404.01, 404.03, 404.11, 404.13, 404.91, 404.93; 428.0, 428.1, 428.20-428.23, 428.30-428.33, 428.40-428.43,<br />

428.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99341-99350 (home visit), 99304-99310<br />

(nursing facility), 99324-99337 (domiciliary)<br />

_____<br />

Beta blocker therapy prescribed <strong>and</strong> left ventricular ejection fraction (LVEF) < 40% or documentation <strong>of</strong><br />

moderately or severely depressed left ventricular systolic function (4006F <strong>and</strong> 3021F)<br />

OR<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing beta-blocker therapy (4006F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing beta-blocker therapy (4006F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not prescribing beta-blocker therapy (4006F-3P)<br />

AND<br />

_____<br />

_____<br />

_____<br />

Left ventricular ejection fraction (LVEF) < 40% or documentation <strong>of</strong> moderately or severely depressed left<br />

ventricular systolic function (3021F)<br />

Left ventricular ejection fraction (LVEF) ≥ 40% or documentation as normal or mildly depressed left<br />

ventricular systolic function (3022F)<br />

Left ventricular ejection fraction (LVEF) was not performed or documented, reason not otherwise specified<br />

(3021F-8P)<br />

OR<br />

_____<br />

Beta-blocker therapy was not prescribed, reason not otherwise specified <strong>and</strong> left ventricular ejection<br />

fraction (LVEF) < 40% or documentation <strong>of</strong> moderately or severely depressed left ventricular systolic<br />

function (4006F-8P <strong>and</strong> 3021F)<br />

9) Antidepressant Medication During Acute Phase for Patients with New Episode <strong>of</strong> Major<br />

Depression - Percentage <strong>of</strong> patients aged 18 years <strong>and</strong> older diagnosed with new episode <strong>of</strong> major depressive<br />

disorder (MDD) <strong>and</strong> documented as treated with antidepressant medication during the entire 84-day (12 week) acute<br />

treatment phase - This <strong>measure</strong> is to be reported for each occurrence <strong>of</strong> MDD during the <strong>reporting</strong> period. It is<br />

anticipated that clinicians who provide the primary management <strong>of</strong> patients with major depressive disorder (MDD)<br />

will submit this <strong>measure</strong>.<br />

ICD-9: 296.20-296.24, 296.30-296.34, 298.0, 300.4, 309.1, 311 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit); 90801, 90802, 90804-90809,<br />

90862 (psychiatry)<br />

Definition: A “new episode” is defined as a patient with major depression who has not been seen or treated for<br />

major depression by any practitioner in the prior 4 months. A new episode can either be a recurrence for a patient<br />

with prior major depression or a patient with a new onset <strong>of</strong> major depression.<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-7

Report G8126: 1) For all patients with a diagnosis <strong>of</strong> Major Depression, New Episode who were prescribed a full<br />

12 week course <strong>of</strong> antidepressant medication OR 2) At the completion <strong>of</strong> a 12 week course <strong>of</strong> antidepressant<br />

medication.<br />

_____<br />

_____<br />

_____<br />

Patient with new episode <strong>of</strong> MDD documented as being treated with antidepressant medication during the<br />

entire 12 week acute treatment phase (G8126)<br />

Patient with new episode <strong>of</strong> MDD not documented as being treated with antidepressant medication during<br />

the entire 12 week acute treatment phase (G8127)<br />

Clinician documented that patient with a new episode <strong>of</strong> MDD was not an eligible c<strong>and</strong>idate for<br />

antidepressant medication treatment or patient did not have a new episode <strong>of</strong> MDD (G8128)<br />

39) Screening or Therapy for Osteoporosis for Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong><br />

female patients aged 65 years <strong>and</strong> older who have a central dual-energy X-ray absorptiometry (DXA) <strong>measure</strong>ment<br />

ordered or performed at least once since age 60 or pharmacologic therapy prescribed within 12 months - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once during the <strong>reporting</strong> period for patients seen during the <strong>reporting</strong><br />

period. Female patients aged 65 years <strong>and</strong> older should have a central DXA <strong>measure</strong>ment ordered or performed at<br />

least once since the time they turned 60 years or have pharmacologic therapy prescribed to prevent or treat<br />

osteoporosis. It is anticipated that clinicians who provide primary care or care for treatment <strong>of</strong> fracture or<br />

osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Central Dual-energy X-Ray Absorptiometry (DXA) ordered (3096F)<br />

