Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Global Economic Outlook and Strategy - Kadin Indonesia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

See the Disclosure Appendix for the Analyst<br />

Certification <strong>and</strong> Other Disclosures.<br />

ECONOMIC & February 28, 2008<br />

MARKET<br />

ANALYSIS<br />

<strong>Economic</strong>s/<strong>Strategy</strong><br />

<strong>Global</strong><br />

Lewis Alex<strong>and</strong>er<br />

1-212-816-9882<br />

lewis.alex<strong>and</strong>er@citi.com<br />

Europe<br />

Michael Saunders<br />

44-20-7986-3299<br />

Japan<br />

Kiichi Murashima<br />

81-3-5574-4730<br />

United States<br />

Robert V. DiClemente<br />

1-212-816-9893<br />

Australia/New Zeal<strong>and</strong><br />

Paul Brennan<br />

Stephen Halmarick<br />

61-2-8225-6043<br />

Canada<br />

Dana Peterson<br />

1-212-816-3549<br />

Emerging Markets<br />

Donald Hanna<br />

1-212-816-9891<br />

<strong>Global</strong> <strong>Economic</strong><br />

<strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

➤ Housing adjustment <strong>and</strong> tight financial conditions<br />

continue to weigh on the U.S. economy. Aggressive<br />

Fed easing <strong>and</strong> other policy measures should help, but<br />

a sustained pickup in growth depends on improved<br />

financial conditions.<br />

➤ Activity in the United Kingdom is also slowing. We<br />

expect the BoE to continue to ease policy gradually<br />

through yearend. We do not anticipate ECB easing<br />

until late in the second quarter.<br />

➤ As the U.S. slowdown broadens to consumption <strong>and</strong><br />

investment, other countries should be more affected.<br />

But we expect only a modest slowdown in emerging<br />

economies.<br />

➤ Inflation worries in emerging markets are probably<br />

overblown but they will reduce the scope for monetary<br />

loosening in the short run.<br />

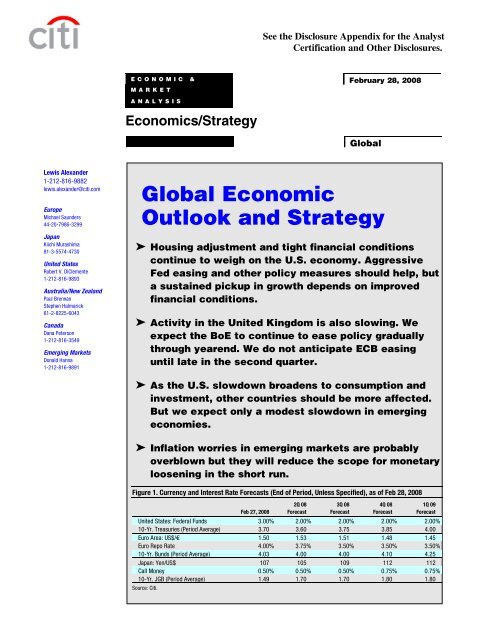

Figure 1. Currency <strong>and</strong> Interest Rate Forecasts (End of Period, Unless Specified), as of Feb 28, 2008<br />

2Q 08 3Q 08 4Q 08 1Q 09<br />

Feb 27, 2008 Forecast Forecast Forecast Forecast<br />

United States: Federal Funds 3.00% 2.00% 2.00% 2.00% 2.00%<br />

10-Yr. Treasuries (Period Average) 3.70 3.60 3.75 3.85 4.00<br />

Euro Area: US$/€ 1.50 1.53 1.51 1.48 1.45<br />

Euro Repo Rate 4.00% 3.75% 3.50% 3.50% 3.50%<br />

10-Yr. Bunds (Period Average) 4.03 4.00 4.00 4.10 4.25<br />

Japan: Yen/US$ 107 105 109 112 112<br />

Call Money 0.50% 0.50% 0.50% 0.75% 0.75%<br />

10-Yr. JGB (Period Average) 1.49 1.70 1.70 1.80 1.80<br />

Source: Citi.

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Table of Contents<br />

Page<br />

Key Events Calendar 2<br />

Summary of Main Views 3<br />

Overview 4-9<br />

Short-Term <strong>Economic</strong> Forecasts 10<br />

Key <strong>Global</strong> <strong>Economic</strong> Indicators 11<br />

Short-Term Currency, Interest Rate <strong>and</strong> Bond Forecasts 12-13<br />

Foreign Exchange <strong>Strategy</strong> 14-15<br />

<strong>Global</strong> Equity <strong>Strategy</strong> 16-17<br />

Long-Term <strong>Economic</strong> <strong>and</strong> Market Forecasts 18-19<br />

Country Commentary<br />

United States 20<br />

Japan 21<br />

Euro Area 22-24<br />

United Kingdom 25<br />

Switzerl<strong>and</strong>, Sweden, Denmark, <strong>and</strong> Norway 26<br />

Canada 27<br />

Australia <strong>and</strong> New Zeal<strong>and</strong> 28<br />

China 29<br />

Emerging Markets 30-38<br />

EMA Contact List 39<br />

Recent Publications 40<br />

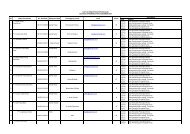

Figure 2. Key Policy Events, 28 Feb – 31 Mar 08<br />

Date Country Event<br />

Mar 2 Russia Presidential Election, First Round<br />

Mar 3-4 European Union Eurogroup Finance Ministers’ Meetings (Mar 3) <strong>and</strong> ECOFIN Meetings (Mar4)<br />

Mar 4 Australia Reserve Bank of Australia Board Meeting<br />

Mar 4 Canada Bank of Canada Interest Rate Announcement<br />

Mar 4-5 Brazil Central Bank of Brazil Monetary Policy Meeting<br />

Mar 5-6 United Kingdom Bank of Engl<strong>and</strong> Monetary Policy Committee Meeting<br />

Mar 5-19 China 11 th National People’s Congress Approves the Formation of the New Government<br />

