FINAL MANAGEMENT REPORT - Baviaans Municipality

FINAL MANAGEMENT REPORT - Baviaans Municipality

FINAL MANAGEMENT REPORT - Baviaans Municipality

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>FINAL</strong> <strong>MANAGEMENT</strong> <strong>REPORT</strong><br />

BAVIAANS MUNICIPALITY<br />

30 June 2011

<strong>MANAGEMENT</strong> <strong>REPORT</strong><br />

BAVIAANS MUNICIPALITY<br />

30 June 2011<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

CONTENTS<br />

Introduction 3<br />

The Auditor-General’s responsibilities 3<br />

The accounting officer/authority’s responsibilities 4<br />

Meetings with oversight bodies and those charged with governance 5<br />

Matters relating to the auditor’s report 6<br />

Conclusion on reporting on predetermined objectives 18<br />

Specific focus areas 25<br />

Significant deficiencies in internal control 27<br />

Ratings of detailed audit findings 36<br />

Conclusions 36<br />

Summary of detailed audit findings 37<br />

Detailed audit findings contained in annexures A – C 57<br />

2

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

<strong>FINAL</strong> <strong>MANAGEMENT</strong> <strong>REPORT</strong> TO THE ACCOUNTING OFFICER ON THE AUDIT OF THE<br />

BAVIAANS MUNICIPALITY FOR THE YEAR ENDED 30 JUNE 2011<br />

INTRODUCTION<br />

1. This management report includes audit findings arising from the audit of the financial<br />

statements, reporting on predetermined objectives and compliance with laws and regulations<br />

for the year ended 30 June 2011 which were communicated to management and includes<br />

their response to these findings. The report also includes information on the internal control<br />

deficiencies that were identified. Addressing these deficiencies will assist in ensuring an<br />

improvement in the audit outcomes.<br />

2. The management report consists of an executive summary and detailed audit finding which<br />

are contained in annexure A, B and C.<br />

THE AUDITOR-GENERAL’S RESPONSIBILITIES<br />

3. As required by section 188 of the Constitution of the Republic of South Africa, 1996 (Act No.<br />

108 of 1996) and section 4 of the Public Audit Act of South Africa, 2004 (Act No. 25 of 2004)<br />

(PAA), our responsibility is to express an opinion on the financial statements and to report on<br />

findings relating to our audit of the report on predetermined objectives and compliance with<br />

material matters in laws and regulations applicable to the entity. Our engagement letter sets<br />

out our responsibilities in detail. These include the following:<br />

<br />

<br />

<br />

<br />

Performing procedures to obtain audit evidence about the amounts and disclosures in the<br />

financial statements, the report on predetermined objectives and compliance with laws<br />

and regulations applicable to the entity. The procedures selected depend on our<br />

judgement, including the assessment of the risks of material misstatement of the financial<br />

statements, the report on predetermined objectives and material non-compliance with<br />

laws and regulations.<br />

Considering internal controls relevant to the entity’s preparation and fair presentation of<br />

the financial statements, the report on predetermined objectives and compliance with<br />

laws and regulations.<br />

Evaluating the appropriateness of accounting policies used and the reasonableness of<br />

accounting estimates made by management.<br />

Evaluating the appropriateness of systems and processes that ensure the accuracy and<br />

completeness of the financial statements, the report on predetermined objectives and<br />

compliance with laws and regulations.<br />

4. Because of the test nature and other inherent limitations of an audit, we do not guarantee the<br />

completeness and accuracy of the financial statements or the report on predetermined<br />

objectives or compliance with all applicable laws and regulations.<br />

5. Having formed an opinion on the financial statements, we may include additional<br />

communication in the auditor’s report that does not have an effect on the auditor’s opinion.<br />

These may include:<br />

<br />

<br />

an emphasis of matter paragraph to draw users’ attention to a matter presented or<br />

disclosed in the financial statements which is of such importance that it is fundamental to<br />

their understanding of the financial statements<br />

an additional matter paragraph to draw users’ attention to any matter, other than those<br />

presented or disclosed in the financial statements, that is relevant to users’ understanding<br />

of the audit, the auditor’s responsibilities or the auditor’s report.<br />

3

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

THE ACCOUNTING OFFICER’S RESPONSIBILITIES<br />

6. The accounting officer’s responsibilities are set out in detail in the engagement letter. These<br />

include the following:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

The preparation and fair presentation of the consolidated financial statements in<br />

accordance with the South African Standards of Generally Recognised Accounting<br />

Practice (SA Standards of GRAP).<br />

Planning, monitoring of and reporting on performance against predetermined objectives.<br />

Review and monitoring of compliance with laws and regulations and disclosing known<br />

instances of non-compliance or suspected non-compliance with laws and regulations.<br />

Designing, implementing and maintaining proper record keeping and internal controls<br />

necessary to enable the preparation of financial statements and the report on<br />

predetermined objectives that are free from material misstatement whether due to fraud<br />

or error, and compliance with laws and regulations.<br />

Designing and implementing formal controls over IT systems to ensure the reliability of<br />

the systems and the availability, accuracy and protection of information.<br />

Implementing appropriate risk management activities to ensure that regular risk<br />

assessments are conducted.<br />

Disclosing all matters concerning any risk, allegation or instance of fraud.<br />

Accounting for and disclosing related-party relationships and transactions.<br />

Providing access to all information that is relevant to the preparation of the financial<br />

statements and performance information, such as records and documents.<br />

4

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

EXECUTIVE SUMMARY<br />

SECTION 1: Meetings with oversight bodies and those charged with governance<br />

7. During the audit cycle we met with key stakeholders to communicate matters relating to the<br />

audit outcomes of the municipality and emerging risks. Insight was provided on the key<br />

controls that impact these audit outcomes to enable corrective action to be taken.<br />

