Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

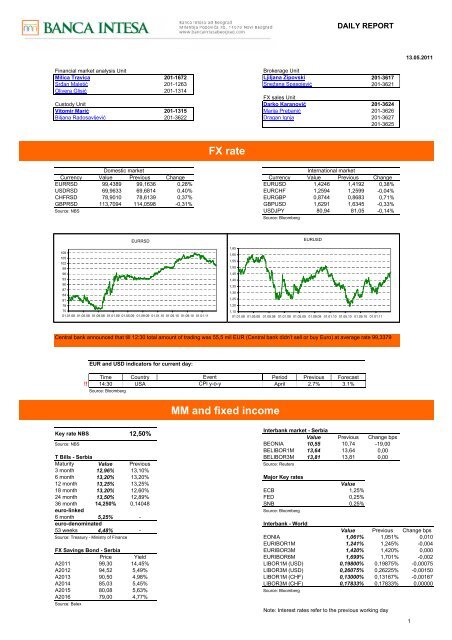

DAILY REPORT<strong>13</strong>.<strong>05</strong>.2011Financial market analysis UnitBrokerage UnitMilica Travica 201-1672 Ljiljana Zipovski201-3617Srñan Maletić 201-1263 Snežana Spasojević201-3621Olivera Glisić 201-<strong>13</strong>14FX sales UnitCustody Unit Darko Karanović 201-3624Vitomir Marić 201-<strong>13</strong>15 Marija Prebanić 201-3626Biljana Radosavljević 201-3622 Dragan Ignja 201-3627201-3625FX rateDomestic marketInternational marketCurrency Value Previous Change Currency Value Previous ChangeEURRSD 99,4389 99,1636 0,28% EURUSD 1,4246 1,4192 0,38%USDRSD 69,9633 69,6814 0,40% EURCHF 1,2594 1,2599 -0,04%CHFRSD 78,9010 78,6<strong>13</strong>9 0,37% EURGBP 0,8744 0,8683 0,71%GBPRSD 1<strong>13</strong>,7094 114,<strong>05</strong>98 -0,31% GBPUSD 1,6291 1,6345 -0,33%Source: NBS USDJPY 80,94 81,<strong>05</strong> -0,14%Source: BloombergEURRSD1081<strong>05</strong>10299969390878481787501.01.08 01.<strong>05</strong>.08 01.09.08 01.01.09 01.<strong>05</strong>.09 01.09.09 01.01.10 01.<strong>05</strong>.10 01.09.10 01.01.11EURUSD1,651,601,551,501,451,401,351,301,251,201,1501.01.08 01.<strong>05</strong>.08 01.09.08 01.01.09 01.<strong>05</strong>.09 01.09.09 01.01.10 01.<strong>05</strong>.10 01.09.10 01.01.11Central bank announced that till 12:30 total amount of trading was 55,5 mil EUR (Central bank didn’t sell or buy Euro) at average rate 99,3379EUR and USD indicators for current day:Time Country EventPeriod Previous Forecast!! 14:30 USA CPI y-o-yApril 2.7% 3.1%Source: BloombergMM and fixed incomeKey rate NBS12,50%Interbank market - SerbiaValue Previous Change bpsSource: NBS BEONIA 10,55 10,74 -19,00BELIBOR1M <strong>13</strong>,64 <strong>13</strong>,64 0,00T Bills - Serbia BELIBOR3M <strong>13</strong>,81 <strong>13</strong>,81 0,00Maturity Value Previous Source: Reuters3 month 12,96% <strong>13</strong>,10%6 month <strong>13</strong>,20% <strong>13</strong>,20% Major Key rates12 month <strong>13</strong>,25% <strong>13</strong>,25% Value18 month <strong>13</strong>,20% 12,60% ECB 1,25%24 month <strong>13</strong>,50% 12,89% FED 0,25%36 month 14,250% 0,14048 SNB 0,25%euro-linkedSource: Bloomberg6 month 5,25% -euro-denominatedInterbank - World53 weeks 4,48% - Value Previous Change bpsSource: Treasury - Ministry of Finance EONIA 1,061% 1,<strong>05</strong>1% 0,010EURIBOR1M 1,241% 1,245% -0,004FX Savings Bond - Serbia EURIBOR3M 1,420% 1,420% 0,000Price Yield EURIBOR6M 1,699% 1,701% -0,002A2011 99,30 14,45% LIBOR1M (USD) 0,19800% 0,19875% -0,00075A2012 94,52 5,49% LIBOR3M (USD) 0,26075% 0,26225% -0,00150A20<strong>13</strong> 90,50 4,98% LIBOR1M (CHF) 0,<strong>13</strong>000% 0,<strong>13</strong>167% -0,00167A2014 85,03 5,45% LIBOR3M (CHF) 0,17833% 0,17833% 0,00000A2015 80,08 5,63% Source: BloombergA2016 79,00 4,77%Source: BelexNote: Interest rates refer to the previous working day1

