HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

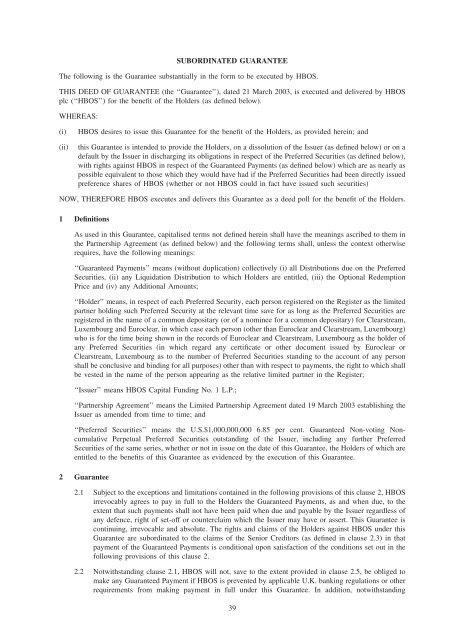

SUBORDINATED GUARANTEE<br />

The following is the Guarantee substantially in the form to be executed by <strong>HBOS</strong>.<br />

THIS DEED OF GUARANTEE (the ‘‘Guarantee’’), dated 21 March 2003, is executed and delivered by <strong>HBOS</strong><br />

<strong>plc</strong> (‘‘<strong>HBOS</strong>’’) for the benefit of the Holders (as defined below).<br />

WHEREAS:<br />

(i)<br />

(ii)<br />

<strong>HBOS</strong> desires to issue this Guarantee for the benefit of the Holders, as provided herein; and<br />

this Guarantee is intended to provide the Holders, on a dissolution of the Issuer (as defined below) or on a<br />

default by the Issuer in discharging its obligations in respect of the Preferred Securities (as defined below),<br />

with rights against <strong>HBOS</strong> in respect of the Guaranteed Payments (as defined below) which are as nearly as<br />

possible equivalent to those which they would have had if the Preferred Securities had been directly issued<br />

preference shares of <strong>HBOS</strong> (whether or not <strong>HBOS</strong> could in fact have issued such securities)<br />

NOW, THEREFORE <strong>HBOS</strong> executes and delivers this Guarantee as a deed poll for the benefit of the Holders.<br />

1 Definitions<br />

As used in this Guarantee, capitalised terms not defined herein shall have the meanings ascribed to them in<br />

the Partnership Agreement (as defined below) and the following terms shall, unless the context otherwise<br />

requires, have the following meanings:<br />

‘‘Guaranteed Payments’’ means (without duplication) collectively (i) all Distributions due on the Preferred<br />

Securities, (ii) any Liquidation Distribution to which Holders are entitled, (iii) the Optional Redemption<br />

Price and (iv) any Additional Amounts;<br />

‘‘Holder’’ means, in respect of each Preferred Security, each person registered on the Register as the limited<br />

partner holding such Preferred Security at the relevant time save for as long as the Preferred Securities are<br />

registered in the name of a common depositary (or of a nominee for a common depositary) for Clearstream,<br />

Luxembourg and Euroclear, in which case each person (other than Euroclear and Clearstream, Luxembourg)<br />

who is for the time being shown in the records of Euroclear and Clearstream, Luxembourg as the holder of<br />

any Preferred Securities (in which regard any certificate or other document issued by Euroclear or<br />

Clearstream, Luxembourg as to the number of Preferred Securities standing to the account of any person<br />

shall be conclusive and binding for all purposes) other than with respect to payments, the right to which shall<br />

be vested in the name of the person appearing as the relative limited partner in the Register;<br />

‘‘Issuer’’ means <strong>HBOS</strong> <strong>Capital</strong> <strong>Funding</strong> <strong>No</strong>. 1 L.P.;<br />

‘‘Partnership Agreement’’ means the Limited Partnership Agreement dated 19 March 2003 establishing the<br />

Issuer as amended from time to time; and<br />

‘‘Preferred Securities’’ means the U.S.$1,000,000,000 6.85 per cent. Guaranteed <strong>No</strong>n-voting <strong>No</strong>ncumulative<br />

Perpetual Preferred Securities outstanding of the Issuer, including any further Preferred<br />

Securities of the same series, whether or not in issue on the date of this Guarantee, the Holders of which are<br />

entitled to the benefits of this Guarantee as evidenced by the execution of this Guarantee.<br />

2 Guarantee<br />

2.1 Subject to the exceptions and limitations contained in the following provisions of this clause 2, <strong>HBOS</strong><br />

irrevocably agrees to pay in full to the Holders the Guaranteed Payments, as and when due, to the<br />

extent that such payments shall not have been paid when due and payable by the Issuer regardless of<br />

any defence, right of set-off or counterclaim which the Issuer may have or assert. This Guarantee is<br />

continuing, irrevocable and absolute. The rights and claims of the Holders against <strong>HBOS</strong> under this<br />

Guarantee are subordinated to the claims of the Senior Creditors (as defined in clause 2.3) in that<br />

payment of the Guaranteed Payments is conditional upon satisfaction of the conditions set out in the<br />

following provisions of this clause 2.<br />

2.2 <strong>No</strong>twithstanding clause 2.1, <strong>HBOS</strong> will not, save to the extent provided in clause 2.5, be obliged to<br />

make any Guaranteed Payment if <strong>HBOS</strong> is prevented by applicable U.K. banking regulations or other<br />

requirements from making payment in full under this Guarantee. In addition, notwithstanding<br />

39