Ready for Breakthrough - Techcombank

Ready for Breakthrough - Techcombank

Ready for Breakthrough - Techcombank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the separate financial statements<br />

Notes to the separate financial statements<br />

<strong>for</strong> the year ended 31 December 2009 (continued)<br />

Form B05/TCTD<br />

<strong>for</strong> the year ended 31 December 2009 (continued)<br />

Form B05/TCTD<br />

(e)<br />

(i)<br />

(ii)<br />

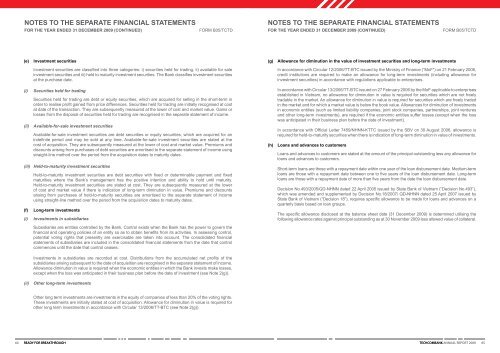

Investment securities<br />

Investment securities are classified into three categories: i) securities held <strong>for</strong> trading, ii) available <strong>for</strong> sale<br />

investment securities and iii) held to maturity investment securities. The Bank classifies investment securities<br />

at the purchase date.<br />

Securities held <strong>for</strong> trading<br />

Securities held <strong>for</strong> trading are debt or equity securities, which are acquired <strong>for</strong> selling in the short-term in<br />

order to realise profit gained from price differences. Securities held <strong>for</strong> trading are initially recognised at cost<br />

at date of the transaction. They are subsequently measured at the lower of cost and market value. Gains or<br />

losses from the disposal of securities held <strong>for</strong> trading are recognised in the separate statement of income.<br />

Available-<strong>for</strong>-sale investment securities<br />

Available-<strong>for</strong>-sale investment securities are debt securities or equity securities, which are acquired <strong>for</strong> an<br />

indefinite period and may be sold at any time. Available-<strong>for</strong>-sale investment securities are stated at the<br />

cost of acquisition. They are subsequently measured at the lower of cost and market value. Premiums and<br />

discounts arising from purchases of debt securities are amortised to the separate statement of income using<br />

straight-line method over the period from the acquisition dates to maturity dates.<br />

(g) Allowance <strong>for</strong> diminution in the value of investment securities and long-term investments<br />

In accordance with Circular 12/2006/TT-BTC issued by the Ministry of Finance (“MoF”) on 21 February 2006,<br />

credit institutions are required to make an allowance <strong>for</strong> long-term investments (including allowance <strong>for</strong><br />

investment securities) in accordance with regulations applicable to enterprises.<br />

In accordance with Circular 13/2006/TT-BTC issued on 27 February 2006 by the MoF applicable to enterprises<br />

established in Vietnam, no allowance <strong>for</strong> diminution in value is required <strong>for</strong> securities which are not freely<br />

tradable in the market. An allowance <strong>for</strong> diminution in value is required <strong>for</strong> securities which are freely traded<br />

in the market and <strong>for</strong> which a market value is below the book value. Allowances <strong>for</strong> diminution of investments<br />

in economic entities (such as limited liability companies, joint stock companies, partnerships, joint ventures<br />

and other long-term investments), are required if the economic entities suffer losses (except when the loss<br />

was anticipated in their business plan be<strong>for</strong>e the date of investment).<br />

In accordance with Official Letter 7459/NHNN-KTTC issued by the SBV on 30 August 2006, allowance is<br />

required <strong>for</strong> held-to-maturity securities when there is indication of long-term diminution in value of investments.<br />

(h) Loans and advances to customers<br />

Loans and advances to customers are stated at the amount of the principal outstanding less any allowance <strong>for</strong><br />

loans and advances to customers.<br />

(iii) Held-to-maturity investment securities<br />

(f)<br />

(i)<br />

Held-to-maturity investment securities are debt securities with fixed or determinable payment and fixed<br />

maturities where the Bank’s management has the positive intention and ability to hold until maturity.<br />

Held-to-maturity investment securities are stated at cost. They are subsequently measured at the lower<br />

of cost and market value if there is indication of long-term diminution in value. Premiums and discounts<br />

arising from purchases of held-to-maturity securities are amortised to the separate statement of income<br />

using straight-line method over the period from the acquisition dates to maturity dates.<br />

Long-term investments<br />

Investments in subsidiaries<br />

Short-term loans are those with a repayment date within one year of the loan disbursement date. Medium-term<br />

loans are those with a repayment date between one to five years of the loan disbursement date. Long-term<br />

loans are those with a repayment date of more than five years from the date the loan disbursement date.<br />

Decision No.493/2005/QD-NHNN dated 22 April 2005 issued by State Bank of Vietnam (“Decision No.493”),<br />

which was amended and supplemented by Decision No.18/2007/ QD-NHNN dated 25 April 2007 issued by<br />

State Bank of Vietnam (“Decision 18”), requires specific allowance to be made <strong>for</strong> loans and advances on a<br />

quarterly basis based on loan groups.<br />

The specific allowance disclosed at the balance sheet date (31 December 2009) is determined utilising the<br />

following allowance rates against principal outstanding as at 30 November 2009 less allowed value of collateral.<br />

Subsidiaries are entities controlled by the Bank. Control exists when the Bank has the power to govern the<br />

financial and operating policies of an entity so as to obtain benefits from its activities. In assessing control,<br />

potential voting rights that presently are exercisable are taken into account. The consolidated financial<br />

statements of subsidiaries are included in the consolidated financial statements from the date that control<br />

commences until the date that control ceases.<br />

Investments in subsidiaries are recorded at cost. Distributions from the accumulated net profits of the<br />

subsidiaries arising subsequent to the date of acquisition are recognised in the separate statement of income.<br />

Allowance diminution in value is required when the economic entities in which the Bank invests make losses,<br />

except when the loss was anticipated in their business plan be<strong>for</strong>e the date of investment (see Note 2(g)).<br />

(ii)<br />

Other long-term investments<br />

Other long term investments are investments in the equity of companies of less than 20% of the voting rights.<br />

These investments are initially stated at cost of acquisition. Allowance <strong>for</strong> diminution in value is required <strong>for</strong><br />

other long term investments in accordance with Circular 13/2006/TT-BTC (see Note 2(g)).<br />

64 READY FOR BREAKTHROUGH<br />

TECHcOMBANK ANNUAL REPORT 2009<br />

65

![[Corporate Logo] - Masan Group](https://img.yumpu.com/49136598/1/190x245/corporate-logo-masan-group.jpg?quality=85)

![[Corporate Logo] - Masan Group](https://img.yumpu.com/46547550/1/184x260/corporate-logo-masan-group.jpg?quality=85)

![[Corporate Logo] - Masan Group](https://img.yumpu.com/44840257/1/184x260/corporate-logo-masan-group.jpg?quality=85)