Equity marketSERBIABelex 15Value738,64Previous739,17Change-0,07%Belex line1.390,001.390,52-0,04%Turnover65.812.561 Din.55.668.950 Din.18,22%663.677 €561.621 €18,17%RatiosP / BP / EBelex15 0,43 7,78YTD<strong>13</strong>,38%8,37%Source: BelexBelex15250020001500100<strong>05</strong>00008.01.08 08.06.08 08.11.08 08.04.09 08.09.09 08.02.10 08.07.10 08.12.10Belex Line4500400035003000250020001500100<strong>05</strong>00008.01.08 08.06.08 08.11.08 08.04.09 08.09.09 08.02.10 08.07.10 08.12.100,50%0,00%-0,50%-1,00%-1,50%-2,00%-2,50%-3,00%-3,50%-4,00%Daily change - members of Belex150,00% 0,00% 0,00% 0,00% 0,00% 0,00%0,11% 0,16% 0,19%-0,38%-0,20%-1,46%-1,89%-3,47%AGBN AIKB MTBN TIGR SJPT KMBN UNBN IMLK MTLC VZAS ALFA ENHL JMBN AEROSerbia will issue a Eurobond by the end of the year worth up to $1 billion, said Branislav Toncic, the head of the Debt ManagementAgency. Preparations are underway for a tender to select an adviser while there will be no tender for the lead manager and thegovernment will send invitation letters “to a dozen banks with experience in the region over the past year to year-and-a-half,” Toncictold Bloomberg in a phone interview yesterday. The government has stepped up borrowing this year in the local market,encouraged by growing investor interest in yields that top 10 percent on dinar-denominated debt. It has to borrow after thegovernment stopped short of selling a controlling stake in Telekom Srbija AD to Telekom Austria AG for less than 1.4 billion euros.Serbia runs more liabilities in euros than in dollars, the likely U.S. dollar issue will be combined with “swaps and hedginginstruments.” The government hopes to select an adviser by the end of May and give them “a couple of months” to preparedocumentation and a road-show. The bond issue should take place “in October or November, perhaps even sooner, in September”Toncic said. (Source: Bloomberg)Serbia is temporarily cutting payroll taxes for employers who create jobs in an effort to reduce a 20 percent unemployment rate andcrack down on illegal workers. For the next year, companies won’t have to make payments to the state pension fund on behalf ofnew hires and the employer’s share of income taxes for those workers will be reduced, Prime Minister Mirko Cvetkovic toldreporters yesterday in Belgrade. The government is seeking to boost employment and living standards less than a year beforeparliamentary elections. Economy Minister Nebojsa Ciric said the package of incentives is designed to reverse a decline inemployment as there were 92,000 fewer jobs in January than a year ago. The national workforce is just under 1.8 million. Theincentives won’t reduce budget revenue, Cvetkovic said. “The state can only gain from this,” the prime minister said. “It will helpreduce the gray economy” as some employers “legalize” workers who are currently unreported, he said. (Source: Bloomberg)Serbia’s central bank left Europe’s highest benchmark interest rate unchanged and signaled it may begin loosening policy asinflation slows in the coming months, triggering a weakening of the dinar. Narodna Banka Srbije kept the two-week repurchase rateat 12.5 percent. The policy rate “is close to, or at its peak of the current cycle,” the bank said in a statement, signaling limitedpotential for further gains in the dinar, the central bank’s main tool to slow price growth. An expected easing of price pressures maywarrant a “very careful reduction in monetary restrictiveness,” it said. Serbian inflation accelerated in April to 14.7 percent, thefastest in 34 months, fuelled by a <strong>13</strong>.5 percent increase in electricity prices that month and rising food costs. “Inflation will peak inApril or May and then start falling toward the target in order to fall within the 3 percent to 6 percent tolerance band in the first half of2012,” the bank said in the statement. (Source: Bloomberg)2