Mar 6 New Zeal<strong>and</strong> Reserve Bank of New Zeal<strong>and</strong> Monetary Policy Statement <strong>and</strong> Official Cash Rate Announcement<br />

Mar 6-7 Japan Bank of Japan Monetary Policy Meeting<br />

Mar 6 Euro Area ECB Monetary Policy Meeting <strong>and</strong> Press Conference<br />

Mar 7 Korea Bank of Korea Monetary Policy Meeting<br />

Mar 9 Spain General Election<br />

Mar 9 France Municipal Elections, First Round (Second Round Mar 16)<br />

Mar 9 United States & Canada Clocks Moved Forward One Hour<br />

Mar 12 United Kingdom 2008 Budget<br />

Mar 13 Philippines Central Bank of the Philippines Monetary Board Meeting<br />

Mar 13 Switzerl<strong>and</strong> Swiss National Bank Monetary Policy Assessment<br />

Mar 13 Norway Norges Bank Monetary Policy Report <strong>and</strong> Interest Rate Announcement<br />

Mar 13 Chile Central Bank of Chile Monetary Policy Meeting<br />

Mar 13 Peru Central Reserve Bank of Peru Monetary Policy Announcement<br />

Mar 13-14 European Union European Council of Heads of State <strong>and</strong> Government (Brussels)<br />

Mar 14 Mexico Bank of Mexico Monetary Policy Announcement<br />

Mar 14-16 G-8 G-8 Dialogue on Climate Change (Chiba, Japan)<br />

Mar 18 United States FOMC Meeting<br />

Mar 19 Turkey Central Bank of the Republic of Turkey Monetary Policy Meeting<br />

Mar 25 Israel Bank of Israel Interest Rate Announcement<br />

Mar 25 Slovakia National Bank of Slovakia Monetary Policy Report<br />

Mar 25-26 Pol<strong>and</strong> National Bank of Pol<strong>and</strong> Monetary Policy Council Meeting<br />

Mar 26 Romania National Bank of Romania Board Meeting<br />

Mar 26 Czech Republic Czech National Bank Monetary Policy Board Meeting<br />

Mar 28-29 European Union Informal Meeting of EU Foreign Ministers<br />

Mar 31 Europe Clocks Moved Forward One Hour<br />

Mar 31 Hungary Central Bank of Hungary Monetary Policy Meeting<br />

2

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

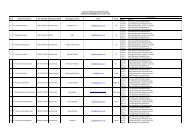

Figure 3. Forecast Highlights <strong>and</strong> Changes from Last Month<br />

G3<br />

• United States • With tight financial conditions reinforcing economic weakness, the<br />

Fed has taken a more aggressive tack, with only limited impact<br />

thus far. We look for cuts in the funds rate to 2% by midyear,<br />

barring a sharp recovery in risk appetite <strong>and</strong> housing leads.<br />

• Euro Area • Growth has slowed to a subtrend pace, where it probably will stay<br />

until late this year. Inflation remains high but should moderate<br />

quickly. We expect the ECB to ease policy modestly later this year.<br />

• Japan • <strong>Economic</strong> growth likely will remain near trend in 2008. The next<br />

BoJ rate hike probably will be delayed until around yearend, as<br />

uncertainties surrounding the global outlook have increased.<br />

Others<br />

• United Kingdom • The MPC will likely cut rates a lot more, but any easing will be<br />

gradual in order to grind down inflation expectations.<br />

• Canada • Moderating inflation <strong>and</strong> lingering downside risks likely will prompt<br />

an additional 100 basis points of BoC easing before summer.<br />

• Australia • The RBA is set to tighten policy again in March <strong>and</strong> May, with the<br />

risk of further tightening beyond that, as the Bank attempts to drive<br />

inflation back down toward the 2%-3% target range.<br />

• China • Rising inflation <strong>and</strong> weakening exports could lead to a period of<br />

tight monetary policy <strong>and</strong> loose fiscal policy.<br />

• Other Emerging Markets • Inflation worries are probably overblown, but they will reduce<br />

the scope for monetary loosening in the short run <strong>and</strong> dampen<br />

growth.<br />

3

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Lewis Alex<strong>and</strong>er<br />

(212) 816-9882<br />

lewis.alex<strong>and</strong>er<br />

@citi.com<br />

Financial conditions are<br />

weighing on the U.S.<br />

economy.<br />

Most countries show few<br />

signs of distress...<br />

...but that may change.<br />

Emerging economies are<br />

well positioned for the<br />

slowdown.<br />

Overview: The United States <strong>and</strong> World <strong>Economic</strong> <strong>Outlook</strong><br />

The recent deterioration in financial conditions is having its biggest impact on the U.S.<br />

economy. Europe is also slowing, but the spillover to most emerging economies<br />

remains modest so far. Looking ahead, we expect a variety of factors — including the<br />

waning of the drag from residential construction, fiscal stimulus, <strong>and</strong> improving<br />

financial conditions driven by a more assertive Fed — to contribute to a modest<br />

recovery in U.S. growth starting in the second half of the year.<br />

The forces restraining the pace of U.S. economic activity have shown few signs of<br />

easing in recent weeks. Incoming data from the housing sector point to ongoing<br />

contraction. The prevailing mix of credit, equity, <strong>and</strong> other asset prices continues to be<br />

a significant headwind for aggregate dem<strong>and</strong> (see Figure 4). Consumption indicators<br />

suggest that household spending has slowed markedly.<br />

The U.S. slowdown is a drag on the Canadian <strong>and</strong> Mexican economies, <strong>and</strong> economic<br />

activity in the United Kingdom <strong>and</strong> the euro area is also slowing, but less sharply than<br />

in the United States.<br />

However, most other countries still show few signs of being adversely affected by the<br />

