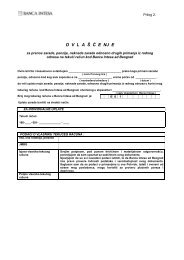

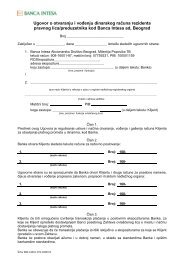

Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

Daily2011_05_13___English_version.pdf - Banca Intesa Beograd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

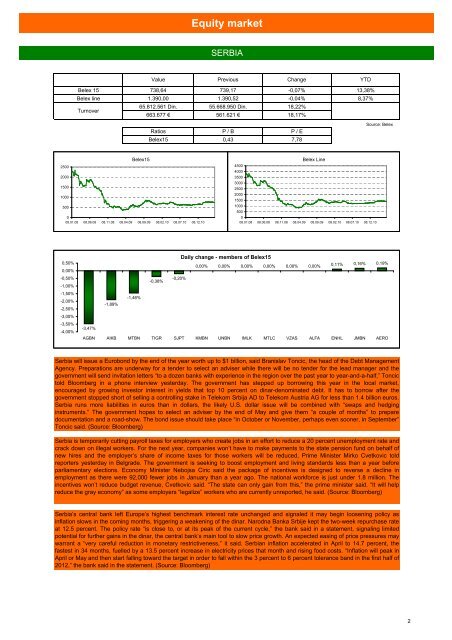

Equity marketSERBIABelex 15Value738,64Previous739,17Change-0,07%Belex line1.390,001.390,52-0,04%Turnover65.812.561 Din.55.668.950 Din.18,22%663.677 €561.621 €18,17%RatiosP / BP / EBelex15 0,43 7,78YTD<strong>13</strong>,38%8,37%Source: BelexBelex15250020001500100<strong>05</strong>00008.01.08 08.06.08 08.11.08 08.04.09 08.09.09 08.02.10 08.07.10 08.12.10Belex Line4500400035003000250020001500100<strong>05</strong>00008.01.08 08.06.08 08.11.08 08.04.09 08.09.09 08.02.10 08.07.10 08.12.100,50%0,00%-0,50%-1,00%-1,50%-2,00%-2,50%-3,00%-3,50%-4,00%Daily change - members of Belex150,00% 0,00% 0,00% 0,00% 0,00% 0,00%0,11% 0,16% 0,19%-0,38%-0,20%-1,46%-1,89%-3,47%AGBN AIKB MTBN TIGR SJPT KMBN UNBN IMLK MTLC VZAS ALFA ENHL JMBN AEROSerbia will issue a Eurobond by the end of the year worth up to $1 billion, said Branislav Toncic, the head of the Debt ManagementAgency. Preparations are underway for a tender to select an adviser while there will be no tender for the lead manager and thegovernment will send invitation letters “to a dozen banks with experience in the region over the past year to year-and-a-half,” Toncictold Bloomberg in a phone interview yesterday. The government has stepped up borrowing this year in the local market,encouraged by growing investor interest in yields that top 10 percent on dinar-denominated debt. It has to borrow after thegovernment stopped short of selling a controlling stake in Telekom Srbija AD to Telekom Austria AG for less than 1.4 billion euros.Serbia runs more liabilities in euros than in dollars, the likely U.S. dollar issue will be combined with “swaps and hedginginstruments.” The government hopes to select an adviser by the end of May and give them “a couple of months” to preparedocumentation and a road-show. The bond issue should take place “in October or November, perhaps even sooner, in September”Toncic said. (Source: Bloomberg)Serbia is temporarily cutting payroll taxes for employers who create jobs in an effort to reduce a 20 percent unemployment rate andcrack down on illegal workers. For the next year, companies won’t have to make payments to the state pension fund on behalf ofnew hires and the employer’s share of income taxes for those workers will be reduced, Prime Minister Mirko Cvetkovic toldreporters yesterday in Belgrade. The government is seeking to boost employment and living standards less than a year beforeparliamentary elections. Economy Minister Nebojsa Ciric said the package of incentives is designed to reverse a decline inemployment as there were 92,000 fewer jobs in January than a year ago. The national workforce is just under 1.8 million. Theincentives won’t reduce budget revenue, Cvetkovic said. “The state can only gain from this,” the prime minister said. “It will helpreduce the gray economy” as some employers “legalize” workers who are currently unreported, he said. (Source: Bloomberg)Serbia’s central bank left Europe’s highest benchmark interest rate unchanged and signaled it may begin loosening policy asinflation slows in the coming months, triggering a weakening of the dinar. Narodna Banka Srbije kept the two-week repurchase rateat 12.5 percent. The policy rate “is close to, or at its peak of the current cycle,” the bank said in a statement, signaling limitedpotential for further gains in the dinar, the central bank’s main tool to slow price growth. An expected easing of price pressures maywarrant a “very careful reduction in monetary restrictiveness,” it said. Serbian inflation accelerated in April to 14.7 percent, thefastest in 34 months, fuelled by a <strong>13</strong>.5 percent increase in electricity prices that month and rising food costs. “Inflation will peak inApril or May and then start falling toward the target in order to fall within the 3 percent to 6 percent tolerance band in the first half of2012,” the bank said in the statement. (Source: Bloomberg)2