setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

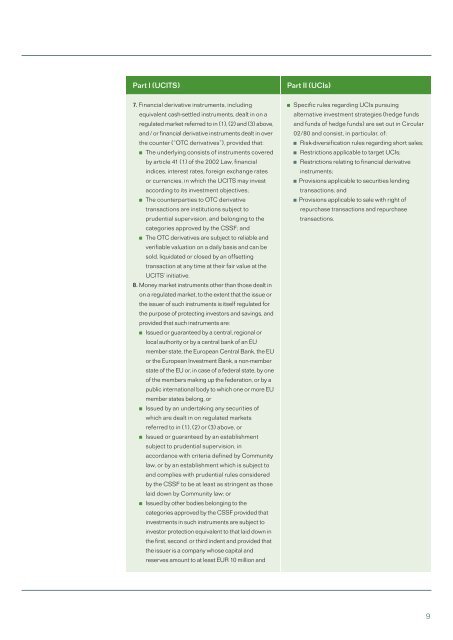

Part I (UCITS)<br />

Part II (UCIs)<br />

7. F<strong>in</strong><strong>an</strong>cial derivative <strong>in</strong>struments, <strong>in</strong>clud<strong>in</strong>g<br />

equivalent cash-settled <strong>in</strong>struments, dealt <strong>in</strong> on a<br />

regulated market referred to <strong>in</strong> (1), (2) <strong>an</strong>d (3) above,<br />

<strong>an</strong>d / or f<strong>in</strong><strong>an</strong>cial derivative <strong>in</strong>struments dealt <strong>in</strong> over<br />

the counter (“OTC derivatives”), provided that:<br />

The underly<strong>in</strong>g consists of <strong>in</strong>struments covered<br />

by article 41 (1) of the 2002 Law, f<strong>in</strong><strong>an</strong>cial<br />

<strong>in</strong>dices, <strong>in</strong>terest rates, foreign exch<strong>an</strong>ge rates<br />

or currencies, <strong>in</strong> which the UCITS may <strong>in</strong>vest<br />

accord<strong>in</strong>g to its <strong><strong>in</strong>vestment</strong> objectives;<br />

The counterparties to OTC derivative<br />

tr<strong>an</strong>sactions are <strong>in</strong>stitutions subject to<br />

prudential s<strong>up</strong>ervision, <strong>an</strong>d belong<strong>in</strong>g to the<br />

categories approved by the CSSF; <strong>an</strong>d<br />

The OTC derivatives are subject to reliable <strong>an</strong>d<br />

verifiable valuation on a daily basis <strong>an</strong>d c<strong>an</strong> be<br />

sold, liquidated or closed by <strong>an</strong> off<strong>sett<strong>in</strong>g</strong><br />

tr<strong>an</strong>saction at <strong>an</strong>y time at their fair value at the<br />

UCITS’ <strong>in</strong>itiative.<br />

8. Money market <strong>in</strong>struments other th<strong>an</strong> those dealt <strong>in</strong><br />

on a regulated market, to the extent that the issue or<br />

the issuer of such <strong>in</strong>struments is itself regulated for<br />

the purpose of protect<strong>in</strong>g <strong>in</strong>vestors <strong>an</strong>d sav<strong>in</strong>gs, <strong>an</strong>d<br />

provided that such <strong>in</strong>struments are:<br />

Issued or guar<strong>an</strong>teed by a central, regional or<br />

local authority or by a central b<strong>an</strong>k of <strong>an</strong> EU<br />

member state, the Europe<strong>an</strong> Central B<strong>an</strong>k, the EU<br />

or the Europe<strong>an</strong> Investment B<strong>an</strong>k, a non-member<br />

state of the EU or, <strong>in</strong> case of a federal state, by one<br />

of the members mak<strong>in</strong>g <strong>up</strong> the federation, or by a<br />

public <strong>in</strong>ternational body to which one or more EU<br />

member states belong, or<br />

Issued by <strong>an</strong> undertak<strong>in</strong>g <strong>an</strong>y securities of<br />

which are dealt <strong>in</strong> on regulated markets<br />

referred to <strong>in</strong> (1), (2) or (3) above, or<br />

Issued or guar<strong>an</strong>teed by <strong>an</strong> establishment<br />

subject to prudential s<strong>up</strong>ervision, <strong>in</strong><br />

accord<strong>an</strong>ce with criteria def<strong>in</strong>ed by Community<br />

law, or by <strong>an</strong> establishment which is subject to<br />

<strong>an</strong>d complies with prudential rules considered<br />

by the CSSF to be at least as str<strong>in</strong>gent as those<br />

laid down by Community law; or<br />

Issued by other bodies belong<strong>in</strong>g to the<br />

categories approved by the CSSF provided that<br />

<strong><strong>in</strong>vestment</strong>s <strong>in</strong> such <strong>in</strong>struments are subject to<br />

<strong>in</strong>vestor protection equivalent to that laid down <strong>in</strong><br />

the first, second or third <strong>in</strong>dent <strong>an</strong>d provided that<br />

the issuer is a comp<strong>an</strong>y whose capital <strong>an</strong>d<br />

reserves amount to at least EUR 10 million <strong>an</strong>d<br />

Specific rules regard<strong>in</strong>g UCIs pursu<strong>in</strong>g<br />

alternative <strong><strong>in</strong>vestment</strong> strategies (hedge <strong>fund</strong>s<br />

<strong>an</strong>d <strong>fund</strong>s of hedge <strong>fund</strong>s) are set out <strong>in</strong> Circular<br />

02/80 <strong>an</strong>d consist, <strong>in</strong> particular, of:<br />

Risk-diversification rules regard<strong>in</strong>g short sales;<br />

Restrictions applicable to target UCIs;<br />

Restrictions relat<strong>in</strong>g to f<strong>in</strong><strong>an</strong>cial derivative<br />

<strong>in</strong>struments;<br />

Provisions applicable to securities lend<strong>in</strong>g<br />

tr<strong>an</strong>sactions; <strong>an</strong>d<br />

Provisions applicable to sale with right of<br />

repurchase tr<strong>an</strong>sactions <strong>an</strong>d repurchase<br />

tr<strong>an</strong>sactions.<br />

9