U.S.-led slowdown. Recent data for China point to a strong start to 2008, while resilient<br />

dem<strong>and</strong> for commodities is supporting many emerging economies <strong>and</strong> smaller highincome<br />

countries with a comparative advantage in commodity production. The<br />

underperformance of the U.S. economy relative to most other major economies is<br />

contributing to downward pressure on the U.S. dollar (see Figure 5).<br />

This pattern may change in coming quarters. The U.S. slowdown is spreading beyond<br />

residential construction. A broader <strong>and</strong> deeper slowdown in U.S. consumption <strong>and</strong><br />

investment should generate a more significant slowdown in imports that will serve to<br />

moderate growth in the rest of the world (see Figure 6).<br />

Policy flexibility around the world is likely to play an important role in containing the<br />

global slowdown. Unlike the past, many emerging economies (such as Brazil, Mexico,<br />

<strong>and</strong> Korea) have strong public <strong>and</strong> private balance sheets, <strong>and</strong> they have established<br />

Figure 4. United States — Citi Financial Conditions Index (St<strong>and</strong>ard<br />

Deviations) <strong>and</strong> the Output Gap (Percent of GDP), 1988-Jan 08<br />

3σ 3<br />

6% 6<br />

Figure 5. United States <strong>and</strong> Other Major Industrial Countries —<br />

<strong>Economic</strong> Surprises (100=1 St<strong>and</strong>ard Deviation), Jan 07-27 Feb 08<br />

100<br />

100<br />

2<br />

4<br />

75<br />

75<br />

1<br />

2<br />

50<br />

50<br />

0<br />

-1<br />

-2<br />

-3<br />

1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008<br />

FCI (Left)<br />

GDP Gap (Right)<br />

0<br />

-2<br />

-4<br />

-6<br />

25<br />

0<br />

-25<br />

-50<br />

United States<br />

Other Major Economies<br />

-75<br />

-75<br />

Jan-07 Apr-07 Jul-07 Oct-07 Jan-08 Apr-08<br />

25<br />

0<br />

-25<br />

-50<br />

Note: Shaded regions denote recession. Sources: Bureau of <strong>Economic</strong> Analysis, Congressional<br />

Budget Office <strong>and</strong> Citi.<br />

Note: Citi <strong>Economic</strong> Surprise Indexes are weighted averages of the difference between<br />

individual data releases <strong>and</strong> the consensus forecast. “Other Industrial Countries” includes the<br />

euro area, Japan, Great Britain, Australia, <strong>and</strong> Canada. Source: Citi.<br />

4

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Slow growth should<br />

contain inflation.<br />

The course of global<br />

growth depends on<br />

financial conditions.<br />

The Citi FCI has tightened<br />

despite Fed easing.<br />

The fiscal package will<br />

provide a temporary<br />

boost.<br />

Inflation likely will cool in<br />

the second half.<br />

strong records of pursuing stable macroeconomic policies. This should make it possible<br />

for these countries to ease policy, if needed, even in the midst of substantial turmoil in<br />

global financial markets.<br />

Strong commodity prices <strong>and</strong> declining output gaps in some countries are putting<br />

upward pressure on inflation. Nonetheless, we expect the slowdown in the United<br />

States <strong>and</strong> Western Europe to contain inflation in those countries (see Figure 7), <strong>and</strong><br />

slowing export growth should help to contain inflationary pressures in other key<br />

countries such as China.<br />

The evolution of financial conditions remains a key source of uncertainty. In recent<br />

days, credit, equity, <strong>and</strong> other financial markets seem to have found a footing in<br />

response to the significant shift in Federal Reserve policy in late January, the U.S. fiscal<br />

stimulus package, <strong>and</strong> other policy measures intended to address some of the stress<br />

points in the financial system. However, even if financial markets stabilize <strong>and</strong> improve<br />

from here, the cumulative impact of the financial turmoil of the last six months is likely<br />

to be a drag on the U.S. <strong>and</strong> global economy for many months. Moreover, given the<br />

still considerable uncertainty about the magnitude <strong>and</strong> distribution of losses in the<br />

financial system, we cannot be confident that we have seen the worst in financial<br />

markets.<br />

U.S. Financial Conditions Critical to the <strong>Outlook</strong><br />

Our composite measure of U.S. financial conditions has tightened since our last forecast<br />

round (see Figure 4). Currently, the Citi financial conditions index (FCI) is about two<br />

st<strong>and</strong>ard deviations tighter than normal, a reading consistent with anemic economic<br />

growth. Recent data, particularly the deceleration of consumption since November,<br />

appear consistent with the deterioration in financial conditions since last summer. The<br />

Federal Reserve seems likely to lower policy rates further in an attempt to offset the<br />

adverse dynamic starting to take hold. Importantly, forecasts of a sustained<br />

improvement in the pace of activity later this year depend on a recovery in financial<br />

conditions.<br />

The recently enacted fiscal stimulus package will boost economic growth later this year<br />

— most likely in the third quarter — but its impact on activity will be temporary. The<br />

lift in household disposable income from the rebate checks could underpin consumer<br />

spending growth that is about 2½ percentage points faster than otherwise would be the<br />

case. But because this is a one-time boost to household income, the step up in spending<br />

will be largely reversed out in ensuing quarters.<br />

An additional 100-basis-point decline in the funds rate is likely despite the continued<br />

stickiness in inflation. Consumer <strong>and</strong> wholesale inflation readings in January were<br />

disappointing, <strong>and</strong> our latest forecast anticipates slightly higher core inflation this year.<br />

