2011 Annual Report & Financial Statements - Kengen

2011 Annual Report & Financial Statements - Kengen

2011 Annual Report & Financial Statements - Kengen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> <strong>Statements</strong>(Continued)<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong>(Continued)<br />

KenGen<br />

KenGen<br />

80<br />

<strong>2011</strong> ANNUAL REPORT & FINANCIAL STATEMENTS For The Year Ended 30 June <strong>2011</strong><br />

For The Year Ended 30 June <strong>2011</strong> <strong>2011</strong> ANNUAL REPORT & FINANCIAL STATEMENTS<br />

81<br />

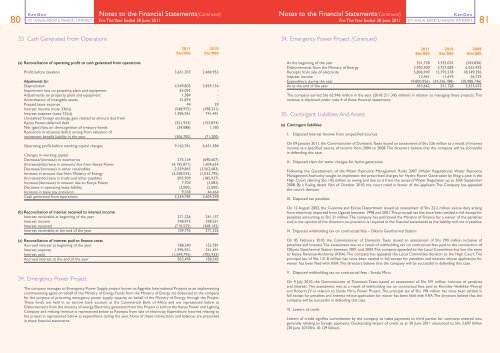

33 Cash Generated From Operations<br />

34. Emergency Power Project (Continued)<br />

(a) Reconciliation of operating profit to cash generated from operations<br />

<strong>2011</strong> 2010<br />

Shs’000 Shs’000<br />

Profit before taxation 3,651,307 2,484,953<br />

Adjustments for:<br />

Depreciation 4,549,805 3,829,136<br />

Impairment loss on property, plant and equipment 63,092 -<br />

Adjustments on property, plant and equipment 1,384 -<br />

Amortisation of intangible assets 31,874 -<br />

Prepaid lease expense 44 29<br />

Interest income (note 33(b)) (548,975) (398,331)<br />

Interest expense (note 33(c)) 1,996,951 741,491<br />

Unrealised foreign exchange gain related to amount due from<br />

Kenya Power-deferred debt (251,933) (155,874)<br />

Net (gain)/loss on derecognition of treasury bonds (24,088) 1,180<br />

Reduction in actuarial deficit arising from valuation of<br />

retirement benefit liability in the year (306,700) (71,200)<br />

Operating profit before working capital changes 9,162,761 6,431,384<br />

Changes in working capital<br />

Decrease/(increase) in inventories 275,134 (690,607)<br />

(Increase)/decrease in amounts due from Kenya Power (4,195,871) 1,604,654<br />

Decrease/(increase) in other receivables 2,359,843 (3,562,683)<br />

Increase in amount due from Ministry of Energy (3,258,033) (1,032,795)<br />

(Increase)/decrease in trade and other payables 895,909 (185,937)<br />

Increase/(decrease) in amount due to Kenya Power 7,704 (2,082)<br />

Decrease in operating lease liability (2,000) (2,000)<br />

Increase in leave pay provision 9,338 44,464<br />

Cash generated from operations 5,254,785 2,604,398<br />

(b) Reconciliation of interest received to interest income<br />

Interest receivable at beginning of the year 271,326 241,137<br />

Interest income 548,975 398,331<br />

Interest received (710,525) (368,142)<br />

Interest receivable at the end of the year 109,776 271,326<br />

(c) Reconciliation of interest paid to finance costs<br />

Accrued interest at beginning of the year 188,340 152,781<br />

Interest expense 1,996,951 741,491<br />

Interest paid (1,349,795) (705,932)<br />

Accrued interest at the end of the year 835,496 188,340<br />

34. Emergency Power Project<br />

The company manages an Emergency Power Supply project known as Aggreko International Projects as an implementing<br />

commissioning agent on behalf of the Ministry of Energy. Funds from the Ministry of Energy are disbursed to the company<br />

for the purpose of procuring emergency power supply capacity on behalf of the Ministry of Energy through the Project.<br />

These funds are held in an escrow bank account at the Commercial Bank of Africa and are represented below as<br />

