2011 Annual Report & Financial Statements - Kengen

2011 Annual Report & Financial Statements - Kengen

2011 Annual Report & Financial Statements - Kengen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the <strong>Financial</strong> <strong>Statements</strong>(Continued)<br />

Notes to the <strong>Financial</strong> <strong>Statements</strong>(Continued)<br />

KenGen<br />

KenGen<br />

88<br />

<strong>2011</strong> ANNUAL REPORT & FINANCIAL STATEMENTS For The Year Ended 30 June <strong>2011</strong><br />

For The Year Ended 30 June <strong>2011</strong> <strong>2011</strong> ANNUAL REPORT & FINANCIAL STATEMENTS<br />

89<br />

39. Operating Segment Information<br />

The company’s only activity is generation of electricity. The business is organised on a regional platform – Western<br />

and Eastern Hydros, Mombasa, Olkaria, Head Office and Ngong’ Hill which only serves the necessary functional and<br />

administrative roles in these areas and not allocation of resources and financial performance assessment. The operations<br />

and management reporting are all done under the head office.<br />

40. Comparatives<br />

Where necessary, comparative figures have been adjusted to conform to changes in presentation in the current year.<br />

Where changes are made and affect the statement of financial position, a third statement of financial position as at the<br />

beginning of the earliest period presented is presented together with the corresponding notes.<br />

41. Prior Year Adjustments<br />

In compiling the financial information included herein, the following adjustments were made to make all the financial<br />

statements compliant with International <strong>Financial</strong> <strong>Report</strong>ing Standards (IFRSs) applicable for the financial period ended<br />

30 June <strong>2011</strong>.<br />

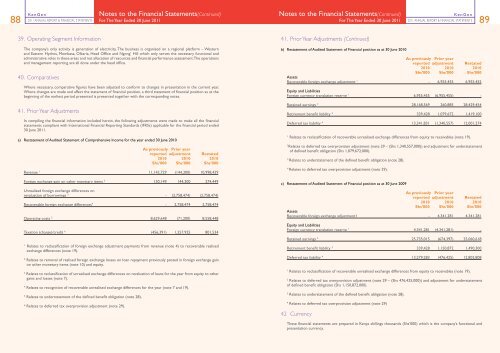

a) Restatement of Audited Statement of Comprehensive Income for the year ended 30 June 2010<br />

As previously Prior year<br />

reported adjustment Restated<br />

2010 2010 2010<br />

Shs’000 Shs’000 Shs’000<br />

Revenue 1 11,142,729 (144,300) 10,998,429<br />

Foreign exchange gain on other monetary items 2 130,149 144,300 274,449<br />

Unrealised foreign exchange differences on<br />

revaluation of borrowings 3 - (2,758,474) (2,758,474)<br />

Recoverable foreign exchange differences 4 - 2,758,474 2,758,474<br />

Operating costs 5 8,629,648 (71,200) 8,558,448<br />

Taxation (charge)/credit 6 (456,391) 1,257,925 801,534<br />

1<br />

Relates to reclassification of foreign exchange adjustment payments from revenue (note 4) to recoverable realised<br />

exchange differences (note 19).<br />

2<br />

Relates to removal of realised foreign exchange losses on loan repayment previously posted in foreign exchange gain<br />

on other monetary items (note 10) and equity.<br />

3<br />

Relates to reclassification of unrealised exchange differences on revaluation of loans for the year from equity to other<br />

gains and losses (note 7).<br />

4<br />

Relates to recognition of recoverable unrealised exchange differences for the year (note 7 and 19).<br />

5<br />

Relates to understatement of the defined benefit obligation (note 28).<br />

6<br />

Relates to deferred tax overprovision adjustment (note 29).<br />

41. Prior Year Adjustments (Continued)<br />

b) Restatement of Audited Statement of <strong>Financial</strong> position as at 30 June 2010<br />

As previously Prior year<br />

reported adjustment Restated<br />

2010 2010 2010<br />

Shs’000 Shs’000 Shs’000<br />

Assets<br />

Recoverable foreign exchange adjustment 1 - 6,955,455 6,955,455<br />

Equity and Liabilities<br />

Foreign currency translation reserve 1 6,955,455 (6,955,455) -<br />

Retained earnings 2 28,168,569 260,885 28,429,454<br />

Retirement benefit liability 3 339,428 1,079,672 1,419,100<br />

Deferred tax liability 4 13,341,831 (1,340,557) 12,001,274<br />

1<br />

Relates to reclassification of recoverable unrealised exchange differences from equity to receivables (note 19).<br />

2<br />

Relates to deferred tax overprovision adjustment (note 29 – (Shs 1,340,557,000)) and adjustment for understatement<br />

of defined benefit obligation (Shs 1,079,672,000).<br />

3<br />

Relates to understatement of the defined benefit obligation (note 28).<br />

4<br />

Relates to deferred tax overprovision adjustment (note 29).<br />

c) Restatement of Audited Statement of <strong>Financial</strong> position as at 30 June 2009<br />

As previously Prior year<br />

reported adjustment Restated<br />

2010 2010 2010<br />

Shs’000 Shs’000 Shs’000<br />

Assets<br />

Recoverable foreign exchange adjustment1 - 4,341,281 4,341,281<br />

Equity and Liabilities<br />

Foreign currency translation reserve 1 4,341,281 (4,341,281) -<br />

Retained earnings 2 25,735,015 (674,397) 25,060,618<br />

Retirement benefit liability 3 339,428 1,150,872 1,490,300<br />

Deferred tax liability 4 13,279,283 (476,425) 12,802,808<br />

1<br />

Relates to reclassification of recoverable unrealised exchange differences from equity to receivables (note 19).<br />

2<br />

Relates to deferred tax overprovision adjustment (note 29 – (Shs 476,425,000)) and adjustment for understatement<br />

of defined benefit obligation (Shs 1,150,872,000).<br />

3<br />

Relates to understatement of the defined benefit obligation (note 28).<br />

4<br />

Relates to deferred tax overprovision adjustment (note 29)<br />

42 Currency<br />

These financial statements are prepared in Kenya shillings thousands (Shs’000) which is the company’s functional and<br />

presentation currency.