As long as inflation expectations remain anchored near current levels, however, the<br />

combination of soft dem<strong>and</strong>, tight financial conditions, <strong>and</strong> falling home prices should<br />

produce a cooling in price pressures. The timetable for such a cooling probably will be<br />

deeper into the year than we previously envisioned. As key Fed officials continue to<br />

remind market participants, an unmooring of pricing attitudes could upend expectations<br />

of an easing in inflation. So, we will continue to monitor developments on this front<br />

closely.<br />

5

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Improved financial<br />

conditions will be<br />

necessary to avoid the<br />

worst outcomes.<br />

Risks to euro area growth<br />

are to the downside...<br />

...while Japan may show<br />

little impact from slower<br />

global growth.<br />

In recent days, however, financial markets have improved marginally in response to the<br />

likelihood that Fed officials will continue to pursue a risk-management approach to<br />

policy <strong>and</strong> hints that some regulators’ efforts may be reducing the probability of select<br />

risk outcomes (see Figures 8 <strong>and</strong> 9). Considerable additional improvement remains<br />

necessary.<br />

The Euro Area Has Started to Slow<br />

GDP growth in the euro area slowed markedly in late 2007, <strong>and</strong> confidence indicators<br />

suggest that the expansion remains somewhat below trend early this year, although not<br />

dramatically so. Still, the risks to the growth outlook remain on the downside, reflecting<br />

not only the global slowdown, but also, <strong>and</strong> more importantly, disappointing domestic<br />

consumption. Against a backdrop of less favorable labor market conditions, tighter<br />

lending st<strong>and</strong>ards suggest that a significant rebound of consumer outlays is less likely<br />

than before. The near-term inflation outlook is uncertain, as food <strong>and</strong> energy prices may<br />

rise further. However, medium-term price prospects remain favorable because the<br />

economic slowdown limits the risk of a rise in inflation expectations <strong>and</strong> wage growth.<br />

The European Central Bank (ECB) probably will keep official rates unchanged until<br />

near-term inflation <strong>and</strong> wage risks diminish. If inflation moderates rapidly starting in<br />

the second quarter <strong>and</strong> wages are contained, the ECB probably will lower rates this<br />

year, although not aggressively. The rise in the latest German ifo business survey will<br />

no doubt encourage ECB officials to consider that growth will not be far below<br />

potential.<br />

Muted Impact on Japanese Economy<br />

Japan’s economic outlook remains relatively favorable <strong>and</strong> stable among the major<br />

industrialized countries. Real GDP grew a stronger-than-expected 3.7% annualized in<br />

the fourth quarter of 2007, driven by strong gains in exports <strong>and</strong> business investment.<br />

While exports will inevitably decelerate in 2008 in the context of the slower global<br />

economy, we still expect near or slightly above-trend growth this year. Trade statistics<br />

for January indicate that Japan’s exports remain on a solid upward track, driven by<br />

exports not bound for the United States. Moreover, negative effects from the<br />

Figure 6. United States — Year-to-Year Percent Change in Imports<br />

<strong>and</strong> the Average of ISM New Orders <strong>and</strong> Imports (Six-Month Lag),<br />

1996–Jan 08<br />

25%<br />

20<br />

15<br />

10<br />

70<br />

65<br />

60<br />

Figure 7. United States — Nominal Final Domestic Dem<strong>and</strong> (Yearto-Year<br />

Percent Change, Four-Quarter Lag) <strong>and</strong> Change in Two-Year<br />

Annualized Core CPI (Percent), 1990–Jan 08<br />

9% 9<br />

1.2%<br />

Final Dem<strong>and</strong> (Left)<br />

8<br />

Core CPI (Right)<br />

0.8<br />

7<br />

6<br />

0.4<br />

5<br />

55<br />

5<br />

0.0<br />

0<br />

-5<br />

-10<br />

Growth of Imports (Left)<br />

Imports&Orders (Right)<br />

50<br />

45<br />

4<br />

3<br />

2<br />

-0.4<br />

-0.8<br />

-15<br />

1996 1998 2000 2002 2004 2006<br />

40<br />

1<br />

1990 1993 1996 1999 2002 2005 2008<br />

-1.2<br />

Sources: Institute for Supply Management <strong>and</strong> Bureau of <strong>Economic</strong> Analysis.<br />

Sources: Bureau of <strong>Economic</strong> Analysis <strong>and</strong> Bureau of Labor Statistics.<br />

6

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

The change in BoJ<br />

leadership will not alter<br />

policy.<br />

Rising commodity prices<br />

have helped some<br />

industrial economies.<br />

Strong fundamentals have<br />

insulated some emerging<br />

economies...<br />

...from deteriorating global<br />

growth.<br />

government’s economic policies — namely, the enforcement of the revised Building<br />

St<strong>and</strong>ard Law <strong>and</strong> tax <strong>and</strong> social security burden hikes for the household sector — will<br />

diminish meaningfully or even reverse in 2008. Finally, financial conditions remain<br />

much more favorable than in other industrialized countries as damages to banks’ capital<br />

from subprime mortgage-related structured products have been limited.<br />

Bank of Japan (BoJ) Governor Fukui will leave office on March 19. The government is<br />

scheduled to announce its proposal for the next governor <strong>and</strong> two deputy governors<br />

next week. Press reports suggest that Mr. Toshiro Muto, a current deputy governor, is<br />

likely to be nominated to replace Mr. Fukui. The basic thrust of monetary policy (that<br />

is, gradual rate hikes to more normal levels) will likely remain largely intact. While<br />

uncertainties surrounding the U.S. economy <strong>and</strong> global financial markets will likely<br />

continue to dissuade the BoJ from hiking rates until around the turn of this year, the<br />

next policy action will probably be a rate hike unless the domestic economy slows<br />

much more sharply than we now expect.<br />

Strong Commodities Dem<strong>and</strong> Is Boosting Some Industrial Countries<br />

In contrast to developments in the major industrial economies, economic growth has<br />

remained resilient in a number of smaller industrialized economies that principally are<br />

leveraged to the boom in commodity prices, such as Australia. Indeed, many<br />

commodity prices have continued to rise this year, especially energy-related<br />

commodities, iron ore, food, <strong>and</strong> some base metals, despite the marking down of<br />

prospects for global economic growth. The strength of commodity prices reflects<br />

ongoing supply bottlenecks <strong>and</strong> still rampant dem<strong>and</strong> in China <strong>and</strong> emerging<br />

economies generally. Against this backdrop, a deteriorating outlook for inflation forced<br />

both the Reserve Bank of Australia <strong>and</strong> the Riksbank to raise official interest rates in<br />

February, <strong>and</strong> we expect more monetary policy tightening in Australia <strong>and</strong> Norway,<br />

while the Reserve Bank of New Zeal<strong>and</strong> is likely to maintain a tightening bias this year.<br />