Disbursements from the ministry of energy. Electricity generated from this Project is sold to the Kenya Power and Lighting<br />

Company and relating revenue is represented below as Receipts from sale of electricity. Expenditure incurred relating to<br />

the project is represented below as expenditure during the year. None of these transactions and balances are presented<br />

in these financial statements.<br />

<strong>2011</strong> 2010 2009<br />

Shs’000 Shs’000 Shs’000<br />

At the beginning of the year 531,728 3,335,035 (343,836)<br />

Disbursements from the Ministry of Energy 3,903,500 5,727,689 6,253,492<br />

Receipts from sale of electricity 5,806,949 15,793,518 18,349,396<br />

Interest income 12,441 11,674 56,729<br />

Expenditure during the year (9,800,956) (24,336,188) (20,980,746)<br />

As at the end of the year 453,662 531,728 3,335,035<br />

The company earned Shs 62.946 million in the year (2010: 211.345 million) in relation to managing these projects. This<br />

revenue is disclosed under note 4 of these financial statements.<br />

35. Contingent Liabilities And Assets<br />

(a) Contingent liabilities<br />

I. Disputed Interest Income from unspecified sources<br />

On 09 January <strong>2011</strong>, the Commissioner of Domestic Taxes issued an assessment of Shs 526 million as a result of interest<br />

income as a specified source of income from 2004 to 2008. The directors believe that the company will be successful<br />

in defending this case.<br />

II. Disputed claim for water charges for hydro-generation<br />

Following the Gazettement of the Water Resource Management Rules 2007 (Water Regulations), Water Resource<br />

Management Authority sought to implement the prescribed charges for Hydro Power Generation by filing a case in the<br />

High Court claiming Shs 142 million as owing and due to it from the onset of Water Regulation up to 30th September<br />

2008. By a Ruling dated 15th of October 2010, the court ruled in favour of the applicant. The Company has appealed<br />

the court’s decision.<br />

III. Disputed tax penalties<br />

On 12 August 2002, the Customs and Excise Department issued an assessment of Shs 22.2 million excise duty arising<br />

from electricity imported from Uganda between 1998 and 2001. The principal tax has since been settled in full except for<br />

penalties amounting to Shs 31 million. The company has petitioned the Ministry of Finance for a waiver of the penalties<br />

and, in the opinion of the directors, no provision is required in the financial statements as the liability will not crystallise.<br />

IV. Disputed withholding tax on contractual fees - Olkaria Geothermal Station<br />

On 05 February 2010, the Commissioner of Domestic Taxes issued an assessment of Shs 290 million inclusive of<br />

penalties and interest. The assessment was as a result of withholding tax on contractual fees paid to the contractors of<br />

Olkaria Geothermal Station between 2001 and 2004. The company appealed to the Local Committee but lost the same<br />

to Kenya Revenue Authority (KRA). The company has appealed the Local Committee decision to the High Court. The<br />

principal tax of Shs 131.8 million has since been settled in full except for penalties and interest whose application for<br />

waiver has been filed with KRA. The directors believe that the company will be successful in defending this case.<br />

V. Disputed withholding tax on contractual fees - Sondu Miriu<br />

On 9 July 2010, the Commissioner of Domestic Taxes issued an assessment of Shs 591 million inclusive of penalties<br />

and interest. The assessment was as a result of withholding tax on contractual fees paid to Konoike–Veidekke–Murray<br />

and Roberts JV in relation to Sondu Miriu Power Project. The principal tax of Shs 198 million has since been settled in<br />

full except for penalties and interest whose application for waiver has been filed with KRA. The directors believe that the<br />

company will be successful in defending this case.<br />

VI. Letters of credit<br />

Letters of credit signifies commitment by the company to make payments to third parties for contracts entered into,<br />

generally relating to foreign payments. Outstanding letters of credit as at 30 June <strong>2011</strong> amounted to Shs 3.697 billion<br />

(30 June 2010Shs 10.129 billion).