8. Meetings were conducted as follows:<br />

Executive authority: 01 July 2011<br />

05 July 2011<br />

15 August 2011<br />

Accounting officer: 24 May 2011<br />

01 July 2011<br />

05 July 2011<br />

15 August 2011<br />

25 August 2011<br />

08 September 2011<br />

20 September 2011<br />

06 October 2011<br />

13 October 2011<br />

Internal audit: 25 August 2011<br />

Audit committee: 25 August 2011<br />

9. At these meetings commitments were made to address improvements in the internal control<br />

environment with the objective of achieving clean administration. Progress made on these<br />

commitments is discussed later in this report.<br />

5

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

SECTION 2: MATTERS RELATING TO THE AUDITOR’S <strong>REPORT</strong><br />

PART A – MISSTATEMENTS IN THE FINANCIAL STATEMENTS<br />

10. Material misstatements in the financial statements were identified during the audit. These misstatements were not prevented or detected by the<br />

municipality’s system of internal control. These material misstatements also constitute non-compliance with the Municipal Finance Management Act of<br />

South Africa, 2003 (Act No. 56 of 2003) (MFMA).<br />

11. The misstatements not corrected form the basis for the disclaimer opinion on the financial statements.<br />

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Material misstatements not corrected<br />

Expenditure - Personnel Inappropriate classification of EPWP Wages 2 745 952<br />

Expenditure<br />

Expenditure – General<br />

Expenditure<br />

Revenue<br />

-2 745 952<br />

Overstatement of VAT receivable at year end. 405 177<br />

Leadership - Exercise oversight responsibility<br />

regarding financial and performance reporting and<br />

compliance and related internal controls.<br />

Leadership<br />

Expenditure – General<br />

Expenditure<br />

Current Assets – VAT<br />

Revenue<br />

Adjustment to Trade and other Payables line<br />

item in Statement of Financial Performance for<br />

which there is no audit evidence.<br />

1 041<br />

– 406 218<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

4 199 544 Financial and performance management<br />

Implement controls over daily and monthly processing<br />

and reconciling of transactions.<br />

Revenue<br />

Expenditure – General<br />

Expenditure<br />

Incorrect classification between income and<br />

expense and availability charges was charged<br />

twice to one debtor.<br />

-576 472<br />

576 472<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

6

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Revenue<br />

Grants not used for intended purpose 935 242<br />

Leadership<br />

Current Liabilities - Unspent<br />

conditional Grants<br />

Revenue<br />

Current Liabilities - Unspent<br />

conditional Grants<br />

Grant expenditure for which documentation not<br />

received - Deemed to be incorrectly classified.<br />

-935 242<br />

1 265 717<br />

-1 265 717<br />

Provide effective leadership based on a culture of<br />

honesty, ethical business practices and good<br />

governance, protecting and enhancing the best<br />

interests of the entity.<br />

Leadership<br />

Provide effective leadership based on a culture of<br />

honesty, ethical business practices and good<br />

governance, protecting and enhancing the best<br />

interests of the entity.<br />

Expenditure – General<br />

Expenditure<br />

Expenditure – General<br />

Expenditure<br />

No supporting documentation for expenditure<br />

detail test.<br />

Documentation for testing of expenditure not<br />

received.<br />

-674 752 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

-6 129 466 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

7

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Leadership<br />

Expenditure – General<br />

Expenditure<br />

Non-current assets -<br />

Property, Plant & Equipment<br />

Expenditure - Bad debt<br />

expense<br />

Current Assets - Trade<br />

Receivables<br />

Capital grant expenditure incorrectly expensed. -624 980<br />

No supporting documents for bad debt written<br />

off in the current year.<br />

624 980<br />

-709 441<br />

2 460 928<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

Leadership<br />

Provide effective leadership based on a culture of<br />

honesty, ethical business practices and good<br />

governance, protecting and enhancing the best<br />

interests of the entity.<br />

Financial and Performance Management<br />

Prepare regular, accurate and complete financial and<br />

performance reports that are supported and<br />

evidenced by reliable information.<br />

Provision for debt<br />

impairment<br />

Expenditure - Special<br />

Projects<br />

Current liabilities - Trade<br />

Payables<br />

Current liabilities - Trade<br />

Payables<br />

Special projects expenditure incorrectly<br />

classified by nature instead of function.<br />

Reversal of Journals due to no proof could be<br />

provided to verify that it is a valid journal.<br />

.<br />

Insufficient supporting documentation to<br />

substantiate unrecorded liabilities.<br />

-1 751 487<br />

-1 036 057 Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

-3 445 804 Financial and performance management<br />

Implement controls over daily and monthly processing<br />

and reconciling of transactions<br />

-2 927 918 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

8

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Current Assets - Trade<br />

Receivables<br />

Current Assets - Trade<br />

Receivables<br />

Current Liabilities - Provision<br />

for doubtful debts<br />

Insufficient supporting documentation for<br />

existence of debtors.<br />

Insufficient supporting documentation for<br />

debtor journals processed.<br />

No supporting documentation for the inputs<br />

used to calculate the provision for doubtful<br />

debts.<br />

information is accessible and available to support<br />

financial and performance reporting<br />

-419 876 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

-339 175 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

901 411 Financial and performance management<br />

Prepare regular, accurate and complete financial and<br />

performance reports that are supported and<br />

evidenced by reliable information.<br />

Current Assets – VAT<br />

Current Assets – VAT<br />

Non-current assets -<br />

Property, Plant & Equipment<br />

Unidentified VAT variances on the 2010 VAT<br />

reconciliation that will be brought forward to the<br />

current year<br />

Unidentified VAT variances on the VAT<br />

reconciliation.<br />

Property, plant and equipment could that could<br />

not be verified for existence.<br />

-1 008 297 Financial and Performance Management<br />

Implement controls over daily and monthly processing<br />

and reconciling of transactions.<br />

500 128 Financial and performance management<br />

Implement controls over daily and monthly processing<br />

and reconciling of transactions.<br />

-7 451 855 Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

9

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Non-current assets -<br />

Property, Plant & Equipment<br />

Incorrect classification of PPE -<br />

Infrastructure (Disclosure).<br />

-1 086 248<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Incorrect classification of PPE -<br />