Central Dual-energy X-Ray Absorptiometry (DXA) results documented (3095F)<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not ordering or performing central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not ordering or performing central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-3P)<br />

Central dual energy X-ray absorptiometry (DXA) <strong>measure</strong>ment was not ordered or performed <strong>and</strong> a<br />

pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (3096F-8P)<br />

40) Osteoporosis: Management Following Fracture - Percentage <strong>of</strong> patients aged 50 years <strong>and</strong> older with<br />

fracture <strong>of</strong> the hip, spine, or distal radius who had a central dual-energy X-ray absorptiometry (DXA) <strong>measure</strong>ment<br />

ordered or performed or pharmacologic therapy prescribed - This <strong>measure</strong> is to be reported after each occurrence <strong>of</strong><br />

a fracture during the <strong>reporting</strong> period. Patients with a fracture <strong>of</strong> the hip, spine, or distal radius should have a central<br />

DXA <strong>measure</strong>ment ordered or performed or pharmacologic therapy prescribed. The management (DXA ordered or<br />

performed or pharmacologic therapy prescribed) should occur within three months <strong>of</strong> the initial visit with the<br />

<strong>reporting</strong> clinician following the fracture. Patients with documentation <strong>of</strong> prior central DXA <strong>measure</strong>ment or already<br />

receiving pharmacologic therapy would automatically meet the intent <strong>of</strong> this <strong>measure</strong>. It is anticipated that clinicians<br />

who manage the primary or ongoing care for osteoporosis or osteoporosis related fracture(s) will submit this<br />

<strong>measure</strong>.<br />

ICD-9: 733.12-733.14, 805.00-805.08, 805.10-805.18, 805.2, 805.4, 805.6, 805.8, 813.40-813.42, 813.44, 813.45, 813.50-813.52, 813.54,<br />

820.00-820.03, 820.09-820.11, 820.20-820.22, 820.13. 820.8, 820.9 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice<br />

consult)<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-8

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Central dual energy X-ray absorptiometry (DXA) ordered (3096F)<br />

Central dual energy X-ray absorptiometry (DXA) results documented (3095F)<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-1P)<br />

Documentation <strong>of</strong> patient reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-2P)<br />

Documentation <strong>of</strong> system reason(s) for not ordering or performing a central dual energy X-ray<br />

absorptiometry (DXA) <strong>measure</strong>ment or not prescribing pharmacologic therapy for osteoporosis (3096F-3P)<br />

Central dual energy X-ray absorptiometry (DXA) <strong>measure</strong>ment was not ordered or performed <strong>and</strong> a<br />

pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (3096F-8P)<br />

41) Osteoporosis: Pharmacologic Therapy - Percentage <strong>of</strong> patients aged 50 years <strong>and</strong> older with a diagnosis<br />

<strong>of</strong> osteoporosis who were prescribed pharmacologic therapy within 12 months - This <strong>measure</strong> is to be reported a<br />

minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. Patients with a diagnosis <strong>of</strong><br />

osteoporosis should be prescribed pharmacologic therapy to treat osteoporosis. It is anticipated that clinicians who<br />

provide services for patients with the diagnosis <strong>of</strong> osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: 733.00-733.03, 733.09 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99386-99387 <strong>and</strong><br />

99396- 99397 (preventive), 99401-99404 (preventive counseling)<br />

Definition: Pharmacologic Therapy: U.S. Food <strong>and</strong> Drug Administration approved pharmacologic options for<br />

osteoporosis prevention <strong>and</strong>/or treatment <strong>of</strong> postmenopausal osteoporosis include, in alphabetical order:<br />

bisphosphonates (alendronate, ib<strong>and</strong>ronate, <strong>and</strong> risedronate), calcitonin, estrogens (estrogens <strong>and</strong>/or hormone<br />

therapy), parathyroid hormone [PTH (1-34), teriparatide], <strong>and</strong> selective estrogen receptor modules or SERMs<br />

(raloxifene).<br />

_____<br />

_____<br />

1P)<br />

_____<br />

_____<br />

_____<br />

Pharmacologic therapy (other than minerals/vitamins) for osteoporosis prescribed (4005F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing pharmacologic therapy for osteoporosis (4005F-<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing pharmacologic therapy for osteoporosis (4005F-2P)<br />

