- Page 1 and 2:

Revised Law Sec. 101.253. DESIGNATI

- Page 3 and 4:

including the execution of an instr

- Page 5 and 6:

(b) An otherwise valid contract or

- Page 7 and 8:

Revisor's Note This provision of th

- Page 9 and 10:

e removed, with or without cause, a

- Page 11 and 12:

majority of the managers, elected b

- Page 13 and 14:

equired by Subsection (a) shall be

- Page 15 and 16:

Source Law F. Except as otherwise p

- Page 17 and 18:

(5) authorize any transaction, agre

- Page 19 and 20:

sale of all or substantially all of

- Page 21 and 22:

person; and (3) purchase or procure

- Page 23 and 24:

not institute or maintain a derivat

- Page 25 and 26:

includes a manager or, to the exten

- Page 27 and 28:

(6) a reference to bylaws includes

- Page 29 and 30:

includes a manager or, to the exten

- Page 31 and 32:

egulations. [TBCA 5.14.D] (2) If a

- Page 33 and 34:

(a) have been met, the burden of pr

- Page 35 and 36:

the articles of the TBCA and the Te

- Page 37 and 38:

liability company may be required t

- Page 39 and 40:

corporate defendant may be required

- Page 41 and 42:

(1) a derivative proceeding brought

- Page 43 and 44:

agreement; and (7) except as provid

- Page 45 and 46:

found in Section 3.151, pertaining

- Page 47 and 48:

and may make all other orders, dire

- Page 49 and 50:

Revisor's Note Section 101.552 prov

- Page 51 and 52:

appropriate. (10) "Partnership agre

- Page 53 and 54:

exists. (c) Giving Notice. A person

- Page 55 and 56:

eceive distributions. A partnership

- Page 57 and 58:

the provision in the partnership's

- Page 59 and 60:

or the other partnership provisions

- Page 61 and 62:

"association" has the plain English

- Page 63 and 64:

of the business, and including a di

- Page 65 and 66:

Board of Medical Examiners and pers

- Page 67 and 68:

(1) the partnership in its name; or

- Page 69 and 70:

profits. Revisor's Note No substant

- Page 71 and 72:

(f) Trustee Standard Inapplicable.

- Page 73 and 74:

Revisor's Note No substantive chang

- Page 75 and 76:

partner, including rights and inter

- Page 77 and 78:

Revisor's Note No substantive chang

- Page 79 and 80:

omission or other actionable conduc

- Page 81 and 82:

partnership property subject to exe

- Page 83 and 84:

SUBCHAPTER F. TRANSFER OF PARTNERSH

- Page 85 and 86:

ooks. (c) Rights of Transferee on W

- Page 87 and 88:

partner's express will to withdraw

- Page 89 and 90:

the notice; (2) an event specified

- Page 91 and 92:

partnership in writing of the partn

- Page 93 and 94:

individual, a trust other than a bu

- Page 95 and 96:

discharge the partner's liability f

- Page 97 and 98:

Source Law (a) Redemption. If an ev

- Page 99 and 100:

whether currently due, including in

- Page 101 and 102:

Subdivision (1)(B). (TRPA 7.01(g),

- Page 103 and 104:

not entitled to receive any portion

- Page 105 and 106:

the amount the withdrawn partner wo

- Page 107 and 108:

equest of the transferee, the payme

- Page 109 and 110:

8.02. A partnership continues after

- Page 111 and 112:

(1) is appropriate for winding up t

- Page 113 and 114:

settlement of all partnership accou

- Page 115 and 116:

Revisor's Note No substantive chang

- Page 117 and 118:

a prior voluntary decision to wind

- Page 119 and 120:

omissions, negligence, incompetence

- Page 121 and 122:

(2) expired and not been renewed. (

- Page 123 and 124:

egistration of a partnership whose

- Page 125 and 126:

specifically designated and segrega

- Page 127 and 128:

"RLLP," or "LLP"; . . . Revisor's N

- Page 129 and 130:

Source Law 10.05. (a) A foreign lim

- Page 131 and 132:

(f), the appointment of an agent te

- Page 133 and 134:

Service had in this manner on the s

- Page 135 and 136:

later date specified in the stateme

- Page 137 and 138:

partnership. The renewal statement

- Page 139 and 140:

articles of amendment must contain

- Page 141 and 142:

this chapter. (c) A limited partner

- Page 143 and 144:

SUBCHAPTER B. SUPPLEMENTAL PROVISIO

- Page 145 and 146:

Source Law (d) A certificate of lim

- Page 147 and 148:

from the limited partnership, on co

- Page 149 and 150:

general partner; (C) an officer, di

- Page 151 and 152:

guarantee or assume one or more spe

- Page 153 and 154:

partner in the control of the busin

- Page 155 and 156:

Source Law (a) . . . (2) files or c

- Page 157 and 158:

Revisor's Note No substantive chang

- Page 159 and 160:

subsection does not affect any obli

- Page 161 and 162:

limited partnership has the liabili

- Page 163 and 164:

(C) 90 days after the date of expir

- Page 165 and 166:

vacated or stayed, or 90 days expir

- Page 167 and 168:

held by the withdrawing general par

- Page 169 and 170:

voting rights with respect to the m

- Page 171 and 172:

law, effect that recovery by offset

- Page 173 and 174:

partner's legal representative or s

- Page 175 and 176:

obligation, after the partner signs

- Page 177 and 178:

agreement. (b) If a written partner

- Page 179 and 180:

liabilities to partners with respec

- Page 181 and 182:

Source Law (a) An assignee of a par

- Page 183 and 184:

has only the rights of an assignee

- Page 185 and 186:

Revised Law Sec. 153.302. FORM AND

- Page 187 and 188:

day after the date on which notice

- Page 189 and 190:

forfeiture. . . . Revisor's Note No

- Page 191 and 192:

the 120th day after the date of mai

- Page 193 and 194:

e relieved of the cancellation by f

- Page 195 and 196:

Source Law (c) If a limited partner

- Page 197 and 198:

court, the court shall dismiss the

- Page 199 and 200:

partners; or (3) subject to Subsect

- Page 201 and 202:

Source Law 8.01. . . . (1) the occu

- Page 203 and 204:

the limited partners. In addition,

- Page 205 and 206:

(1) to the extent otherwise permitt

- Page 207 and 208:

(B) the last known street address o

- Page 209 and 210:

any proper purpose, and at the part

- Page 211 and 212:

(3) a certificate of cancellation m

- Page 213 and 214:

order granting appropriate relief.

- Page 215 and 216:

Revisor's Note No substantive chang

- Page 217 and 218:

(5) quorum requirements; (6) voting

- Page 219 and 220:

matters as a person who is not a pa

- Page 221 and 222:

Revisor's Note No substantive chang

- Page 223 and 224:

ecause the act, conveyance, or tran

- Page 225 and 226:

Revisor's Note No substantive chang

- Page 227 and 228:

in a restated certificate of format

- Page 229 and 230:

Source Law (A) The declaration of t

- Page 231 and 232:

may amend or repeal bylaws or adopt

- Page 233 and 234:

of beneficial interest the real est

- Page 235 and 236:

Source Law (A) A real estate invest

- Page 237 and 238:

contracts for services to be perfor

- Page 239 and 240:

may not be revoked within six month

- Page 241 and 242:

Revisor's Note See the revisor's no

- Page 243 and 244:

Source Law (A) . . . (5) . . . no s

- Page 245 and 246:

security that is the subject of an

- Page 247 and 248:

provision must be identified by ref

- Page 249 and 250:

the person acquires actual knowledg

- Page 251 and 252:

held liable for considering a perso

- Page 253 and 254:

actual fraud on the obligee primari

- Page 255 and 256:

Revisor's Note No substantive chang

- Page 257 and 258:

Revised Law Sec. 200.204. RESERVES,

- Page 259 and 260:

authorized but unissued shares with

- Page 261 and 262:

(3) financial information that is p

- Page 263 and 264:

eference to "payment of" a share di

- Page 265 and 266:

Source Law (C) Special meetings of

- Page 267 and 268:

Revisor's Note No substantive chang

- Page 269 and 270:

ylaws, the shareholders represented

- Page 271 and 272:

(2) distributes the votes among one

- Page 273 and 274:

shareholders at which a quorum is p

- Page 275 and 276:

(f) Unless otherwise provided by th

- Page 277 and 278:

class or series, whether with or wi

- Page 279 and 280:

"winding up" instead of "dissolutio

- Page 281 and 282:

provide that the act of the holders

- Page 283 and 284:

Source Law (C) Any shareholder may

- Page 285 and 286:

whether the transfer is for value,

- Page 287 and 288:

evised law as redundant with "inves

- Page 289 and 290:

shall receive such compensation as

- Page 291 and 292:

trust managers, (1) an annual elect

- Page 293 and 294:

number of trust managers unless the

- Page 295 and 296:

shares in accordance with Section 3

- Page 297 and 298:

trust shall be jointly and severall

- Page 299 and 300:

Revised Law Sec. 200.316. OFFICERS.

