tariff of fees for services of banca intesa ad beograd (revised text)

tariff of fees for services of banca intesa ad beograd (revised text)

tariff of fees for services of banca intesa ad beograd (revised text)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Date <strong>of</strong> publication: 27/06/2012<br />

Date <strong>of</strong> application: 13/07/2012<br />

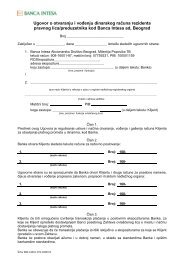

TARIFF OF FEES FOR SERVICES OF<br />

BANCA INTESA AD BEOGRAD<br />

(REVISED TEXT)<br />

Banca Intesa <strong>ad</strong> Beogr<strong>ad</strong><br />

Milentija Popovića 7b, 11070 Novi Beogr<strong>ad</strong>; call center: +381 (011) 310 88 88; www.<strong>banca</strong><strong>intesa</strong>.rs; tekući račun: 908-16001-87

GENERAL PROVISIONS<br />

Fees shall be collected <strong>for</strong> the <strong>services</strong> Banca Intesa <strong>ad</strong> Beogr<strong>ad</strong> (hereinafter: the Bank) provides in the<br />

country and abro<strong>ad</strong> on the basis <strong>of</strong> banking operations, the level <strong>of</strong> which shall be determined in<br />

accordance with market business conditions, as well as depending on the transaction risk level, <strong>for</strong> the<br />

purpose <strong>of</strong> covering actual expenses <strong>of</strong> per<strong>for</strong>med banking <strong>services</strong> and realized income on that basis.<br />

Tariff Service type Tariff line level<br />

Line<br />

No.<br />

1 2 3<br />

SADRŽAJ:<br />

1. DOMESTIC OPERATIONS FOR LEGAL ENTITIES ........................................................................................... 3<br />

2. INTERNATIONAL PAYMENTS FOR CORPORATE ........................................................................................... 5<br />

3. GUARANTEE AND DOCUMENTARY OPERATIONS, FINANCIAL INSTITUTIONS AND ECONOMIC<br />

PRODUCTS .......................................................................................................................................................... 7<br />

4. LOANS ................................................................................................................................................................ 10<br />

5. FEES FOR OTHER OPERATIONS.................................................................................................................... 11<br />

6. BROKER OPERATIONS .................................................................................................................................... 12<br />

7. RETAIL FEES ..................................................................................................................................................... 13<br />

8. ELECTRONIC BANKING FOR INDIVIDUALS .................................................................................................. 16<br />

9. PAYMENT CARDS ............................................................................................................................................. 17<br />

PAYMENT CARDS FOR RETAIL ...................................................................................................................... 17<br />

FEES ................................................................................................................................................................... 19<br />

TRANSACTION PROCESSING EXPENSES .................................................................................................... 19<br />

PAYMENT CARDS FOR LEGAL ENTITIES ..................................................................................................... 21<br />

FEES ................................................................................................................................................................... 21<br />

COSTS OF THE TRANSACTIONS’ PROCESSING.......................................................................................... 21<br />

E-COMMERCE ISSUING MEMBERSHIP FEES ............................................................................................... 22<br />

ACCEPTING PAYMENT CARDS ON POS TERMINALS ................................................................................. 22<br />

10. SAFE-DEPOSIT-BOXES .................................................................................................................................... 23<br />

11. OTHER PROVISIONS ........................................................................................................................................ 24<br />

2

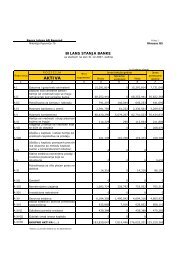

1. Domestic operations <strong>for</strong> Legal entities<br />

1.1. Non-cash payment operations<br />

Order type<br />

A<br />

Internal<br />

orders<br />

B<br />

Clearing<br />

orders<br />

be<strong>for</strong>e 1:00<br />

p.m. 1)<br />

D<br />

C<br />

RTGS<br />

Clearing<br />

orders<br />

orders after<br />

1:00 p.m. 2) be<strong>for</strong>e1:00<br />

p.m. 1)<br />

E<br />

RTGS<br />

orders after<br />

1:00 p.m. 2)<br />

Transfer and collection Min. RSD 15 RSD 25 RSD 35 RSD 45 RSD 80<br />

1.1.1. orders<br />

% <strong>of</strong> the order 0.050% 0.090% 0.100% 0.100% 0.110%<br />

Max. RSD 1.000 RSD 4.000 RSD 6.000<br />

1.1.2. Orders crediting the Bank's account 50% cheaper than the rate in paragraph 1.1.1 3)<br />

1.1.3.<br />

Orders created through the use <strong>of</strong> VISA Business<br />

Electron payment card<br />

40% cheaper than the rate in paragraph 1.1.1 3)<br />

1.1.4. Electronic orders (in house s<strong>of</strong>tware)<br />

A. internal orders fix RSD 15; order than the B.; C.; D.; E.<br />

40% cheaper than the rate in paragraph 1.1.1 3)<br />

1.1.5. Electronic orders (through intermediary service centers) 20% cheaper than the rate in paragraph 1.1.1 3)<br />

1.1.6.<br />

Electronic orders crediting individuals’ current accounts<br />

in BIB<br />

No fee<br />

1.1.7.<br />

Internal orders between the accounts <strong>of</strong> the same legal<br />

person<br />

No fee<br />

1.1.8. Orders initiated by SWIFT message MT101 4) 20% cheaper than the rate in paragraph 1.1.1 3)<br />

1) Orders received be<strong>for</strong>e 13,00 p.m, processed until 14,00 p.m.<br />

2) Orders received after 13,00 p.m, processed until 16,00 p.m.<br />

3) The discount is not calculated <strong>for</strong> the minimal amounts <strong>of</strong> the commission.<br />

4) Fee will be aplicable upon implementation <strong>of</strong> SWIFT MT101 service<br />

1.2. Cash payment operations<br />

1.2.1. Deposits on the bank account Min. Max.<br />

1.2.1.1.<br />

Deposits crediting the account that h<strong>ad</strong> total deposits <strong>of</strong> > RSD 1,000,000.00 in the<br />

previous month<br />

RSD 25 0.1%<br />

1.2.1.2.<br />

Deposits crediting the account that h<strong>ad</strong> total deposits <strong>of</strong> > RSD 5,000,000.00 in the<br />

previous month<br />

RSD 25 0.06%<br />

1.2.1.3.<br />

Deposits crediting the account that h<strong>ad</strong> total deposits <strong>of</strong> > RSD 10,000,000.00 in the<br />

previous month<br />

RSD 25 0.03%<br />

1.2.1.4. Deposits on the account in another bank RSD 25 per order<br />

1.2.1.5. Withdrawals RSD 30 0.3%<br />

1.2.2. Withdrawals in coins RSD 25 0.5%<br />

1.2.2.1. Withdrawals on the Bank ATMs using ISA business electron payment cards RSD 50 1%<br />

1.2.2.2. Withdrawals on the ATMs <strong>of</strong> another banks by using VISA business payment cards<br />

40% cheaper than the rate para<br />

1.2.2<br />

1.2.2.3. POS terminal withdrawals RSD 60 2%<br />

1.2.2.4. Change <strong>of</strong> effective <strong>for</strong>eign currency <strong>for</strong> smaller or bigger denominations RSD 60 2%<br />

1.2.2.5. Change <strong>of</strong> the damaged <strong>for</strong>eign currency banknotes RSD 80 0.5%<br />

1.2.2.6. Deposits on the bank account RSD 10 2%<br />

3

1.3. Other <strong>fees</strong><br />

1.3.1.<br />

1.3.2.<br />

1.3.3.<br />

Account<br />

maintenance<br />

Certificate<br />

issuance<br />

Fees on E-<br />

banking<br />

RSD 5.000<br />

(supplement<br />

card)<br />

1 - 3 change per month RSD 195 per month<br />

4 - 20 change per month RSD 295 per month<br />

21 - 100 change per month RSD 395 per month<br />

Over 100 change per month<br />

RSD 495 per month<br />

Issuance <strong>of</strong> archive statement<br />

RSD 100 + RSD 20 per page<br />

Certificate issuance upon special request <strong>of</strong> the client RSD 1.000<br />

Final order execution certificate issuance RSD 100<br />

Electronic service in house s<strong>of</strong>tware activation RSD 2.000<br />

Electronic service through intermediary service centres<br />

(Halkom) activation<br />

RSD 8.000 (re<strong>ad</strong>er and card)<br />

Utilization <strong>of</strong> Electronic service in house s<strong>of</strong>tware<br />

No fee<br />

Utilization <strong>of</strong> Electronic service through intermediary service<br />

centers<br />

RSD 1.000 per month<br />

Replacement <strong>of</strong> damaged smart card or card destroying fee RSD 2.000<br />

1.3.4. Withdrawal <strong>of</strong> the collection basis RSD 1.000 per basis<br />

1.3.5. Account closing at client's request RSD 100<br />

1.3.6. Fees on SMS banking – SMS request<br />

1.3.6.1. For TELENOR network users RSD 7.08<br />

1.3.6.2. For MTS network users RSD 7.08<br />

1.3.6.3. For VIP network users RSD 7.08<br />

1.3.7. Charges <strong>for</strong> registration <strong>of</strong> Bills <strong>of</strong> Exchange and Direct-Debit Authorizations<br />

1.3.7.1. Fee <strong>for</strong> registration/discharge <strong>of</strong> Bills/Authorizations, received on Banks counter RSD 50 billsi/dda<br />

1.3.7.2. Fee <strong>for</strong> registration <strong>of</strong> Bills received electronically via In-House solution RSD 10<br />

1.3.7.3.<br />

Fee <strong>for</strong> registration / deregistration <strong>of</strong> Bills <strong>of</strong> exchange / direct debit authorization<br />

where the bank is a payee, and <strong>for</strong> deregistration <strong>of</strong> the bills <strong>of</strong> exchange / direct No fee<br />

debit authorization which are en<strong>for</strong>ced <strong>for</strong> the account <strong>of</strong> the borrower in the Bank<br />