Strong Fundamentals Are Bolstering Many Emerging Economies...<br />

Strong economic growth is likely to continue in emerging Asia, despite the weakening<br />

of the U.S. economy. However, Asia’s resilient growth is not because it has decoupled<br />

from the United States, but because it enjoys greater policy flexibility from improved<br />

macroeconomic fundamentals. China is likely to step up public-sector dominated<br />

spending on infrastructure <strong>and</strong> the resource sectors in the face of slowing exports. This<br />

could also happen in many other economies, including Korea, Hong Kong, Singapore,<br />

Thail<strong>and</strong>, the Philippines, <strong>and</strong> even <strong>Indonesia</strong>. This implies that, in the short term,<br />

while headline growth could moderate, Asian economies could become more dependent<br />

on investment. As a result, commodity dem<strong>and</strong> intensity could increase.<br />

Deteriorating global prospects, especially in the major economies, have so far had only<br />

a modest impact on Latin American economies. Growth remains generally strong,<br />

although somewhat slower than in 2007, <strong>and</strong> should remain above trend with a regional<br />

average of 4.4% for 2008. After a temporary selloff, currencies have strengthened, with<br />

the Brazilian real, Peruvian sol, <strong>and</strong> Colombian <strong>and</strong> Chilean pesos making new highs<br />

against the U.S. dollar in recent weeks.<br />

China will appoint its new government for the next five years at the National People’s<br />

Congress meetings starting March 5. A new president just took office in Korea. In<br />

general, we do not expect these political changes to have a significant impact on<br />

7

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

economic policies. However, economic policies in Taiwan <strong>and</strong> Thail<strong>and</strong> could show<br />

significant improvement following the elections, generating an important<br />

macroeconomic turnaround in these two sluggish economies.<br />

Slowing exports may<br />

harm some emerging<br />

economies.<br />

Reduced capital flows are<br />

hurting countries that rely<br />

on external financing.<br />

However, financial stability remains a concern in a number of emerging European<br />

economies thanks to a sustained decline in risk appetite, together with concerns about<br />

the risks to net exports in the context of a slowdown in the Eurozone. The export shock<br />

will be felt most acutely in central Europe, particularly in Hungary, Czech Republic,<br />

<strong>and</strong> Slovakia, whose economies are highly dependent on exports, <strong>and</strong> whose recent<br />

growth rates have benefited considerably from Eurozone dem<strong>and</strong>. Pol<strong>and</strong>, by contrast,<br />

should be relatively insulated because it is a more closed economy reliant on domestic<br />

spending growth.<br />

The decline in capital flows is naturally proving most painful to those economies<br />

heavily dependent on external financing: Romania, South Africa, <strong>and</strong> the Baltics are<br />

key examples. The clearest expression of risk aversion in these countries has been the<br />

continued rise in sovereign credit (particularly CDS) spreads. The rise in spreads has<br />

been noticeably large even in countries with very low public debt burdens like<br />

Kazakhstan (6% of GDP) or Romania (16% of GDP). In addition, currency volatility<br />

has increased in a number of countries, particularly in South Africa <strong>and</strong> Romania.<br />

...But Inflation Remains a Concern<br />

Rates have risen in<br />

countries at risk to higher<br />

inflation.<br />

Oil exports also are<br />

experiencing rising<br />

inflation.<br />

The decline in capital flows <strong>and</strong> the rise in exchange rate volatility complicate the<br />

inflation outlook in many countries, particularly in the context of higher global food<br />

prices. Interest rates are under upward pressure in South Africa, Romania, Hungary, the<br />

Czech Republic, Pol<strong>and</strong>, <strong>and</strong> Egypt, among other countries. Our interest rate forecasts<br />

are subject to the risk that we have underestimated food price shocks in the region.<br />

Inflation is also a key issue for many of the “surplus” economies, notably the Gulf<br />

Cooperation Council <strong>and</strong> Russia. For these economies it remains the case that currency<br />

appreciation will be the most reliable disinflationary tool. Policymakers remain fearful<br />

in many cases that stronger nominal exchange rates will hurt competitiveness. In time<br />

we expect this dilemma to be resolved mostly in favor of local currency revaluation<br />

against the dollar.<br />

Figure 8. United States — Spreads for Indexes of Credit Defaults<br />

Swaps <strong>and</strong> Leveraged Loans (Basis Points), Jan 07-26 Feb 08<br />

Figure 9. United States — S&P 500 <strong>and</strong> S&P Financials Equity Price<br />

Indexes (May 2007=100), Jan 07-26 Feb 08<br />

180bp<br />

800bp<br />

110<br />

110<br />

160<br />

140<br />

CDX-IG5 (left)<br />

CDX-HY5 (right)<br />

LCDX (right)<br />

700<br />

600<br />

100<br />

FOMC Inter-Meeting<br />

Interest Rate Cut<br />

100<br />

120<br />

500<br />

90<br />

90<br />

100<br />

400<br />

80<br />

300<br />

80<br />

80<br />

60<br />

40<br />

FOMC Inter-Meeting<br />

Interest Rate Cut<br />

200<br />

100<br />

70<br />

S&P 500<br />

S&P Financial Index<br />

70<br />

20<br />

0<br />

60<br />

60<br />

Jan-07 Apr-07 Jul-07 Oct-07 Jan-08<br />

Jan-07 Apr-07 Jul-07 Oct-07 Jan-08<br />

Source: Citi.<br />

Source: Haver.<br />

8

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Rising global food<br />

prices...<br />

...complicate monetary<br />

policy.<br />

Food inflation has become a key challenge in a number of economies, including China,<br />

Hong Kong, Singapore, Taiwan, <strong>and</strong> Vietnam. This has led to tightening monetary<br />

policies, including faster appreciation of Asian currencies, especially the Taiwanese<br />

dollar <strong>and</strong> Vietnamese dong. In other economies where inflation is less of a challenge,<br />

monetary policy easing is likely to continue following the Fed actions, especially in<br />

