Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

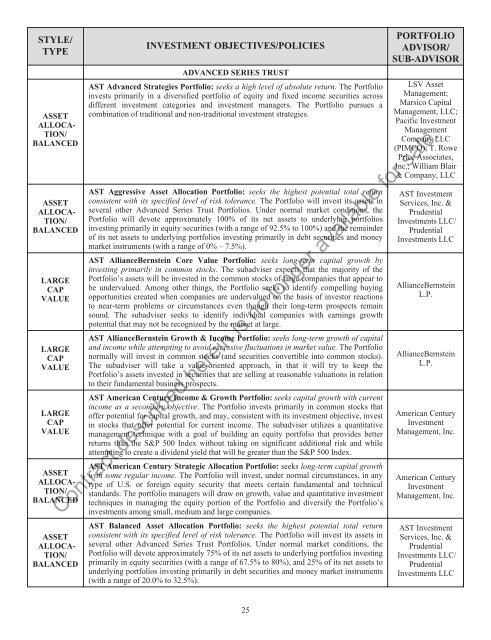

STYLE/<br />

TYPE<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

LARGE<br />

CAP<br />

VALUE<br />

LARGE<br />

CAP<br />

VALUE<br />

LARGE<br />

CAP<br />

VALUE<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

INVESTMENT OBJECTIVES/POLICIES<br />

ADVANCED SERIES TRUST<br />

AST Advanced Strategies Portfolio: seeks a high level of absolute return. The Portfolio<br />

invests primarily in a diversified portfolio of equity and fixed income securities across<br />

different investment categories and investment managers. The Portfolio pursues a<br />

combination of traditional and non-traditional investment strategies.<br />

AST Aggressive Asset Allocation Portfolio: seeks the highest potential total return<br />

consistent with its specified level of risk tolerance. The Portfolio will invest its assets in<br />

several other Advanced Series Trust Portfolios. Under normal market conditions, the<br />

Portfolio will devote approximately 100% of its net assets to underlying portfolios<br />

investing primarily in equity securities (with a range of 92.5% to 100%) and the remainder<br />

of its net assets to underlying portfolios investing primarily in debt securities and money<br />

market instruments (with a range of 0% – 7.5%).<br />

AST AllianceBernstein Core Value Portfolio: seeks long-term capital growth by<br />

investing primarily in common stocks. The subadviser expects that the majority of the<br />

Portfolio’s assets will be invested in the common stocks of large companies that appear to<br />

be undervalued. Among other things, the Portfolio seeks to identify compelling buying<br />

opportunities created when companies are undervalued on the basis of investor reactions<br />

to near-term problems or circumstances even though their long-term prospects remain<br />

sound. The subadviser seeks to identify individual companies with earnings growth<br />

potential that may not be recognized by the market at large.<br />

AST AllianceBernstein Growth & Income Portfolio: seeks long-term growth of capital<br />

and income while attempting to avoid excessive fluctuations in market value. The Portfolio<br />

normally will invest in common stocks (and securities convertible into common stocks).<br />

The subadviser will take a value-oriented approach, in that it will try to keep the<br />

Portfolio’s assets invested in securities that are selling at reasonable valuations in relation<br />

to their fundamental business prospects.<br />

AST American Century Income & Growth Portfolio: seeks capital growth with current<br />

income as a secondary objective. The Portfolio invests primarily in common stocks that<br />

offer potential for capital growth, and may, consistent with its investment objective, invest<br />

in stocks that offer potential for current income. The subadviser utilizes a quantitative<br />

management technique with a goal of building an equity portfolio that provides better<br />

returns than the S&P 500 Index without taking on significant additional risk and while<br />

attempting to create a dividend yield that will be greater than the S&P 500 Index.<br />

AST American Century <strong>Strategic</strong> Allocation Portfolio: seeks long-term capital growth<br />

with some regular income. The Portfolio will invest, under normal circumstances, in any<br />

type of U.S. or foreign equity security that meets certain fundamental and technical<br />

standards. The portfolio managers will draw on growth, value and quantitative investment<br />

techniques in managing the equity portion of the Portfolio and diversify the Portfolio’s<br />

investments among small, medium and large companies.<br />

AST Balanced Asset Allocation Portfolio: seeks the highest potential total return<br />

consistent with its specified level of risk tolerance. The Portfolio will invest its assets in<br />

several other Advanced Series Trust Portfolios. Under normal market conditions, the<br />

Portfolio will devote approximately 75% of its net assets to underlying portfolios investing<br />

primarily in equity securities (with a range of 67.5% to 80%), and 25% of its net assets to<br />

underlying portfolios investing primarily in debt securities and money market instruments<br />

(with a range of 20.0% to 32.5%).<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

LSV Asset<br />

Management;<br />

Marsico Capital<br />

Management, LLC;<br />

Pacific Investment<br />

Management<br />

Company LLC<br />

(PIMCO); T. Rowe<br />

Price Associates,<br />

Inc.; William Blair<br />

& Company, LLC<br />

AST Investment<br />

Services, Inc. &<br />

<strong>Prudential</strong><br />

Investments LLC/<br />

<strong>Prudential</strong><br />

Investments LLC<br />

AllianceBernstein<br />

L.P.<br />

AllianceBernstein<br />

L.P.<br />

American Century<br />

Investment<br />

Management, Inc.<br />

American Century<br />

Investment<br />

Management, Inc.<br />

Contract described herein is no longer available for sale.<br />

AST Investment<br />

Services, Inc. &<br />

<strong>Prudential</strong><br />

Investments LLC/<br />

<strong>Prudential</strong><br />

Investments LLC<br />

25