Documentation <strong>of</strong> system reason for not prescribing pharmacologic therapy for osteoporosis (4005F-3P)<br />

Pharmacologic therapy for osteoporosis was not prescribed reason not otherwise specified (4005F-8P)<br />

42) Osteoporosis: Counseling for Vitamin D, Calcium Intake, <strong>and</strong> Exercise - Percentage <strong>of</strong> patients,<br />

regardless <strong>of</strong> age, with a diagnosis <strong>of</strong> osteoporosis who are either receiving both calcium <strong>and</strong> vitamin D or have<br />

been counseled regarding both calcium <strong>and</strong> vitamin D intake, <strong>and</strong> exercise at least once within 12 months - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period.<br />

Patients with a diagnosis <strong>of</strong> osteoporosis should be receiving both calcium <strong>and</strong> vitamin D or had counseling<br />

regarding their use <strong>and</strong> counseled on exercise. It is anticipated that clinicians who provide services for patients with<br />

the diagnosis <strong>of</strong> osteoporosis will submit this <strong>measure</strong>.<br />

ICD-9: 733.00-733.03, 733.09 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99385-99387 <strong>and</strong><br />

99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> receipt <strong>of</strong> counseling on exercise AND either both calcium <strong>and</strong> vitamin D use or<br />

counseling regarding both calcium <strong>and</strong> vitamin D use (4019F)<br />

Documentation <strong>of</strong> medical reason(s) for patient not receiving both calcium <strong>and</strong> vitamin D or <strong>and</strong> not<br />

needing counseling regarding both calcium <strong>and</strong> vitamin D intake, <strong>and</strong> exercise (e.g., patient has dementia<br />

<strong>and</strong> is unable to receive counseling) (4019F-1P)<br />

Receipt <strong>of</strong> counseling on exercise AND either both calcium <strong>and</strong> vitamin D use or counseling regarding<br />

both calcium <strong>and</strong> vitamin D use was not documented reason not otherwise specified (4019F-8P)<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.<br />

5-9

46) Medication Reconciliation - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older discharged from any inpatient<br />

facility (e.g., hospital, skilled nursing facility, or rehabilitation facility) <strong>and</strong> seen within 60 days following discharge<br />

in the <strong>of</strong>fice by the physician providing on-going care who had a reconciliation <strong>of</strong> the discharge medications with<br />

the current medication list in the medical record documented - This <strong>measure</strong> is to be reported at an <strong>of</strong>fice visit<br />

occurring within 60 days <strong>of</strong> each inpatient facility discharge during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate<br />

for use in the ambulatory setting only. It is anticipated that clinicians who provide primary on-going care will submit<br />

this <strong>measure</strong> when a patient is seen in the <strong>of</strong>fice within 60 days following discharge from any inpatient facility. If a<br />

patient has not been discharged within the 60-day timeframe from an inpatient facility, there are no <strong>reporting</strong><br />

requirements for this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis code <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

_____<br />

_____<br />

Patient discharged from an inpatient facility within the last 60 days <strong>and</strong> discharge medications reconciled<br />

with the current medication list in outpatient medical record (1110F <strong>and</strong> 1111F)<br />

Patient discharged from an inpatient facility within the last 60 days <strong>and</strong> discharge medication not<br />

reconciled with current medication list in the medical record, reason not specified (1110F <strong>and</strong> 1111F-8P)<br />

47) Advance Care Plan - Percentage <strong>of</strong> patients aged 65 years <strong>and</strong> older with documentation <strong>of</strong> a surrogate<br />

decision-maker or advance care plan in the medical record - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per<br />

<strong>reporting</strong> period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in all healthcare<br />

settings. It is anticipated that clinicians who provide primary care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: No specific diagnosis codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99218-99220 (observation services), 99221-99223 (initial<br />

inpatient), 99231-99233 (subsequent inpatient), 99234-99236 (admit <strong>and</strong> discharge on the same day), 99281-99285 (ED services), 99291<br />

(critical care), 99304-99310 (nursing facility), 99324-99337 (domiciliary/rest home), 99341-99350 (home visits), 99387 <strong>and</strong> 99397<br />

(preventive services), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Surrogate decision maker or advance care plan documented in the medical record (1080F)<br />

Surrogate decision maker or advance directive not documented for patient reasons (1080F-2P)<br />

