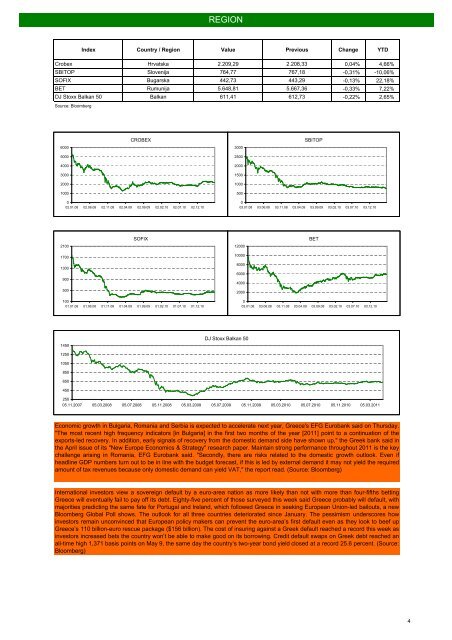

REGIONIndexCountry / RegionValuePreviousChangeYTDCrobex Hrvatska2.209,292.208,33SBITOPSlovenija 764,77767,18SOFIXBugarska442,73443,29BETRumunija5.648,81 5.667,36DJ Stoxx Balkan 50 Balkan611,41612,73Source: Bloomberg0,04% 4,66%-0,31% -10,06%-0,<strong>13</strong>% 22,18%-0,33% 7,22%-0,22% 2,65%CROBEXSBITOP6000300<strong>05</strong>00025004000200030002000crobex15001000sbi20100<strong>05</strong>00002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10SOFIXBET2100120001700<strong>13</strong>00900sofix10000800060004000bet-c500200010001.01.08 01.06.08 01.11.08 01.04.09 01.09.09 01.02.10 01.07.10 01.12.10003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.101450DJ Stoxx Balkan 5012501<strong>05</strong>0850650dj balkan450250<strong>05</strong>.11.2007 <strong>05</strong>.03.2008 <strong>05</strong>.07.2008 <strong>05</strong>.11.2008 <strong>05</strong>.03.2009 <strong>05</strong>.07.2009 <strong>05</strong>.11.2009 <strong>05</strong>.03.2010 <strong>05</strong>.07.2010 <strong>05</strong>.11.2010 <strong>05</strong>.03.2011Economic growth in Bulgaria, Romania and Serbia is expected to accelerate next year, Greece's EFG Eurobank said on Thursday."The most recent high frequency indicators [in Bulgaria] in the first two months of the year [2011] point to a continuation of theexports-led recovery. In addition, early signals of recovery from the domestic demand side have shown up," the Greek bank said inthe April issue of its "New Europe Economics & Strategy" research paper. Maintain strong performance throughout 2011 is the keychallenge arising in Romania, EFG Eurobank said. "Secondly, there are risks related to the domestic growth outlook. Even ifheadline GDP numbers turn out to be in line with the budget forecast, if this is led by external demand it may not yield the requiredamount of tax revenues because only domestic demand can yield VAT," the report read. (Source: Bloomberg)International investors view a sovereign default by a euro-area nation as more likely than not with more than four-fifths bettingGreece will eventually fail to pay off its debt. Eighty-five percent of those surveyed this week said Greece probably will default, withmajorities predicting the same fate for Portugal and Ireland, which followed Greece in seeking European Union-led bailouts, a newBloomberg Global Poll shows. The outlook for all three countries deteriorated since January. The pessimism underscores howinvestors remain unconvinced that European policy makers can prevent the euro-area’s first default even as they look to beef upGreece’s 110 billion-euro rescue package ($156 billion). The cost of insuring against a Greek default reached a record this week asinvestors increased bets the country won’t be able to make good on its borrowing. Credit default swaps on Greek debt reached anall-time high 1,371 basis points on May 9, the same day the country’s two-year bond yield closed at a record 25.6 percent. (Source:Bloomberg)4

