You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

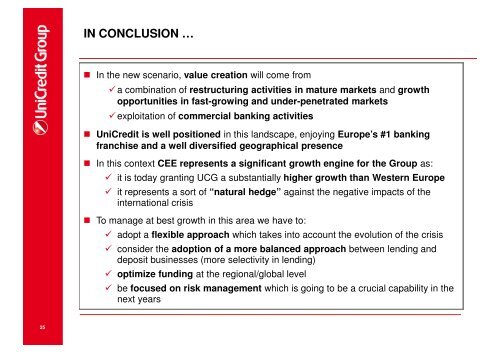

IN CONCLUSION …<br />

In the new scenario, value creation will come from<br />

a combination of restructuring activities in mature markets and growth<br />

opportunities in fast-growing and under-penetrated markets<br />

exploitation of commercial banking activities<br />

UniCredit is well positioned in this landscape, enjoying Europe’s #1 banking<br />

franchise and a well diversified geographical presence<br />

In this context CEE represents a significant growth engine for the Group as:<br />

it is today granting UCG a substantially higher growth than Western Europe<br />

it represents a sort of “natural hedge” against the negative impacts of the<br />

international crisis<br />

To manage at best growth in this area we have to:<br />

adopt a flexible approach which takes into account the evolution of the crisis<br />

consider the adoption of a more balanced approach between lending and<br />

deposit businesses (more selectivity in lending)<br />

optimize funding at the regional/global level<br />

be focused on risk management which is going to be a crucial capability in the<br />

next years<br />

25