Infrastructure (Disclosure).<br />

465 535<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

<br />

Incorrect classification of PPE –Community<br />

(Disclosure).<br />

-931 070<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

<br />

Incorrect classification of PPE - Other<br />

Equipment (Disclosure).<br />

-6 672 671<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

10

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

<br />

Understating of assets pledged as security<br />

(Disclosure).<br />

1 532 270<br />

Financial and Performance Management<br />

Prepare regular, accurate and complete financial and<br />

performance reports that are supported and<br />

evidenced by reliable information.<br />

Incorrect classification of PPE on AFS -<br />

Plant & Equipment (Disclosure)<br />

Incorrect classification of PPE on AFS -<br />

Furniture & Fittings – (Disclosure).<br />

Incorrect classification of PPE on AFS -<br />

Electronic Equipment (Disclosure).<br />

Incorrect classification of PPE on AFS -<br />

Motor vehicles (Disclosure).<br />

620 714<br />

1 706 962<br />

5 120 887<br />

775 891<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting. .<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting. .<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

11

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Non-current Assets -<br />

Investment property<br />

Current Assets - Cash and<br />

bank<br />

Current liabilities - Trade<br />

Payables<br />

Existence of Investment Properties could not<br />

be verified.<br />

Invalid Reconciling Items on the bank<br />

reconciliation.<br />

information is accessible and available to support<br />

financial and performance reporting. .<br />

-10 155 Financial and performance management<br />

533 128<br />

-533 128<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting..<br />

Financial and performance management<br />

Prepare regular, accurate and complete financial and<br />

performance reports that are supported and<br />

evidenced by reliable information. .<br />

Disclosure - Contractual<br />

commitments<br />

Disclosure – Financial<br />

Instruments<br />

Design and implement formal controls over IT<br />

systems to ensure the reliability of the systems and<br />

the availability, accuracy and protection of information<br />

Contractual commitments overstated. -1 154 342 Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

Financial instruments are overstated -2 935 167 Financial and Performance Management:<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Disclosure – Property, plant<br />

and equipment<br />

Finance lease assets not disclosed -3 215 380<br />

3 215 380<br />

Financial and Performance Management:<br />

Implement proper record keeping in a timely manner<br />

12

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Disclosure – Cash flow<br />

statement<br />

Proceeds from sale of assets are overstated -1 013 660 Financial and Performance Management:<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Disclosure - Personnel<br />

expenditure<br />

Detailed breakdown of different classes of<br />

remuneration for councillors not disclosed.<br />

Refer to the following:<br />

Basic Salaries: Councillors - Note 28.<br />

<br />

Public Office Allowance - Note28.<br />

554 908<br />

323 707<br />

Financial and Performance Management:<br />

Implement proper record keeping in a timely manner<br />

to ensure that complete, relevant and accurate<br />

information is accessible and available to support<br />

financial and performance reporting.<br />

Non Taxable allowances – Note 28.<br />

185 000<br />

Back pay - Note 28.<br />

30 638<br />

Medical Contribution to Mayor – Note 28.<br />

12 168<br />

Incorrect disclosure of remunerations of<br />

councillors in AFS<br />

-1 042 232<br />

Disclosure - Irregular<br />

expenditure<br />

Irregular expenditure identified in detail testing 9 759 082 Financial and performance management<br />

Review and monitor compliance with applicable laws<br />

and regulations.<br />

13

Financial statement item<br />

Material misstatements<br />

Finding<br />

Impact<br />

R<br />

DR/(CR)<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Internal control deficiency–<br />

improvement or intervention is required to design<br />

and/or implement appropriate controls as detailed<br />

below<br />

Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls<br />

Financial and performance management<br />

Implement controls over daily and monthly processing<br />

and reconciling of transactions<br />

Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls<br />

Disclosure - Unauthorised<br />

expenditure<br />

Accumulation of immaterial<br />

uncorrected misstatements<br />

Unauthorised expenditure identified in detail<br />

testing.<br />

Aggregate non-material uncorrected<br />

misstatements for the statement of financial<br />

performance<br />

Financial and performance management<br />

Review and monitor compliance with applicable laws<br />

and regulations<br />

8 718 341 Financial and performance management<br />

Review and monitor compliance with applicable laws<br />

and regulations.<br />

831 574 Financial and performance management<br />

Prepare regular, accurate and complete financial and<br />

performance reports that are supported and<br />

evidenced by reliable information.<br />

14

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Prior year misstatement identified in the current year<br />

Revenue – Services<br />

charges<br />

Inappropriate classification of revenue 219 544<br />

Revenue – Rates<br />

-219 544<br />

Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

Revenue – Services<br />

charges<br />

Current assets – Cash and<br />

bank<br />

Invalid bank reconciling items in bank recon<br />

of 2010<br />

-232 848<br />

232 848<br />

Financial and performance management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

Revenue – Rates<br />

Journal erroneously processed to VAT 491 841<br />

Design and implement formal controls over IT<br />

systems to ensure the reliability of the systems and<br />

the availability, accuracy and protection of<br />

information.<br />

Leadership<br />

Current assets – VAT<br />

receivable<br />

Revenue – Rates<br />

Current assets – VAT<br />

Receivable<br />

No supporting documentation for incorrect<br />

VAT journal processed.<br />

-491 841<br />

-153 110<br />

150 917<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

Leadership<br />

Exercise oversight responsibility regarding financial<br />

and performance reporting and compliance and<br />

related internal controls.<br />

Expenditure – General<br />

expenditure<br />

Personnel expenditure<br />

Current liabilities –<br />

Provision for accrued leave<br />

Overstatement of provision for leave pay<br />

2009-10<br />

2 193<br />

-142 829<br />

142 829<br />

Financial and performance management<br />

Implement controls over daily and monthly<br />

processing and reconciling of transactions.<br />

15

Expenditure – General<br />

expenditure<br />

Expenditure – General<br />

expenditure<br />

Current liabilities – Trade<br />

payables<br />

Non-current assets –<br />

Property, plant and<br />

equipment<br />

Current assets – Provision<br />

for landfill site<br />

Accumulated surplus<br />

Expenditure – General<br />

expenditure<br />

Non-current assets –<br />

Property, plant and<br />

equipment<br />

Current assets – VAT<br />

receivable<br />

Factual limitation misstatement for no<br />

supporting documentation for prior period<br />

error journals on expenditure<br />

Projected limitation misstatement for no<br />

supporting documentation for prior period<br />

error journals on expenditure<br />

No supporting documentation provided on<br />

payable journals relating to prior period<br />

error corrections<br />

No supporting documentation to support<br />

reversal of landfill site provision<br />

Understating of assets pledged as security<br />

(Disclosure)<br />

VAT vote 300350041 not brought forward<br />

from the prior year.<br />

-124 694 Leadership<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-66 229 Leadership<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-93 059 Financial and performance management<br />