CompanyAerodrom Nikola TeslaEnergoprojekt holdingNaftna industrija SrbijeSoja proteinTigarIzvor: BloombergCompanyAlfa PlamKomercijalna bankaMetalacIzvor: BloombergCompanyAgrobankaAIK banka<strong>Beograd</strong>ska industrija pivaBambiCredy bankaČačanska bankaDIN prioritetneDunav osiguranjeGalenika FitofarmacijaGlobos osiguranjeImlekInformatikaJedinstvo SevojnoJubmes bankaKomercijalna banka PBLastaNapred GPPolitikaPrivredna bankaProgresPupin TelecomPutevi UžiceRazvojna banka VojvodineSimpoTehnogasTelefonijaUniverzal bankaVelefarmVeterinarski zavod SuboticaVino ŽupaVitalVoda VrnjciSource: BloombergTickerPriceTurnover inRSDDailychangeA ListingWeeklychangeAERO 5<strong>13</strong> 5.300.316 0,19% 0,58% 781,42 7.862,31 0,03ENHL 911 2.563.554 0,11% -0,98% 1,00 9,72 10,02NIIS 538 26.089.772 3,03% 4,62% 1,87 5,24 42,34SJPT 1.018 481.514 -0,20% 0,39% 0,96 10,64 7,81TIGR 780 819.000 -0,38% 1,96% 0,39 n/a -1,76TickerB ListingALFA 9.273 0 0,00% -2,39% 0,44 3,55 12,92KMBN 3.200 0 0,00% -1,51% 0,74 9,65 8,62MTLC 2.400 0 0,00% 2,<strong>13</strong>% 0,79 8,04 9,92TickerAGBN 8.361 175.581 -3,47% -0,32% 0,37 n/a 7,95AIKB 3.627 21.167.172 -1,89% -4,33% 0,74 5,08 16,21BIPB 26 0 0,00% 3,96% 0,54 n/a -126,53BMBI 19.000 0 0,00% 0,53% 2,34 28,90 8,15CYBN 2.299 0 0,00% 6,93% 0,34 n/a -44,75CCNB 15.000 0 0,00% 0,00% 0,51 27,74 1,84DINNPB 1.848 0 0,00% -0,69% 1,00 5,61 7,47DNOS 1.706 0 0,00% -1,10% n/a n/a 1,36FITO 7.542 0 0,00% -0,80% 1,11 5,39 22,12GLOS 396 0 0,00% -12,00% 0,18 n/a 2,08IMLK 1.900 0 0,00% -4,95% 1,77 22,93 8,01INFM 2.850 0 0,00% <strong>13</strong>,64% 0,49 <strong>13</strong>1,42 0,40JESV 6.600 0 0,00% -1,48% 1,<strong>13</strong> 4,02 28,72JMBN 16.496 164.960 0,16% 0,22% 0,87 18,98 6,74KMBNPB 974 243.500 -0,61% -0,61% n/a n/a 8,62LSTA 450 0 0,00% -0,44% 0,30 1,34 25,59NPRD 2.800 0 0,00% 0,00% 0,28 0,86 39,62PLTK 80 0 0,00% 0,00% 0,24 n/a -16,32PRBN 500 0 0,00% -0,20% 0,50 n/a -12,35PRGS 84 14.700 2,44% 5,00% 0,09 331,62 0,03PTLK 121 0 0,00% 0,00% 0,14 221,47 0,06PUUE 964 0 0,00% -2,23% 0,74 5,23 14,74MTBN 2.703 154.071 -1,46% -10,32% 0,48 73,44 0,59SIMP 367 21.286 -0,81% -10,49% 0,07 n/a -7,95TGAS 7.438 0 0,00% 6,26% 0,92 10,54 9,15TLFN 1.095 20.8<strong>05</strong> 0,00% -5,36% 0,50 21,14 1,86UNBN 4.287 0 0,00% -4,73% 0,40 6,42 3,35VLFR 502 0 0,00% 0,00% 0,36 n/a -58,54VLFR 530 83.210 0,00% -0,93% 0,42 3,54 8,63VINZ 7.620 0 0,00% -7,<strong>05</strong>% 0,72 4,25 21,84VITL 1.250 50.000 -3,85% 0,00% 0,28 30,68 0,90VDAV 3.855 0 0,00% 0,00% 0,45 n/a 4,11P/BVTurnover in Daily WeeklyPrice P/BV P/E ROERSD change changePriceTurnover inRSDContinuous Trading MethodDailychangeWeeklychangeP/BVP/EP/EROEROEMarket Capitalization17.590.440.000 Din.8.625.175.000 Din.87.726.490.000 Din.10.022.<strong>05</strong>0.000 Din.1.340.399.000 Din.Market Capitalization1.621.032.000 Din.27.869.790.000 Din.2.448.000.000 Din.Market Capitalization6.009.452.000 Din.30.270.590.000 Din.236.757.500 Din.7.473.004.000 Din.730.394.600 Din.2.001.840.000 Din.6.114.603.000 Din.442.159.400 Din.3.318.480.000 Din.414.187.900 Din.17.293.710.000 Din.523.850.000 Din.2.011.145.000 Din.3.852.075.000 Din.363.798.700 Din.688.932.000 Din.961.181.200 Din.520.197.000 Din.1.246.414.000 Din.452.991.000 Din.<strong>13</strong>5.758.700 Din.946.880.300 Din.2.778.276.000 Din.388.909.900 Din.7.710.662.000 Din.634.218.500 Din.2.432.791.000 Din.782.665.700 Din.1.197.904.000 Din.1.511.579.000 Din.954.921.300 Din.442.503.900 Din.Napomene: (1) Promet=prosečna ponderisana cena x obim. (2) P/BV-price to book value je racio koji predstavlja odnos tržišne cene i knjigovodstvene vrednosti. (3) P/E-price toearnings je racio koji predstavlja odnos tržišne cene i zarade po akciji (EPS). (4) ROE-return on equity je racio koji predstavlja odnos neto dobiti i akcijskog kapitala. (5) Mcap-tržišnakapitalizacija=tržišna cena akcije x broj akcija3