Surrogate decision maker or advance directive not documented, reason not specified (1080F-8P)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, primary care physicians will have to report on this<br />

<strong>measure</strong> at least one time for every Medicare patient.)<br />

48) Assessment <strong>of</strong> Presence or Absence <strong>of</strong> Urinary Incontinence in Women Aged 65 Years <strong>and</strong><br />

Older - Percentage <strong>of</strong> female patients aged 65 years <strong>and</strong> older who were assessed for the presence or absence <strong>of</strong><br />

urinary incontinence within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for<br />

patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting only. It is<br />

anticipated that clinicians who provide primary care for the patient will submit this <strong>measure</strong>.<br />

ICD-9: No specific codes <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99387 <strong>and</strong> 99397 (preventive), 99401-99404 (preventive<br />

counseling)<br />

Definition: Urinary incontinence is defined as any involuntary leakage <strong>of</strong> urine.<br />

_____<br />

_____<br />

_____<br />

Presence or absence <strong>of</strong> urinary incontinence assessed (1090F)<br />

Presence or absence <strong>of</strong> urinary incontinence not assessed for medical reasons (1090F-1P)<br />

Presence or absence <strong>of</strong> urinary incontinence not assessed reason not specified (1090F-8P)<br />

49) Characterization <strong>of</strong> Urinary Incontinence in Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong><br />

female patients aged 65 years <strong>and</strong> older with a diagnosis <strong>of</strong> urinary incontinence whose urinary incontinence was<br />

characterized at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong><br />

period for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting<br />

only. It is anticipated that clinicians who provide services for patients with the diagnosis <strong>of</strong> urinary incontinence will<br />

submit this <strong>measure</strong>.<br />

ICD-9: 307.6, 625.6, 788.30-788.39 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99387 <strong>and</strong> 99397<br />

(preventive), 99401-99404 (preventive counseling)<br />

5-10<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

Definition: Characterization includes, but is not limited to, (frequency, volume, timing, type <strong>of</strong> symptoms, how<br />

bothersome)<br />

_____<br />

_____<br />

Urinary incontinence characterized (1091F)<br />

Urinary incontinence not characterized reason not specified (1091F-8P)<br />

50) Plan <strong>of</strong> Care for Urinary Incontinence in Women Aged 65 Years <strong>and</strong> Older - Percentage <strong>of</strong> female<br />

patients aged 65 years <strong>and</strong> older with a diagnosis <strong>of</strong> urinary incontinence with a documented plan <strong>of</strong> care for urinary<br />

incontinence at least once within 12 months - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period<br />

for patients seen during the <strong>reporting</strong> period. This <strong>measure</strong> is appropriate for use in the ambulatory setting only. It is<br />

anticipated that clinicians who provide services for patients with the diagnosis <strong>of</strong> urinary incontinence will submit<br />

this <strong>measure</strong>.<br />

ICD-9: 307.6, 625.6, 788.30-788.39 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult), 99387 <strong>and</strong> 99397<br />

(preventive), 99401-99404 (preventive counseling)<br />

Definition: Plan <strong>of</strong> care may include behavioral interventions (e.g., bladder training, pelvic floor muscle training,<br />

prompted voiding), referral to specialist, surgical treatment, reassess at follow-up visit, lifestyle interventions,<br />

addressing co-morbid factors, modification or discontinuation <strong>of</strong> medications contributing to urinary incontinence,<br />

or pharmacologic therapy.<br />

_____<br />

_____<br />

Urinary incontinence plan <strong>of</strong> care documented (0509F)<br />

Plan <strong>of</strong> care for urinary incontinence not documented reason not specified (0509F-8P)<br />

51) Chronic Obstructive Pulmonary Disease (COPD): Spirometry Evaluation - Percentage <strong>of</strong> patients<br />

aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> COPD who had spirometry evaluation results documented - This<br />

<strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period using the most recent spirometry results in the<br />

patient record for patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary care<br />

services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 491.0, 491.1, 491.20-491.22, 491.8, 491.9, 492.0, 492.8, 496 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245<br />

(<strong>of</strong>fice/outpatient consult), 99385-99387, 99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

Instructions: Look for most recent documentation <strong>of</strong> spirometry evaluation results in the medical record; do not<br />

limit the search to the <strong>reporting</strong> period.<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Spirometry results documented <strong>and</strong> reviewed (3023F)<br />