785 290<br />

-989 664<br />

112 756<br />

91 587<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

Financial and performance management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

1 532 270 Financial and performance management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

-436 814 Financial and performance management<br />

16

Accumulated surplus 436 814<br />

Current assets – VAT VAT processed through the general ledger<br />

113 444<br />

receivable<br />

but not claimed on the VAT 201.<br />

Accumulated surplus<br />

Current assets – VAT<br />

receivable<br />

Current assets – Cash and<br />

bank<br />

Current assets –<br />

Investments<br />

Current assets - Cash and<br />

bank<br />

Accumulated surplus<br />

Unidentified VAT variances in the VAT<br />

reconciliation.<br />

Inappropriate classification of Investments. 1 019 470<br />

No evidence provided for PY error journal<br />

entries for cash and bank.<br />

No explanation provided for prior year<br />

adjustments.<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Implement controls over daily and monthly<br />

processing and reconciling of transactions.<br />

Financial and performance management<br />

Implement controls over daily and monthly<br />

-113 444 processing and reconciling of transactions.<br />

-1 008 297 Financial and performance management<br />

Implement controls over daily and monthly<br />

processing and reconciling of transactions.<br />

Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

-1 019 470 accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-218 012 Financial and performance management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

114 084 Financial and performance management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

Accumulated surplus<br />

Accumulated surplus<br />

No supporting documentation provided on<br />

payable journals relating to prior period<br />

error corrections.<br />

No evidence provided for PY error journal<br />

entries for cash and bank.<br />

759 757 Financial and Performance Management<br />

Prepare regular, accurate and complete financial<br />

and performance reports that are supported and<br />

evidenced by reliable information.<br />

-447 859 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

17

Disclosure – Statement of<br />

changes in net assets<br />

Disclosure – Interest<br />

No supporting documentation for the<br />

opening balance of accumulated surplus on<br />

the statement of changes in net assets<br />

compared to 2008 closing balance.<br />

Note 27 – Interest revenue from the bank<br />

does not agree with that on the statement<br />

of financial performance.<br />

Grants (Disclosure) Note 25 – Tourism hospitality grant –<br />

Conditions met – transferred to revenue<br />

Disclosure – Interest<br />

Note 27 – Interest revenue from trade and<br />

other receivables does not agree with that n<br />

the statement of financial performance<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

support financial and performance reporting.<br />

1 112 748 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-140 650 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-188 754 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

-203 958 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

Cash flow statement Miss classification of investments 1 019 470 Financial and performance management<br />

Implement proper record keeping in a timely<br />

manner to ensure that complete, relevant and<br />

accurate information is accessible and available to<br />

support financial and performance reporting.<br />

18

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

PART B – MATTERS TO BE BROUGHT TO THE ATTENTION OF THE USERS<br />

EMPHASIS OF MATTER PARAGRAPHS<br />

An emphasis of matter paragraph will be included in our auditor’s report to highlight the following<br />

matters to the users of the financial statements:<br />

Restatement of corresponding figures<br />

12. As disclosed in note 37 to the financial statements, the corresponding figures for 30 June<br />

2010 have been restated due to errors discovered during the period ended 30 June 2011 in<br />

the financial statements of <strong>Baviaans</strong> <strong>Municipality</strong> at, and for the year ended, 30 June 2010.<br />

ADDITIONAL MATTER PARAGRAPHS<br />

An additional matter paragraph will be included in our auditor’s report to highlight the following<br />

matters to the users of the financial statements:<br />

Material inconsistencies in other information included in the annual report<br />

13. Material inconsistencies between the draft annual report and financial statements were<br />

identified. This is due to the draft financial statements being included in the annual report<br />

rather than the final set of financial statements that was submitted for audit purposes.<br />

Unaudited supplementary schedules<br />

14. The supplementary information set out in appendices A, B, F and D do not form part of the<br />

financial statements and is presented as additional information. I have not audited these<br />

schedules and accordingly I do not express an opinion thereon.<br />

PART C – <strong>REPORT</strong> ON OTHER LEGAL AND REGULATORY REQUIREMENTS<br />

FINDINGS ON THE <strong>REPORT</strong> ON PREDETERMINED OBJECTIVES<br />

15. Included below are the findings raised during our audit of the report on predetermined<br />

objectives.<br />

19

Report on predetermined objectives<br />

Presentation of information<br />

16. The following criteria are relevant to the findings below:<br />

<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Performance against predetermined objectives is reported using the National Treasury<br />

guidelines.<br />

17. Audit findings:<br />

Reasons for major variances between planned and actual reported targets were not<br />

provided in the report on predetermined objectives<br />

Adequate explanations for any major variances between the planned and the actual<br />

reported targets were not provided, as required in terms of the relevant reporting<br />

guidance.<br />

Usefulness of information<br />

18. The following criteria are relevant to the findings below:<br />

<br />

<br />

Relevance: A clear and logical link exists between the objectives, outcomes, outputs,<br />

indicators and performance targets<br />

Measurability: Indicators are well defined and verifiable, and targets are specific,<br />

measurable and time bound<br />

19. Audit findings:<br />

Planned and reported indicators are not well defined<br />

<br />

Sixty-four per cent of the planned and reported indicators that were selected were not<br />

clear, as unambiguous data definitions were not available to allow for data to be collected<br />

consistently.<br />

Planned and reported indicators are not verifiable<br />

Valid performance management processes and systems, that produce actual<br />

performance against the planned indicators, do not exist for 47% of the selected<br />

indicators.<br />

Planned and reported targets are not specific<br />

<br />

Targets were not specific in clearly identifying the nature and the required level of<br />

performance in respect of 55% of the selected objectives.<br />

Planned and reported targets are not measurable<br />

<br />

Seventy-four per cent of the planned and reported targets for the selected indicators<br />

were not measurable in identifying the required performance.<br />

Planned and reported targets are not time bound<br />

<br />

All of the planned and reported targets that were selected were not time bound in<br />

specifying the time period or deadline for delivery.<br />

20

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Planned objectives and indicators are not relevant to the mandate and objectives of<br />

the entity<br />

<br />

The indicator and targets as per the integrated development plan did not relate directly,<br />

in more than 39% of instances, to the institution’s strategic goals and objectives as per<br />

the five year integrated development plan.<br />

Reliability of information<br />

20. The following criteria are relevant to the findings below::<br />

<br />

<br />

<br />

Validity: Actual reported performance has occurred and pertains to the entity<br />