REGIONIndexCountry / RegionValuePreviousChangeYTDCrobex Hrvatska2.209,292.208,33SBITOPSlovenija 764,77767,18SOFIXBugarska442,73443,29BETRumunija5.648,81 5.667,36DJ Stoxx Balkan 50 Balkan611,41612,73Source: Bloomberg0,04% 4,66%-0,31% -10,06%-0,<strong>13</strong>% 22,18%-0,33% 7,22%-0,22% 2,65%CROBEXSBITOP6000300<strong>05</strong>00025004000200030002000crobex15001000sbi20100<strong>05</strong>00002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10SOFIXBET2100120001700<strong>13</strong>00900sofix10000800060004000bet-c500200010001.01.08 01.06.08 01.11.08 01.04.09 01.09.09 01.02.10 01.07.10 01.12.10003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.101450DJ Stoxx Balkan 5012501<strong>05</strong>0850650dj balkan450250<strong>05</strong>.11.2007 <strong>05</strong>.03.2008 <strong>05</strong>.07.2008 <strong>05</strong>.11.2008 <strong>05</strong>.03.2009 <strong>05</strong>.07.2009 <strong>05</strong>.11.2009 <strong>05</strong>.03.2010 <strong>05</strong>.07.2010 <strong>05</strong>.11.2010 <strong>05</strong>.03.2011Economic growth in Bulgaria, Romania and Serbia is expected to accelerate next year, Greece's EFG Eurobank said on Thursday."The most recent high frequency indicators [in Bulgaria] in the first two months of the year [2011] point to a continuation of theexports-led recovery. In addition, early signals of recovery from the domestic demand side have shown up," the Greek bank said inthe April issue of its "New Europe Economics & Strategy" research paper. Maintain strong performance throughout 2011 is the keychallenge arising in Romania, EFG Eurobank said. "Secondly, there are risks related to the domestic growth outlook. Even ifheadline GDP numbers turn out to be in line with the budget forecast, if this is led by external demand it may not yield the requiredamount of tax revenues because only domestic demand can yield VAT," the report read. (Source: Bloomberg)International investors view a sovereign default by a euro-area nation as more likely than not with more than four-fifths bettingGreece will eventually fail to pay off its debt. Eighty-five percent of those surveyed this week said Greece probably will default, withmajorities predicting the same fate for Portugal and Ireland, which followed Greece in seeking European Union-led bailouts, a newBloomberg Global Poll shows. The outlook for all three countries deteriorated since January. The pessimism underscores howinvestors remain unconvinced that European policy makers can prevent the euro-area’s first default even as they look to beef upGreece’s 110 billion-euro rescue package ($156 billion). The cost of insuring against a Greek default reached a record this week asinvestors increased bets the country won’t be able to make good on its borrowing. Credit default swaps on Greek debt reached anall-time high 1,371 basis points on May 9, the same day the country’s two-year bond yield closed at a record 25.6 percent. (Source:Bloomberg)4