Spirometry results not documented medical reason(s) (3023F-1P)<br />

Spirometry results not documented for patient reasons (3023F-2P)<br />

Spirometry results not documented for system reasons (3023F-3P)<br />

Spirometry results not documented, reason not specified (3023F-8P)<br />

52) Chronic Obstructive Pulmonary Disease (COPD): Bronchodilator Therapy - Percentage <strong>of</strong> patients<br />

aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> COPD <strong>and</strong> who have an FEV1/FVC less than 70% <strong>and</strong> have symptoms<br />

who were prescribed an inhaled bronchodilator - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong><br />

period for all COPD patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary<br />

care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 491.0, 491.1, 491.20-491.22, 491.8, 491.9, 492.0, 492.8, 496 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245<br />

(<strong>of</strong>fice/outpatient consult), 99385-99387, 99395-99397 (preventive), 99401-99404 (preventive counseling)<br />

_____<br />

_____<br />

_____<br />

Inhaled bronchodilator prescribed <strong>and</strong> spirometry test results demonstrate FEV 1 /FVC < 70% with COPD<br />

symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F <strong>and</strong> 3025F)<br />

Documentation <strong>of</strong> medical reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test<br />

results demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing)<br />

(4025F-1P <strong>and</strong> 3025F)<br />

Documentation <strong>of</strong> patient reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test results<br />

demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-2P<br />

<strong>and</strong> 3025F)<br />

5-11<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

_____<br />

_____<br />

_____<br />

_____<br />

Documentation <strong>of</strong> system reason(s) for not prescribing an inhaled bronchodilator <strong>and</strong> spirometry test results<br />

demonstrate FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-3P<br />

<strong>and</strong> 3025F)<br />

Spirometry results demonstrate FEV 1 /FVC ≥ 70% or patient does not have COPD symptoms (3027F)<br />

Spirometry test not performed or documented (3025F-8P)<br />

Inhaled bronchodilator not prescribed, reason not specified <strong>and</strong> spirometry test results demonstrate<br />

FEV 1 /FVC < 70% with COPD symptoms (e.g., dyspnea, cough/sputum, wheezing) (4025F-8P <strong>and</strong> 3025F)<br />

53) Asthma: Pharmacologic Therapy - Percentage <strong>of</strong> patients aged 5 to 40 years with a diagnosis <strong>of</strong> mild,<br />

moderate, or severe persistent asthma who were prescribed either the preferred long-term control medication<br />

(inhaled corticosteroid) or an acceptable alternative treatment - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once<br />

per <strong>reporting</strong> period for all asthma patients seen during the <strong>reporting</strong> period. It is anticipated that clinicians who<br />

provide primary care services for the patient will submit this <strong>measure</strong>.<br />

ICD-9: 493.00-493.02, 493.10-493.12, 493.20-493.22, 493.81, 493.82, 493.90, 493.92 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-<br />

99245 (<strong>of</strong>fice/outpatient consult), 99383-99386, 99393-99396 (preventive), 99401-99404 (preventive counseling)<br />

Definition: acceptable alternative treatment (leukotriene modifiers, cromolyn sodium, nedocromil sodium, or<br />

sustained-released methylxanthines)<br />

_____<br />

_____<br />

_____<br />

_____<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long term control medication or acceptable<br />

alternative treatment prescribed (4015F <strong>and</strong> 1038F)<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long-term control medication or acceptable<br />

alternative treatment not prescribed for patient reasons (4015F-2P <strong>and</strong> 1038F)<br />

Intermittent asthma (1039F)<br />

Persistent asthma (mild, moderate, or severe) <strong>and</strong> preferred long-term control medication or acceptable<br />

alternative treatment not prescribed, reason not specified (4015F-8P <strong>and</strong> 1038F)<br />

60) Gastroesophageal Reflux Disease (GERD): Assessment for Alarm Symptoms - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial evaluation, who were assessed for the<br />

presence or absence <strong>of</strong> the following alarm symptoms: involuntary weight loss, dysphagia, <strong>and</strong> GI bleeding - This<br />

<strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong> period. Patients seen for an initial<br />

evaluation <strong>of</strong> GERD should have documentation in the medical record <strong>of</strong> the presence or absence <strong>of</strong> alarm<br />

symptoms. If the initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period, report the proper CPT Category<br />