Accuracy: Amounts, numbers, and other data relating to reported actual performance<br />

have been recorded and reported appropriately<br />

Completeness: All actual results and events that should have been recorded have been<br />

included in the annual performance report<br />

21. Audit findings:<br />

Reported performance against targets is not valid, accurate and complete when<br />

compared to source information<br />

<br />

<br />

<br />

<br />

<br />

Sixty-seven per cent of the reported targets for the selected objective were not accurate<br />

and valid based on the source information provided.<br />

All of the reported targets for the selected objectives were not valid and accurate based<br />

on the source information provided.<br />

None of the reported targets in respect of the selected objectives are complete, based on<br />

the source information provided.<br />

Fifty per cent of the reported targets for the selected objectives were not valid and<br />

accurate based on the source information provided.<br />

Based on the source information provided, 33% of the reported targets for 33% of the<br />

selected objectives were not complete.<br />

Reasons for major variances between planned and actual reported targets were not<br />

provided in the report on predetermined objectives<br />

<br />

Adequate explanations for all of major variances between the planned and the actual<br />

reported targets for none of the objectives, as required in terms of the relevant reporting<br />

guidance, could not be provided.<br />

FINDINGS ON COMPLIANCE WITH LAWS AND REGULATIONS<br />

Included below are findings on material non-compliance with laws and regulations applicable to the<br />

municipality.<br />

Strategic planning and performance management<br />

22. The municipality did not implement a framework that describes and represents how the<br />

municipality’s cycle and processes of performance planning, monitoring, measurement,<br />

review, reporting and improvement will be conducted, organised and managed, including<br />

determining the roles of the different role players as required by sections 38, 39, 40 and 41 of<br />

the Municipal Systems Act of South Africa, 2000 (Act No.32 of 2000) (MSA) and Municipal<br />

Planning and Performance Management Regulations, 2001 (MPPR) published in General<br />

Notice 796 of 24 August 2001.<br />

23. The accounting officer of the municipality did not submit the results of the assessment on the<br />

performance of the municipality during the first half of the financial year to the mayor of the<br />

21

Budgets<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

municipality, the National Treasury, and the provincial treasury as required by section 72(1)<br />

(b) of the MFMA.<br />

24. The municipality incurred expenditure that was not budgeted for and incurred expenditure in<br />

excess of the limits of the amounts provided for in the votes in the approved budget, in<br />

contravention of section 15 of the MFMA.<br />

25. The annual budget of the municipality is not based on the development priorities and<br />

objectives as well as the performance targets set by the municipality in its IDP as required by<br />

regulation 6 of the MPPR.<br />

Annual financial statements, performance and annual reports<br />

26. The financial statements submitted for auditing were not prepared in all material respects in<br />

accordance with the requirements of section 122 of the MFMA. Material misstatements<br />

identified by the auditors were not adequately corrected, which resulted in the financial<br />

statements receiving an adverse audit opinion.<br />

27. The accounting officer neither wrote the council's oversight report on the 2009-10 annual<br />

report within seven days of its adoption (section 129(3) of the MFMA), nor did he make the<br />

annual report for 2009-10 public immediately after the annual report was tabled in the council<br />

(section 127(5) of the MFMA).<br />

28. The report containing the council’s comments on the annual report for 2009-10 was not<br />

adopted within two months from the date on which the annual report was tabled in the<br />

council as required by section 129(1) of the MFMA.<br />

29. The performance report for the financial year under review was not prepared as required by<br />

section 46 of the MSA and section 121(3) (c) of the MFMA.<br />

Audit committees<br />

30. The audit committee did not advise the council, the accounting officer and the management<br />

staff of the municipality on matters relating to accounting policies and performance<br />

evaluation. It also did not review the annual financial statements and also did not meet at<br />

least four times a year (section 166 of MFMA).<br />

31. The performance audit committee or another committee functioning as the performance audit<br />

committee did not review the quarterly reports of the internal auditors on their audits of the<br />

performance measurements or submit a report to the council regarding the performance<br />

management system at least twice during the financial year (MPPR Regulation 14).<br />

Procurement and contract management<br />

32. It was not possible to determine whether goods and services with a transaction value of<br />

between R10 000 and R200 000 were either procured without obtaining written price<br />

quotations from at least three different or quotation were obtain at all (Supply Chain<br />

Management Regulation (SCM) 17) due to the lack of documentation provided.<br />

33. Adequate documentation was not submitted to confirm that quotations were accepted from<br />

suppliers who are not on the list of accredited prospective providers and sufficient or that<br />

they meet the listing requirements of SCM Regulation 16 and 17.<br />

22

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

34. Sufficient evidence could not be obtained that goods and services with a transaction value<br />

above R200 000 were procured by inviting competitive bids as per the requirements of SCM<br />

Regulations 19(a) and 36(1) or that bid specifications for procurement of goods and services<br />

were drafted in an unbiased manner that allowed all potential suppliers to offer their goods or<br />

services (SCM Regulation 27).<br />

35. Due to the lack of evidence it was not possible to confirm that awards were granted in terms<br />

of criteria that were stipulated in the original bid documents as per the requirements of SCM<br />

regulations 21(b) and 28(1). Sufficient evidence could also not be provided to confirm that, in<br />

all cases, invitations for competitive bidding were advertised for 30 days (SCM Regulation<br />

22), that bid specifications were the product of a bid specification committee (S CM<br />

Regulation 27) or that bids were evaluated by properly composed bid evaluation committee<br />

(SCM Regulation 28).<br />

36. Inadequate audit evidence could not be obtained to confirm that final awards and/or<br />

recommendation of awards to the accounting officer were made by an adjudication<br />

committee that was constituted in terms of the requirements of SCM Regulation 29.<br />

37. Sufficient audit evidence could not be obtained to confirm that awards were made to<br />

suppliers who were able to provide tax clearance certificates tax matters had been declared<br />

by the South African Revenue Service to be in order as required by SCM Regulation 43.<br />