WORLDIndexCountry / RegionValuePrevious Change YTDDow Jones IndustrialS&P 500NASDAQFTSEDow Jones Stoxx 600Nikkei 225SAD12.695,92SAD1.348,65SADEngleska2.863,045.944,96EU 281,80Japan9.716,6512.630,031.342,082.845,065.976,00283,739.864,260,52% 9,66%0,49% 7,24%0,63% 7,92%-0,52% 0,76%-0,68% 2,17%-1,50% -5,01%Source: BloombergDow Jones IndustrialS&P 50014000160012000140010000dow jones12001000s&p8000800600002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.1060003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10NASDAQ CompositeFTSE700028002400nasdaq6000dax200<strong>05</strong>00016004000120003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10300002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10DJ Stoxx 600Nikkei 2253703201450012500270220nikkei1<strong>05</strong>00\dj stoxx170850012002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10650004.01.08 04.06.08 04.11.08 04.04.09 04.09.09 04.02.10 04.07.10 04.12.10U.S. stocks advanced, erasing the second straight decline for the Standard & Poor’s 500 Index, as the dollar fell and commoditiesrebounded from an early slump triggered by China’s efforts to curb lending. Cliffs Natural Resources Inc. and Schlumberger Ltd.rose at least 1.5 percent. Symantec Corp., the biggest maker of security software, climbed 5.2 percent after forecasting higherrevenue than analysts estimated. Tyson Foods Inc. added 4.6 percent as the biggest U.S. meat processor announced a stockbuyback. Cisco Systems Inc. slumped 4.8 percent and helped drag the market down earlier yesterday after forecasting profit thatmissed estimates. Federal Reserve Bank of Philadelphia President Charles Plosser said the U.S. economic recovery is nearing apoint where the central bank should begin pulling back record stimulus. “If the economy continues to make progress, then monetarypolicy will need to exit from its extraordinary accommodation in the not-too-distant future,” Plosser said yesterday. (Source:Bloomberg)European stocks fell, sending the benchmark Stoxx Europe 600 Index down for the first time in three days, led by a selloff in metaland oil producers as commodities extended rout. BHP Billiton Ltd. and Rio Tinto Group each lost more than 1 percent after copperslumped to a five-month low. Insurers declined as companies from Allianz SE to Aegon NA reported earnings. Thales SA dropped2.7 percent on a report that the company may make a cash contribution as part of an asset swap with Safran SA. Commodities fellfor a second day as investors speculated that China will raise interest rates to contain inflation, curbing demand for raw materials.The People’s Bank of China yesterday raised its lenders’ reserve requirements for the fifth time this year to restrain prices. Nationalbenchmark indexes declined in <strong>13</strong> of the 18 western European markets. France’s CAC 40 Index dropped 0.9 percent, the U.K.’sFTSE 100 Index slid 0.5 percent and Germany’s DAX Index fell 0.7 percent. Norway’s OBX Index retreated 1.1 percent after thecountry’s central bank raised interest rates. (Source: Bloomberg)Navedene informacije date su u svrhu opšteg informisanja i ne mogu biti zamena za finansijski savet niti se njihovim objavljivanjem stvara bilo kakva obveza za <strong>Banca</strong> <strong>Intesa</strong> ad<strong>Beograd</strong>. <strong>Banca</strong> <strong>Intesa</strong> ad <strong>Beograd</strong> ne prihvata odgovornost za bilo kakvu štetu nastalu upotrebom informacija iz ovog materijala. niti garantuje za njihovu tačnost. Zabranjeno je daljedistribuiranje i umnožavanje ovog materijala ili nekih njegovih delova bez prethodnog pisanog pristanka <strong>Banca</strong> <strong>Intesa</strong> ad <strong>Beograd</strong>.5