* Tariff rate calculation and collection <strong>for</strong> domestic payment operations is effected every 10th, 20th and last day in a month (except <strong>for</strong> the <strong>fees</strong> marked<br />

as monthly or upon request)<br />

4

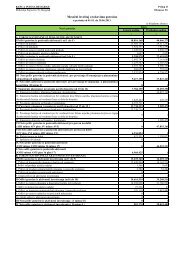

2. International payments <strong>for</strong> corporate<br />

2.1. Remittances<br />

Min. % amount Max.<br />

2.1. 1 Nostro remittances From F/X accounts RSD 1.000 0,2% RSD 40.000<br />

2.1.2<br />

Nostro remittances submitted by e-mail or by SWIFT message<br />

MT101*<br />

10% discount on <strong>tariff</strong> rate 2.1.1.<br />

Nostro remittances (payments from Order up to 50,000.00 € RSD 1,000 From 0.08% to 3%<br />

the account <strong>of</strong> purchased fx money),<br />

sales <strong>of</strong> fx money from bank’s<br />

potentials <strong>for</strong> inter-bank transfers in<br />

2.1.3<br />

the country and sales <strong>of</strong> fx money<br />

Order over 50,000.00 € Tariff rate is subject to the agreement<br />

from bank’s potentials intended <strong>for</strong><br />

settlement <strong>of</strong> liabilities <strong>for</strong> loans and<br />

L/Cs<br />

2.1.4<br />

Nostro remittances on the order <strong>of</strong> domestic Legal entities in<br />

the currencies that are not the subject <strong>of</strong> purchase and sale on Up to 3%<br />

the inter-bank <strong>for</strong>eign exchange market<br />

2.1.5<br />

Nostro remittances in favor <strong>of</strong> non-resident accounts in the<br />

Bank<br />

RSD 500<br />

2.1.6<br />

Nostro remittances in RSD in favor <strong>of</strong> clients <strong>of</strong> other<br />

domestic banks<br />

RSD 800 0.4% RSD 60.000<br />

2.1.7<br />

Clients who effect more remittances at the same time, in favour <strong>of</strong> the same <strong>for</strong>eign partner, the fee shall be<br />

calculated according to the total amount <strong>of</strong> remittances<br />

2.1.8<br />

Inquires and requests <strong>for</strong> cancellation or amendment <strong>of</strong><br />

payments. Corrections and amendments <strong>of</strong> faulty orders RSD 2.500 + actual <strong>for</strong>eign bank expenses<br />

submitted by SWIFT message MT101*.<br />

2.1.9 EUR nostro remittances with charging options OUR<br />

2.1.9.1. Up to 5.000,00 RSD 1.150<br />

2.1.9.2. 5.000,01 - 12.500,00 RSD 1.500<br />

2.1.9.3. 12.500,01 - 50.000,00 RSD 2.300<br />

2.1.9.4. Above 50.000,01 RSD 4.000<br />

2.1.10 Other FX nostro remittances with charging options OUR RSD 1.800<br />

2.2. Loro remittances<br />

Min. % amount Max.<br />

2.2.1. Remittances from abro<strong>ad</strong> (loro) No fee<br />

2.2.2.<br />

Loro remittances from Kosovo and Metohija (pay out in rsd<br />

0.1%<br />

RSD 800<br />

counter value prior to the due date <strong>of</strong> payment from the NBS)<br />

0.2%<br />

2.2.3.<br />

Loro remittances on the basis <strong>of</strong> inflows from non-resident<br />

accounts in RSD<br />

RSD 800 0,05% RSD 50.000<br />

2.2.4. Conditional remittances<br />

2.2.4.1. Conditional payments up to EUR 250.000 RSD 2.000 0,3% RSD 50.000<br />

2.2.4.2. Conditional payments from EUR 250.000,01 to 500.000 0,25% RSD 75.000<br />

2.2.4.3. Conditional payments over EUR 500.000 0,20% RSD 125.000<br />

2.2.5. Collection <strong>of</strong> <strong>for</strong>eign cheques 1,5 % + actual <strong>for</strong>eign bank expenses<br />

2.3. Transfers<br />

Min. % amount Max.<br />

2.3.1. Inter-bank transfers in the country drawn from FX accounts RSD 1.500 0,3% RSD 60.000<br />

2.3.1.1. Transfers from the life insurance accounts within Bank RSD 300<br />

2.3.2. Purchase, sale and lease <strong>of</strong> real estates<br />

2.3.2.1. Transfers <strong>for</strong> purchase, sale and lease within BiB RSD 800 0,1% RSD 8.000<br />

2.3.2.2. Transfers <strong>for</strong> purchase, sale and lease to other domestic banks. RSD 1.500 0,2% RSD 16.000<br />

2.3.3.<br />

Inquires and requests <strong>for</strong> reimbursement or amendment <strong>of</strong><br />

transfers<br />

RSD 2.500<br />

2.4. Cash money and business trip expenses<br />

Min. % amount Max.<br />

2.4.1. Withdrawal <strong>of</strong> cash money as <strong>ad</strong>vance <strong>for</strong> business trip RSD 800 0.3%<br />

2.4.2. Final calculation related to business trip – transfer within BIB RSD 400 0.15%<br />

2.4.3.<br />

Final calculation related to business trip – transfer to other<br />

domestic bank<br />

RSD 800 0.3%<br />

2.4.4. Placement <strong>of</strong> effective money on account RSD 500 0,2% RSD 20.000<br />

2.4.5.<br />

Placement <strong>of</strong> effective money <strong>for</strong> capital increase and<br />

founding investment<br />

RSD 800 0.2%<br />

5

2.5. Non-residents<br />

Min. % amount Max.<br />

2.5.1. Opening <strong>of</strong> accounts No fee<br />

2.5.2. Opening and keeping <strong>of</strong> earmarked fx accounts RSD 5.000<br />

RSD 500 0,2% RSD 20.000 RSD 20.000<br />

Effective money<br />

2.5.3.<br />

RSD 800 0.3%<br />

RSD 800 0,1%<br />

2.5.4. Nostro remittance abro<strong>ad</strong> RSD 1000 0,2% RSD 40.000<br />

2.5.5. Loro remittance from abro<strong>ad</strong> No fee<br />

2.5.6. RSD payments in the country up to RSD 10.000,00 RSD 500<br />

2.5.7. RSD payments in the country over RSD 10.000,00 RSD 1.000 0,15% RSD 50.000<br />

2.5.8.<br />

Payments and transfers in <strong>for</strong>eign currency in favor <strong>of</strong> clients <strong>of</strong><br />

other domestic banks<br />

RSD 1.500 0,3% RSD 80.000<br />

2.5.9. Money transfer within the bank RSD 1.000<br />

2.6. Embassies<br />

Min. % amount Max.<br />

2.6.1. Opening and keeping <strong>of</strong> accounts No fee<br />

Placement <strong>of</strong> cash money RSD 500 0,1% RSD 20.000<br />

Effective money Withdrawal <strong>of</strong> cash money in <strong>for</strong>eign currency RSD 500 0,2%<br />

2.6.2.<br />

Withdrawal <strong>of</strong> cash money in RSD (limit<br />

RSD 500 0,1%<br />

100.000 RSD)<br />

2.6.3. International payments RSD 800 0,15% RSD 40.000<br />

2.6.4. Loro remittance from abro<strong>ad</strong> No fee<br />

2.6.5. Domestic payments<br />

2.6.5.1. Payments in favor <strong>of</strong> bank clients RSD 800<br />

2.6.5.2. RSD payments in favor <strong>of</strong> clients <strong>of</strong> another domestic bank RSD 800 0,15% RSD 50.000<br />

2.6.5.3.<br />

Payments and transfers in <strong>for</strong>eign currency in favor <strong>of</strong> clients <strong>of</strong> other<br />

domestic banks<br />

RSD 1.000 0,2% RSD 60.000<br />

2.7. Tariff rate <strong>for</strong> banks<br />

Min. % <strong>of</strong> amount Max.<br />

2.7.1.<br />

Incoming payments received from <strong>for</strong>eign banks with charging<br />

option „OUR<br />

5 € 0,1% 100 €<br />

2.7.2.<br />

Incoming payments from domestic banks with charging option<br />

„OUR“<br />

RSD 1.000 0,1% RSD 8.000<br />

2.7.3.<br />

Inquires, amendments and requests <strong>for</strong> cancellation received<br />

from <strong>for</strong>eign banks.<br />

25 €<br />

2.7.4.<br />

Inquires, amendments and requests <strong>for</strong> cancellation received<br />

from domestic banks<br />

RSD 2.500<br />

2.7.5.<br />

Transfer <strong>of</strong> incoming payment in favor <strong>of</strong> legal entity, client <strong>of</strong><br />

another domestic bank<br />

RSD 1.000 0,1% RSD 8.000<br />

2.7.6. Transfers by order <strong>of</strong> domestic banks RSD 1.000<br />

2.7.7.<br />

Transfer <strong>of</strong> incoming payment in favor <strong>of</strong> private individual,<br />

client <strong>of</strong> another domestic bank<br />

RSD 200 0.1% RSD 8.000<br />

2.8. Other operations<br />

2.8.1. Sending <strong>of</strong> Swift MT 940 <strong>for</strong> client’s account RSD 2.000 per month<br />

2.8.2. Sending <strong>of</strong> Swift order copy upon client’s request RSD 300<br />

2.8.3. Issuance <strong>of</strong> confirmations upon client’s request RSD 1.000<br />

2.8.4. Sending <strong>of</strong> statements copy upon client’s request RSD 200<br />

2.8.5.<br />

Sale <strong>of</strong> <strong>for</strong>eign currency from bank’s potentials <strong>for</strong> the settlement<br />

<strong>of</strong> liabilities in relation to the credit cards<br />

0.2%<br />

2.8.6.<br />

Sale <strong>of</strong> <strong>for</strong>eign currency from bank’s potentials <strong>for</strong> the settlement<br />

<strong>of</strong> liabilities in relation to the fx loan<br />

0.2%<br />

2.8.7. Activation <strong>of</strong> MT101* RSD 6.000<br />

2.8.8. Receipt <strong>of</strong> Swift MT101 messages per account* RSD 2.000 per month<br />

*Tariff items marked by * will be applicable upon implementation <strong>of</strong> MT101 service.<br />

