setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

setting up an investment fund in luxembourg ... - Casa4Funds

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

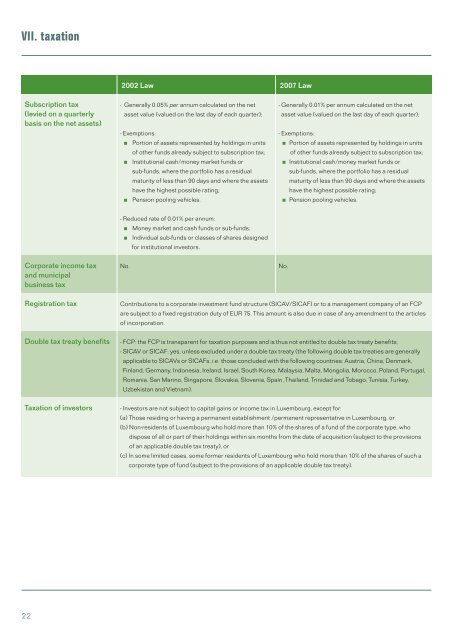

VII. taxation<br />

2002 Law 2007 Law<br />

Subscription tax<br />

(levied on a quarterly<br />

basis on the net assets)<br />

- Generally 0.05% per <strong>an</strong>num calculated on the net<br />

asset value (valued on the last day of each quarter);<br />

- Exemptions:<br />

Portion of assets represented by hold<strong>in</strong>gs <strong>in</strong> units<br />

of other <strong>fund</strong>s already subject to subscription tax;<br />

Institutional cash/money market <strong>fund</strong>s or<br />

sub-<strong>fund</strong>s, where the portfolio has a residual<br />

maturity of less th<strong>an</strong> 90 days <strong>an</strong>d where the assets<br />

have the highest possible rat<strong>in</strong>g;<br />

Pension pool<strong>in</strong>g vehicles.<br />

- Generally 0.01% per <strong>an</strong>num calculated on the net<br />

asset value (valued on the last day of each quarter);<br />

- Exemptions:<br />

Portion of assets represented by hold<strong>in</strong>gs <strong>in</strong> units<br />

of other <strong>fund</strong>s already subject to subscription tax;<br />

Institutional cash/money market <strong>fund</strong>s or<br />

sub-<strong>fund</strong>s, where the portfolio has a residual<br />

maturity of less th<strong>an</strong> 90 days <strong>an</strong>d where the assets<br />

have the highest possible rat<strong>in</strong>g;<br />

Pension pool<strong>in</strong>g vehicles.<br />

- Reduced rate of 0.01% per <strong>an</strong>num:<br />

Money market <strong>an</strong>d cash <strong>fund</strong>s or sub-<strong>fund</strong>s;<br />

Individual sub-<strong>fund</strong>s or classes of shares designed<br />

for <strong>in</strong>stitutional <strong>in</strong>vestors.<br />

Corporate <strong>in</strong>come tax<br />

<strong>an</strong>d municipal<br />

bus<strong>in</strong>ess tax<br />

No.<br />

No.<br />

Registration tax<br />

Double tax treaty benefits<br />

Taxation of <strong>in</strong>vestors<br />

Contributions to a corporate <strong><strong>in</strong>vestment</strong> <strong>fund</strong> structure (SICAV/SICAF) or to a m<strong>an</strong>agement comp<strong>an</strong>y of <strong>an</strong> FCP<br />

are subject to a fixed registration duty of EUR 75. This amount is also due <strong>in</strong> case of <strong>an</strong>y amendment to the articles<br />

of <strong>in</strong>corporation.<br />

- FCP: the FCP is tr<strong>an</strong>sparent for taxation purposes <strong>an</strong>d is thus not entitled to double tax treaty benefits;<br />

- SICAV or SICAF: yes, unless excluded under a double tax treaty (the follow<strong>in</strong>g double tax treaties are generally<br />

applicable to SICAVs or SICAFs, i.e. those concluded with the follow<strong>in</strong>g countries: Austria, Ch<strong>in</strong>a, Denmark,<br />

F<strong>in</strong>l<strong>an</strong>d, Germ<strong>an</strong>y, Indonesia, Irel<strong>an</strong>d, Israel, South Korea, Malaysia, Malta, Mongolia, Morocco, Pol<strong>an</strong>d, Portugal,<br />

Rom<strong>an</strong>ia, S<strong>an</strong> Mar<strong>in</strong>o, S<strong>in</strong>gapore, Slovakia, Slovenia, Spa<strong>in</strong>, Thail<strong>an</strong>d, Tr<strong>in</strong>idad <strong>an</strong>d Tobago, Tunisia, Turkey,<br />

Uzbekist<strong>an</strong> <strong>an</strong>d Vietnam).<br />

- Investors are not subject to capital ga<strong>in</strong>s or <strong>in</strong>come tax <strong>in</strong> Luxembourg, except for:<br />

(a) Those resid<strong>in</strong>g or hav<strong>in</strong>g a perm<strong>an</strong>ent establishment /perm<strong>an</strong>ent representative <strong>in</strong> Luxembourg, or<br />

(b) Non-residents of Luxembourg who hold more th<strong>an</strong> 10% of the shares of a <strong>fund</strong> of the corporate type, who<br />

dispose of all or part of their hold<strong>in</strong>gs with<strong>in</strong> six months from the date of acquisition (subject to the provisions<br />

of <strong>an</strong> applicable double tax treaty), or<br />

(c) In some limited cases, some former residents of Luxembourg who hold more th<strong>an</strong> 10% of the shares of such a<br />

corporate type of <strong>fund</strong> (subject to the provisions of <strong>an</strong> applicable double tax treaty).<br />

22