- Page 301 and 302: authorizes the contract or transact

- Page 303 and 304: disposition is made with the goodwi

- Page 305 and 306: corporation provisions of the Texas

- Page 307 and 308: provided by this subchapter. The tr

- Page 309 and 310: conveyance of an interest in real p

- Page 311 and 312: trust managers was duly adopted. 24

- Page 313 and 314: Act for giving notice of meetings t

- Page 315 and 316: series entitled to vote on the auth

- Page 317 and 318: investment trust is entitled to vot

- Page 319 and 320: and . . . Revisor's Note No substan

- Page 321 and 322: contain the shareholder's address,

- Page 323 and 324: the agreed value, the shareholder c

- Page 325 and 326: surviving, or new entity, pursuant

- Page 327 and 328: to be paid the fair value of the sh

- Page 329: 200.261. (New.) Revisor's Note See

- Page 332 and 333: the certificate of formation, or by

- Page 334 and 335: Corporation Act do not conflict wit

- Page 336 and 337: section clarifies that the applicab

- Page 338 and 339: of notice shall be accompanied by t

- Page 340 and 341: SUBCHAPTER C. MANAGEMENT Revised La

- Page 342 and 343: ylaws, a vacancy on the board of di

- Page 344 and 345: written notice of the charges. The

- Page 346 and 347: (c) Each certificate for invested c

- Page 348 and 349: jeopardize the cooperative associat

- Page 350 and 351: Source Law 14. The secretary shall

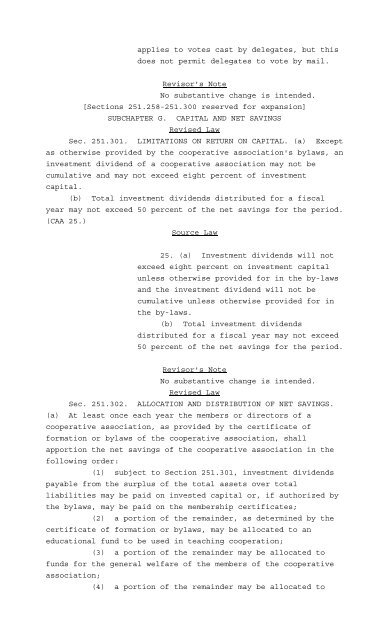

- Page 354 and 355: etained earnings; and (5) the remai

- Page 356 and 357: Revisor's Note No substantive chang

- Page 358 and 359: (e) A person commits an offense if

- Page 360 and 361: egistered letter mailed to its prin

- Page 362 and 363: (3) by returning the amount of patr

- Page 364 and 365: the association is exempted by that

- Page 366 and 367: nonprofit purpose. A form of joint

- Page 368 and 369: Revised Law Sec. 252.005. STATEMENT

- Page 370 and 371: Revised Law Sec. 252.006. LIABILITY

- Page 372 and 373: Revisor's Note No substantive chang

- Page 374 and 375: any law of this state has occurred.

- Page 376 and 377: notice of cancellation must contain

- Page 378 and 379: interest for members of the nonprof

- Page 380 and 381: contained in Article 4.03 of this A

- Page 382 and 383: association, professional corporati

- Page 384 and 385: limited liability company only thro

- Page 386 and 387: professional legal corporations tha

- Page 388 and 389: Revisor's Note No substantive chang

- Page 390 and 391: ender such professional service in

- Page 392 and 393: the name of the corporation or the

- Page 394 and 395: legal service in this state; provid

- Page 396 and 397: 9. No person not duly licensed or o

- Page 398 and 399: professional entities, as well as p

- Page 400 and 401: professional entity, the person sha

- Page 402 and 403:

for which the professional associat

- Page 404 and 405:

Revisor's Note No substantive chang

- Page 406 and 407:

professions to which this section a

- Page 408 and 409:

assert control over treatment decis

- Page 410 and 411:

Revised Law Sec. 302.002. DURATION

- Page 412 and 413:

Committee, as the members may decid

- Page 414 and 415:

Executive Committee except that the

- Page 416 and 417:

Source Law 21. A professional assoc

- Page 418 and 419:

the corporation. (b) A shareholder

- Page 420 and 421:

withdrawal, retirement or expulsion

- Page 422 and 423:

of this code may voluntarily elect

- Page 424 and 425:

members entitled to vote at the mee

- Page 426 and 427:

Statutes) is amended by adding Sect

- Page 428:

Texas Civil Statutes are repealed o