6

3. Guarantee and documentary operations, financial institutions and economic<br />

products<br />

3.1. Documentary collection (collection operations)<br />

SB SME L<br />

Min. % from amount Max.<br />

3.1.1. Sending documents <strong>for</strong> collection RSD 5.000 0.2% RSD 60.000<br />

3.1.2. Receipt <strong>of</strong> documents on collection basis RSD 5.000 0.2% RSD 90.000<br />

3.1.3. Document delivery without payment RSD 5.000<br />

3.1.4. Obtaining acceptance RSD 5.000 0.2%<br />

3.1.5. Amendment <strong>of</strong> collection intructions RSD 5.000<br />

3.1.6. Collection with protest <strong>of</strong> bills<br />

RSD 5.000 +<br />

protest costs<br />

0.3%<br />

3.1.7. Collection <strong>of</strong> other securities RSD 4.000 0.2%<br />

3.1.8. Mail handling fee<br />

3.2. Documentary letters <strong>of</strong> credit<br />

SB SME L<br />

Min. % from amount Max.<br />

3.2.1. Import (nostro) L/Cs<br />

3.2.1.1. L/C application processing fee RSD 5.000 0.15% RSD 70.000<br />

3.2.1.2. Opening irrevocable covered L/C RSD 5.000 0.3% 0.3% 0.2%<br />

3.2.1.3. Opening irrevocable uncovered L/C RSD 7.000 0.6% 0.5% 0.4%<br />

3.2.1.4. Opening standby L/C<br />

the fee shall be calculated as in the case <strong>of</strong> guarantee<br />

operations (according to Tariff Line 3.3)<br />

3.2.2. Changing the L/C conditions<br />

3.2.2.1. Increasing the L/C am the fee shall be calculated according to Tariff Line 3.2.1<br />

3.2.2.2. Increasing the L/C amount or validity period RSD 5.000<br />

3.2.3. Other changes* RSD 5.000 0.25% per document set<br />

3.2.4. Checking <strong>of</strong> Documents* 100 eur per document set<br />

3.2.5. Documents accepted with discrepancies the fee shall be calculated according to Tariff Line 2.1.2<br />

3.2.6. L/C settlement 0.50%<br />

3.2.7. Obtaining L/C confirmation** RSD 5.000 0,2%<br />

3.2.8. Export (loro) L/Cs<br />

3.2.8.1. Notification * RSD 5.000 0,10% RSD 100.000<br />

3.2.9. Changing the conditions<br />

3.2.9.1. Increasing the value<br />

the fee shall be calculated according to Tariff Line 3.2.8.1 +<br />

RSD 5,000.00 fixed<br />

3.2.9.2. Other changes* RSD 5.000<br />

3.2.10. Document review* RSD 7.000 0.25% per document set<br />

3.2.11. Sending documents without checking* RSD 5.000 0.15% RSD 60.000<br />

3.2.12. Confirmation * RSD 11.000 0,75%<br />

3.2.13. Transferring L/C to another client* RSD 7.000 0,35%<br />

3.2.14. „Prechecking“* RSD 7.000 0,2%<br />

3.2.15. For L/C collection the fee shall be calculated according to Tariff Line 2.1.3<br />

3.2.16. Other<br />

3.2.16.1. Other consulting <strong>services</strong> depending on the time spent with the client - min. RSD 5.000<br />

3.2.16.2. Translation <strong>services</strong> RSD 1.000 per page<br />

3.2.16.3. Urgent requests (execution within 24h) RSD 5.000<br />

3.2.16.4. SWIFT charges RSD 600<br />

3.2.16.5. Cancellation <strong>of</strong> the letter <strong>of</strong> credit*** RSD 10.000<br />

3.3. Nostro RSD and FX guarantees and bill guarantees (in domestic payment<br />

operations)<br />

3.3.1. Application processing fee<br />

SB SME L<br />

Min. % from amount Max.<br />

3.3.1.1. FX guarantees RSD 5.000 0,15% RSD 60.000<br />

3.3.1.2.<br />

RSD guarantees and bill guarantee in domestic<br />

payment operations*<br />

RSD 1.500 0,1% RSD 15.000<br />

3.3.2. Tender guarantee<br />

3.3.2.1. Issuing 100% covered guarantee<br />

3.3.2.1.1. FX guarantees* RSD 5.000 0.5% 0.3% 0.2%<br />

7

3.3.2.1.2. RSD guarantees* RSD 1.500 0.8% 0.3% 0.2%<br />

3.3.2.2. Issuing uncovered guarantee<br />

3.3.2.2.1. FX guarantees* RSD 5.000 1% 0.8% 0.5%<br />

3.3.2.2.2. RSD guarantees* RSD 3.000 1% 0.8% 0.5%<br />

3.3.3. Other guarantees<br />

3.3.3.1. Issuing 100% covered guarantee<br />

3.3.3.1.1. FX guarantees** RSD 5.000 0.5% 0.35% 0.25%<br />

3.3.3.1.2. RSD guarantees** RSD 1.500 0.4% 0.3% 0.2%<br />

3.3.3.2. Issuing uncovered guarantee<br />

3.3.3.2.1. FX guarantees** RSD 5.000 0.8% 0.7% 0.6%<br />

3.3.3.2.2. RSD guarantees** RSD 3.000 0.8% 0.5% 0.5%<br />

3.3.4.<br />

Bill guaranteeing (avals) in domestic payment<br />

operations<br />

3.3.4.1. Uncovered** RSD 5.000 0.8% 0.8% 0.75%<br />

3.3.4.2. 100% covered** RSD 2.000 0.5%<br />

3.3.5.<br />

Issuing counter guarantee, with commission,<br />

according to the Tariff lines <strong>for</strong> the issuing<br />

0.5%<br />

guarantees shall be charged <strong>ad</strong>ditionally**<br />

3.3.6. Changing guarantee conditions<br />

3.3.6.1. Increasing guarantee value*<br />

The fee shall be calculated according to Tariff Line <strong>for</strong><br />

guarantee issuance (depending on the type <strong>of</strong> guarantee)+<br />

request processing fee according to Tariff Line3.3.1<br />

3.3.6.2. Changing other guarantee conditions*<br />

RSD 5.000+ request processing fee according to Tariff<br />

Line3.3.1<br />

3.3.6.3. Guarantee transfer to new beneficiary* 2%<br />

3.3.7.<br />

Documentation checking upon protesting nostro<br />

guarantee<br />

3.3.7.1. FX guarantees* RSD 5.000 0,1%<br />

3.3.7.2. RSD guarantees*<br />

<strong>of</strong> the amount<br />

protested<br />

RSD 60.000<br />

3.3.8.<br />

Consulting <strong>services</strong> (preparation <strong>of</strong> draft guarantee<br />

<strong>text</strong>, analysis <strong>of</strong> commercial agreement and other)*<br />

RSD 3.000<br />

3.3.9. Translation <strong>services</strong> on clients request* <strong>of</strong> the amount protested<br />

3.3.10. Urgent requests (execution within 24h)* depending on the time spent with the client - min. RSD 5,000.00<br />

3.3.11.<br />

Providing statements and certificates along with<br />

guarantees and/or providing letters <strong>of</strong> intent <strong>for</strong> RSD 1.000 per page<br />

guarantees<br />

3.3.11.1. FX guarantees* RSD 5.000<br />

3.3.11.2. RSD guarantees*<br />

3.3.12. SWIFT charges* RSD 7.000<br />

3.3.13. Cancellation <strong>of</strong> the fx guarantee *** RSD 5.000<br />

3.3.14.<br />

Authentication <strong>of</strong> signatures on the guarantees and<br />

documents related to the guarantees sent directly to RSD 600<br />

the client*<br />

Note:<br />

*One-<strong>of</strong>f collection.<br />

** Collection on a quarter basis. Every beginning <strong>of</strong> the quarter period shall be calculated as a whole period. If the maturity in the last quarter (except <strong>for</strong><br />

liabilities lasting only one quarter) is shorter than 30 days the fee shall be calculated <strong>for</strong> 1/3 <strong>of</strong> the quarter.<br />

*** Charged in case that the client is provided with the draft <strong>of</strong> the lc <strong>of</strong> fx lg andbut the lc or fx lg has never been issued through Banca <strong>intesa</strong> Beogr<strong>ad</strong>:<br />

Note: Actual costs shall be charged against all operations, including <strong>for</strong>eign Bank confirmation costs. .<br />

All fee related to L/Cs and inkaso operations shall be calculated when executing orders, and collected 5 days after the date <strong>of</strong> calculation. .<br />

Fee related to nostro L/Cs calculated quarterly shall be collected at the beginning <strong>of</strong> each quarter. .<br />

In cases when L/C has been used –partially or as entirety <strong>for</strong> any reason, the collected fee shall not be returned.<br />

As <strong>for</strong> L/Cs with deferred payment fee shall be calculated till the maturity date.<br />

8

3.4. Loro guarantees<br />

Min. % from amount Max.<br />

3.4.1.<br />

0.1% <strong>of</strong> the guarantee value, min RSD 5,000<br />

Notification i change notification if the guarantee<br />

(EUR 50 if at the originator's expense)<br />

value increases<br />

max. 60,000 (EUR 500 if at the originator's expense)<br />

3.4.2. Change notification - other changes RSD 4.000(EUR 35 if at the originator's expense)<br />

3.4.3. Forwarding to another bank RSD 5.000(EUR 50 if at the originator's expense)<br />

3.4.4. Protest (preparation and realization) RSD 5.000 0,2% <strong>of</strong> the amount protested RSD 5.000<br />

3.4.5. SWIFT charges RSD 600<br />

3.4.6.<br />

Issuing guarantee on the basis <strong>of</strong> <strong>for</strong>eign bank<br />

counter guarantee<br />

3.5. Rate <strong>for</strong> <strong>for</strong>eign banks (loro accounts)<br />

Up to 2% p.a. <strong>of</strong> the guarantee value min RSD 11,000 (EUR<br />

100 if at the expense <strong>of</strong> the <strong>for</strong>eign bank / originator)<br />