Thail<strong>and</strong>, the Philippines, <strong>and</strong> Korea. While inflation complicates macroeconomic<br />

policymaking, we think the chances of stagflation remain remote, as slowing activities<br />

should help ease inflation rates, especially core rates. But food prices could stay high in<br />

coming months, suggesting that tightening biases may continue in a number of<br />

economies.<br />

Given the high share of food in the typical CPI basket in Latin America, inflation<br />

pressures should remain a concern for most regional central bankers in the coming<br />

month. Interest rate markets reflect a lower risk of rate hikes in Brazil, <strong>and</strong> they are now<br />

pricing in cuts in Mexico. But the central banks of Chile, Colombia, <strong>and</strong> Peru remain<br />

under pressure to tighten further, as inflation rates continue to print well above their<br />

targets. Our current forecasts show the region shifting into a current account deficit of<br />

0.2% of GDP in 2008 on the back of rapidly growing imports. However, we believe<br />

that sky-high commodity prices place our forecast at risk, <strong>and</strong> may lead to higher-thanexpected<br />

reserves accumulation again this year.<br />

9

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

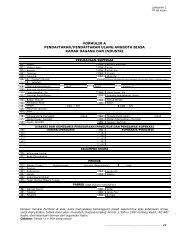

Figure 10. Forecast Overview, 2007-09F<br />

GDP Growth CPI Inflation Current Balance (% of GDP) Fiscal Balance (% of GDP)<br />

2007 2008F 2009F 2007 2008F 2009F 2007 2008F 2009F 2007 2008F 2009F<br />

<strong>Global</strong> 3.9% 3.2% 3.3% 3.0% 3.7% 2.8% 0.2% 0.1% 0.1% -0.6% -1.3% -1.4%<br />

Based on PPP weights 4.8 4.1 4.2 3.6 4.2 3.3 1.0 0.7 0.4 -0.7 -1.4 -1.5<br />

Industrial Countries 2.5% 1.7% 2.0% 2.1% 2.6% 1.8% -1.5% -1.2% -0.7% -1.0% -1.9% -1.9%<br />

United States 2.2 1.6 2.1 2.9 3.6 2.0 -5.4 -4.9 -4.1 -1.1 -3.0 -3.0<br />

Japan 2.1 1.9 1.7 0.0 0.7 0.3 4.8 4.8 5.2 -2.8 -3.0 -3.1<br />

Euro Area 2.6 1.7 1.8 2.1 2.3 1.8 0.2 0.2 0.3 -1.0 -1.3 -1.2<br />

Canada 2.5 1.0 1.5 2.1 1.4 2.0 0.9 -0.2 -0.8 0.2 0.1 0.1<br />

Australia 3.8 2.7 3.4 2.3 3.3 2.8 -5.9 -5.2 -5.2 1.6 1.3 1.5<br />

Germany 2.6 1.6 1.9 2.1 1.8 1.6 6.6 6.8 6.8 0.0 -0.5 -0.7<br />

France 1.9 1.6 1.6 1.5 2.2 1.4 -1.5 -1.7 -1.6 -2.6 -2.9 -2.8<br />

Italy 1.6 0.8 1.4 2.2 2.5 1.8 -2.0 -1.5 -1.5 -2.3 -2.7 -2.9<br />

Spain 3.8 2.1 2.2 2.7 3.4 2.3 -9.6 -8.9 -7.5 2.2 1.2 0.0<br />

United Kingdom 3.1 1.7 1.9 2.3 2.5 2.0 -5.2 -4.5 -3.3 -3.0 -3.3 -3.5<br />

Emerging Markets 7.2% 6.5% 6.4% 5.2% 6.1% 5.4% 4.6% 3.5% 2.3% 0.4% -0.1% -0.4%<br />

China 11.4 10.5 10.0 4.8 5.0 4.0 10.8 8.8 7.0 -1.8 -2.0 -1.5<br />

India 8.7 8.3 8.5 4.5 4.3 4.0 -1.2 -1.9 -1.8 -6.0 -5.8 -5.2<br />

Korea 4.9 4.6 4.8 2.5 3.3 2.5 0.6 -1.3 -0.6 2.0 2.0 1.5<br />

Pol<strong>and</strong> 6.5 5.0 4.7 2.5 4.2 3.0 -3.7 -4.7 -4.6 -1.5 -2.1 -2.5<br />

Russia 8.1 6.6 6.5 9.0 12.9 8.9 5.9 6.2 3.3 5.4 5.6 5.0<br />

South Africa 5.1 3.5 4.3 7.1 6.1 5.4 -7.1 -7.7 -7.7 0.8 0.3 0.2<br />

Turkey 3.8 4.2 5.2 8.8 7.8 6.5 -7.7 -8.3 -6.8 -2.2 -2.4 -3.2<br />

Brazil 5.3 4.4 4.0 3.6 4.7 4.5 0.3 -0.6 -1.0 -1.4 -0.7 -0.4<br />

Mexico 3.3 2.9 3.7 4.0 3.9 3.5 -0.9 -1.8 -2.3 0.0 0.0 0.0<br />

Note: Aggregation based on nominal GDP except where noted. F Citi forecast. For India, inflation forecast is for WPI.<br />

Source: Citi.<br />

10

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Key <strong>Economic</strong> Indicators<br />

Figure 11. Euro Area, Japan, <strong>and</strong> the United States — Business Activity Survey Measures, 1987-Feb 2008<br />

3.0<br />

St<strong>and</strong>ard Deviations from Mean d<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

-5.0<br />

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

-1.0<br />

-2.0<br />

-3.0<br />

-4.0<br />

-5.0<br />

St<strong>and</strong>ard Deviations from Mean<br />

U.S. ISM Euro Area Japan Tankan<br />

Note: The figure shows business activity survey indexes in the euro area, Japan <strong>and</strong> the United States, measured in units of st<strong>and</strong>ard deviations from the ten-year mean.<br />

Sources: Bank of Japan, EU Commission <strong>and</strong> the U.S. Institute for Supply Management.<br />

