setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

One or more classes of shares or units that<br />

match various characteristics may be created <strong>in</strong><br />

a st<strong>an</strong>d-alone <strong>fund</strong> or <strong>in</strong> each sub-<strong>fund</strong> of <strong>an</strong><br />

umbrella <strong>fund</strong>. The classes of shares or units<br />

may for example have the follow<strong>in</strong>g dist<strong>in</strong>guish<strong>in</strong>g<br />

features:<br />

Distribution policy (distribution or capitalization<br />

shares / units).<br />

Currency (different currencies for the shares/<br />

units may be accommodated, e.g. USD, EUR,<br />

JPY, etc).<br />

Investors targeted (either retail, professional<br />

or <strong>in</strong>stitutional <strong>in</strong>vestors, <strong>in</strong>vestors of a<br />

different nationality, etc).<br />

Structure of fees (different fee structures may<br />

be accommodated, such as e.g. <strong>in</strong> relation to<br />

the subscription fee, redemption fee, conversion<br />

fee, deferred sales charge, distribution<br />

fee, m<strong>an</strong>agement fee, etc).<br />

Currency hedg<strong>in</strong>g (hedged classes or not).<br />

M<strong>in</strong>imum subscription <strong>an</strong>d hold<strong>in</strong>g<br />

requirements.<br />

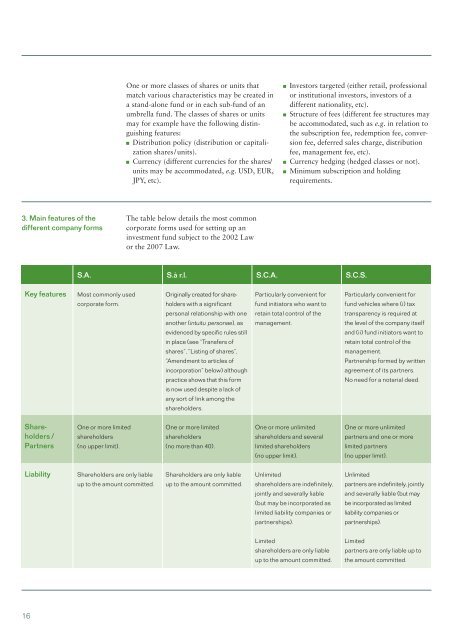

3. Ma<strong>in</strong> features of the<br />

different comp<strong>an</strong>y forms<br />

The table below details the most common<br />

corporate forms used for <strong>sett<strong>in</strong>g</strong> <strong>up</strong> <strong>an</strong><br />

<strong><strong>in</strong>vestment</strong> <strong>fund</strong> subject to the 2002 Law<br />

or the 2007 Law.<br />

S.A. S.à r.l. S.C.A. S.C.S.<br />

Key features<br />

Most commonly used<br />

Orig<strong>in</strong>ally created for share-<br />

Particularly convenient for<br />

Particularly convenient for<br />

corporate form.<br />

holders with a signific<strong>an</strong>t<br />

<strong>fund</strong> <strong>in</strong>itiators who w<strong>an</strong>t to<br />

<strong>fund</strong> vehicles where (i) tax<br />

personal relationship with one<br />

reta<strong>in</strong> total control of the<br />

tr<strong>an</strong>sparency is required at<br />

<strong>an</strong>other (<strong>in</strong>tuitu personae), as<br />

m<strong>an</strong>agement.<br />

the level of the comp<strong>an</strong>y itself<br />

evidenced by specific rules still<br />

<strong>an</strong>d (ii) <strong>fund</strong> <strong>in</strong>itiators w<strong>an</strong>t to<br />

<strong>in</strong> place (see “Tr<strong>an</strong>sfers of<br />

reta<strong>in</strong> total control of the<br />

shares”, “List<strong>in</strong>g of shares”,<br />

m<strong>an</strong>agement.<br />

“Amendment to articles of<br />

Partnership formed by written<br />

<strong>in</strong>corporation” below) although<br />

agreement of its partners.<br />

practice shows that this form<br />

No need for a notarial deed.<br />

is now used despite a lack of<br />

<strong>an</strong>y sort of l<strong>in</strong>k among the<br />

shareholders.<br />

Shareholders<br />

/<br />

Partners<br />

One or more limited<br />

shareholders<br />

(no <strong>up</strong>per limit).<br />

One or more limited<br />

shareholders<br />

(no more th<strong>an</strong> 40).<br />

One or more unlimited<br />

shareholders <strong>an</strong>d several<br />

limited shareholders<br />

One or more unlimited<br />

partners <strong>an</strong>d one or more<br />

limited partners<br />

(no <strong>up</strong>per limit).<br />

(no <strong>up</strong>per limit).<br />

Liability<br />

Shareholders are only liable<br />

Shareholders are only liable<br />

Unlimited<br />

Unlimited<br />

<strong>up</strong> to the amount committed.<br />

<strong>up</strong> to the amount committed.<br />

shareholders are <strong>in</strong>def<strong>in</strong>itely,<br />

partners are <strong>in</strong>def<strong>in</strong>itely, jo<strong>in</strong>tly<br />

jo<strong>in</strong>tly <strong>an</strong>d severally liable<br />

<strong>an</strong>d severally liable (but may<br />

(but may be <strong>in</strong>corporated as<br />

be <strong>in</strong>corporated as limited<br />

limited liability comp<strong>an</strong>ies or<br />

liability comp<strong>an</strong>ies or<br />

partnerships).<br />

partnerships).<br />

Limited<br />

Limited<br />

shareholders are only liable<br />

partners are only liable <strong>up</strong> to<br />

<strong>up</strong> to the amount committed.<br />

the amount committed.<br />

16