Pricing organic cotton...

Pricing organic cotton...

Pricing organic cotton...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Jesse Last, Lending & Strategy<br />

Associate at Root Capital, tells<br />

us how their financing model<br />

can help build closer value chain<br />

business relationships with<br />

longer-term outlooks...<br />

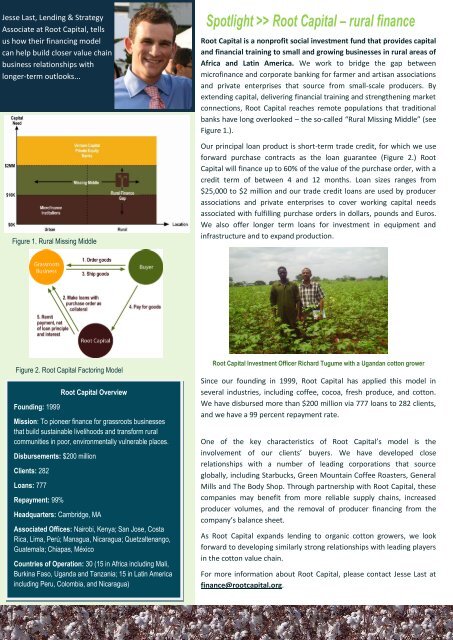

Figure 1. Rural Missing Middle<br />

Spotlight >> Root Capital – rural finance<br />

Root Capital is a nonprofit social investment fund that provides capital<br />

and financial training to small and growing businesses in rural areas of<br />

Africa and Latin America. We work to bridge the gap between<br />

microfinance and corporate banking for farmer and artisan associations<br />

and private enterprises that source from small-scale producers. By<br />

extending capital, delivering financial training and strengthening market<br />

connections, Root Capital reaches remote populations that traditional<br />

banks have long overlooked – the so-called “Rural Missing Middle” (see<br />

Figure 1.).<br />

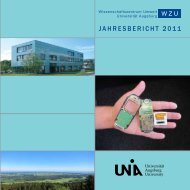

Our principal loan product is short-term trade credit, for which we use<br />

forward purchase contracts as the loan guarantee (Figure 2.) Root<br />

Capital will finance up to 60% of the value of the purchase order, with a<br />

credit term of between 4 and 12 months. Loan sizes ranges from<br />

$25,000 to $2 million and our trade credit loans are used by producer<br />

associations and private enterprises to cover working capital needs<br />

associated with fulfilling purchase orders in dollars, pounds and Euros.<br />

We also offer longer term loans for investment in equipment and<br />

infrastructure and to expand production.<br />

Figure 2. Root Capital Factoring Model<br />

Founding: 1999<br />

Root Capital Overview<br />

Mission: To pioneer finance for grassroots businesses<br />

that build sustainable livelihoods and transform rural<br />

communities in poor, environmentally vulnerable places.<br />

Disbursements: $200 million<br />

Clients: 282<br />

Loans: 777<br />

Repayment: 99%<br />

Headquarters: Cambridge, MA<br />

Associated Offices: Nairobi, Kenya; San Jose, Costa<br />

Rica, Lima, Perú; Managua, Nicaragua; Quetzaltenango,<br />

Guatemala; Chiapas, México<br />

Countries of Operation: 30 (15 in Africa including Mali,<br />

Burkina Faso, Uganda and Tanzania; 15 in Latin America<br />

including Peru, Colombia, and Nicaragua)<br />

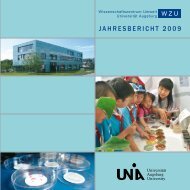

Root Capital Investment Officer Richard Tugume with a Ugandan <strong>cotton</strong> grower<br />

Since our founding in 1999, Root Capital has applied this model in<br />

several industries, including coffee, cocoa, fresh produce, and <strong>cotton</strong>.<br />

We have disbursed more than $200 million via 777 loans to 282 clients,<br />

and we have a 99 percent repayment rate.<br />

One of the key characteristics of Root Capital’s model is the<br />

involvement of our clients’ buyers. We have developed close<br />

relationships with a number of leading corporations that source<br />

globally, including Starbucks, Green Mountain Coffee Roasters, General<br />

Mills and The Body Shop. Through partnership with Root Capital, these<br />

companies may benefit from more reliable supply chains, increased<br />

producer volumes, and the removal of producer financing from the<br />

company’s balance sheet.<br />

As Root Capital expands lending to <strong>organic</strong> <strong>cotton</strong> growers, we look<br />

forward to developing similarly strong relationships with leading players<br />

in the <strong>cotton</strong> value chain.<br />

For more information about Root Capital, please contact Jesse Last at<br />

finance@rootcapital.org.