II code with modifier indicated in the numerator <strong>coding</strong> indicating this is not the initial evaluation. It is anticipated<br />

that clinicians who provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definition: Patients assessed for the presence or absence <strong>of</strong> the following alarm symptoms: involuntary weight loss,<br />

dysphagia, <strong>and</strong> GI bleeding<br />

_____<br />

_____<br />

_____<br />

_____<br />

_____<br />

Alarm symptoms assessed; none present (1070F)<br />

Alarm symptoms assessed; one or more present (1071F)<br />

Patient does not meet denominator inclusion because the initial evaluation <strong>of</strong> GERD occurred prior to the<br />

<strong>reporting</strong> period (1070F-8P)<br />

Alarm symptoms not assessed for medical reasons (1070F-1P)<br />

Alarm symptoms not assessed, reason not specified (1071F-8P)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> at least<br />

one time for every Medicare patient with GERD.)<br />

61) Gastroesophageal Reflux Disease (GERD): Upper Endoscopy for Patients with Alarm<br />

Symptoms - Percentage <strong>of</strong> patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial<br />

evaluation, with at least one alarm symptom who were either referred for upper endoscopy or had an upper<br />

endoscopy performed - This <strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong> period.<br />

Patients seen for an initial evaluation <strong>of</strong> GERD <strong>and</strong> at least one alarm symptom will be referred for upper endoscopy<br />

or have an upper endoscopy performed. If the initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period,<br />

5-12<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

eport the proper CPT II Category II code with modifier indicated in the numerator <strong>coding</strong> indicating this is not the<br />

initial evaluation. It is anticipated that clinicians who provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definition: Alarm symptoms for GERD include involuntary weight loss, dysphagia, <strong>and</strong> GI bleeding.<br />

_____ Upper gastrointestinal endoscopy performed (3130F)<br />

_____ Documentation <strong>of</strong> referral for upper gastrointestinal endoscopy (3132F <strong>and</strong> 1071F)<br />

_____ Patient does not have alarm symptoms (1070F)<br />

_____ Initial evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period (1071F-8P)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for medical reasons (e.g.,<br />

patient has already had the procedure) (3130F-1P <strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for patient reasons (3130F-2P<br />

<strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy for system reasons (3130F-3P<br />

<strong>and</strong> 1071F)<br />

_____ Upper endoscopy not performed or patient not referred for upper endoscopy, reason not specified (3130F-<br />

8P <strong>and</strong> 1071F)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> <strong>and</strong><br />

<strong>measure</strong> #60 at least one time for every Medicare patient with GERD.)<br />

63) Gastroesophageal Reflux Disease (GERD): Barium Swallow- Inappropriate Use - Percentage <strong>of</strong><br />

patients aged 18 years <strong>and</strong> older with a diagnosis <strong>of</strong> GERD, seen for an initial evaluation, who did not have a<br />

Barium swallow test ordered - This <strong>measure</strong> is to be reported once for all GERD patients seen during the <strong>reporting</strong><br />

period. Patients being seen for an initial evaluation <strong>of</strong> GERD should not receive a barium swallow test. If the initial<br />

evaluation <strong>of</strong> GERD occurred prior to the <strong>reporting</strong> period, report the proper CPT Category II with modifier<br />

indicated in the numerator <strong>coding</strong> indicating this is not the initial evaluation. It is anticipated that clinicians who<br />

provide care for patients with GERD will submit this <strong>measure</strong>.<br />

ICD-9: 530.81, 530.10-530.12, 530.19 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-99245 (<strong>of</strong>fice/outpatient consult)<br />

Definitions: This is an overuse <strong>measure</strong>. For performance, the numerator will be calculated as the difference<br />

between patients in the denominator <strong>and</strong> patients for whom a CPT Category II code was reported for barium<br />

swallow test ordered. A higher score indicates appropriate treatment <strong>of</strong> patients with GERD (i.e., the proportion for<br />

whom a barium swallow test was not ordered).<br />

_____<br />

_____<br />

_____<br />

_____<br />

Barium swallow test ordered (3142F)<br />

Patient does not meet denominator inclusion because the initial evaluation <strong>of</strong> GERD occurred prior to the<br />

