Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

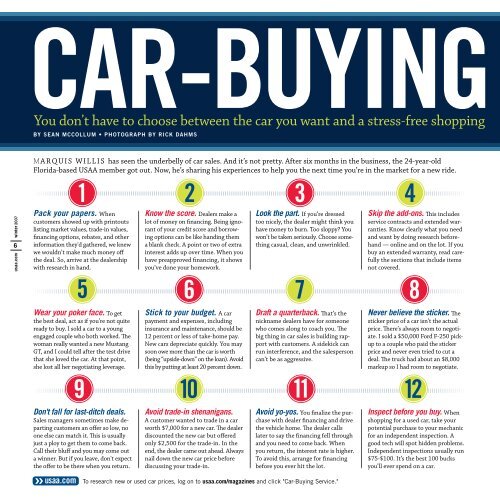

CAR-BUYING<br />

You don’t have to choose between the car you want and a stress-free shopping<br />

By Sean McCollum • photograph by rick dahms<br />

winter <strong>2007</strong><br />

6<br />

usaa.<strong>com</strong><br />

Ma r q u i s w i l l i s has seen the underbelly of car sales. And it’s not pretty. After six months in the business, the 24-year-old<br />

Florida-based <strong>USAA</strong> member got out. Now, he’s sharing his experiences to help you the next time you’re in the market for a new ride.<br />

1<br />

Pack your papers. When<br />

customers showed up with printouts<br />

listing market values, trade-in values,<br />

financing options, rebates, and other<br />

information they'd gathered, we knew<br />

we wouldn’t make much money off<br />

the deal. So, arrive at the dealership<br />

with research in hand.<br />

5<br />

Wear your poker face. To get<br />

the best deal, act as if you’re not quite<br />

ready to buy. I sold a car to a young<br />

engaged couple who both worked. The<br />

woman really wanted a new Mustang<br />

GT, and I could tell after the test drive<br />

that she loved the car. At that point,<br />

she lost all her negotiating leverage.<br />

9<br />

Don't fall for last-ditch deals.<br />

Sales managers sometimes make departing<br />

customers an offer so low, no<br />

one else can match it. This is usually<br />

just a ploy to get them to <strong>com</strong>e back.<br />

Call their bluff and you may <strong>com</strong>e out<br />

a winner. But if you leave, don't expect<br />

the offer to be there when you return.<br />

usaa.<strong>com</strong><br />

2<br />

Know the score. Dealers make a<br />

lot of money on financing. Being ignorant<br />

of your credit score and borrowing<br />

options can be like handing them<br />

a blank check. A point or two of extra<br />

interest adds up over time. When you<br />

have preapproved financing, it shows<br />

you’ve done your homework.<br />

6<br />

Stick to your budget. A car<br />

payment and expenses, including<br />

insurance and maintenance, should be<br />

12 percent or less of take-home pay.<br />

New cars depreciate quickly. You may<br />

soon owe more than the car is worth<br />

(being “upside-down” on the loan). Avoid<br />

this by putting at least 20 percent down.<br />

10<br />

Avoid trade-in shenanigans.<br />

A customer wanted to trade in a car<br />

worth $7,000 for a new car. The dealer<br />

discounted the new car but offered<br />

only $2,500 for the trade-in. In the<br />

end, the dealer came out ahead. Always<br />

nail down the new car price before<br />

discussing your trade-in.<br />

3<br />

Look the part. If you’re dressed<br />

too nicely, the dealer might think you<br />

have money to burn. Too sloppy You<br />

won’t be taken seriously. Choose something<br />

casual, clean, and unwrinkled.<br />

7<br />

Draft a quarterback. That’s the<br />

nickname dealers have for someone<br />

who <strong>com</strong>es along to coach you. The<br />

big thing in car sales is building rapport<br />

with customers. A sidekick can<br />

run interference, and the salesperson<br />

can’t be as aggressive.<br />

11<br />

Avoid yo-yos. You finalize the purchase<br />

with dealer financing and drive<br />

the vehicle home. The dealer calls<br />

later to say the financing fell through<br />

and you need to <strong>com</strong>e back. When<br />

you return, the interest rate is higher.<br />

To avoid this, arrange for financing<br />

before you ever hit the lot.<br />

To research new or used car prices, log on to usaa.<strong>com</strong>/magazines and click "Car-Buying Service."<br />

4<br />

Skip the add-ons. This includes<br />

service contracts and extended warranties.<br />

Know clearly what you need<br />

and want by doing research beforehand<br />

— online and on the lot. If you<br />

buy an extended warranty, read carefully<br />

the sections that include items<br />

not covered.<br />

8<br />

Never believe the sticker. The<br />

sticker price of a car isn’t the actual<br />

price. There’s always room to negotiate.<br />

I sold a $50,000 Ford F-250 pickup<br />

to a couple who paid the sticker<br />

price and never even tried to cut a<br />

deal. The truck had about an $8,000<br />

markup so I had room to negotiate.<br />

12<br />

Inspect before you buy. When<br />

shopping for a used car, take your<br />

potential purchase to your mechanic<br />

for an independent inspection. A<br />

good tech will spot hidden problems.<br />

Independent inspections usually run<br />

$75-$100. It’s the best 100 bucks<br />

you’ll ever spend on a car.