Min. % <strong>of</strong> amount Max.<br />

3.5.1. Account maintenance<br />

3.5.1.1.<br />

Account balance certificate at <strong>for</strong>eign bank request, in<br />

<strong>ad</strong>dition to regular notification<br />

50 €<br />

3.5.1.2. Replies to inquiries on account debit/credit:<br />

3.5.1.2.1. Older than 3 months 50 €<br />

3.5.1.2.2. Older than 12 months 100 €<br />

3.5.2. Payments in favor <strong>of</strong> financial institutions 5,00 €<br />

3.5.3.<br />

Payments in favor <strong>of</strong> other persons where it is stated<br />

that the originator bears expenses (OUR)<br />

5 € 0.1% 100 EUR<br />

* The Bank may charge an account in case the Bank <strong>of</strong> the funds beneficiary or its intermediary bank sends a request <strong>for</strong> collection <strong>of</strong> their expenses.<br />

In case <strong>of</strong> RSD payments, the account shall be charged also <strong>for</strong> the amount <strong>of</strong> tax <strong>for</strong> certain transactions in accordance with the Law on Payment<br />

Operations.<br />

3.5.4.<br />

Request <strong>for</strong> payment order revocation after its<br />

execution<br />

50 €<br />

3.5.5. Changes after the payment has been executed 50 €<br />

* The <strong>fees</strong> shall be charged in the currency in which the account is maintained and shall represent equivalents <strong>of</strong> the <strong>fees</strong> expressed in EUR.<br />

3.6. Other operations<br />

3.6.1.<br />

Authentication <strong>of</strong> signatures on the documents sent<br />

directly to the client<br />

RSD 5.000<br />

3.6.2.<br />

Authentication <strong>of</strong> client’s signatures at <strong>for</strong>eign bank<br />

request<br />

40 €<br />

3.6.3. Issuing opinion on <strong>for</strong>eign bank solvency RSD 3.000<br />

3.6.4.<br />

Issuing opinion on client solvency at <strong>for</strong>eign bank<br />

request<br />

50 €<br />

3.6.5. Issuing certificates at client request RSD 4.000<br />

3.6.6. Issuing certificate at non-client request RSD 6.000<br />

3.6.7. Sending SWIFT order copies at client request RSD 500<br />

3.6.8. Research expenses (data and in<strong>for</strong>mation collection) RSD 3.000<br />

* Note:<br />

The fee <strong>for</strong> per<strong>for</strong>ming the operations mentioned in Tariff Line 3.6. in concrete case shall be determined depending on the time spent with the client.<br />

Special provisions:<br />

Besides the fee, the Bank shall also collect actual telecommunication expenses as well as the expenses <strong>of</strong> <strong>for</strong>eign banks.<br />

9

4. Loans<br />

4.1. Loans <strong>for</strong> Legal entities<br />

SB<br />

SME i L<br />

For short-term loans:0%-<br />

2%<br />

For short-term loans:0.5%,min<br />

RSD1.000(<strong>for</strong> RSD loans);min<br />

4.1.1. Fee <strong>for</strong> processing and realization <strong>of</strong> loan application *<br />

EUR 20(<strong>for</strong> fx loans)<br />

For long-term loans: 0%- For long-term loans: 1%,min<br />

3%, min EUR 15 FOR<br />

100% SECURED LOANS)<br />

RSD5.000(<strong>for</strong> RSD loans);min<br />

EUR 100(<strong>for</strong> fx loans)<br />

4.1.2. Fee <strong>for</strong> processing request <strong>for</strong> changing loan conditions<br />

In case <strong>of</strong> increased loan amount the <strong>tariff</strong> rate as in 4.1.1,and<br />

<strong>for</strong> other changes RSD 4.000 fixed<br />

4.1.3.<br />

Commission <strong>for</strong> unused part <strong>of</strong> the loan - commitment<br />

fee (only <strong>for</strong> long-term loans)*<br />

Up to 0.5% p.a. <strong>for</strong> the unused portion<br />

4.1.4. Fee <strong>for</strong> early loan repayment-(only <strong>for</strong> long-term loans)* Up to 2% on the amount repaid early<br />

4.1.5. Monitoring fee *<br />

1% per annum (at the beginning <strong>of</strong> the business year on the<br />

amount <strong>of</strong> debt balance)<br />

4.2. Project and special finance**<br />

4.2.1. Fee <strong>for</strong> processing and realization <strong>of</strong> loan application<br />

do 1%<br />

min RSD 5.000 (za RSD loans);<br />

min EUR 100,00 (<strong>for</strong> fx loans)<br />

4.2.2. Fee <strong>for</strong> processing request <strong>for</strong> changing loan conditions<br />

In case <strong>of</strong> increased loan amount the <strong>tariff</strong> rate as in 4.2.1,and<br />

<strong>for</strong> other changes RSD 4.000 fixed<br />

4.2.3. Commitment fee Up to 2% p.a. <strong>for</strong> the unutilized portion<br />

4.2.4. Prepaymet fee Up to 2% on the prepaid amount<br />

4.2.5. Monitoring fee Up to 1% p.a.<br />

4.2.6. Arrangement fee Up to 1%<br />

4.2.7. Security agent fee Up to 0,5%<br />

4.2.8. Risk participation fee By arrangement<br />

Note: Fees <strong>for</strong> standard products are defined while creating credit products.<br />

*Only in case it is defined as a requirement by the decision <strong>of</strong> the competent decision-making body<br />

** For each actual project / special financing the particular fee and pct <strong>of</strong> the fee within the given range as well as the manner <strong>of</strong> calculating <strong>of</strong> the same<br />

shall be determined<br />

10

5. Fees <strong>for</strong> other operations<br />

5.1.1.<br />

Expert opinions on the investment loan studies given by experts<br />

engaged outside the Bank<br />

actual expenses<br />

5.1.2.<br />

Commission operations in usage and repayment <strong>for</strong> which the interest is charged in the amount <strong>of</strong> 4 perc. points<br />

Bank per<strong>for</strong>ms <strong>services</strong> <strong>for</strong> account <strong>of</strong> clients<br />

increased by the VAT<br />

5.1.3. Preparation <strong>of</strong> daily statements <strong>of</strong> account No fee<br />

5.1.4. Taking measures against debtor and guarantor in default RSD 100 per warning letter<br />

5.1.5. Protest, complaint, execution and other measures actual expenses<br />

5.1.6.<br />

Executing decisions <strong>of</strong> commercial and other courts and orders <strong>of</strong><br />

other authorities <strong>for</strong> claim collection<br />

actual expenses<br />

5.1.7. Fee <strong>for</strong> assessment and check <strong>of</strong> investment projects<br />

actual expenses, or according to the criteria<br />

determined by the Credit committee<br />

5.1.8.<br />

Various <strong>services</strong> to clients (service <strong>for</strong> financial and accounting<br />

operations on the basis <strong>of</strong> loans and other)<br />

according to the agreement<br />

5.1.9.<br />

Settling sales agreement certificates arriving from the Central 0.20% on the market value <strong>of</strong> sales agreement<br />

Securities Registry, Depository and Clearing House<br />

certificates<br />

5.1.10.<br />

5.1.11.<br />

5.1.11.1.<br />

5.1.11.2.<br />

5.1.11.3.<br />

5.1.11.4.<br />

5.1.12.<br />

Settling sales agreement certificates arriving from the Central<br />

Securities Registry, Depository and Clearing House <strong>for</strong> the clients <strong>of</strong><br />

the Brokerage Dealing Unit<br />

0.1% on the market value <strong>of</strong> sales agreement<br />

certificates<br />

Registration <strong>of</strong> international credit operations (<strong>for</strong>eign borrowing transaction and <strong>for</strong>eign lending transaction) and<br />

registration <strong>of</strong> realisation <strong>of</strong> international credit operations with NBS.<br />

Preparation <strong>of</strong> <strong>for</strong>ms and registration <strong>of</strong> <strong>for</strong>eign borrowing<br />

transaction or registration <strong>of</strong> Realization or <strong>for</strong>eign borrowing 3.000,00 RSD<br />

transaction with NBS when the creditor is member <strong>of</strong> Intesa Per each transaction<br />

SanPaolo group<br />

Preparation <strong>of</strong> <strong>for</strong>ms and registration <strong>of</strong> <strong>for</strong>eign borrowing<br />

transaction or registration <strong>of</strong> Realizations or <strong>for</strong>eign borrowing<br />

transaction with NBS when the creditor is not member <strong>of</strong> Intesa<br />

SanPaolo group<br />

Preparation <strong>of</strong> <strong>for</strong>ms and registration <strong>of</strong> <strong>for</strong>eign lending transaction<br />

or registration <strong>of</strong> Realization or <strong>for</strong>eign lending transaction with NBS<br />

Delivery <strong>of</strong> Statements with regard to international credit operations<br />

registered with NBS.<br />

Issuing <strong>of</strong> a document that is disclaimer <strong>of</strong> the Bank's right to an<br />

appeal according to the decision on deleting the pledge right<br />

5.000,00 RSD<br />

Per each transaction<br />

3.000,00 RSD<br />

Per each transaction<br />

1.000,00 RSD<br />

Per Statement<br />

5.000,00 RSD<br />

Per document<br />

11

6. Broker operations<br />

6.1. Brokerage in tr<strong>ad</strong>ing shares at the MTP and regulated market<br />

6.2. Provision <strong>for</strong> tr<strong>ad</strong>e equity securities <strong>of</strong> issuing orders <strong>for</strong> depositing<br />

6.3.<br />

1% calculated on market value per transaction or<br />

sales agreement certificate<br />

1% calculated on market value per transaction or<br />

sales agreement certificate<br />

Brokerage in tr<strong>ad</strong>ing debt securities (bills, bonds and other) the issuer <strong>of</strong> which is the Republic <strong>of</strong> Serbia, the NBS,<br />

municipality or other local government entities(calculated on transaction market value):<br />

6.3.1. RSD from 100.000-500.000 1%<br />

6.3.2. RSD from 500.000-1.000.000 0,8%<br />

6.3.3. RSD 1.000.000-5.000.000 0,6%<br />

6.3.4. RSD 5.000.000-10.000.000 0,4%<br />

6.3.5. RSD 10.000.000-30.000.000 0,2%<br />

6.3.6. RSD 30.000.000-50.000.000 0,17%<br />

6.3.7. RSD 50.000.000-100.000.000 0,16%<br />

6.3.8. over RSD 100.000.000 0,15%<br />

6.4. Tr<strong>ad</strong>ing bonds <strong>for</strong> settlement <strong>of</strong> retail FX savings<br />

6.4.1. Series A2013-A2016 1,4%<br />

6.5. Tr<strong>ad</strong>ing debt securities bussines entities<br />

6.5.1. Up to RSD 5.000.000 1%<br />

6.5.2. RSD 5.000.000-10.000.000 0,9%<br />

6.5.3. RSD 10.000.000-20.000.000 0,8%<br />

6.5.4. over RSD 20.000.000 0,7%<br />

6.6. Change and/or revorking orders RSD 500<br />

6.7. Subscription and payment <strong>of</strong> the securities <strong>for</strong> buyers (investitors)<br />

Min RSD 500 per order, 1%, max RSD 100,000, per<br />

order<br />

6.8. Borrowing or mediation in borrowing securities 1% calculated on nominal value <strong>of</strong> the lent securities<br />