<strong>reporting</strong> period (3200F-8P)<br />

Barium swallow test ordered for medical reasons (3142F-1P)<br />

Barium swallow test not ordered (3200F)<br />

(Joy’s Comment: For successful <strong>reporting</strong> <strong>of</strong> this <strong>measure</strong>, physicians will have to report on this <strong>measure</strong> <strong>and</strong><br />

<strong>measure</strong> #60 at least one time for every Medicare patient with GERD.)<br />

64) Asthma Assessment - Percentage <strong>of</strong> patients aged 5 to 40 years with a diagnosis <strong>of</strong> asthma who were<br />

evaluated during at least one <strong>of</strong>fice visit within 12 months for the frequency (numeric) <strong>of</strong> daytime <strong>and</strong> nocturnal<br />

asthma symptoms - This <strong>measure</strong> is to be reported a minimum <strong>of</strong> once per <strong>reporting</strong> period for patients seen during<br />

the <strong>reporting</strong> period. It is anticipated that clinicians who provide primary care services for the patient with a<br />

diagnosis <strong>of</strong> asthma will submit this <strong>measure</strong>.<br />

ICD-9: 493.00-493.02, 493.10-493.12, 493.20-493.22, 493.81, 493.82, 493.90, 493.92 <strong>and</strong> CPT: 99201-99215 (<strong>of</strong>fice/outpatient visit), 99241-<br />

99245 (<strong>of</strong>fice/outpatient consult), 99383-99386, 99393-99396 (preventive), 99401-99404 (preventive counseling)<br />

Definitions: To be counted in calculations <strong>of</strong> this <strong>measure</strong>, symptom frequency must be numerically quantified.<br />

Measure may also be met by clinician documentation or patient completion <strong>of</strong> an asthma assessment<br />

5-13<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

tool/survey/questionnaire. Assessment tool may include the Quality Metric Asthma Control Test, National Asthma<br />

Education & Prevention Program (NAEPP) Asthma Symptoms <strong>and</strong> Peak Flow Diary.<br />

_____<br />

_____<br />

Asthma symptoms evaluated (includes physician documentation <strong>of</strong> numeric frequency <strong>of</strong> symptoms or<br />

patient completion <strong>of</strong> an asthma assessment tool/survey/questionnaire) (1005F)<br />

Asthma symptom frequency not evaluated, reason not specified (1005F-8P)<br />

PAYMENT FOR EVALUATION AND MANAGEMENT SERVICES<br />

PROVIDED DURING GLOBAL PERIOD OF SURGERY<br />

Medicare Claims Processing Manual Chapter 12 §30.6.6 (Rev. 954, Issued: 05-19-06, Effective: 06-01-<br />

06, Implementation: 08-20-06)<br />

CPT Modifier -24 - Unrelated Evaluation <strong>and</strong> Management Service by Same Physician during<br />

Postoperative Period<br />

Carriers pay for an evaluation <strong>and</strong> management service other than inpatient hospital care before discharge<br />

from the hospital following surgery (CPT codes 99221-99238) if it was provided during the postoperative<br />

period <strong>of</strong> a surgical procedure, furnished by the same physician who performed the procedure, billed with<br />

CPT modifier -24, <strong>and</strong> accompanied by documentation that supports that the service is not related to the<br />

postoperative care <strong>of</strong> the procedure. They do not pay for inpatient hospital care that is furnished during<br />

the hospital stay in which the surgery occurred unless the doctor is also treating another medical condition<br />

that is unrelated to the surgery. All care provided during the inpatient stay in which the surgery occurred<br />

is compensated through the global surgical payment.<br />

CPT Modifier -25 - Significant Evaluation <strong>and</strong> Management Service by Same Physician on Date <strong>of</strong><br />

Global Procedure<br />

Medicare requires that Current Procedural Terminology (CPT) modifier -25 should only be used on<br />

claims for evaluation <strong>and</strong> management (E/M) services, <strong>and</strong> only when these services are provided by the<br />

same physician (or same qualified nonphysician practitioner) to the same patient on the same day as<br />

another procedure or other service. Carriers pay for an E/M service provided on the day <strong>of</strong> a procedure<br />

with a global fee period if the physician indicates that the service is for a significant, separately<br />

identifiable E/M service that is above <strong>and</strong> beyond the usual pre- <strong>and</strong> post-operative work <strong>of</strong> the<br />

procedure. Different diagnoses are not required for <strong>reporting</strong> the E/M service on the same date as the<br />

procedure or other service. Modifier -25 is added to the E/M code on the claim.<br />

