Annual Report 2005-2006 - New Zealand Customs Service

Annual Report 2005-2006 - New Zealand Customs Service

Annual Report 2005-2006 - New Zealand Customs Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

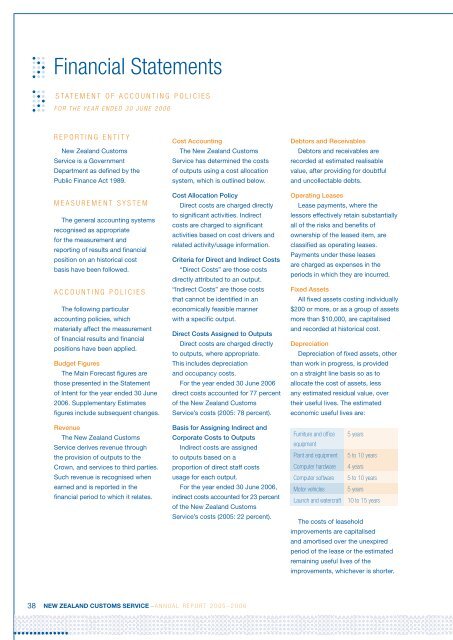

Financial Statements<br />

S t a t e m e n t o f A c c o u n t i n g P o l i c i e s<br />

F O R T H E Y E A R E N D E D 3 0 J U N E 2 0 0 6<br />

R e p o r t i n g E n t i t y<br />

<strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong><br />

<strong>Service</strong> is a Government<br />

Department as defined by the<br />

Public Finance Act 1989.<br />

M e a s u r e m e n t S y s t e m<br />

The general accounting systems<br />

recognised as appropriate<br />

for the measurement and<br />

reporting of results and financial<br />

position on an historical cost<br />

basis have been followed.<br />

A c c o u n t i n g P o l i c i e s<br />

The following particular<br />

accounting policies, which<br />

materially affect the measurement<br />

of financial results and financial<br />

positions have been applied.<br />

Budget Figures<br />

The Main Forecast figures are<br />

those presented in the Statement<br />

of Intent for the year ended 30 June<br />

<strong>2006</strong>. Supplementary Estimates<br />

figures include subsequent changes.<br />

Revenue<br />

The <strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong><br />

<strong>Service</strong> derives revenue through<br />

the provision of outputs to the<br />

Crown, and services to third parties.<br />

Such revenue is recognised when<br />

earned and is reported in the<br />

financial period to which it relates.<br />

Cost Accounting<br />

The <strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong><br />

<strong>Service</strong> has determined the costs<br />

of outputs using a cost allocation<br />

system, which is outlined below.<br />

Cost Allocation Policy<br />

Direct costs are charged directly<br />

to significant activities. Indirect<br />

costs are charged to significant<br />

activities based on cost drivers and<br />

related activity/usage information.<br />

Criteria for Direct and Indirect Costs<br />

“Direct Costs” are those costs<br />

directly attributed to an output.<br />

“Indirect Costs” are those costs<br />

that cannot be identified in an<br />

economically feasible manner<br />

with a specific output.<br />

Direct Costs Assigned to Outputs<br />

Direct costs are charged directly<br />

to outputs, where appropriate.<br />

This includes depreciation<br />

and occupancy costs.<br />

For the year ended 30 June <strong>2006</strong><br />

direct costs accounted for 77 percent<br />

of the <strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong><br />

<strong>Service</strong>’s costs (<strong>2005</strong>: 78 percent).<br />

Basis for Assigning Indirect and<br />

Corporate Costs to Outputs<br />

Indirect costs are assigned<br />

to outputs based on a<br />

proportion of direct staff costs<br />

usage for each output.<br />

For the year ended 30 June <strong>2006</strong>,<br />

indirect costs accounted for 23 percent<br />

of the <strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong><br />

<strong>Service</strong>’s costs (<strong>2005</strong>: 22 percent).<br />

Debtors and Receivables<br />

Debtors and receivables are<br />

recorded at estimated realisable<br />

value, after providing for doubtful<br />

and uncollectable debts.<br />

Operating Leases<br />

Lease payments, where the<br />

lessors effectively retain substantially<br />

all of the risks and benefits of<br />

ownership of the leased item, are<br />

classified as operating leases.<br />

Payments under these leases<br />

are charged as expenses in the<br />

periods in which they are incurred.<br />

Fixed Assets<br />

All fixed assets costing individually<br />

$200 or more, or as a group of assets<br />

more than $10,000, are capitalised<br />

and recorded at historical cost.<br />

Depreciation<br />

Depreciation of fixed assets, other<br />

than work in progress, is provided<br />

on a straight line basis so as to<br />

allocate the cost of assets, less<br />

any estimated residual value, over<br />

their useful lives. The estimated<br />

economic useful lives are:<br />

Furniture and office 5 years<br />

equipment<br />

Plant and equipment 5 to 10 years<br />

Computer hardware 4 years<br />

Computer software 5 to 10 years<br />

Motor vehicles 5 years<br />

Launch and watercraft 10 to 15 years<br />

The costs of leasehold<br />

improvements are capitalised<br />

and amortised over the unexpired<br />

period of the lease or the estimated<br />

remaining useful lives of the<br />

improvements, whichever is shorter.<br />

38 <strong>New</strong> <strong>Zealand</strong> <strong>Customs</strong> <strong>Service</strong> – A N N U A L R E P O R T 2 0 0 5 – 2 0 0 6