6.9. Services as a member <strong>of</strong> Central securities depositor and clearing house and corporete agent sevices<br />

6.9.1. For opening proprietery account (client – individual) RSD 500<br />

6.9.2. For opening proprietery account (client – corporation) RSD 1.000<br />

6.9.3. For opening escrow account (client -individual) RSD 500<br />

6.9.4. For opening escrow account (client – corporation) RSD 1.000<br />

6.9.5. For opening depo securities account RSD 20.000<br />

6.9.6. For opening securities deposit account RSD 10.000<br />

6.9.7. For opening emission account RSD 10.000<br />

6.9.8. For closing account RSD 500<br />

6.9.9. For closing depo securities account RSD 5.000<br />

6.9.10.<br />

For transfer <strong>of</strong> securities ownership from proprietry to custody<br />

account (per ISIN number)<br />

RSD 2.000<br />

6.9.11.<br />

For transferring securities from proprietary account opened through<br />

one member <strong>of</strong> the Central Securities Registry proprietary account<br />

<strong>of</strong> the same owner to anather member <strong>of</strong> the Central Securities<br />

RSD 1.000<br />

Registry (change depositories, per ISIN number)<br />

6.9.12.<br />

For transfer <strong>of</strong> securities based on the contracts <strong>of</strong> gift and other<br />

contracts (per ISIN number)<br />

RSD 2.000<br />

6.9.13.<br />

For transfer <strong>of</strong> securities based on final court decision and<br />

requirements (inheritance and other solution, per ISIN number)<br />

RSD 2.000<br />

6.9.14. Subscription prohibition <strong>of</strong> disposal (per ISIN number) RSD 2.000<br />

6.9.15. Deleting prohibition <strong>of</strong> disposal (per ISIN number) RSD 2.000<br />

6.9.16. Enrollment <strong>of</strong> restriction (per ISIN number) RSD 2.000<br />

6.9.17. Assigning CFI code and ISIN number RSD 5.000<br />

6.9.18. Submission <strong>of</strong> a single shareholder book RSD 5.000<br />

6.9.19. Changes <strong>of</strong> ID Number <strong>for</strong> clients RSD 1.000<br />

6.9.20. Divident payments, <strong>for</strong> the issuer 3% od amount <strong>of</strong> dividend, min RSD 20.000<br />

6.9.21.<br />

Payment <strong>of</strong> dividends or coupons to holders <strong>of</strong> securities <strong>for</strong><br />

corporate clients (per order)<br />

0.05%<br />

6.9.22.<br />

Publication <strong>of</strong> the notice on the website <strong>of</strong> Central Securities<br />

Registry<br />

RSD 2.000<br />

Services that Banca Intesa provides in connection with opening and maintenance <strong>of</strong> special-purpose<br />

6.10. fx account <strong>for</strong> purchase or sale <strong>of</strong> fx bonds<br />

6.10.1. Opening special-purpose FX account<br />

6.10.1.1. Domestic legal person<br />

RSD 600 (collection shall be m<strong>ad</strong>e at account<br />

opening)<br />

6.10.1.2. Foreign legal person RSD 2000 (collection shall be m<strong>ad</strong>e at acc.opening)<br />

12

7. Retail <strong>fees</strong><br />

7.1. RSD operations<br />

7.1.1. Opening current account and RSD savings account No fee<br />

7.1.2. Maintaining RSD savings account No fee<br />

7.1.3. Maintaining current account:<br />

7.1.3.1. Basic account * RSD 125 per month<br />

7.1.3.2. »Intesa Hit« account ** RSD 300 per month<br />

7.1.3.3. maintaining blocked current accounts No fee<br />

7.1.3.4. Maintaining other types <strong>of</strong> current accounts*** No fee<br />

7.1.3.5. »Intesa Magnifica« current account ** RSD 400 per month<br />

7.1.4. Statement from current account<br />

One statement a month - no fee, each subsequent<br />

RSD 50.00 a month<br />

7.1.4.1. Statement <strong>of</strong> purpose account <strong>for</strong> Farmers No fee<br />

7.1.4.2.<br />

Monthly fee, <strong>for</strong> sending to the home <strong>ad</strong>dress confirmation <strong>of</strong> payment<br />

m<strong>ad</strong>e electronically, at the request <strong>of</strong> client<br />

RSD 40.00<br />

7.1.5. Cash withdrawal from current and dinar account (<strong>for</strong> any reason) No fee<br />

7.1.6. Non-cash payments by transfer from current account and Min. % <strong>of</strong> amount Max.<br />

7.1.6.1. RSD savings account and cash payments to current accounts <strong>of</strong> RSD 20<br />

7.1.6.2. Legal entities 0,2% RSD 1.000<br />

7.1.6.3.<br />

Transfer/payment by HIT/Intesa Magnifica current account owner up to RSD 50 1% RSD 5.000<br />

RSD 50.000<br />

7.1.6.4.<br />

Transfer/payment by HIT / Intesa Magnifica current account owner RSD 15 0,20% RSD 1.000<br />

over RSD 50.000<br />

7.1.6.5. Transfer/payment by other clients RSD 15 0,20% RSD 1.000<br />

7.1.6.6. Payments <strong>of</strong> liquidity loans (by the founder) No fee<br />

7.1.7.<br />

transfer/payments on the basis <strong>of</strong> special arrangements<br />

concluded with Legal entities<br />

7.1.7.1. Transfer / payment by owner <strong>of</strong> purpose account <strong>for</strong> Farmer No fee<br />

7.1.7.2. Issuing cheques according to retail current accounts RSD 5 per cheque<br />

7.1.8. Up to 5 cheques per month No fee<br />

7.1.9. Over 5 cheques per month 3%<br />

* Fee <strong>for</strong> maintaining <strong>of</strong> basic current account is charged from the available funds. According to A/C which are transmiting into Basic current account due<br />

to executing conciliation with clients, are not charged fee <strong>for</strong> maintaining <strong>of</strong> Basic current account.<br />

** fee <strong>for</strong> maintaining Intesa Hit / Intesa Magnifica current account is charged against accounts which recorded financial transaction within the month. For<br />

Intesa Magnifica current account under financial transactions credit card’s financial transactions are included.<br />

***Other types <strong>of</strong> current accounts are type 8 (students), type 10 (specific-purpose current accounts <strong>for</strong> Laki Keš, type 008 (specific purpose current<br />

account <strong>for</strong> farmers)<br />

7.2. FX operations<br />

7.2.1. Opening and maintaining FX savings deposit No fee<br />

7.2.2. Deposit <strong>of</strong> FX cash to FX savings account No fee<br />

7.2.3. Conversion at request <strong>of</strong> the FX savings account holder<br />

7.2.3.1. For concrete payments (nostro remittance) * 0,4%<br />

7.2.3.2. For FX cash withdrawal ** No fee<br />

7.2.3.3. For withdrawal or transfer, at the owner's request*** 0,4%<br />

7.2.3.4. For payments <strong>of</strong> credit card expenditure No fee<br />

7.2.4.<br />

Withdrawals from FX savings account In RSD **** No fee<br />

in FX cash *****<br />

No fee<br />

7.2.5.<br />

Non-cash payment from FX savings account crediting current<br />

% from<br />

Min.<br />

account <strong>of</strong> legal person:<br />

amount<br />

Max.<br />

7.2.5.1. - client <strong>of</strong> Banca Intesa <strong>ad</strong> Beogr<strong>ad</strong> RSD 15 0.20% RSD 1.000<br />

7.2.5.2. - other clients RSD 25 0.40% RSD 5.000<br />

*If client wants that the remittance is effected in the currency that he/she does not have at his FX savings deposit (conversion <strong>for</strong> nostro remittance is<br />

carried out according to purchase exchange rate <strong>of</strong> the BIB exchange list).<br />

** If client wants that withdraw effective FX banknotes in the currency that he/she does not have at his FX savings deposit, and Bank cannot per<strong>for</strong>m it<br />

(conversion is per<strong>for</strong>med applying mid exchange rate <strong>of</strong> the NBS exchange list)<br />

*** If client wants that the payment <strong>of</strong>f is effected in the currency that he/she does not have at his FX savings, or coverts FX within FX savings deposit<br />

from one currency to another (conversion is per<strong>for</strong>med according to purchase exchange rate <strong>of</strong> the BIB exchange list)<br />

**** Amounts <strong>of</strong> RSD Paying-out transactions, exceeding RSD 200.000 are to be announced to the branch at least 24 hours in <strong>ad</strong>vance<br />

*****Amounts <strong>of</strong> effective FX banknotes , exceeding EUR 5.000 or counter value <strong>of</strong> this amount in other currency, are to be announced to the branch at<br />

least 24 hours in <strong>ad</strong>vance; amounts exceeding EUR 15.000 should be announced 3 days be<strong>for</strong>e<br />

13

7.3. Remittances<br />

Min.<br />

% from<br />

amount<br />

Max.<br />

7.3.1. Nostro remittances<br />

7.3.1.1. Nostro remittances ordered by natural persons RSD 800 0,6% RSD 40.000<br />

7.3.1.2.<br />

RSD Nostro remittances ordered by nonresidents on the account<br />

opened with the Bank.<br />

RSD 1.000<br />

7.3.1.3.<br />

RSD Nostro remittances ordered by nonresidents on the account<br />

opened with some other domestic bank<br />

RSD 800 0,8% RSD 50.000<br />

7.3.1.4.<br />

RSD Nostro remittances ordered by residents on the account opened<br />

with the Bank.<br />

RSD 500<br />

7.3.1.5.<br />

RSD Nostro remittances ordered by residents on the account opened<br />

with some other domestic bank<br />

RSD 800 0,6% RSD 40.000<br />

7.3.1.6.<br />

Inquires and requests <strong>for</strong> reimbursement or amendment <strong>of</strong> nostro<br />

remittance<br />

RSD 2.500 + actual <strong>for</strong>eign bank expenses<br />

7.3.1.7. Nostro remittances in Eur with option OUR <strong>for</strong> actual <strong>for</strong>eign bank expenses<br />