Both the medically necessary E/M service <strong>and</strong> the procedure must be appropriately <strong>and</strong> sufficiently<br />

documented by the physician or qualified nonphysician practitioner in the patient’s medical record to<br />

support the claim for these services, even though the documentation is not required to be submitted with<br />

the claim.<br />

CPT Modifier -57 - Decision for Surgery Made Within Global Surgical Period<br />

Carriers pay for an evaluation <strong>and</strong> management service on the day <strong>of</strong> or on the day before a procedure<br />

with a 90-day global surgical period if the physician uses CPT modifier -57 to indicate that the service<br />

resulted in the decision to perform the procedure. Carriers may not pay for an evaluation <strong>and</strong> management<br />

service billed with the CPT modifier -57 if it was provided on the day <strong>of</strong> or the day before a procedure<br />

with a 0 or 10-day global surgical period.<br />

Payment for Evaluation <strong>and</strong> Management Services Provided During Global Period <strong>of</strong> Surgery<br />

• The Centers for Medicare & Medicaid Services (CMS) has clarified the documentation<br />

requirements <strong>and</strong> policy requirements for the use <strong>of</strong> CPT modifier -25 used with E/M services.<br />

Please refer to the manual attachment to CR5025, The Medicare Claims Processing Manual,<br />

Chapter 12, §30.6.6, for revisions regarding the use <strong>of</strong> CPT modifier -25<br />

5-14<br />

*All CPT Codes, Descriptions, <strong>and</strong> Two-Digit Modifiers<br />

Only Are Copyright 2006 American Medical Association. GEN 2007 REV 07-01<br />

Copyright 2007 Newby Consulting, Inc.

• Physicians <strong>and</strong> qualified nonphysician practitioners (NPP) should use CPT modifier -25 to<br />

designate a significant, separately identifiable E/M service provided by the same<br />

physician/qualified NPP to the same patient on the same day as another procedure or other<br />

service with a global fee period.<br />

• Common Procedural Terminology (CPT) modifier -25 identifies a significant, separately<br />

identifiable evaluation <strong>and</strong> management (E/M) service. It should be used when the E/M service is<br />

above <strong>and</strong> beyond the usual pre- <strong>and</strong> postoperative work <strong>of</strong> a procedure with a global fee period<br />

performed on the same day as the E/M service.<br />

• Different diagnoses are not required for <strong>reporting</strong> the E/M service on the same date as the<br />

procedure or other service with a global fee period. Modifier -25 is added to the E/M code on the<br />

claim.<br />

• Both the medically necessary E/M service <strong>and</strong> the procedure must be appropriately <strong>and</strong><br />

sufficiently documented by the physician or qualified NPP in the patient’s medical record to<br />

support the need for modifier -25 on the claim for these services, even though the documentation<br />

is not required to be submitted with the claim.<br />

• Your Carrier will not retract payment for claims already paid or retroactively pay claims<br />

processed prior to the implementation <strong>of</strong> CR5025. But, they will adjust claims brought to their<br />

attention.<br />

• Carriers will not pay for an E/M service reported with a procedure having a global fee period<br />

unless CPT modifier -25 is appended to the E/M service to designate it as a significant <strong>and</strong><br />

separately identifiable E/M service from the procedure.<br />

PREOPERATIVE SERVICES<br />

§1862(a)(1)(A) <strong>of</strong> the Social Security Act requires that in order to qualify for Medicare coverage, a<br />

service must be reasonable <strong>and</strong> necessary for the diagnosis <strong>and</strong> treatment <strong>of</strong> illness or injury, or to<br />

improve the functioning <strong>of</strong> a malformed body member. A preoperative service performed due to hospital<br />

or malpractice protocol cannot supercede this guideline for Medicare coverage purposes. Medicare will<br />

pay for preoperative evaluation <strong>and</strong> management services, <strong>and</strong> diagnostic tests if they are medically<br />

necessary <strong>and</strong> meet the documentation requirements <strong>of</strong> the service rendered.<br />

CMS Transmittal #1707 – May 31, 2001<br />

A. General--This manual instruction addresses payment for preoperative services that are not included in<br />

the global surgery payment.<br />

B. Non-global Preoperative Services -- Consist <strong>of</strong> evaluation <strong>and</strong> management (E/M) services<br />