Vol. III - Penn State Abington

Vol. III - Penn State Abington

Vol. III - Penn State Abington

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

their operations in a short time to comply with CRA requirements for a higher grading.<br />

Structured finance products, however, are able to restructure their products to cater to the criteria<br />

of CRAs. Credit rating agencies will also carry out a new assessment for the adjusted structured<br />

product (Gullo, 2009). This way, CRAs actually have taken part in the process of designing<br />

structured finance products.<br />

These CRAs do not consider this interaction process a consulting service offered to<br />

arrangers. The agencies explain that they may give rating to proposed structured finance products<br />

with credit-enhancement levels, but they do not provide any advice on how these products<br />

should be adjusted (Gullo, 2009). So, there are no additional conflicts of interest here. However,<br />

if the rating agencies are really as fair as they claim, rated products with the same grading should<br />

bear similar default rates. When we compare the corporate bonds and CDOs that received Baa<br />

ratings from Moody’s between 1983 and 2005, the default rate of the former was only 2.2%,<br />

while CDOs’ default rate was as high as 24% (Strier, 2008). Given that CDO issuers were more<br />

generous to CRAs than corporate bonds issuers, Moody’s obviously tilted towards their CDO<br />

clientele.<br />

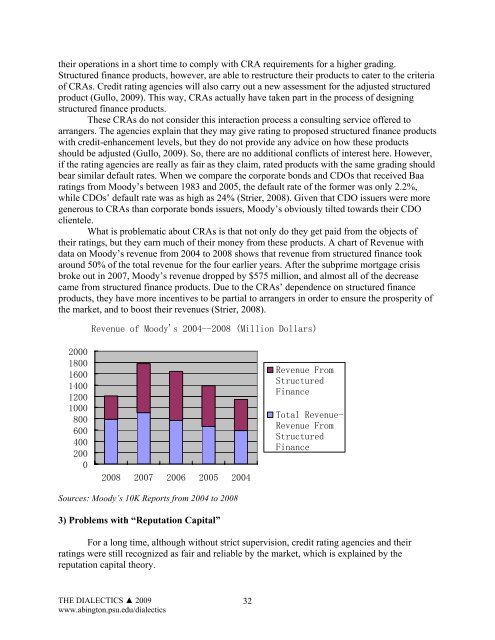

What is problematic about CRAs is that not only do they get paid from the objects of<br />

their ratings, but they earn much of their money from these products. A chart of Revenue with<br />

data on Moody’s revenue from 2004 to 2008 shows that revenue from structured finance took<br />

around 50% of the total revenue for the four earlier years. After the subprime mortgage crisis<br />

broke out in 2007, Moody’s revenue dropped by $575 million, and almost all of the decrease<br />

came from structured finance products. Due to the CRAs’ dependence on structured finance<br />

products, they have more incentives to be partial to arrangers in order to ensure the prosperity of<br />

the market, and to boost their revenues (Strier, 2008).<br />

Revenue of Moody's 2004--2008 (Million Dollars)<br />

2000<br />

1800<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

2008 2007 2006 2005 2004<br />

Revenue From<br />

Structured<br />

Finance<br />

Total Revenue-<br />

Revenue From<br />

Structured<br />

Finance<br />

Sources: Moody’s 10K Reports from 2004 to 2008<br />

3) Problems with “Reputation Capital”<br />

For a long time, although without strict supervision, credit rating agencies and their<br />

ratings were still recognized as fair and reliable by the market, which is explained by the<br />

reputation capital theory.<br />

THE DIALECTICS ▲ 2009<br />

www.abington.psu.edu/dialectics<br />

32