Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

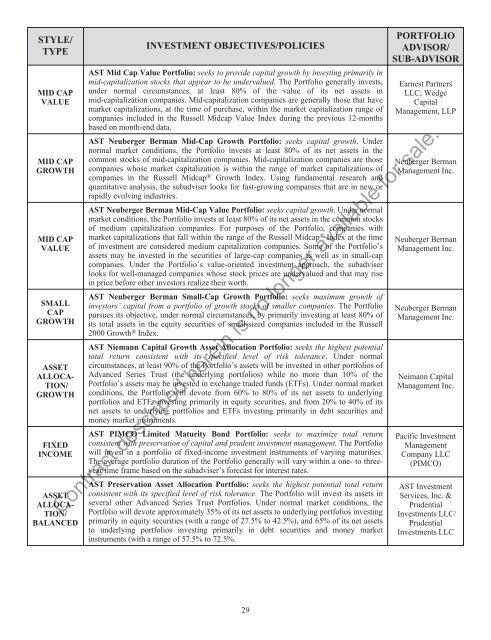

STYLE/<br />

TYPE<br />

MID CAP<br />

VALUE<br />

MID CAP<br />

GROWTH<br />

MID CAP<br />

VALUE<br />

SMALL<br />

CAP<br />

GROWTH<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

GROWTH<br />

FIXED<br />

INCOME<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

INVESTMENT OBJECTIVES/POLICIES<br />

AST Mid Cap Value Portfolio: seeks to provide capital growth by investing primarily in<br />

mid-capitalization stocks that appear to be undervalued. The Portfolio generally invests,<br />

under normal circumstances, at least 80% of the value of its net assets in<br />

mid-capitalization companies. Mid-capitalization companies are generally those that have<br />

market capitalizations, at the time of purchase, within the market capitalization range of<br />

companies included in the Russell Midcap Value Index during the previous 12-months<br />

based on month-end data.<br />

AST Neuberger Berman Mid-Cap Growth Portfolio: seeks capital growth. Under<br />

normal market conditions, the Portfolio invests at least 80% of its net assets in the<br />

common stocks of mid-capitalization companies. Mid-capitalization companies are those<br />

companies whose market capitalization is within the range of market capitalizations of<br />

companies in the Russell Midcap ® Growth Index. Using fundamental research and<br />

quantitative analysis, the subadviser looks for fast-growing companies that are in new or<br />

rapidly evolving industries.<br />

AST Neuberger Berman Mid-Cap Value Portfolio: seeks capital growth. Under normal<br />

market conditions, the Portfolio invests at least 80% of its net assets in the common stocks<br />

of medium capitalization companies. For purposes of the Portfolio, companies with<br />

market capitalizations that fall within the range of the Russell Midcap ® Index at the time<br />

of investment are considered medium capitalization companies. Some of the Portfolio’s<br />

assets may be invested in the securities of large-cap companies as well as in small-cap<br />

companies. Under the Portfolio’s value-oriented investment approach, the subadviser<br />

looks for well-managed companies whose stock prices are undervalued and that may rise<br />

in price before other investors realize their worth.<br />

AST Neuberger Berman Small-Cap Growth Portfolio: seeks maximum growth of<br />

investors’ capital from a portfolio of growth stocks of smaller companies. The Portfolio<br />

pursues its objective, under normal circumstances, by primarily investing at least 80% of<br />

its total assets in the equity securities of small-sized companies included in the Russell<br />

2000 Growth ® Index.<br />

AST Niemann Capital Growth Asset Allocation Portfolio: seeks the highest potential<br />

total return consistent with its specified level of risk tolerance. Under normal<br />

circumstances, at least 90% of the Portfolio’s assets will be invested in other portfolios of<br />

Advanced Series Trust (the underlying portfolios) while no more than 10% of the<br />

Portfolio’s assets may be invested in exchange traded funds (ETFs). Under normal market<br />

conditions, the Portfolio will devote from 60% to 80% of its net assets to underlying<br />

portfolios and ETFs investing primarily in equity securities, and from 20% to 40% of its<br />

net assets to underlying portfolios and ETFs investing primarily in debt securities and<br />

money market instruments.<br />

AST PIMCO Limited Maturity Bond Portfolio: seeks to maximize total return<br />

consistent with preservation of capital and prudent investment management. The Portfolio<br />

will invest in a portfolio of fixed-income investment instruments of varying maturities.<br />

The average portfolio duration of the Portfolio generally will vary within a one- to threeyear<br />

time frame based on the subadviser’s forecast for interest rates.<br />

AST Preservation Asset Allocation Portfolio: seeks the highest potential total return<br />

consistent with its specified level of risk tolerance. The Portfolio will invest its assets in<br />

several other Advanced Series Trust Portfolios. Under normal market conditions, the<br />

Portfolio will devote approximately 35% of its net assets to underlying portfolios investing<br />

primarily in equity securities (with a range of 27.5% to 42.5%), and 65% of its net assets<br />

to underlying portfolios investing primarily in debt securities and money market<br />

instruments (with a range of 57.5% to 72.5%.<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

Earnest <strong>Partners</strong><br />

LLC; Wedge<br />

Capital<br />

Management, LLP<br />

Neuberger Berman<br />

Management Inc.<br />

Neuberger Berman<br />

Management Inc.<br />

Neuberger Berman<br />

Management Inc.<br />

Neimann Capital<br />

Management Inc.<br />

Pacific Investment<br />

Management<br />

Company LLC<br />

(PIMCO)<br />

AST Investment<br />

Services, Inc. &<br />

<strong>Prudential</strong><br />

Investments LLC/<br />

<strong>Prudential</strong><br />

Investments LLC<br />

Contract described herein is no longer available for sale.<br />

29