videocon industries limited - Domain-b

videocon industries limited - Domain-b

videocon industries limited - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

e) The consortium, comprising the subsidiary (Special Purpose Vehicle) of the Company,<br />

Global Energy Inc. Oilex (JPDA 06-103) Limited, GSPC (JPDA) Limited and Bharat<br />

Petro Resources JPDA Limited, has been awarded block JPDA 06-103 situated within<br />

the Bonaparte Basin, East Timor. The PSC has been signed on 15th November,<br />

2006 and Joint Operating Agreement has been signed on 5th January, 2007. The<br />

participating interest of Global Energy Inc. is 25%. Contract for 3D Seicmic Data<br />

has been awarded. The capital commitments based on committed minimum work<br />

programme for five years period in relation to participating interest of Global Energy<br />

Inc is Rs.738.78 million (Previous Year Rs.716.72 million).<br />

The Financial Statements reflect the share of the Company in the assets and the liabilities<br />

as well as the income and the expenditure of Joint Venture Operations on a line by line<br />

basis. The Company incorporates its share in the operations of the Joint Venture based<br />

on statements of account received from the Operator. The Company has, in terms of<br />

Accounting Policy No. A-6 above, recognised abondonment costs based on the latest<br />

technical assessments at current costs available with the Company as cost of producing<br />

properties and has provided Depletion thereon under ‘Unit of Production’ method as part of<br />

Producing Properties in line with Guidance Note on Accounting of Oil and Gas Producing<br />

Activities issued by the Institute of Chartered Accountants of India.<br />

Incorporated jointly controlled Entities :<br />

VB (Brasil) Petroleo Private Limitada (“VB Brasil”), a 50: 50 joint venture company<br />

incorporated in Brazil along with Bharat PetroResources Limited (“BPRL”), a wholly<br />

owned subsidiary of Bharat Petroleum Corporation Ltd., aquired 100% equity of EnCana<br />

Brasil Petroleo Limitada (name changed to IBV Brasil Petroleo Limitada) from EnCana<br />

Corporation and 749739 Alberta Limited (the “Vendors”) under a Share Sale Agreement<br />

dated September 8, 2007 wherein the effective date was agreed as January 1, 2007 (the<br />

“Effective Date”). The acquisition transaction was completed by VB Brasil on September<br />

18, 2008 (the “Closing Date”) for a consideration of US$ 165 million plus operating costs<br />

from the Effective Date till the Closing Date amounting to US$ 117.85 million. IBV Brasil<br />

Petroleo Limitada has interests in four concessions with ten deep water offshore exploration<br />

blocks in Brazil. The national oil company of Brazil is the operator in three of the four<br />

concessions whereas Anadarko Corporation U.S.A. through its Brazilian subsidiary is the<br />

operator in one remaining concession. The pre-salt exploration programme is continuing in<br />

the deep water Campos and Espirito Santos basins, with a pre-salt discovery at the Wahoo<br />

prospect offshore Brazil in the Campos Basin.<br />

The financial interest in the said jointly controlled entity VB (Brasil) Petroleo Private Limitada<br />

is as under:<br />

The Company’s 50% share of 30th Sept. 2008<br />

(Rs. in million)<br />

30th Sept. 2007<br />

(Rs. in million)<br />

Assets 6,988.27 -<br />

Liabilities 7,303.77 -<br />

Income - -<br />

Expenses 339.10 -<br />

Tax - -<br />

7. The Exceptional items in profit and loss account represents<br />

a) The amount of interest on delayed payment of profit petroleum and royalty on oil and<br />

gas of Rs.391.78 million recovered by the Government of India in respect of which<br />

the application is pending before the Hon’ble Arbitral Tribunal for final determination<br />

of such amount.<br />

b) Exchange rate difference on ECB and FCCB amounting to Rs. 886.32 million which<br />

is only a provision made and may reverse in case, the exchange rate moving back to<br />

