Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Strategic Partners Plus 3 - Prudential Annuities

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

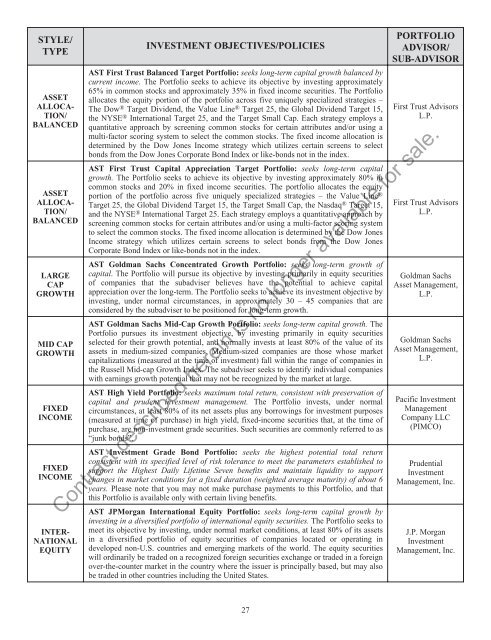

STYLE/<br />

TYPE<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

ASSET<br />

ALLOCA-<br />

TION/<br />

BALANCED<br />

LARGE<br />

CAP<br />

GROWTH<br />

MID CAP<br />

GROWTH<br />

FIXED<br />

INCOME<br />

FIXED<br />

INCOME<br />

INTER-<br />

NATIONAL<br />

EQUITY<br />

INVESTMENT OBJECTIVES/POLICIES<br />

AST First Trust Balanced Target Portfolio: seeks long-term capital growth balanced by<br />

current income. The Portfolio seeks to achieve its objective by investing approximately<br />

65% in common stocks and approximately 35% in fixed income securities. The Portfolio<br />

allocates the equity portion of the portfolio across five uniquely specialized strategies –<br />

The Dow ® Target Dividend, the Value Line ® Target 25, the Global Dividend Target 15,<br />

the NYSE ® International Target 25, and the Target Small Cap. Each strategy employs a<br />

quantitative approach by screening common stocks for certain attributes and/or using a<br />

multi-factor scoring system to select the common stocks. The fixed income allocation is<br />

determined by the Dow Jones Income strategy which utilizes certain screens to select<br />

bonds from the Dow Jones Corporate Bond Index or like-bonds not in the index.<br />

AST First Trust Capital Appreciation Target Portfolio: seeks long-term capital<br />

growth. The Portfolio seeks to achieve its objective by investing approximately 80% in<br />

common stocks and 20% in fixed income securities. The portfolio allocates the equity<br />

portion of the portfolio across five uniquely specialized strategies – the Value Line ®<br />

Target 25, the Global Dividend Target 15, the Target Small Cap, the Nasdaq ® Target 15,<br />

and the NYSE ® International Target 25. Each strategy employs a quantitative approach by<br />

screening common stocks for certain attributes and/or using a multi-factor scoring system<br />

to select the common stocks. The fixed income allocation is determined by the Dow Jones<br />

Income strategy which utilizes certain screens to select bonds from the Dow Jones<br />

Corporate Bond Index or like-bonds not in the index.<br />

AST Goldman Sachs Concentrated Growth Portfolio: seeks long-term growth of<br />

capital. The Portfolio will pursue its objective by investing primarily in equity securities<br />

of companies that the subadviser believes have the potential to achieve capital<br />

appreciation over the long-term. The Portfolio seeks to achieve its investment objective by<br />

investing, under normal circumstances, in approximately 30 – 45 companies that are<br />

considered by the subadviser to be positioned for long-term growth.<br />

AST Goldman Sachs Mid-Cap Growth Portfolio: seeks long-term capital growth. The<br />

Portfolio pursues its investment objective, by investing primarily in equity securities<br />

selected for their growth potential, and normally invests at least 80% of the value of its<br />

assets in medium-sized companies. Medium-sized companies are those whose market<br />

capitalizations (measured at the time of investment) fall within the range of companies in<br />

the Russell Mid-cap Growth Index. The subadviser seeks to identify individual companies<br />

with earnings growth potential that may not be recognized by the market at large.<br />

AST High Yield Portfolio: seeks maximum total return, consistent with preservation of<br />

capital and prudent investment management. The Portfolio invests, under normal<br />

circumstances, at least 80% of its net assets plus any borrowings for investment purposes<br />

(measured at time of purchase) in high yield, fixed-income securities that, at the time of<br />

purchase, are non-investment grade securities. Such securities are commonly referred to as<br />

“junk bonds”.<br />

AST Investment Grade Bond Portfolio: seeks the highest potential total return<br />

consistent with its specified level of risk tolerance to meet the parameters established to<br />

support the Highest Daily Lifetime Seven benefits and maintain liquidity to support<br />

changes in market conditions for a fixed duration (weighted average maturity) of about 6<br />

years. Please note that you may not make purchase payments to this Portfolio, and that<br />

this Portfolio is available only with certain living benefits.<br />

AST JPMorgan International Equity Portfolio: seeks long-term capital growth by<br />

investing in a diversified portfolio of international equity securities. The Portfolio seeks to<br />

meet its objective by investing, under normal market conditions, at least 80% of its assets<br />

in a diversified portfolio of equity securities of companies located or operating in<br />

developed non-U.S. countries and emerging markets of the world. The equity securities<br />

will ordinarily be traded on a recognized foreign securities exchange or traded in a foreign<br />

over-the-counter market in the country where the issuer is principally based, but may also<br />

be traded in other countries including the United States.<br />

PORTFOLIO<br />

ADVISOR/<br />

SUB-ADVISOR<br />

First Trust Advisors<br />

L.P.<br />

First Trust Advisors<br />

L.P.<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.<br />

Goldman Sachs<br />

Asset Management,<br />

L.P.<br />

Pacific Investment<br />

Management<br />

Company LLC<br />

(PIMCO)<br />

<strong>Prudential</strong><br />

Investment<br />

Management, Inc.<br />

Contract described herein is no longer available for sale.<br />

J.P. Morgan<br />

Investment<br />

Management, Inc.<br />

27