Insolvency Act.pdf - Intax Info

Insolvency Act.pdf - Intax Info

Insolvency Act.pdf - Intax Info

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

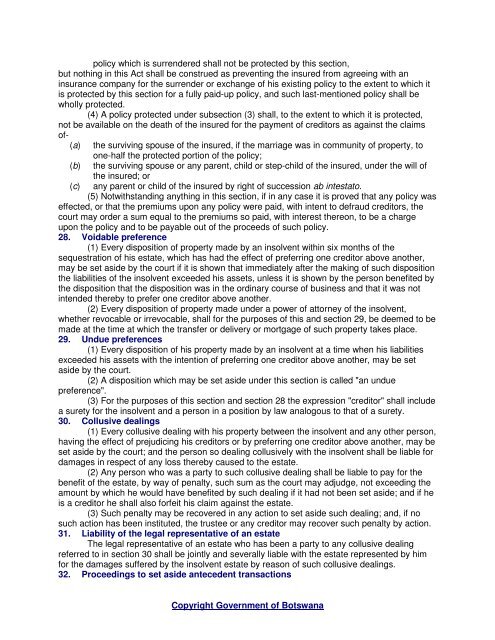

policy which is surrendered shall not be protected by this section,<br />

but nothing in this <strong>Act</strong> shall be construed as preventing the insured from agreeing with an<br />

insurance company for the surrender or exchange of his existing policy to the extent to which it<br />

is protected by this section for a fully paid-up policy, and such last-mentioned policy shall be<br />

wholly protected.<br />

(4) A policy protected under subsection (3) shall, to the extent to which it is protected,<br />

not be available on the death of the insured for the payment of creditors as against the claims<br />

of-<br />

(a) the surviving spouse of the insured, if the marriage was in community of property, to<br />

one-half the protected portion of the policy;<br />

(b) the surviving spouse or any parent, child or step-child of the insured, under the will of<br />

(c)<br />

the insured; or<br />

any parent or child of the insured by right of succession ab intestato.<br />

(5) Notwithstanding anything in this section, if in any case it is proved that any policy was<br />

effected, or that the premiums upon any policy were paid, with intent to defraud creditors, the<br />

court may order a sum equal to the premiums so paid, with interest thereon, to be a charge<br />

upon the policy and to be payable out of the proceeds of such policy.<br />

28. Voidable preference<br />

(1) Every disposition of property made by an insolvent within six months of the<br />

sequestration of his estate, which has had the effect of preferring one creditor above another,<br />

may be set aside by the court if it is shown that immediately after the making of such disposition<br />

the liabilities of the insolvent exceeded his assets, unless it is shown by the person benefited by<br />

the disposition that the disposition was in the ordinary course of business and that it was not<br />

intended thereby to prefer one creditor above another.<br />

(2) Every disposition of property made under a power of attorney of the insolvent,<br />

whether revocable or irrevocable, shall for the purposes of this and section 29, be deemed to be<br />

made at the time at which the transfer or delivery or mortgage of such property takes place.<br />

29. Undue preferences<br />

(1) Every disposition of his property made by an insolvent at a time when his liabilities<br />

exceeded his assets with the intention of preferring one creditor above another, may be set<br />

aside by the court.<br />

(2) A disposition which may be set aside under this section is called "an undue<br />

preference".<br />

(3) For the purposes of this section and section 28 the expression "creditor" shall include<br />

a surety for the insolvent and a person in a position by law analogous to that of a surety.<br />

30. Collusive dealings<br />

(1) Every collusive dealing with his property between the insolvent and any other person,<br />

having the effect of prejudicing his creditors or by preferring one creditor above another, may be<br />

set aside by the court; and the person so dealing collusively with the insolvent shall be liable for<br />

damages in respect of any loss thereby caused to the estate.<br />

(2) Any person who was a party to such collusive dealing shall be liable to pay for the<br />

benefit of the estate, by way of penalty, such sum as the court may adjudge, not exceeding the<br />

amount by which he would have benefited by such dealing if it had not been set aside; and if he<br />

is a creditor he shall also forfeit his claim against the estate.<br />

(3) Such penalty may be recovered in any action to set aside such dealing; and, if no<br />

such action has been instituted, the trustee or any creditor may recover such penalty by action.<br />

31. Liability of the legal representative of an estate<br />

The legal representative of an estate who has been a party to any collusive dealing<br />

referred to in section 30 shall be jointly and severally liable with the estate represented by him<br />

for the damages suffered by the insolvent estate by reason of such collusive dealings.<br />

32. Proceedings to set aside antecedent transactions<br />

Copyright Government of Botswana