earlier levels.<br />

For the year<br />

ended<br />

30th Sept., 2008<br />

(Rs. in Million)<br />

For the year<br />

ended<br />

30th Sept., 2007<br />

(Rs. in Million)<br />

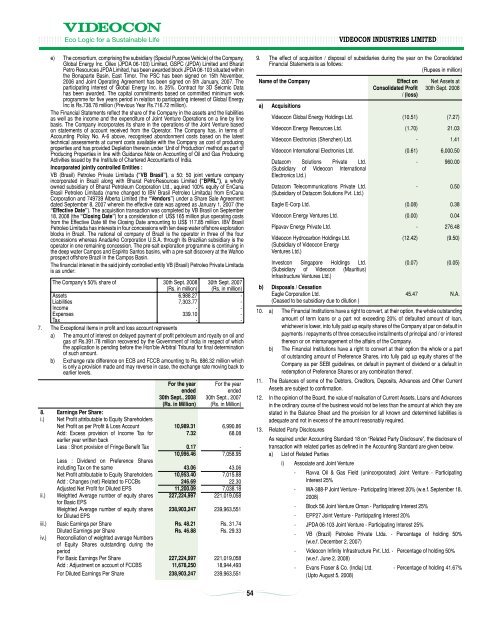

8. Earnings Per Share:<br />

i.) Net Profit attributable to Equity Shareholders<br />

Net Profit as per Profit & Loss Account 10,989.31 6,990.86<br />

Add: Excess provision of Income Tax for<br />

7.32 68.08<br />

earlier year written back<br />

Less : Short provision of Fringe Benefit Tax 0.17 -<br />

10,996.46 7,058.95<br />

Less : Dividend on Preference Shares<br />

including Tax on the same 43.06 43.06<br />

Net Profit attributable to Equity Shareholders 10,953.40 7,015.88<br />

Add : Changes (net) Related to FCCBs 246.69 22.30<br />

Adjusted Net Profit for Diluted EPS 11,200.09 7,038.18<br />

ii.) Weighted Average number of equity shares 227,224,997 221,019,058<br />

for Basic EPS<br />

Weighted Average number of equity shares 238,903,247 239,963,551<br />

for Diluted EPS<br />

iii.) Basic Earnings per Share Rs. 48.21 Rs. 31.74<br />

Diluted Earnings per Share Rs. 46.88 Rs. 29.33<br />

iv.) Reconciliation of weighted average Numbers<br />

of Equity Shares outstanding during the<br />

period<br />

For Basic Earnings Per Share 227,224,997 221,019,058<br />

Add : Adjustment on account of FCCBS 11,678,250 18,944,493<br />

For Diluted Earnings Per Share 238,903,247 239,963,551<br />

9. The effect of acquisition / disposal of subsidiaries during the year on the Consolidated<br />

Financial Statements is as follows:<br />

(Rupees in million)<br />

Name of the Company Effect on<br />

Consolidated Profit<br />

/ (loss)<br />

Net Assets at<br />

30th Sept. 2008<br />

a) Acquisitions<br />

Videocon Global Energy Holdings Ltd. (10.51) (7.27)<br />

Videocon Energy Resources Ltd. (1.70) 21.03<br />

Videocon Electronics (Shenzhen) Ltd. - 1.41<br />

Videocon International Electronics Ltd. (0.61) 6,000.50<br />

Datacom Solutions Private Ltd.<br />

- 960.00<br />

(Subsidiary of Videocon International<br />

Electronics Ltd.)<br />

Datacom Telecommunications Private Ltd.<br />

(Subsidiary of Datacom Solutions Pvt. Ltd.)<br />

- 0.50<br />

Eagle E-Corp Ltd. (0.08) 0.38<br />

Videocon Energy Ventures Ltd. (0.00) 0.04<br />

Pipavav Energy Private Ltd. - 276.48<br />

Videocon Hydrocarbon Holdings Ltd.<br />

(Subsidiary of Videocon Energy<br />

Ventures Ltd.)<br />

(12.42) (9.50)<br />

Investcon Singapore Holdings Ltd.<br />

(Subsidiary of Videocon (Mauritius)<br />

Infrastructure Ventures Ltd.)<br />

(0.07) (0.05)<br />

b) Disposals / Cessation<br />

Eagle Corporation Ltd.<br />

45.47 N.A.<br />

(Ceased to be subsidiary due to dilution )<br />

10. a) The Financial Institutions have a right to convert, at their option, the whole outstanding<br />

amount of term loans or a part not exceeding 20% of defaulted amount of loan,<br />

whichever is lower, into fully paid up equity shares of the Company at par on default in<br />

payments / repayments of three consecutive installments of principal and / or interest<br />

thereon or on mismanagement of the affairs of the Company.<br />

b) The Financial Institutions have a right to convert at their option the whole or a part<br />

of outstanding amount of Preference Shares, into fully paid up equity shares of the<br />

Company as per SEBI guidelines, on default in payment of dividend or a default in<br />

redemption of Preference Shares or any combination thereof.<br />

11. The Balances of some of the Debtors, Creditors, Deposits, Advances and Other Current<br />

Assets are subject to confirmation.<br />

12. In the opinion of the Board, the value of realisation of Current Assets, Loans and Advances<br />

in the ordinary course of the business would not be less than the amount at which they are<br />

stated in the Balance Sheet and the provision for all known and determined liabilities is<br />

adequate and not in excess of the amount reasonably required.<br />

13. Related Party Disclosures<br />

As required under Accounting Standard 18 on “Related Party Disclosure”, the disclosure of<br />

transaction with related parties as defined in the Accounting Standard are given below.<br />

a) List of Related Parties<br />

i) Associate and Joint Venture<br />

- Ravva Oil & Gas Field (unincorporated) Joint Venture - Participating<br />

Interest 25%<br />

- WA-388-P Joint Venture - Participating Interest 20% (w.e.f. September 18,<br />

2008)<br />

- Block 56 Joint Venture Oman - Participating Interest 25%<br />

- EPP27 Joint Venture - Participating Interest 20%<br />

- JPDA 06-103 Joint Venture - Participating Interest 25%<br />

- VB (Brazil) Petroleo Private Ltda. - Percentage of holding 50%<br />

(w.e.f. December 2, 2007)<br />

- Videocon Infinity Infrastructure Pvt. Ltd. - Percentage of holding 50%<br />

(w.e.f. June 2, 2008)<br />

- Evans Fraser & Co. (India) Ltd. - Percentage of holding 41.67%<br />

(Upto August 5, 2008)<br />

54