Figure 12. Commodity Prices, 1987-Feb 2008<br />

$ per Barrel<br />

240<br />

220<br />

200<br />

180<br />

160<br />

140<br />

120<br />

100<br />

80<br />

87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08<br />

Economist Index (Left)<br />

Oil Prices (Right)<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Figure 13. Selected Countries — <strong>Global</strong> Industrial Production<br />

(Year-to-Year Percent Change), 2007-09F<br />

2007 2008F 20009F<br />

World 4.2% 3.5% 3.9%<br />

United States 2.1 1.7 2.5<br />

Japan 2.9 2.3 2.5<br />

Euro Area 2.5 1.9 1.6<br />

United Kingdom 0.3 0.8 0.8<br />

Canada -0.1 -3.0 1.0<br />

China 18.5 16.8 16.5<br />

India 9.0 8.5 10.0<br />

Korea 8.2 7.7 8.0<br />

Brazil 3.0 4.8 4.2<br />

Note: “World” includes 22 countries based on industrial production weights.<br />

Sources: National sources <strong>and</strong> Citi.<br />

Note: Brent crude. Sources: The Economist <strong>and</strong> OECD.<br />

Figure 14. Euro Area, Japan, United Kingdom, <strong>and</strong> United States — Forecasts for 2008 GDP (Left) <strong>and</strong> 2008 Inflation (Right), 2006-Feb 2008.<br />

4.0% 4.0%<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.5<br />

Jan-06 Apr Jul Oct Jan-07 Apr Jul Oct Jan-08<br />

U.S. Euro U.K. Japan<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

4.0%<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

Jan-06 Apr Jul Oct Jan-07 Apr Jul Oct Jan-08<br />

U.S. Euro U.K. Japan<br />

4.0%<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

1.0<br />

0.5<br />

0.0<br />

-0.5<br />

Source: Citi.<br />

11

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Figure 15. Short Rates (End of Period), as of Feb 28, 2008<br />

Current 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09<br />

United States 3.00 % 2.50 % 2.00 % 2.00 % 2.00 % 2.00 %<br />

Japan 0.50 0.50 0.50 0.50 0.75 0.75<br />

Euro Area 4.00 4.00 3.75 3.50 3.50 3.50<br />

Canada 4.00 % 3.50 % 3.00 % 3.00 % 3.00 % 3.00 %<br />

Australia 7.00 7.25 7.50 7.50 7.50 7.50<br />

New Zeal<strong>and</strong> 8.25 8.25 8.25 8.25 8.25 8.25<br />

Denmark 4.25 % 4.25 % 4.00 % 3.75 % 3.75 % 3.75 %<br />

Norway 5.25 5.25 5.50 5.50 5.75 5.75<br />

Sweden 4.25 4.25 4.25 4.25 4.00 3.75<br />

Switzerl<strong>and</strong> 2.75 2.75 2.75 2.75 2.75 2.75<br />

United Kingdom 5.25 5.25 4.75 4.50 4.25 4.25<br />

China 7.47 % 7.74 % 7.74 % 7.74 % 7.74 % 7.74 %<br />

Source: Citi.<br />

Figure 16. 10-Year Yield Forecasts (Period Average), as of Feb 28, 2008<br />

Current 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09<br />

United States 3.71 % 3.65 % 3.60 % 3.75 % 3.85 % 4.00 %<br />

Japan 1.43 1.50 1.70 1.70 1.80 1.80<br />

Euro Area 4.00 4.00 4.00 4.00 4.10 4.25<br />

Canada 3.73 % 3.90 % 3.90 % 4.00 % 4.05 % 4.15 %<br />

Australia 6.44 6.50 6.50 6.35 6.35 6.25<br />

New Zeal<strong>and</strong> 6.40 6.50 6.50 6.25 6.25 6.05<br />

Denmark 4.11 % 4.10 % 4.05 % 4.05 % 4.15 % 4.30 %<br />

Norway 4.40 4.63 4.76 4.90 5.08 5.23<br />

Sweden 4.09 4.10 4.14 4.25 4.50 4.59<br />

Switzerl<strong>and</strong> 3.00 2.80 2.90 2.95 3.15 3.35<br />

United Kingdom 4.60 4.55 4.55 4.55 4.65 4.79<br />

Notes: Bond yields measured on local market basis (semi-annual for the United States, United Kingdom, Canada, Australia, <strong>and</strong> New Zeal<strong>and</strong>; annual for the<br />

rest). The 10-year yield for the euro area is the Bund yield. Source: Citi.<br />

Figure 17. 10-Year Yield Spreads (Period Average), as of Feb 28, 2008<br />

Spread vs. US$<br />

Spread vs. Germany<br />

Current 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09 Current 1Q 08 2Q 08 3Q 08 4Q 08 1Q 09<br />

United States NA NA NA NA NA NA -20 bp -21 bp -21 bp -11 bp -21 bp -21 bp<br />

Japan -241 bp -229 bp -209 bp -219 bp -209 bp -224 bp -261 -250 -230 -230 -230 -245<br />

Euro Area 20 21 21 11 21 21 NA NA NA NA NA NA<br />

Canada -13bp 15bp 15bp 15bp 20bp 15bp -23bp -6bp -6bp 4bp -1bp -6bp<br />

Australia 259 275 275 250 250 225 245 261 261 245 235 210<br />

New Zeal<strong>and</strong> 263 275 275 240 240 205 249 261 261 235 225 189<br />

France 32 bp 33 bp 31 bp 20 bp 29 bp 29 bp 12 bp 12 bp 10 bp 9 bp 8 bp 8 bp<br />

Italy 61 61 59 46 56 54 41 40 38 35 35 33<br />

Spain 34 36 35 25 33 31 14 15 14 14 12 10<br />

Netherl<strong>and</strong>s 29 30 29 18 27 27 9 9 8 7 6 6<br />

Belgium 47 46 39 27 36 34 27 25 18 16 15 13<br />

Denmark 31 bp 31 bp 26 bp 16 bp 26 bp 26 bp 11 bp 10 bp 5 bp 5 bp 5 bp 5 bp<br />

