2013 benefits open enrollment guide - Jones Lang LaSalle

2013 benefits open enrollment guide - Jones Lang LaSalle

2013 benefits open enrollment guide - Jones Lang LaSalle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Flexible Spending Accounts (FSA)<br />

<strong>Jones</strong> <strong>Lang</strong> <strong>LaSalle</strong> offers employees an opportunity to pay for expenses such as childcare and healthcare expenses on a pre-tax basis through<br />

an FSA.<br />

Healthcare FSA<br />

*NEW- the annual FSA contribution limit for <strong>2013</strong> has decreased from $5,000 to $2,500. The HealthCare FSA works differently depending on which<br />

medical plan option you select. This is due to changes in the Health Care Reform laws.<br />

If you enroll in the Standard Plan option, you may use your FSA to reimburse all eligible out-of-pocket medical, dental, and vision care expenses.<br />

If you enroll in the Plus or Basic Plan, your Healthcare FSA is considered a limited purpose FSA by the IRS and may only be used to<br />

reimburse dental and vision expenses.<br />

Child/Elder (Dependent) Care FSA<br />

The Dependent Care FSA reimburses you for expenses incurred in the form of wages paid to a licensed baby sitter, licensed day care center,<br />

nursery school, adult day care center, or housekeeper caring for an eligible dependent.<br />

You will also receive a debit card for eligible expenses.<br />

If you live in the states of Massachusetts, Maine, and New Hampshire you will not receive a Consumer Account MasterCard from UnitedHealth<br />

Care. You will need to submit claims for reimbursement through UnitedHealth Care.<br />

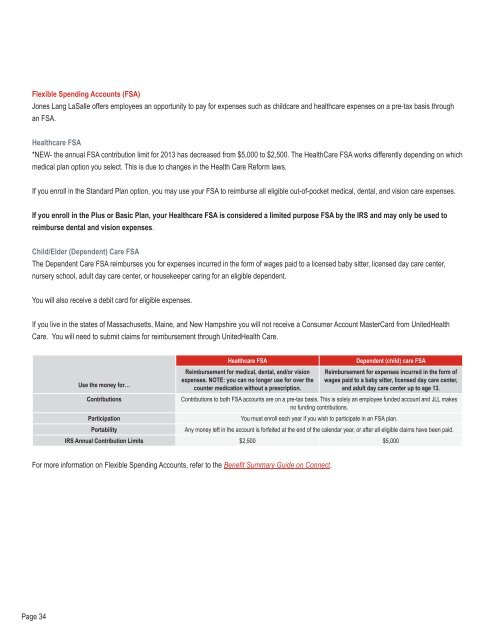

Use the money for…<br />

Contributions<br />

Participation<br />

Portability<br />

Healthcare FSA<br />

Reimbursement for medical, dental, and/or vision<br />

expenses. NOTE: you can no longer use for over the<br />

counter medication without a prescription.<br />

Dependent (child) care FSA<br />

Reimbursement for expenses incurred in the form of<br />

wages paid to a baby sitter, licensed day care center,<br />

and adult day care center up to age 13.<br />

Contributions to both FSA accounts are on a pre-tax basis. This is solely an employee funded account and JLL makes<br />

no funding contributions.<br />

You must enroll each year if you wish to participate in an FSA plan.<br />

Any money left in the account is forfeited at the end of the calendar year, or after all eligible claims have been paid.<br />

IRS Annual Contribution Limits $2,500 $5,000<br />

For more information on Flexible Spending Accounts, refer to the Benefit Summary Guide on Connect.<br />

Page 34