WORLDIndexCountry / RegionValuePrevious Change YTDDow Jones IndustrialS&P 500NASDAQFTSEDow Jones Stoxx 600Nikkei 225SAD12.695,92SAD1.348,65SADEngleska2.863,045.944,96EU 281,80Japan9.716,6512.630,031.342,082.845,065.976,00283,739.864,260,52% 9,66%0,49% 7,24%0,63% 7,92%-0,52% 0,76%-0,68% 2,17%-1,50% -5,01%Source: BloombergDow Jones IndustrialS&P 50014000160012000140010000dow jones12001000s&p8000800600002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.1060003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10NASDAQ CompositeFTSE700028002400nasdaq6000dax200<strong>05</strong>00016004000120003.01.08 03.06.08 03.11.08 03.04.09 03.09.09 03.02.10 03.07.10 03.12.10300002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10DJ Stoxx 600Nikkei 2253703201450012500270220nikkei1<strong>05</strong>00\dj stoxx170850012002.01.08 02.06.08 02.11.08 02.04.09 02.09.09 02.02.10 02.07.10 02.12.10650004.01.08 04.06.08 04.11.08 04.04.09 04.09.09 04.02.10 04.07.10 04.12.10U.S. stocks advanced, erasing the second straight decline for the Standard & Poor’s 500 Index, as the dollar fell and commoditiesrebounded from an early slump triggered by China’s efforts to curb lending. Cliffs Natural Resources Inc. and Schlumberger Ltd.rose at least 1.5 percent. Symantec Corp., the biggest maker of security software, climbed 5.2 percent after forecasting higherrevenue than analysts estimated. Tyson Foods Inc. added 4.6 percent as the biggest U.S. meat processor announced a stockbuyback. Cisco Systems Inc. slumped 4.8 percent and helped drag the market down earlier yesterday after forecasting profit thatmissed estimates. Federal Reserve Bank of Philadelphia President Charles Plosser said the U.S. economic recovery is nearing apoint where the central bank should begin pulling back record stimulus. “If the economy continues to make progress, then monetarypolicy will need to exit from its extraordinary accommodation in the not-too-distant future,” Plosser said yesterday. (Source:Bloomberg)European stocks fell, sending the benchmark Stoxx Europe 600 Index down for the first time in three days, led by a selloff in metaland oil producers as commodities extended rout. BHP Billiton Ltd. and Rio Tinto Group each lost more than 1 percent after copperslumped to a five-month low. Insurers declined as companies from Allianz SE to Aegon NA reported earnings. Thales SA dropped2.7 percent on a report that the company may make a cash contribution as part of an asset swap with Safran SA. Commodities fellfor a second day as investors speculated that China will raise interest rates to contain inflation, curbing demand for raw materials.The People’s Bank of China yesterday raised its lenders’ reserve requirements for the fifth time this year to restrain prices. Nationalbenchmark indexes declined in <strong>13</strong> of the 18 western European markets. France’s CAC 40 Index dropped 0.9 percent, the U.K.’sFTSE 100 Index slid 0.5 percent and Germany’s DAX Index fell 0.7 percent. Norway’s OBX Index retreated 1.1 percent after thecountry’s central bank raised interest rates. (Source: Bloomberg)Navedene informacije date su u svrhu opšteg informisanja i ne mogu biti zamena za finansijski savet niti se njihovim objavljivanjem stvara bilo kakva obveza za <strong>Banca</strong> <strong>Intesa</strong> ad<strong>Beograd</strong>. <strong>Banca</strong> <strong>Intesa</strong> ad <strong>Beograd</strong> ne prihvata odgovornost za bilo kakvu štetu nastalu upotrebom informacija iz ovog materijala. niti garantuje za njihovu tačnost. Zabranjeno je daljedistribuiranje i umnožavanje ovog materijala ili nekih njegovih delova bez prethodnog pisanog pristanka <strong>Banca</strong> <strong>Intesa</strong> ad <strong>Beograd</strong>.5