setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

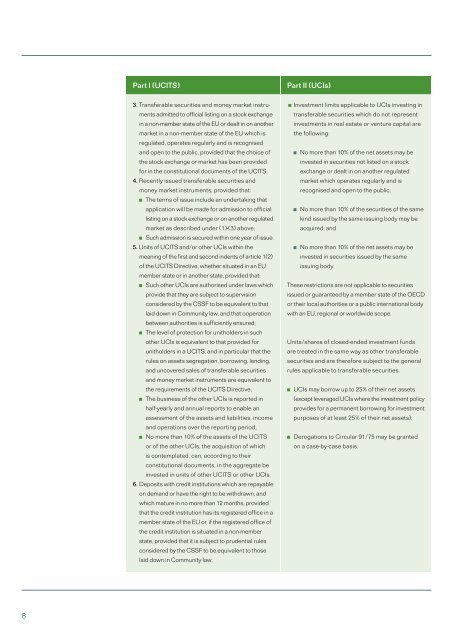

Part I (UCITS)<br />

Part II (UCIs)<br />

3. Tr<strong>an</strong>sferable securities <strong>an</strong>d money market <strong>in</strong>struments<br />

admitted to official list<strong>in</strong>g on a stock exch<strong>an</strong>ge<br />

<strong>in</strong> a non-member state of the EU or dealt <strong>in</strong> on <strong>an</strong>other<br />

market <strong>in</strong> a non-member state of the EU which is<br />

regulated, operates regularly <strong>an</strong>d is recognised<br />

<strong>an</strong>d open to the public, provided that the choice of<br />

the stock exch<strong>an</strong>ge or market has been provided<br />

for <strong>in</strong> the constitutional documents of the UCITS;<br />

4. Recently issued tr<strong>an</strong>sferable securities <strong>an</strong>d<br />

money market <strong>in</strong>struments, provided that:<br />

The terms of issue <strong>in</strong>clude <strong>an</strong> undertak<strong>in</strong>g that<br />

application will be made for admission to official<br />

list<strong>in</strong>g on a stock exch<strong>an</strong>ge or on <strong>an</strong>other regulated<br />

market as described under (1)-(3) above;<br />

Such admission is secured with<strong>in</strong> one year of issue.<br />

5. Units of UCITS <strong>an</strong>d/or other UCIs with<strong>in</strong> the<br />

me<strong>an</strong><strong>in</strong>g of the first <strong>an</strong>d second <strong>in</strong>dents of article 1(2)<br />

of the UCITS Directive, whether situated <strong>in</strong> <strong>an</strong> EU<br />

member state or <strong>in</strong> <strong>an</strong>other state, provided that:<br />

Such other UCIs are authorised under laws which<br />

provide that they are subject to s<strong>up</strong>ervision<br />

considered by the CSSF to be equivalent to that<br />

laid down <strong>in</strong> Community law, <strong>an</strong>d that ooperation<br />

between authorities is sufficiently ensured;<br />

The level of protection for unitholders <strong>in</strong> such<br />

other UCIs is equivalent to that provided for<br />

unitholders <strong>in</strong> a UCITS, <strong>an</strong>d <strong>in</strong> particular that the<br />

rules on assets segregation, borrow<strong>in</strong>g, lend<strong>in</strong>g,<br />

<strong>an</strong>d uncovered sales of tr<strong>an</strong>sferable securities<br />

<strong>an</strong>d money market <strong>in</strong>struments are equivalent to<br />

the requirements of the UCITS Directive;<br />

The bus<strong>in</strong>ess of the other UCIs is reported <strong>in</strong><br />

half-yearly <strong>an</strong>d <strong>an</strong>nual reports to enable <strong>an</strong><br />

assessment of the assets <strong>an</strong>d liabilities, <strong>in</strong>come<br />

<strong>an</strong>d operations over the report<strong>in</strong>g period;<br />

No more th<strong>an</strong> 10% of the assets of the UCITS<br />

or of the other UCIs, the acquisition of which<br />

is contemplated, c<strong>an</strong>, accord<strong>in</strong>g to their<br />

constitutional documents, <strong>in</strong> the aggregate be<br />

<strong>in</strong>vested <strong>in</strong> units of other UCITS or other UCIs.<br />

6. Deposits with credit <strong>in</strong>stitutions which are repayable<br />

on dem<strong>an</strong>d or have the right to be withdrawn, <strong>an</strong>d<br />

which mature <strong>in</strong> no more th<strong>an</strong> 12 months, provided<br />

that the credit <strong>in</strong>stitution has its registered office <strong>in</strong> a<br />

member state of the EU or, if the registered office of<br />

the credit <strong>in</strong>stitution is situated <strong>in</strong> a non-member<br />

state, provided that it is subject to prudential rules<br />

considered by the CSSF to be equivalent to those<br />

laid down <strong>in</strong> Community law;<br />

Investment limits applicable to UCIs <strong>in</strong>vest<strong>in</strong>g <strong>in</strong><br />

tr<strong>an</strong>sferable securities which do not represent<br />

<strong><strong>in</strong>vestment</strong>s <strong>in</strong> real estate or venture capital are<br />

the follow<strong>in</strong>g:<br />

No more th<strong>an</strong> 10% of the net assets may be<br />

<strong>in</strong>vested <strong>in</strong> securities not listed on a stock<br />

exch<strong>an</strong>ge or dealt <strong>in</strong> on <strong>an</strong>other regulated<br />

market which operates regularly <strong>an</strong>d is<br />

recognised <strong>an</strong>d open to the public;<br />

No more th<strong>an</strong> 10% of the securities of the same<br />

k<strong>in</strong>d issued by the same issu<strong>in</strong>g body may be<br />

acquired; <strong>an</strong>d<br />

No more th<strong>an</strong> 10% of the net assets may be<br />

<strong>in</strong>vested <strong>in</strong> securities issued by the same<br />

issu<strong>in</strong>g body.<br />

These restrictions are not applicable to securities<br />

issued or guar<strong>an</strong>teed by a member state of the OECD<br />

or their local authorities or a public <strong>in</strong>ternational body<br />

with <strong>an</strong> EU, regional or worldwide scope.<br />

Units/shares of closed-ended <strong><strong>in</strong>vestment</strong> <strong>fund</strong>s<br />

are treated <strong>in</strong> the same way as other tr<strong>an</strong>sferable<br />

securities <strong>an</strong>d are therefore subject to the general<br />

rules applicable to tr<strong>an</strong>sferable securities.<br />

UCIs may borrow <strong>up</strong> to 25% of their net assets<br />

(except leveraged UCIs where the <strong><strong>in</strong>vestment</strong> policy<br />

provides for a perm<strong>an</strong>ent borrow<strong>in</strong>g for <strong><strong>in</strong>vestment</strong><br />

purposes of at least 25% of their net assets);<br />

Derogations to Circular 91/75 may be gr<strong>an</strong>ted<br />

on a case-by-case basis;<br />

8