HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

HBOS Capital Funding No. 1 L.P. HBOS plc - Lloyds Banking Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

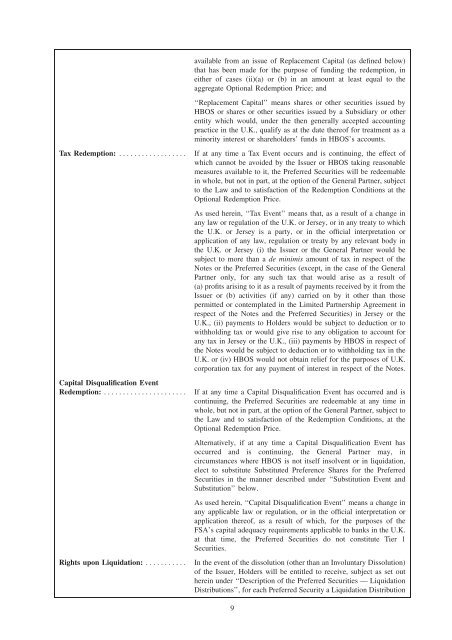

available from an issue of Replacement <strong>Capital</strong> (as defined below)<br />

that has been made for the purpose of funding the redemption, in<br />

either of cases (ii)(a) or (b) in an amount at least equal to the<br />

aggregate Optional Redemption Price; and<br />

‘‘Replacement <strong>Capital</strong>’’ means shares or other securities issued by<br />

<strong>HBOS</strong> or shares or other securities issued by a Subsidiary or other<br />

entity which would, under the then generally accepted accounting<br />

practice in the U.K., qualify as at the date thereof for treatment as a<br />

minority interest or shareholders’ funds in <strong>HBOS</strong>’s accounts.<br />

Tax Redemption: ******************<br />

<strong>Capital</strong> Disqualification Event<br />

Redemption: **********************<br />

Rights upon Liquidation: ***********<br />

If at any time a Tax Event occurs and is continuing, the effect of<br />

which cannot be avoided by the Issuer or <strong>HBOS</strong> taking reasonable<br />

measures available to it, the Preferred Securities will be redeemable<br />

in whole, but not in part, at the option of the General Partner, subject<br />

to the Law and to satisfaction of the Redemption Conditions at the<br />

Optional Redemption Price.<br />

As used herein, ‘‘Tax Event’’ means that, as a result of a change in<br />

any law or regulation of the U.K. or Jersey, or in any treaty to which<br />

the U.K. or Jersey is a party, or in the official interpretation or<br />

application of any law, regulation or treaty by any relevant body in<br />

the U.K. or Jersey (i) the Issuer or the General Partner would be<br />

subject to more than a de minimis amount of tax in respect of the<br />

<strong>No</strong>tes or the Preferred Securities (except, in the case of the General<br />

Partner only, for any such tax that would arise as a result of<br />

(a) profits arising to it as a result of payments received by it from the<br />

Issuer or (b) activities (if any) carried on by it other than those<br />

permitted or contemplated in the Limited Partnership Agreement in<br />

respect of the <strong>No</strong>tes and the Preferred Securities) in Jersey or the<br />

U.K., (ii) payments to Holders would be subject to deduction or to<br />

withholding tax or would give rise to any obligation to account for<br />

any tax in Jersey or the U.K., (iii) payments by <strong>HBOS</strong> in respect of<br />

the <strong>No</strong>tes would be subject to deduction or to withholding tax in the<br />

U.K. or (iv) <strong>HBOS</strong> would not obtain relief for the purposes of U.K.<br />

corporation tax for any payment of interest in respect of the <strong>No</strong>tes.<br />

If at any time a <strong>Capital</strong> Disqualification Event has occurred and is<br />

continuing, the Preferred Securities are redeemable at any time in<br />

whole, but not in part, at the option of the General Partner, subject to<br />

the Law and to satisfaction of the Redemption Conditions, at the<br />

Optional Redemption Price.<br />

Alternatively, if at any time a <strong>Capital</strong> Disqualification Event has<br />

occurred and is continuing, the General Partner may, in<br />

circumstances where <strong>HBOS</strong> is not itself insolvent or in liquidation,<br />

elect to substitute Substituted Preference Shares for the Preferred<br />

Securities in the manner described under ‘‘Substitution Event and<br />

Substitution’’ below.<br />

As used herein, ‘‘<strong>Capital</strong> Disqualification Event’’ means a change in<br />

any applicable law or regulation, or in the official interpretation or<br />

application thereof, as a result of which, for the purposes of the<br />

FSA’s capital adequacy requirements applicable to banks in the U.K.<br />

at that time, the Preferred Securities do not constitute Tier 1<br />

Securities.<br />

In the event of the dissolution (other than an Involuntary Dissolution)<br />

of the Issuer, Holders will be entitled to receive, subject as set out<br />

herein under ‘‘Description of the Preferred Securities — Liquidation<br />

Distributions’’, for each Preferred Security a Liquidation Distribution<br />

9