7.3.1.7.1. Up to € 5.000,00 RSD 1.150<br />

7.3.1.7.2. From € 5.000,01 to € 12.500,00 RSD 1.500<br />

7.3.1.7.3. From € 12.500,01 to € 50.000,00 RSD 2.300<br />

7.3.1.7.4. From € 50.000,01 RSD 4.000<br />

7.3.1.8.<br />

Nostro remittance in other currencies with option OUR <strong>for</strong> actual<br />

<strong>for</strong>eign bank expenses<br />

RSD 1.800<br />

7.3.2. Loro remittances<br />

7.3.2.1.<br />

Loro remittances while taking the party term <strong>for</strong>eign currency deposits<br />

<strong>of</strong> all terms<br />

No free<br />

Up to 100 €<br />

No free<br />

7.3.2.2. Loro remittances<br />

from 100,01 € to 10.000 € RSD 300 0,15%<br />

Over 10.000 € 0,25% RSD 40.000<br />

7.4. Transfers within the country - Purchase, sale and lease <strong>of</strong> real estates, life<br />

insurance and clean transfer (among the own accounts)<br />

Min.<br />

% from<br />

amount<br />

Max.<br />

7.4.1. Transfers within the bank * RSD 800 0,2% RSD 8.000<br />

7.4.2. Transfers to other domestic banks RSD 1.500 0,3% RSD 16.000<br />

7.4.2.1.<br />

Return <strong>of</strong> funds per final calculation <strong>of</strong> business trip expenses <strong>for</strong> the<br />

account with other domestic bank<br />

RSD 600 0,2%<br />

7.4.3. Inquires and requests <strong>for</strong> cancellation or amendment <strong>of</strong> transfers RSD 2.500<br />

* If client terms deposits on the grounds <strong>of</strong> concluded purchase agreement or lease agreement <strong>for</strong> min. 1 month, the fee is not charged<br />

Note – In case <strong>of</strong> transfers with charging option OUR, Bank will withhold RSD 1.600 as the reservation <strong>for</strong> transfers in local currency, i.e. 0,1% , min.EUR<br />

30 (in RSD counter value on the bases <strong>of</strong> NBS middle exchange rate) <strong>for</strong> transfers in <strong>for</strong>eign currency.<br />

14

7.5. FX operations<br />

Min.<br />

% from<br />

amount<br />

Max.<br />

7.5.1. Purchase <strong>of</strong> effective FX banknotes no fee<br />

7.5.2. Sales <strong>of</strong> effective FX banknotes no fee<br />

7.5.3.<br />

Change <strong>of</strong> effective FX banknotes <strong>for</strong> smaller or bigger<br />

denominations<br />

RSD 80 0,5%<br />

7.5.4. Change <strong>of</strong> damaged effective FX banknotes RSD 10 2%<br />

7.5.5. Depositing and pay-<strong>of</strong>f <strong>of</strong> loro cheques from FX saving deposit<br />

7.5.5.1. Banking cheque RSD 300 1,2%<br />

7.5.5.2. Traveler’s cheque RSD 300 1,2%<br />

7.5.5.3. Pension cheque RSD 300 0,5%<br />

7.5.5.4. Private cheque RSD 300 2 %<br />

7.5.6. Purchase <strong>of</strong> loro cheques through exchange operations RSD 300 1,2%<br />

7.5.7. Collection <strong>of</strong> inkaso cheques RSD 300 2 % + real expenses<br />

7.6. Tariff rates <strong>for</strong> <strong>for</strong>eign banks<br />

Min.<br />

% from<br />

amount<br />

Max.<br />

7.6.1. Inflows when the ordering party covers expenses 5 € 0,1% 100 €<br />

7.7. Tariff rates regarding financial instruments<br />

Min.<br />

% from<br />

amount<br />

7.7.1. Opening and keeping <strong>of</strong> dinar and FX specific purposes accounts <strong>of</strong> financial instruments<br />

7.7.1.1. Clients <strong>of</strong> BIB Brokerage Dealing Unit no fee<br />

7.7.1.2. Clients <strong>of</strong> other brokerage institutions RSD 500<br />

7.7.2. Cash balancing fee – tr<strong>ad</strong>ing with financial instruments<br />

7.7.2.1. Clients <strong>of</strong> BIB Brokerage Dealing Unit * RSD 20 0,1%<br />

7.7.2.2. Clients <strong>of</strong> other brokerage institutions * RSD 20 0,2%<br />

7.7.2.3. Over-the-counter-sale <strong>of</strong> Old FX savings bonds tr<strong>ad</strong>ing 0.9%<br />

* calculated according to the market value per transaction<br />

7.8. L/G operations <strong>for</strong> natural entities<br />

Min. % od iznosa Max.<br />

7.8.1. Request processing fee P()900 RSD 1.000 0,1%*<br />

7.8.2. L/G <strong>for</strong> participation at tenders, public bids, public competition<br />

7.8.2.1. Issuing <strong>of</strong> L/G with 100% deposit 0,6%* RSD 50.000<br />

7.8.2.2. Issuing <strong>of</strong> L/G without deposit 1%*<br />

* collection is conducted on one-<strong>of</strong>f basis<br />

7.8.3. Other L/G<br />

7.8.3.1. Issuing <strong>of</strong> L/G with 100% deposit 0,8%** RSD 50.000<br />

7.8.3.2. Issuing <strong>of</strong> L/G without deposit 1,5%**<br />

** calculation and collection are conducted on quarter basis, after each three-month-period. Each started three-month-period is<br />

considered the whole.<br />

7.8.4. Cancellation <strong>of</strong> L/G issuing request RSD 1.000 0,1% ***<br />

7.8.5. Extension <strong>of</strong> validity date <strong>of</strong> the issued L/G RSD 1.000 0,1%***<br />

7.8.6. Protest <strong>of</strong> L/G ( preparation and realization) 0,2%***<br />

*** from amount<br />

Max.<br />

15

7.9. Retail Loans<br />

7.9.1. Loan application processing fee 0% - 2.50%<br />

7.9.2. Sending warning notice to the loan user 100 RSD per warning notice<br />

7.9.3.<br />

Premature loans repayment fee – contracts signed from the<br />

05.12.2011.<br />

Client pays to the Bank premature repayment fee<br />

according to costs due to premature repayment,<br />

calculated on the basis <strong>of</strong> Law on Financial<br />

Services Users Protection, not above:<br />

• 1% <strong>of</strong> premature repaid principal, if the<br />

period between premature repayment and agreed<br />

maturity is longer than one year<br />

• 0,50% <strong>of</strong> premature repaid principal, if<br />

the period between premature repayment and<br />

agreed maturity is shorter than one year<br />

Premature repayment fee will not be paid when<br />

total premature repaid amount is equal or less<br />

than 1.000.000 RSD, including all premature<br />

repayments <strong>for</strong> the previous 12 months.<br />

Premature loans repayment fee – contracts signed up to<br />

7.9.4.<br />

On the basis on signed loan contract *<br />

04.12.2011.<br />

Request <strong>for</strong> change <strong>of</strong> the real estate that is the subject <strong>of</strong> the 50 € (in diner counter value, according to the mid<br />

7.9.5.<br />

mortgage.<br />

exchange rate <strong>of</strong> the NBS on the payment day)<br />

* For the contracts signed up to 04.12.2011., in case <strong>of</strong> precisely stated premature repayment fee the provisions <strong>of</strong> the signed contract have to be applied;<br />

Otherwise, if provisions <strong>of</strong> premature repayment fee refer to Tariff <strong>of</strong> <strong>fees</strong>, Tariff position 7.9.3. has to be applied.<br />

7.10. Other operations<br />

7.10.1. Request <strong>for</strong> return <strong>of</strong> FX payment order upon execution 25 €<br />

7.10.2.<br />

Changes after the FX payment is effected, upon request <strong>of</strong> a<br />

client<br />

25 €<br />

7.10.3. Return <strong>of</strong> inflow abro<strong>ad</strong> upon the request <strong>of</strong> the ordering party 25 €<br />

7.10.4.<br />

Liquidity – cash balancing <strong>of</strong> current account, a’vista and term<br />

account<br />

no fee<br />

7.10.5. Issuing <strong>of</strong> various confirmations RSD 300<br />

7.10.6. Blocking <strong>of</strong> accounts no fee<br />

7.10.7. Sending default warning notice RSD 200 per warning notice<br />

7.10.8.<br />

Canceling <strong>of</strong> partial and full amount term savings deposit, be<strong>for</strong>e<br />

expiry <strong>of</strong> the first term saving period<br />

No fee<br />

7.10.9. Issuing <strong>of</strong> confirmation - SWIFT message RSD 250<br />

7.10.10.<br />

Issuing <strong>of</strong> confirmations <strong>for</strong> the effected depositing <strong>of</strong> founding<br />

investment according to the order <strong>of</strong> non-resident.<br />

RSD 300 per confirmation<br />

8. Electronic banking <strong>for</strong> individuals<br />

8.1. Banca Intesa Online<br />

8.1.1. Activation <strong>of</strong> Banca Intesa Online Free <strong>of</strong> charge<br />

8.1.2. Banca Intesa Online monthly fee Free <strong>of</strong> charge<br />

8.2. SMS<br />

8.2.1. MO SMS<br />

8.2.1.1. For TELENOR network users RSD 7.08<br />

8.2.1.2. For MTS network users RSD 7.08<br />

8.2.1.3. For VIP network users RSD 7.08<br />

8.3. IntesaMob<br />

8.3.1. Activation <strong>of</strong> IntesaMob service Free <strong>of</strong> charge<br />

8.3.2. IntesaMob monthly fee* RSD 50 per month<br />

8.3.2.1. IntesaMob monthly fee <strong>for</strong> “Intesa Magnifica” current account users** Free <strong>of</strong> charge<br />

8.4.<br />

8.5.<br />

Non-cash payments <strong>for</strong> “Intesa HIT” current account users trough BIB<br />