38. Awards were made to suppliers who did not submit a declaration on their employment by the<br />

state or their relationship to a person employed by the state as per the requirements of SCM<br />

Regulation 13(c).<br />

39. Due to the lack of audit evidence it could not be confirmed that all items over R30 000 were<br />

procured in terms of the preference point system that is prescribed by section 2 of the<br />

Preferential Procurement Policy Framework Act, 2000 ( Act No. 5 of 2000) (PPPF Act) and<br />

SCM Regulation 28. It was also not possible to obtain confirmation that in all cases awards<br />

were made to suppliers based on preference points that were allocated and calculated in<br />

accordance with the requirements of the (various sections of PPPF Act and its regulations).<br />

Insufficient evidence could be obtained to ascertain that awards were made to suppliers that<br />

scored the highest points in the evaluation process as required by section 2(1) (f) of PPPF<br />

Act.<br />

40. The performance of contractors or suppliers was not monitored effectively, on a monthly<br />

basis as required by section 116(2) of the MFMA.<br />

41. Sufficient appropriate audit evidence could not be obtained that construction contracts were<br />

awarded to contractors that were registered and qualified for the contract in accordance with<br />

the various prescripts of the Construction Industry Development Board.<br />

42. Awards were made to suppliers whose principal shareholders are persons in the service of<br />

other state, in contravention of the requirements of SCM regulation 44. Furthermore,<br />

sufficient and appropriate audit evidence could not be obtained that the provider declared<br />

23

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

that he is in the service of the state as required by SCM Regulation 13(c).<br />

Expenditure management<br />

43. Amounts owing by the municipality to creditors were not always paid within 30 days of<br />

receiving an invoice, as is required by section 65(2)(e) of the MFMA. In certain cases it was<br />

not possible to determine that suppliers were paid within 30 days of receiving an invoice or<br />

statement, due to the lack of documentation provided.<br />

44. All reasonable steps were not taken to ensure that the municipality had and maintained an<br />

effective systems expenditure control and management. Furthermore, adequate steps were<br />

not taken to ensure that the accounting and information system which recognised<br />

expenditure and accounted for creditors of the municipality functioned effectively (section<br />

65(2) of the MFMA). Sufficient appropriate steps were also not taken to prevent unauthorised<br />

expenditure, irregular expenditure, and fruitless and wasteful expenditure, as required by<br />

section 62(1) (d) of the MFMA.<br />

45. The municipality did not determine whether unauthorised, irregular or fruitless and wasteful<br />

expenditure resulted from inappropriate actions of officials and thus did not take steps to<br />

recover amounts from officials where they were negligent or in any other caused the<br />

municipality to breach the requirements of section 32(2) of the MFMA.<br />

Transfers and conditional grants<br />

46. In certain cases the financial management grant, municipal infrastructure grant, municipal<br />

systems improvement grant and tourism training grant were not utilised for the purposes that<br />

they were made available for in terms of section 15(1) of the Division of Revenue Act, 2010<br />

(Act No. 1 of 2010) (DoRA). It was also not always possible to determine whether these<br />

grants had been used for their intended purpose due to the lack of documentation that could<br />

be made available.<br />

Revenue management<br />

47. Adequate steps we not taken ensure that the municipality had and maintained a<br />

management, accounting and information system which recognised revenue when it is<br />

earned, accounted for debtors and receipts of revenue, as required by section 64(2)(e) of the<br />

MFMA.<br />

Asset management<br />

48. Adequate mechanisms, to ensure that internal controls and the accounting and information<br />

systems relating to asset management were insufficient (section 63(2)(a) of the MFMA).<br />

24

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

INTERNAL CONTROL<br />

Achievement of internal control objectives<br />

49. Significant deficiencies that resulted in the basis for the adverse opinion, findings on the<br />

report on predetermined objectives and findings on compliance with laws and regulations are<br />

summarised below. Detailed information on significant internal control deficiencies is<br />

provided in section 4 of this report.<br />

<br />

Leadership<br />

Management has not always acted decisively in addressing audit findings of the<br />

previous financial year. This resulted in material deficiencies not being sufficiently<br />

addressed to avoid similar findings being reported again. This was caused by the lack of<br />

oversight and effective leadership.<br />

The leadership does not exercise sufficient control and direction to ensure that there is a<br />

general regard and compliance with laws and regulations that govern the municipality.<br />

This resulted in a significant irregular expenditure incurred often not being detected by<br />

the municipality but rather through the audit process. The lack of action taken to address<br />

the irregular expenditure reported on in the previous financial year is also an indication<br />

of management’s reluctance and willingness to address the non-compliance with laws<br />

and regulations.<br />

The risks relating to predetermined objectives were also not adequately identified and<br />

addressed by management. This resulted in inadequate structuring of the performance<br />

reporting process and an inability to support actual achievements with reliable and<br />

relevant documentation. It also gave rise to inadequate monitoring and review and<br />

culminated in many service delivery objectives and targets not being met.<br />

<br />

Financial and performance management<br />

Sufficient attention was not given to the strategic financial management direction and<br />

control. Consequently, many of the prior year audit findings were not addressed and<br />

were raised again during the financial year under review. Proper record keeping was not<br />

maintained to ensure that complete, relevant and accurate information is accessible and<br />

available to support financial and performance reporting. This was despite the<br />

municipality making use of financial consultants to carry out a leading role in the<br />

compiling of annual financial statements.<br />

The material misstatements and lack of available supporting documentation are as a<br />

result of the lack of review of transactions at all levels of financial management.<br />

Furthermore, accounting disciplines are not in the form of regular daily, weekly and<br />

monthly reconciliations and review.<br />

The overriding root cause of the inability of the municipality to accurately record and<br />

provide support for financial transactions is that officials are not in all respects fulfilling<br />

their assigned duties and functions with the required diligence and enthusiasm.<br />

25

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

<br />

Governance<br />

The audit committee continues to play a limited role in governance matters. The audit<br />

committee issues the reports of internal audit to the council without making a direct<br />

contribution by informing the council or the oversight committee of its concerns and<br />

recommendation in terms of its legislated mandate. The audit committee does not<br />

promote accountability through evaluating and monitoring responses to risks and<br />

providing oversight over the effectiveness of the internal control environment including<br />

financial and performance reporting and compliance with laws and regulations<br />

