videocon industries limited - Domain-b

videocon industries limited - Domain-b

videocon industries limited - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As at<br />

30th Sept., 2008<br />

(Rupees in Million)<br />

As at<br />

30th Sept., 2007<br />

(Rupees in Million)<br />

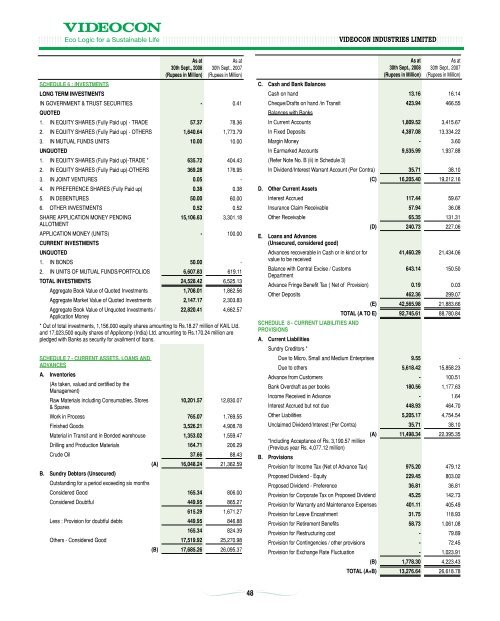

SCHEDULE 6 : INVESTMENTS<br />

LONG TERM INVESTMENTS<br />

IN GOVERNMENT & TRUST SECURITIES - 0.41<br />

QUOTED<br />

1. IN EQUITY SHARES (Fully Paid up) - TRADE 57.37 78.36<br />

2. IN EQUITY SHARES (Fully Paid up) - OTHERS 1,640.64 1,773.79<br />

3. IN MUTUAL FUNDS UNITS 10.00 10.00<br />

UNQUOTED<br />

1. IN EQUITY SHARES (Fully Paid up)-TRADE * 635.72 404.43<br />

2. IN EQUITY SHARES (Fully Paid up)-OTHERS 369.28 176.95<br />

3. IN JOINT VENTURES 0.05 -<br />

4. IN PREFERENCE SHARES (Fully Paid up) 0.38 0.38<br />

5. IN DEBENTURES 50.00 60.00<br />

6. OTHER INVESTMENTS 0.52 0.52<br />

SHARE APPLICATION MONEY PENDING<br />

15,106.63 3,301.18<br />

ALLOTMENT<br />

APPLICATION MONEY (UNITS) - 100.00<br />

CURRENT INVESTMENTS<br />

UNQUOTED<br />

1. IN BONDS 50.00 -<br />

2. IN UNITS OF MUTUAL FUNDS/PORTFOLIOS 6,607.83 619.11<br />

TOTAL INVESTMENTS 24,528.42 6,525.13<br />

Aggregate Book Value of Quoted Investments 1,708.01 1,862.56<br />

Aggregate Market Value of Quoted Investments 2,147.17 2,303.83<br />

Aggregate Book Value of Unquoted Investments / 22,820.41 4,662.57<br />

Application Money<br />

* Out of total investments, 1,156,000 equity shares amounting to Rs.18.27 million of KAIL Ltd.<br />

and 17,023,500 equity shares of Applicomp (India) Ltd. amounting to Rs.170.24 million are<br />

pledged with Banks as security for availment of loans.<br />

SCHEDULE 7 - CURRENT ASSETS, LOANS AND<br />

ADVANCES<br />

A. Inventories<br />

(As taken, valued and certified by the<br />

Management)<br />

Raw Materials including Consumables, Stores<br />

10,201.57 12,830.07<br />

& Spares<br />

Work in Process 765.07 1,769.55<br />

Finished Goods 3,526.21 4,908.78<br />

Material in Transit and in Bonded warehouse 1,353.02 1,559.47<br />

Drilling and Production Materials 164.71 206.29<br />

Crude Oil 37.66 88.43<br />

(A) 16,048.24 21,362.59<br />

B. Sundry Debtors (Unsecured)<br />

Outstanding for a period exceeding six months<br />

Considered Good 165.34 806.00<br />

Considered Doubtful 449.95 865.27<br />

615.29 1,671.27<br />

Less : Provision for doubtful debts 449.95 846.88<br />

165.34 824.39<br />

Others - Considered Good 17,519.92 25,270.98<br />

(B) 17,685.26 26,095.37<br />

As at<br />

30th Sept., 2008<br />

(Rupees in Million)<br />

As at<br />

30th Sept., 2007<br />

(Rupees in Million)<br />

C. Cash and Bank Balances<br />

Cash on hand 13.16 16.14<br />

Cheque/Drafts on hand /in Transit 423.94 466.55<br />

Balances with Banks<br />

In Current Accounts 1,809.52 3,415.67<br />

In Fixed Deposits 4,387.08 13,334.22<br />

Margin Money - 3.60<br />

In Earmarked Accounts 9,535.99 1,937.88<br />

(Refer Note No. B (ii) in Schedule 3)<br />

In Dividend/Interest Warrant Account (Per Contra) 35.71 38.10<br />

(C) 16,205.40 19,212.16<br />

D. Other Current Assets<br />

Interest Accrued 117.44 59.67<br />

Insurance Claim Receivable 57.94 36.08<br />

Other Receivable 65.35 131.31<br />

(D) 240.73 227.06<br />

E. Loans and Advances<br />

(Unsecured, considered good)<br />

Advances recoverable in Cash or in kind or for<br />

41,460.29 21,434.06<br />

value to be received<br />

Balance with Central Excise / Customs<br />

643.14 150.50<br />

Department<br />

Advance Fringe Benefit Tax ( Net of Provision) 0.19 0.03<br />

Other Deposits 462.36 299.07<br />

(E) 42,565.98 21,883.66<br />

TOTAL (A TO E) 92,745.61 88,780.84<br />

SCHEDULE 8 - CURRENT LIABILITIES AND<br />

PROVISIONS<br />

A. Current Liabilities<br />

Sundry Creditors *<br />

Due to Micro, Small and Medium Enterprises 9.55 -<br />

Due to others 5,618.42 15,858.23<br />

Advance from Customers - 100.51<br />

Bank Overdraft as per books 180.56 1,177.63<br />

Income Received in Advance - 1.64<br />

Interest Accrued but not due 448.93 464.70<br />

Other Liabilities 5,205.17 4,754.54<br />

Unclaimed Dividend/Interest (Per Contra) 35.71 38.10<br />

(A)<br />

*Including Acceptance of Rs. 3,190.57 million<br />

(Previous year Rs. 4,077.12 million)<br />

11,498.34 22,395.35<br />

B. Provisions<br />

Provision for Income Tax (Net of Advance Tax) 975.20 479.12<br />

Proposed Dividend - Equity 229.45 803.02<br />

Proposed Dividend - Preference 36.81 36.81<br />

Provision for Corporate Tax on Proposed Dividend 45.25 142.73<br />

Provision for Warranty and Maintenance Expenses 401.11 405.49<br />

Provision for Leave Encashment 31.75 118.93<br />

Provision for Retirement Benefits 58.73 1,061.08<br />

Provision for Restructuring cost - 79.89<br />

Provision for Contingencies / other provisions - 72.45<br />

Provision for Exchange Rate Fluctuation - 1,023.91<br />

(B) 1,778.30 4,223.43<br />

TOTAL (A+B) 13,276.64 26,618.78<br />

48