On Line and / or IntesaMob <strong>services</strong><br />

Non-cash payments <strong>for</strong> “Intesa Magnifica” current account users<br />

trough BIB On Line <strong>services</strong><br />

The first 5 transactions per month free <strong>of</strong> charge,<br />

and the rest are charged according to the Tariff<br />

item 7.1<br />

The first 5 transactions per month free <strong>of</strong> charge,<br />

and the rest are charged according to the Tariff<br />

item 7.1<br />

* Monthly fee will not be charged during period which runs until 31.10.2012. After that period, monthly fee <strong>for</strong> IntesaMob service will be charge in<br />

accordance with currently Decision on <strong>tariff</strong> <strong>of</strong> <strong>fees</strong> <strong>for</strong> <strong>services</strong> <strong>of</strong> Banca Intesa <strong>ad</strong> Beogr<strong>ad</strong><br />

16

9. Payment cards<br />

Payment cards <strong>for</strong> retail<br />

9.1. Annual membership fee <strong>for</strong> basic card<br />

9.1.1. Dina debit card no fee<br />

9.1.2. Dina credit card no fee<br />

9.1.3. Dina debit international RSD 360 (30 montly)<br />

9.1.4. Maestro card no fee<br />

9.1.5. Maestro Pre-paid RSD 300 yearly<br />

9.1.6. Maestro Co Brand BIB-MTS RSD 360 monthly<br />

9.1.7. MC Standard Co Brand BIB-MTS RSD 200 monthly<br />

9.1.8. MC within current account bundle (Standard i Gold) no fee<br />

9.1.9. MC Standard RSD 200 monthly<br />

9.1.10. MC Standard Premium package (Standard + MC2 Standard) RSD 230 monthly<br />

9.1.11. MC Standard Affinity PKB* RSD 180 monthly<br />

9.1.12. MC Gold RSD 500 monthly<br />

9.1.13. MC Gold Premium paket (Gold + MC2 Gold) RSD 550 monthly<br />

9.1.14. MC Gold Affinity PKB* RSD 490 monthly<br />

9.1.15. Visa Eelectron Magnifica*** no fee<br />

9.1.16. Visa Electron no fee<br />

9.1.17. Visa Electron Affinity Paraolimpik no fee<br />

9.1.18. Visa Internet no fee<br />

9.1.19. Visa Classic RSD 200 monthly<br />

9.1.20. Visa Classic Affinity Paraolimpik RSD 160 monthly<br />

9.1.21. Visa Gold RSD 500 monthly<br />

9.1.22. AMEX Green RSD 2.400 yearly<br />

9.1.23. AMEX Green Affinity LK* RSD 2.200 yearly<br />

9.1.24. AMEX Gold** RSD 6.600 yearly<br />

9.1.25. AMEX Blue RSD 1.800 yearly<br />

9.1.26. AMEX Green with 100% deposit* RSD 1.200 yearly<br />

9.2. Annual membership fee <strong>for</strong> supplement card<br />

9.2.1. Dina debit card no fee<br />

9.2.2. Dina debit international 180 RSD (15 RSD montly)<br />

9.2.3. Maestro card no fee<br />

9.2.4. MC within current account bundle (Standard i Gold) no fee<br />

9.2.5. MC Standard RSD 100 monthly<br />

9.2.6. MC Standard Co Brand BIB-MTS RSD 100 monthly<br />

9.2.7. MC Standard Premium package (Standard + MC2 Standard) RSD 130 monthly<br />

9.2.8. MC Standard Affinity PKB* RSD 70 monthly<br />

9.2.9. MC Gold RSD 300 monthly<br />

9.2.10. MC Gold Premium package (Gold + MC2 Gold) RSD 350 monthly<br />

9.2.11. MC Gold Affinity PKB* RSD 280 monthly<br />

9.2.12. Visa Eelectron Magnifica*** no fee<br />

9.2.13. Visa Electron no fee<br />

9.2.14. Visa Electron Affinity Paraolimpik no fee<br />

9.2.15. Visa Classic RSD 100 monthly<br />

9.2.16. Visa Classic Affinity Paraolimpik RSD 70 monthly<br />

9.2.17. Visa Gold RSD 300 monthly<br />

9.2.18. AMEX Green RSD 1.200 yearly<br />

9.2.19. AMEX Green Affinity LK* RSD 1.000 yearly<br />

9.2.20. AMEX Gold** RSD 3.500 yearly<br />

9.2.21. AMEX Blue RSD 900 yearly<br />

9.2.22. AMEX Green with 100% deposit* RSD 600 yearly<br />

* No membership fee is charged in first year<br />

**Amex Gold credit card users (main and <strong>ad</strong>ditional users) with opened Intesa Magnifica current account – 50% decrease <strong>of</strong> annual fee.<br />

17

9.3. Fee <strong>for</strong> issuing<br />

9.3.1. Maestro Gift -Individuals RSD 200 one-<strong>of</strong>f<br />

9.3.2. Maestro Gift -Individuals (at the request <strong>of</strong> legal person) RSD 100 one-<strong>of</strong>f<br />

9.3.3. Dina Credit 6+30 RSD 500<br />

9.4. Block<strong>ad</strong>e <strong>of</strong> the lost or stolen card, including replacement <strong>of</strong> lost or stolen<br />

card<br />

9.4.1. Dina debit card RSD 400<br />

9.4.2. Dina credit card RSD 800<br />

9.4.3. Dina Credit 6+30 RSD 800<br />

9.4.4. Dina debit international RSD 400<br />

9.4.5. Maestro card RSD 400<br />

9.4.6. Maestro Co Brand BIB-MTS RSD 400<br />

9.4.7. Maestro GIFT card RSD 300<br />

9.4.8. MC within current account bundle (Standard i Gold) RSD 800<br />

9.4.9. MC Standard RSD 800<br />

9.4.10. MC Standard Co Brand BIB-MTS RSD 800<br />

9.4.11. MC2 Standard RSD 800<br />

9.4.12. MC Standard Affinity PKB RSD 800<br />

9.4.13. MC Gold RSD 1.500<br />

9.4.14. MC2 Gold RSD 1.500<br />

9.4.15. MC Gold Affinity PKB RSD 1.500<br />

9.4.16. Visa Eelectron Magnifica* RSD 400<br />

9.4.17. Visa Electron RSD 400<br />

9.4.18. Visa Electron Affinity Paraolimpik RSD 400<br />

9.4.19. Visa Internet RSD 400<br />

9.4.20. Visa Classic RSD 800<br />

9.4.21. Visa Classic Affinity Paraolimpik RSD 800<br />

9.4.22. Visa Gold RSD 1.500<br />

9.4.23. AMEX Green RSD 1.000<br />

9.4.24. AMEX Green Affinity LK RSD 1.000<br />

9.4.25. AMEX Gold RSD 1.500<br />

9.4.26. AMEX Blue RSD 200<br />

9.4.27. AMEX Green with 100% deposit RSD 1.000<br />

9.5. Request <strong>for</strong> new PIN<br />

9.5.1. AMEX Blue RSD 200<br />

9.5.2. AMEX Green RSD 300<br />

9.5.3. AMEX Green Affinity LK RSD 300<br />

9.5.4. AMEX Gold RSD 300<br />

9.5.5. AMEX Green with 100% deposit RSD 300<br />

9.6. Cancellation <strong>of</strong> a card utilization<br />

9.6.1. Debit cards No fee<br />

9.6.2. Credit cards No fee<br />

9.7. Urgent card production<br />

9.7.1. AMEX Green RSD 2.500<br />

9.7.2. AMEX Green Affinity LK RSD 2.500<br />

9.7.3. AMEX Gold RSD 2.500<br />

9.7.4. AMEX Blue RSD 2.500<br />

9.7.5. AMEX Green with 100 % deposit RSD 2.500<br />

9.7.6. Other credit cards RSD 1.500<br />

9.7.7. Debit cards RSD 600<br />

9.8. E-commerce issuing membership <strong>fees</strong><br />

9.8.1. Verify By Visa RSD 800<br />

9.9. MasterCard SecureCode<br />

9.9.1.<br />

9.9.2.<br />

Issuing fee <strong>for</strong> MasterCard SecureCode CAP (Chip Authentication<br />

Program) package (1 payment card re<strong>ad</strong>er)<br />

Monthly fee <strong>for</strong> MasterCard SecureCode – CAP (Chip Authentication<br />

