2010 Component Unit Financial Statements - Regional ...

2010 Component Unit Financial Statements - Regional ...

2010 Component Unit Financial Statements - Regional ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Proprietary Funds – Funds that focus on the determination of operating income, changes in net assets<br />

(or cost recovery), financial position, and cash flows are reported for proprietary funds. The RTC has<br />

one type of proprietary fund, an enterprise fund. Enterprise funds are used to report an activity where<br />

fees are charged to external users. The RTC’s sole enterprise fund, the Public Transit Fund, is used to<br />

account for transit operations.<br />

FINANCIAL HIGHLIGHTS<br />

The governmental activities of the RTC consist of two highway improvement funds, two debt service<br />

funds, and two funds utilized to account for administration of the RTC and distribution of a portion of the<br />

sales and excise tax revenue. The RTC funds a portion of street and highway projects for Clark<br />

County, the City of Las Vegas, City of Henderson, City of North Las Vegas, City of Boulder City, City of<br />

Mesquite, Bunkerville, Indian Springs, Laughlin, Moapa, Moapa Valley, Mt. Charleston, and<br />

Searchlight, (collectively referred to as the Jurisdictions) through the nine cent motor vehicle fuel tax<br />

and a portion of the sales and excise tax revenue allocated to the RTC Highway Improvement Fund.<br />

The business-type activities consist solely of the RTC Public Transit System, accounted for in an<br />

enterprise fund. The continued construction of street and highway, public transit facilities, and the<br />

acquisition of public transit equipment account for the majority of the changes in the balances reported<br />

in the statement of net assets.<br />

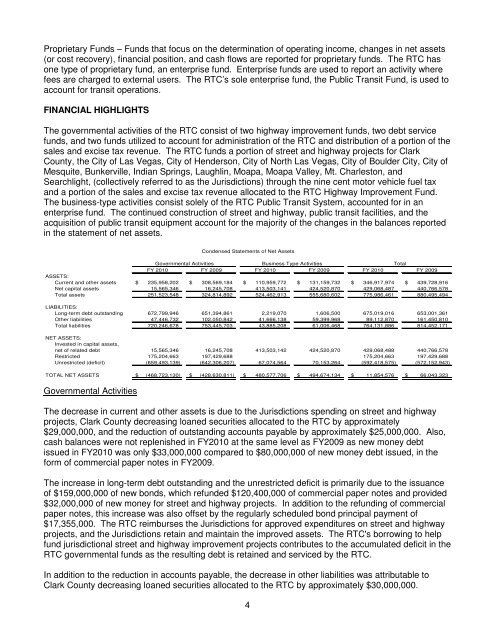

Condensed <strong>Statements</strong> of Net Assets<br />

Governmental Activities Business Type Activities Total<br />

FY <strong>2010</strong> FY 2009 FY <strong>2010</strong> FY 2009 FY <strong>2010</strong> FY 2009<br />

ASSETS:<br />

Current and other assets $ 235,958,202 $ 308,569,184 $ 110,959,772 $ 131,159,732 $ 346,917,974 $ 439,728,916<br />

Net capital assets 15,565,346 16,245,708 413,503,141 424,520,870 429,068,487 440,766,578<br />

Total assets 251,523,548 324,814,892 524,462,913 555,680,602 775,986,461 880,495,494<br />

LIABILITIES:<br />

Long-term debt outstanding 672,799,946 651,394,861 2,219,070 1,606,500 675,019,016 653,001,361<br />

Other liabilities 47,446,732 102,050,842 41,666,138 59,399,968 89,112,870 161,450,810<br />

Total liabilities 720,246,678 753,445,703 43,885,208 61,006,468 764,131,886 814,452,171<br />

NET ASSETS:<br />

Invested in capital assets,<br />

net of related debt 15,565,346 16,245,708 413,503,142 424,520,870 429,068,488 440,766,578<br />

Restricted 175,204,663 197,429,688 175,204,663 197,429,688<br />

Unrestricted (deficit) (659,493,139) (642,306,207) 67,074,564 70,153,264 (592,418,575) (572,152,943)<br />

TOTAL NET ASSETS $ (468,723,130) $ (428,630,811) $ 480,577,706 $ 494,674,134 $ 11,854,576 $ 66,043,323<br />

Governmental Activities<br />

The decrease in current and other assets is due to the Jurisdictions spending on street and highway<br />

projects, Clark County decreasing loaned securities allocated to the RTC by approximately<br />

$29,000,000, and the reduction of outstanding accounts payable by approximately $25,000,000. Also,<br />

cash balances were not replenished in FY<strong>2010</strong> at the same level as FY2009 as new money debt<br />

issued in FY<strong>2010</strong> was only $33,000,000 compared to $80,000,000 of new money debt issued, in the<br />

form of commercial paper notes in FY2009.<br />

The increase in long-term debt outstanding and the unrestricted deficit is primarily due to the issuance<br />

of $159,000,000 of new bonds, which refunded $120,400,000 of commercial paper notes and provided<br />

$32,000,000 of new money for street and highway projects. In addition to the refunding of commercial<br />

paper notes, this increase was also offset by the regularly scheduled bond principal payment of<br />

$17,355,000. The RTC reimburses the Jurisdictions for approved expenditures on street and highway<br />

projects, and the Jurisdictions retain and maintain the improved assets. The RTC's borrowing to help<br />

fund jurisdictional street and highway improvement projects contributes to the accumulated deficit in the<br />

RTC governmental funds as the resulting debt is retained and serviced by the RTC.<br />

In addition to the reduction in accounts payable, the decrease in other liabilities was attributable to<br />

Clark County decreasing loaned securities allocated to the RTC by approximately $30,000,000.<br />

4