Case study: Downsizing strategy influence on the structure of the firm

Case study: Downsizing strategy influence on the structure of the firm

Case study: Downsizing strategy influence on the structure of the firm

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Management, Vol. 17, 2012, 1, pp. 75-92<br />

A. H. de E. E. de los M<strong>on</strong>teros, C. S. Bravo: <str<strong>on</strong>g>Case</str<strong>on</strong>g> <str<strong>on</strong>g>study</str<strong>on</strong>g>: <str<strong>on</strong>g>Downsizing</str<strong>on</strong>g> <str<strong>on</strong>g>strategy</str<strong>on</strong>g> <str<strong>on</strong>g>influence</str<strong>on</strong>g> <strong>on</strong> <strong>the</strong>…<br />

80<br />

• Retrenchment <str<strong>on</strong>g>strategy</str<strong>on</strong>g> is characterized by a specialized producti<strong>on</strong>,<br />

c<strong>on</strong>centrating activities to achieve ec<strong>on</strong>omies <strong>of</strong> scale. Structures tend<br />

to mechanical models, with increased levels <strong>of</strong> standardizati<strong>on</strong>,<br />

formalizati<strong>on</strong> and centralizati<strong>on</strong>.<br />

• Downscaling <str<strong>on</strong>g>strategy</str<strong>on</strong>g> is associated with structural movements, aimed at<br />

organic c<strong>on</strong>figurati<strong>on</strong>s. These <strong>structure</strong>s have low levels <strong>of</strong> horiz<strong>on</strong>tal<br />

differentiati<strong>on</strong> and standardizati<strong>on</strong>, but high levels <strong>of</strong> vertical<br />

differentiati<strong>on</strong> and centralizati<strong>on</strong>.<br />

• Downscoping strategies reduce <strong>the</strong> product-market complexity level<br />

leading to less differentiati<strong>on</strong> <strong>of</strong> activities. If <strong>the</strong> reducti<strong>on</strong> <strong>of</strong><br />

complexity is caused by <strong>the</strong> eliminati<strong>on</strong> <strong>of</strong> products or customers, <strong>the</strong><br />

organizati<strong>on</strong> tends to matrix <strong>structure</strong>s. On <strong>the</strong> o<strong>the</strong>r hand, if <strong>the</strong><br />

complexity is reduced due to <strong>the</strong> eliminati<strong>on</strong> <strong>of</strong> activities in <strong>the</strong> value<br />

system, <strong>the</strong> primary <strong>structure</strong> will c<strong>on</strong>tinue with <strong>the</strong> same c<strong>on</strong>figurati<strong>on</strong><br />

but reducing <strong>the</strong> differentiati<strong>on</strong> and standardizati<strong>on</strong> levels, so it will<br />

c<strong>on</strong>figure virtual <strong>structure</strong>s or company’s networks.<br />

This case <str<strong>on</strong>g>study</str<strong>on</strong>g> focuses <strong>on</strong> downscoping strategies because, according to<br />

business evidence, most diversified <strong>firm</strong>s held a lower diversificati<strong>on</strong> level<br />

since <strong>the</strong> ’90s, and downscoping is <strong>the</strong> most comm<strong>on</strong> <str<strong>on</strong>g>strategy</str<strong>on</strong>g> (Markides,<br />

1995). The analysis is based <strong>on</strong> a case <str<strong>on</strong>g>study</str<strong>on</strong>g> that, as it is shown in several<br />

studies (Hartley, 1995), allows <strong>the</strong> analysis <strong>of</strong> <strong>on</strong>e or more organizati<strong>on</strong>s to<br />

examine a c<strong>on</strong>temporary phenomen<strong>on</strong> in its own c<strong>on</strong>text. This analysis is also<br />

particularly relevant in research areas where <strong>the</strong>re are complex processes with<br />

several variables.<br />

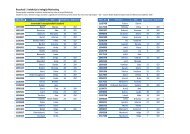

The results <strong>of</strong> <strong>the</strong> case are analyzed by <strong>the</strong>ir value <strong>on</strong> <strong>the</strong> stock market. In<br />

additi<strong>on</strong> to <strong>the</strong> results analysis, it is necessary to test whe<strong>the</strong>r <strong>the</strong> downsizing<br />

strategies implemented have had an effect <strong>on</strong> <strong>the</strong>m. For this analysis, we used a<br />

statistical event <str<strong>on</strong>g>study</str<strong>on</strong>g>. Hotchkiss & Stricklan (2003) use this methodology to<br />

analyze mergers, explaining how financial investors act according to <strong>the</strong><br />

informati<strong>on</strong> issued by <strong>the</strong> company.<br />

However, financial markets react not <strong>on</strong>ly to <strong>the</strong> event, but to <strong>the</strong><br />

informati<strong>on</strong> itself, so it is necessary to create temporal windows <strong>of</strong> events in<br />

which to analyze <strong>the</strong> effect <strong>on</strong> pr<strong>of</strong>itability. The event date is <strong>the</strong> time that <strong>the</strong><br />

informati<strong>on</strong> provided by <strong>the</strong> company has an effect, or <strong>the</strong> dates around which<br />

<strong>the</strong> event takes effect. This <str<strong>on</strong>g>study</str<strong>on</strong>g> refers to downscoping strategies, so it<br />

c<strong>on</strong>siders a time window <strong>of</strong> four m<strong>on</strong>ths prior to <strong>the</strong> finalizati<strong>on</strong> <strong>of</strong> <strong>the</strong> sale <strong>of</strong><br />

<strong>the</strong> business, and four m<strong>on</strong>ths after it. The relevant facts reported by <strong>the</strong><br />

company are <strong>the</strong> basis for calculating <strong>the</strong>se time frames because <strong>the</strong>y are