PART D – OTHER <strong>REPORT</strong>S<br />

INVESTIGATIONS<br />

50. Investigations in progress<br />

Description<br />

An investigation is being conducted to<br />

probe the possible irregularities of<br />

prepaid electricity revenue collected by<br />

vendors but not paid over to the<br />

municipality. The investigation aims to<br />

establish whether vendors did withhold<br />

money received on behalf of the<br />

municipality for the sale of prepaid<br />

electricity. The investigation was still<br />

ongoing at the reporting date.<br />

Supply chain<br />

management<br />

Reason<br />

Fraud<br />

X<br />

Financial<br />

misconduct<br />

SECTION 3: SPECIFIC FOCUS AREAS<br />

PART A – SIGNIFICANT FINDINGS FROM THE AUDIT OF PROCUREMENT AND CONTRACT<br />

<strong>MANAGEMENT</strong><br />

51. The audit included an assessment of procurement processes, contract management and<br />

controls of the municipality, which should ensure a fair, equitable, transparent, competitive<br />

and cost-effective supply chain management system that complies with legislation and<br />

minimises the likelihood of fraud, corruption, favouritism, and unfair and irregular practices.<br />

The assessment which was performed has revealed the following deficiencies:<br />

Irregular expenditure<br />

52. An amount of R12 819 416,70 of irregular expenditure was incurred in the period as a result<br />

of the contravention of SCM legislation. A total of 76,08% of the irregular expenditure was<br />

identified during the audit process. The incomplete identification of SCM irregular<br />

expenditure was as a result of inadequate processes and procedures to identify irregular<br />

expenditure with regard to SCM and an inadequate filing system in place which resulted in a<br />

scope limitation. It could thus not be established to what extent the procurement process<br />

was followed.<br />

Limitations on audit<br />

53. Sufficient appropriate audit evidence could not be provided that five of the 16 selected<br />

contracts awarded and four of the 55 of the selected quotations accepted (hereinafter<br />

26

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

referred to as “awards”) to the value of R4 759 284 were made in accordance with the<br />

requirements of the SCM legislation. No alternative audit procedures could be performed to<br />

obtain reasonable assurance that the expenditure incurred on these awards was not<br />

irregular. Restrictions were also placed on the auditors to assess specific matters, the detail<br />

of which is listed below.<br />

54. The limitations experienced were as a result of missing documentation, inadequate<br />

documents management systems, as well as a failure by management to fully comply with<br />

SCM regulations in all cases, thus leading to many cases of documents not being available.<br />

As a result of the limitations experienced, the findings reported in the rest of this section<br />

might not reflect the true extent of irregularities and SCM weaknesses at the entity.<br />

Awards to persons in the service of the state<br />

55. Awards made to supplier’s persons in service of the state include:<br />

Supplier<br />

Surname<br />

of person<br />

First name of<br />

person<br />

Masibambane Food<br />

Francis<br />

Services<br />

Erasmus Cathleen<br />

Mayihlume<br />

Mhlangenaba<br />

Construction<br />

Nonkonana Alfred<br />

Masibambane Food<br />

Services De Vos Eunice Euna<br />

Swarts & Matolla<br />

Construction CC Swarts Justin Edmond<br />

Awards in<br />

Department 2011<br />

Eastern Cape:<br />

Education 1,980.00<br />

Eastern Cape:<br />

Health 92,460.00<br />

Eastern Cape:<br />

Health 1,980.00<br />

Eastern Cape:<br />

Health 636.00<br />

Performance of other remunerative work by employees<br />

56. Three persons in the employment of other state institutions were discovered to have a<br />

business or private interest in one of the client’s suppliers as listed above.<br />

There was no declaration of interest or approval from the relevant person for contract of<br />

R92 460 awarded to Mayihlume Construction.<br />

Procurement processes and contract management<br />

57. Findings were identified in 16 contracts with a total rand value of R12 198 125 and 55 price<br />

quotations with a total rand value of R2 620 061 and are summarised in the following<br />

categories:<br />

Procurement need and economy<br />

<br />

<br />

It was determined that in general the municipality operated in terms of their needs as<br />

the majority of the expenditure identified was on projects, including road, water and<br />

electricity maintenance, as well as maintenance of housing schemes, which is in line<br />

with the nature of the municipality’s operations and the allocation of the municipality’s<br />

budget was towards necessary and value-adding projects.<br />

The municipality deviated from the SCM process by an amount of R20 780 724 of the<br />

items selected for testing, which could result in goods and services that were not<br />

obtained at a fair market price.<br />

Procurement process – Quotations<br />

<br />

In the evaluation of the standard SCM procedures for quotations for the year, the<br />

municipality did not obtain three quotations from suppliers and deviated from the SCM<br />

process for quotations with a value of R1 479 143. The deviation process was not<br />

sufficiently followed and no reasons could be provided for instances where the<br />

municipality did not obtain three quotations and deviated from the SCM process.<br />

27

Procurement process – Competitive bidding<br />

<br />

<br />

<br />

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

In the evaluation of expenditure to suppliers where tenders exceeded R200 000 for the<br />

year, no supporting documentation was provided for an amount of R9 414 071 of the<br />

tenders selected for testing and we could not verify whether the competitive bidding<br />

process was followed.<br />

In addition to this, we verified that supplier and service providers had been adopted by<br />

the municipality through contractual arrangements and no competitive bidding process<br />

followed.<br />

The fact that management failed to follow the SCM process increases the risk of fraud<br />

being committed.<br />

Construction contracts<br />

<br />

<br />

No cognisance was taken of the regulations set out in the Construction Industry<br />

Development Board (CIDB) regulations for construction contracts procured between<br />

R30 000 and R200 000.<br />

Construction contracts with a value of R517 459 were identified where no specification<br />

for the minimum category for which potential bidders should be registered with the<br />