Program) service usage<br />

1,000 RSD one-time fee<br />

Free <strong>of</strong> charge<br />

18

Fees<br />

9.10. Costs <strong>of</strong> sending notices in case <strong>of</strong> 60-day-default<br />

9.10.1. AMEX Green RSD 100<br />

9.10.2. AMEX Green Affinity LK RSD 100<br />

9.10.3. AMEX Gold RSD 100<br />

9.10.4. AMEX Blue RSD 100<br />

9.10.5. AMEX Green with 100% deposit RSD 100<br />

9.11. Costs <strong>of</strong> sending notices in case <strong>of</strong> 90-day-default<br />

9.11.1. AMEX Green RSD 200<br />

9.11.2. AMEX Green Affinity LK RSD 200<br />

9.11.3. AMEX Gold RSD 200<br />

9.11.4. AMEX Blue RSD 200<br />

9.11.5. AMEX Green with 100% deposit RSD 200<br />

Transaction processing expenses<br />

9.12. Cash withdrawals at the counters <strong>of</strong> BIB<br />

9.12.1. Dina debit card no fee<br />

9.12.2. Dina credit card 3% (min RSD 150)<br />

9.12.3. Dina Credit 6+30 2% ( min RSD 100)<br />

9.12.4. Dina debit card international no fee<br />

9.12.5. Maestro card no fee<br />

9.12.6. Maestro Co Brand BIB-MTS no fee<br />

9.12.7. MC within current account bundle (Standard i Gold) 3% (min RSD 150)<br />

9.12.8. MC Standard 3% (min RSD 150)<br />

9.12.9. MC Standard Co Brand BIB-MTS 3% (min RSD 150)<br />

9.12.10. MC2 Standard 3% (min RSD 150)<br />

9.12.11. MC Standard Affinity PKB 3% (min RSD 150)<br />

9.12.12. MC Gold 3% (min RSD 150)<br />

9.12.13. MC2 Gold 3% (min RSD 150)<br />

9.12.14. MC Gold Affinity PKB 3% (min RSD 150)<br />

9.12.15. Visa Electron Magnifica* no fee<br />

9.12.16. Visa Electron no fee<br />

9.12.17. Visa Electron Affinity Paraolimpik no fee<br />

9.12.18. Visa Classic 3% (min RSD 150)<br />

9.12.19. Visa Classic Affinity Paraolimpik 3% (min RSD 150)<br />

9.12.20. Visa Gold 3% (min RSD 150)<br />

9.12.21. AMEX Green 3% (min RSD 150)<br />

9.12.22. AMEX Green Affinity LK 3% (min RSD 150)<br />

9.12.23. AMEX Gold 3% (min RSD 150)<br />

9.12.24. AMEX Blue 3% (min RSD 150)<br />

9.12.25. AMEX Green with 100% deposit 3% (min RSD 150)<br />

9.13. Cash withdrawal abro<strong>ad</strong><br />

9.13.1. Maestro card 2% (min 2 eur)<br />

9.13.2. Maestro Co Brand BIB-MTS 2% (min 2 eur)<br />

9.13.3. Maestro Pre-paid 2% (min 2 eur)<br />

9.13.4. MC within current account bundle (Standard i Gold) 3% (min 3 eur)<br />

9.13.5. MC Standard 3% (min 3 eur)<br />

9.13.6. MC Standard Co Brand BIB-MTS 3% (min 3 eur)<br />

9.13.7. MC2 Standard* 3% (min 3 eur)<br />

9.13.8. MC Standard Affinity PKB 3% (min 3 eur)<br />

9.13.9. MC Gold 3% (min 3 eur)<br />

9.13.10. MC2 Gold* 3% (min 3 eur)<br />

9.13.11. MC Gold Affinity PKB 3% (min 3 eur)<br />

9.13.12. Visa Electron Magnifica** 2% (min 2 eur)<br />

9.13.13. Visa Electron 2% (min 3 eur)<br />

9.13.14. Visa Electron Affinity Paraolimpik 2% (min 3 eur)<br />

9.13.15. Visa Classic 3% (min 3 eur)<br />

9.13.16. Visa Classic Affinity Paraolimpik 3% (min 3 eur)<br />

9.13.17. Visa Gold 3% (min 3 eur)<br />

9.13.18. Dina debit card international 2% ( min 3 eur)<br />

9.13.19. AMEX Green 3% (min 5 eur)<br />

19

9.13.20. AMEX Green Affinity LK 3% (min 5 eur)<br />

9.13.21. AMEX Gold 3% (min 5 eur)<br />

9.13.22. AMEX Blue 3% (min 5 eur)<br />

9.13.23. AMEX Green with 100% deposit 3% (min 5 eur)<br />

* the <strong>tariff</strong> refers to cash withdrawal at <strong>for</strong>eign banks’ counters, excluding the option to withdraw cash at ATMs abro<strong>ad</strong><br />

** Cash withdrawals at ATM-s wihin the Intesa Sanpaolo Group – without fee,Change m<strong>ad</strong>e by decision number IO/4/31/11 from<br />

06.10.2011<br />

9.14. Cash withdrawal at the ATMs <strong>of</strong> BIB<br />

9.14.1. Dina debit card no fee<br />

9.14.2. Dina credit card 3% (min RSD 60)<br />

9.14.3. Dina Credit 6+30 2% (min RSD 100)<br />

9.14.4. Dina debit card international no fee<br />

9.14.5. Maestro card no fee<br />

9.14.6. Maestro Co Brand BIB-MTS no fee<br />

9.14.7. Maestro Pre-paid no fee<br />

9.14.8. MC within current account bundle (Standard i Gold) 3% (min RSD 90)<br />

9.14.9. MC Standard 3% (min RSD 90)<br />

9.14.10. MC Standard Co Brand BIB MTS 3% (min RSD 90)<br />

9.14.11. MC Standard Affinity PKB 3% (min RSD 90)<br />

9.14.12. MC Gold 3% (min RSD 90)<br />

9.14.13. MC Gold Affinity PKB 3% (min RSD 90)<br />

9.14.14. Visa Electron Magnifica* no fee<br />

9.14.15. Visa Electron no fee<br />

9.14.16. Visa Electron Affinity Paraolimpik no fee<br />

9.14.17. Visa Classic 3% (min RSD 90)<br />

9.14.18. Visa Classic Affinity Paraolimpik 3% (min RSD 90)<br />

9.14.19. Visa Gold 3% (min RSD 90)<br />

9.14.20. AMEX Green 3% (min RSD 150 )<br />

9.14.21. AMEX Green Affinity LK 3% (min RSD 150)<br />

9.14.22. AMEX Gold 3% (min RSD 150)<br />

9.14.23. AMEX Blue 3% (min RSD 150)<br />

9.14.24. AMEX Green with 100% deposit 3% (min RSD 150)<br />

9.15. Cash withdrawal at the ATMs and counters <strong>of</strong> other domestic principals<br />

9.15.1. Dina debit card 2% (min RSD 90)<br />

9.15.2. Dina credit card 3% (min RSD 150)<br />

9.15.3. Dina Credit 6+30 2% ( min RSD 100)<br />

9.15.4. Dina debit card international 2%(min RSD 90)<br />

9.15.5. Maestro card 2% (min RSD 90)<br />

9.15.6. Maestro Co Brand BIB-MTS 2% (min RSD 90)<br />

9.15.7. Maestro Pre-paid 2% (min RSD 90)<br />

9.15.8. MC within current account bundle (Standard i Gold) 3% (min RSD 150)<br />

9.15.9. MC Standard 3% (min RSD 150)<br />

9.15.10. MC Standard Co Brand BIB-MTS 3% (min RSD 150)<br />

9.15.11. MC2 Standard* 3% (min RSD 150)<br />

9.15.12. MC Standard Affinity PKB 3% (min RSD 150)<br />

9.15.13. MC Gold 3% (min RSD 150)<br />

9.15.14. MC2 Gold* 3% (min RSD 150)<br />

9.15.15. MC Gold Affinity PKB 3% (min RSD 150)<br />

9.15.16. Visa Electron Magnifica** 2% (min RSD 90)<br />

9.15.17. Visa Electron 2% (min RSD 150)<br />

9.15.18. Visa Electron Affinity Paraolimpik 2% (min RSD 150)<br />

9.15.19. Visa Classic 3% (min RSD 150)<br />

9.15.20. Visa Classic Affinity Paraolimpik 3% (min RSD 150)<br />

9.15.21. Visa Gold 3% (min RSD 150)<br />

* the <strong>tariff</strong> refers to cash withdrawal at domestic banks’ counters, excluding the option to withdraw cash at ATMs<br />

9.16. Expenses <strong>of</strong> processing unfounded complaints<br />

9.16.1. Expenses <strong>of</strong> processing unfounded complaints in the country RSD 1.000<br />

9.16.2. Expenses <strong>of</strong> processing unfounded complaints abro<strong>ad</strong> 15 eur<br />

20

Payment cards <strong>for</strong> legal entities<br />

9.17. Annual membership<br />

9.17.1. MC Business <strong>for</strong> small business RSD 2.500<br />

9.17.2. MC Business RSD 4.000<br />

9.17.3. MC Business Affinity PKB No fee<br />

9.17.4. Visa Business Electron No fee<br />

9.17.5. Visa Business Gold RSD 6.900<br />

*The <strong>tariff</strong> line is applied if the stated number <strong>of</strong> cards is activated in the same months.<br />

9.18. Replacement <strong>of</strong> lost or stolen card, card replacement at the user's request<br />

9.18.1. MC Business RSD 1.500<br />

9.18.2. MC Business Affinity PKB RSD 1.500<br />

9.18.3. Visa Business Electron RSD 300<br />

9.18.4. Visa Business Gold RSD 1.800<br />

Fees<br />

9.19. Card blocking fee<br />

9.19.1. MC Business RSD 3.000<br />

9.19.2. MC Business Affinity PKB RSD 3.000<br />

9.19.3. Visa Business Electron RSD 300<br />

9.19.4. Visa Business Gold RSD 3.000<br />

Costs <strong>of</strong> the transactions’ processing<br />

9.20. Cash withdrawals at the counters <strong>of</strong> BIB<br />

9.20.1. MC Business 3% (min RSD 150)<br />

9.20.2. MC Business Affinity PKB 3% (min RSD 150)<br />

9.20.3. Visa Business Gold 3% (min RSD 150)<br />

9.21. Cash withdrawals abro<strong>ad</strong><br />

9.21.1. MC Business 3% (min 5 eur)<br />

9.21.2. MC Business Affinity PKB 3% (min 5 eur)<br />

9.21.3. Visa Business Electron 3% (min 5 eur)<br />

9.21.4. Visa Business Gold 3% (min 5 eur)<br />

9.22. Cash withdrawal at the ATMs <strong>of</strong> BIB<br />

9.22.1. MC Business 3% (min RSD 60)<br />

9.22.2. MC Business Affinity PKB 3% (min RSD 60)<br />

9.22.3. Visa Business Gold 3% (min RSD 60)<br />

9.23. Cash withdrawal at the ATMs <strong>of</strong> BIB and counters <strong>of</strong> other domestic<br />

principals<br />

9.23.1. MC Business 3% (min. RSD 200)<br />

9.23.2. MC Business Affinity PKB 3% (min. RSD 200)<br />

9.23.3. Visa Business Gold 3% (min. RSD 200)<br />

9.24. Expenses <strong>of</strong> processing unfounded complaints<br />

9.24.1. Expenses <strong>of</strong> processing unfounded complaints in the country RSD 1.000<br />

9.24.2. Expenses <strong>of</strong> processing unfounded complaints abro<strong>ad</strong> 15 eur<br />

9.25. Merchant commission percentage range <strong>for</strong> accepting payment cards<br />

fee<br />

Term <strong>of</strong> payment<br />

9.25.1. MasterCard I Maestro<br />

a) up to 5%<br />

up to 20 business<br />

b) up to 5% Min.( up to<br />

days<br />

RSD 100)<br />

9.25.2. VISA<br />

a) up to 5%<br />

up to 20 business<br />

b) up to 5% Min.( up to<br />

days<br />

RSD 100)<br />

9.25.3. American Express<br />

a) up to 5%<br />