CIDB was specified in the advertisements. In addition, we verified instances where<br />

projects were not advertised on the CIDB website as required in terms of the<br />

regulations for construction contracts.<br />

Contracts, contract management and payments<br />

<br />

There were certain issues identified where contracts are not monitored on a monthly<br />

basis and there are no measures implemented to evaluate the monitoring of these<br />

projects.<br />

Internal control deficiencies<br />

58. Management did not exercise oversight responsibility regarding internal control procedures<br />

to verify the effective operation of the Supply Chain Management policy and that all<br />

legislative requirements have been met.<br />

SECTION 4: SIGNIFICANT DEFICIENCIES IN INTERNAL CONTROL<br />

PART A – ASSESSMENT OF THE ACHIEVEMENT OF CONTROL OBJECTIVES<br />

59. The achievement of the objectives of internal control is demonstrated by the implementation<br />

of key controls. The assessment below is based on significant deficiencies relating to the fair<br />

presentation of the financial statements, material misstatements corrected as a result of the<br />

audit, findings on predetermined objectives and findings on non-compliance with laws and<br />

regulations. Significant deficiencies occur when internal controls either do not exist or are not<br />

appropriately designed to address the risk or are not implemented and which either had or<br />

could cause the financial statements or report on predetermined objectives to be materially<br />

misstated and material non-compliance with laws and regulations to occur. When a<br />

significant deficiency is not applicable, it is assessed with a , to indicate that the<br />

deficiency still exists but significant progress had been made to address it, while indicates<br />

that urgent attention to the matter is required. Part B gives additional information on the<br />

28

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

deficiencies that should be addressed. Other deficiencies in internal control, which require<br />

the attention of management, are included in the detailed findings attached to this report.<br />

29

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

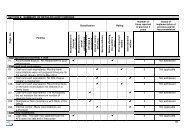

Fundamentals<br />

of internal control<br />

3 Audit dimensions<br />

Financial<br />

Performance<br />

objectives<br />

Assessment<br />

Compliance<br />

with laws<br />

and<br />

regulations<br />

Leadership<br />

Provide effective leadership based on a culture of honesty, ethical business<br />

practices and good governance, protecting and enhancing the best interests<br />

of the entity<br />

Exercise oversight responsibility regarding financial and performance<br />

reporting and compliance and related internal controls<br />

Implement effective HR management to ensure that adequate and<br />

sufficiently skilled resources are in place and that performance is monitored<br />

Establish and communicate policies and procedures to enable and support<br />

understanding and execution of internal control objectives, processes, and<br />

responsibilities<br />

Develop and monitor the implementation of action plans to address internal<br />

control deficiencies<br />

Establish an IT governance framework that supports and enables the<br />

business, delivers value and improves performance<br />

Financial and performance management<br />

Implement proper record keeping in a timely manner to ensure that<br />

complete, relevant and accurate information is accessible and available to<br />

support financial and performance reporting<br />

Implement controls over daily and monthly processing and reconciling of<br />

transactions<br />

Prepare regular, accurate and complete financial and performance reports<br />

that are supported and evidenced by reliable information<br />

Review and monitor compliance with applicable laws and regulations<br />

Design and implement formal controls over IT systems to ensure the<br />

reliability of the systems and the availability, accuracy and protection of<br />

information<br />

Governance<br />

Implement appropriate risk management activities to ensure that regular risk<br />

assessments, including consideration of IT risks and fraud prevention, are<br />

conducted and that a risk strategy to address the risks is developed and<br />

monitored<br />

Ensure that there is an adequately resourced and functioning internal audit<br />

unit that identifies internal control deficiencies and recommends corrective<br />

action effectively<br />

Ensure that the audit committee promotes accountability and service<br />

delivery through evaluating and monitoring responses to risks and providing<br />

oversight over the effectiveness of the internal control environment including<br />

financial and performance reporting and compliance with laws and<br />

regulations<br />

30

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

PART B – DETAILS CONCERNING THE ACHIEVEMENT OF INTERNAL CONTROL<br />

OBJECTIVES<br />

Leadership<br />

Ethical business practices<br />

60. Management established a formal code of conduct which addressed appropriate ethical and<br />

moral behaviour which was communicated to all staff members of the municipality. This code<br />

was, however, not adequately implemented which has resulted non-compliance with laws and<br />

regulations and inaccurate financial reporting.<br />

Oversight responsibility regarding reporting and compliance<br />

61. The accounting officer does not exercise oversight responsibility over reporting, compliance<br />

with laws and regulations and internal control. Actions are not taken to address the risks<br />

relating to the achievement of complete and accurate financial and performance reporting.<br />

Control weaknesses are not analysed and appropriate follow-up actions are not taken that<br />

address the root causes. Furthermore, the internal and external audit findings are not<br />

adequately addressed.<br />

Effective human resource management<br />

62. An assessment of human resource management has identified the following deficiencies:<br />

Human resource planning and organisation<br />

<br />

Job descriptions did not exist for each post or group of posts.<br />

Appointment processes<br />

<br />

The prescribed selection and approval processes were not followed for all appointments<br />

as instances were identified where the vacant post was not advertised and no clear<br />

evidence that the candidate was successfully evaluated due to CVs that were not on file.<br />

Competencies of key personnel<br />

<br />

There is a lack of review, supervision and direction in the finance department.<br />

Management and middle management in finance has little knowledge of accounting best<br />

practice and the accounting standards applicable to the presentation of the financial<br />

statements. In addition to this, the qualification of key finance personnel is insufficient for<br />

accurate financial reporting. Consequently, the municipality had to employ consultants to<br />

correct the accounting records and to prepare the financial statements submitted for<br />

auditing.<br />

Overtime<br />

<br />

We could not obtain a register of overtime converted into leave to confirm that written<br />

authorisation had been provided for employees who converted their overtime into leave.<br />

Leave administration<br />

<br />

The required medical certificates were not submitted for sick leave for certain employees.<br />

In addition to this, there were various instances where the leave being reported on the<br />

leave system did not match the leave application forms, leave not processed on proper<br />

time, attendance registers provided do not match the leave captured on the system and<br />

the leave in leave form files and attendance registers that could not be provided for audit<br />

purposes.<br />

Restrictions<br />

<br />

Restrictions were placed on the auditors to assess HR management due to missing<br />

employee files, allowance forms, deduction approvals and termination documents.<br />

31

Management Report of <strong>Baviaans</strong> <strong>Municipality</strong><br />

Implementation of policies and procedures<br />