Norway 55 84 97 101 119 119 56 63 76 90 98 98<br />

Sweden 24 31 35 36 61 55 10 10 14 25 40 34<br />

Switzerl<strong>and</strong> -84 -99 -89 -94 -74 -69 -104 -120 -110 -105 -95 -90<br />

United Kingdom 85 80 80 70 80 79 65 60 60 60 60 60<br />

NA Not applicable. Note: Spreads calculated on annual basis (except those of the United Kingdom, Canada, Australia <strong>and</strong> New Zeal<strong>and</strong> over the United States).<br />

Source: Citi.<br />

12

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Figure 18. Foreign Exchange Forecasts (End of Period), as of Feb 28, 2008<br />

vs USD<br />

vs EUR<br />

Current Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Current Mar-08 Jun-08 Sep-08 Dec-08 Mar-09<br />

United States NA NA NA NA NA NA 1.51 1.51 1.53 1.51 1.48 1.45<br />

Japan 106 105 105 109 112 112 160 159 161 165 166 162<br />

Euro Area 1.51 1.51 1.53 1.51 1.48 1.45 NA NA NA NA NA NA<br />

Canada 0.98 1.01 1.02 1.03 1.04 1.04 1.48 1.53 1.56 1.56 1.54 1.51<br />

Australia 0.94 0.92 0.95 0.92 0.90 0.88 1.60 1.64 1.61 1.64 1.64 1.65<br />

New Zeal<strong>and</strong> 0.81 0.80 0.78 0.76 0.75 0.73 1.86 1.89 1.96 1.99 1.97 1.99<br />

Norway 5.20 5.07 4.84 4.83 4.90 4.97 7.87 7.65 7.40 7.30 7.25 7.20<br />

Sweden 6.20 6.16 5.95 6.03 6.22 6.41 9.37 9.30 9.10 9.10 9.20 9.30<br />

Switzerl<strong>and</strong> 1.06 1.06 1.04 1.03 1.03 1.03 1.60 1.60 1.59 1.56 1.52 1.50<br />

United Kingdom 1.98 1.97 1.96 1.95 1.92 1.93 0.76 0.77 0.78 0.77 0.77 0.75<br />

China 7.11 7.06 7.00 6.90 6.75 6.55 10.8 10.7 10.7 10.7 10.0 9.5<br />

India 39.9 39.0 38.5 38.0 37.5 37.0 60.3 58.9 58.9 57.4 55.5 53.7<br />

Korea 938 960 960 940 920 870 1418 1450 1469 1419 1362 1262<br />

Pol<strong>and</strong> 2.33 2.34 2.42 2.44 2.42 2.43 3.52 3.53 3.70 3.68 3.58 3.52<br />

Russia 24.1 24.2 23.9 24.1 24.3 24.6 36.4 36.5 36.6 36.3 36.0 35.7<br />

South Africa 7.56 7.70 7.90 8.10 8.00 8.10 11.43 11.63 12.09 12.23 11.84 11.75<br />

Turkey 1.18 1.22 1.24 1.27 1.29 1.32 1.79 1.84 1.90 1.92 1.91 1.91<br />

Brazil 1.67 1.79 1.80 1.80 1.80 1.85 2.52 2.70 2.75 2.72 2.66 2.68<br />

Mexico 10.7 10.8 10.9 11.0 11.0 11.0 16.2 16.3 16.7 16.6 16.2 16.0<br />

Source: Citi.<br />

Figure 19. Foreign Exchange Forecasts (End of Period), as of Feb 28, 2008<br />

vs JPY<br />

Current Mar-08 Jun-08 Sep-08 Dec-08 Mar-09<br />

United States 106 105 105 109 112 112<br />

Japan NA NA NA NA NA NA<br />

Euro Area 160 159 161 165 166 162<br />

Canada 108 104 103 106 108 108<br />

Australia 100 97 100 100 101 99<br />

New Zeal<strong>and</strong> 86.1 84.0 81.9 82.8 84.0 81.8<br />

Norway 20.4 20.7 21.7 22.5 22.9 22.6<br />

Sweden 17.1 17.0 17.7 18.1 18.0 17.5<br />

Switzerl<strong>and</strong> 100 99 101 105 109 108<br />

United Kingdom 211 207 206 213 215 216<br />

China 15 15 15 15 17 17<br />

India 2.66 2.69 2.73 2.87 2.99 3.03<br />

Korea 8.84 9.14 9.14 8.62 8.21 7.77<br />

Pol<strong>and</strong> 45.6 44.9 43.4 44.7 46.3 46.1<br />

Russia 4.4 4.3 4.4 4.5 4.6 4.5<br />

South Africa 14.0 13.6 13.3 13.5 14.0 13.8<br />

Turkey 89.6 86.1 84.7 85.8 86.8 84.8<br />

Brazil 63.6 58.7 58.3 60.6 62.2 60.5<br />

Mexico 9.9 9.7 9.6 9.9 10.2 10.2<br />

Source: Citi.<br />

13

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Stephen Halmarick<br />

011-612 8225-6043<br />

stephen.halmarick<br />

@citi.com<br />

Currency <strong>Outlook</strong><br />

With the depth of the near-term deceleration of the U.S. economy still in doubt, <strong>and</strong><br />

financial conditions continuing to deteriorate, we expect downward pressure on the<br />

U.S. dollar to persist in coming months. The dollar downtrend should, however,<br />

remain modest. Aggressive action by the Federal Reserve should help to stabilize<br />

financial conditions <strong>and</strong> prospects for growth in coming quarters. In addition, the<br />

outlook for growth in the euro area appears to be deteriorating, <strong>and</strong> this change in<br />

cyclical outlooks should eventually turn the tide on USD/EUR.<br />

The USD will likely depreciate modestly relative to the Japanese yen in the first half of<br />

2008. Japan appears to be the least affected by the money <strong>and</strong> credit market strains<br />

among the major economies <strong>and</strong> should benefit from any further heightened risk<br />

aversion. However, we expect the JPY to start weakening against the USD in the second<br />

half of the year. As global economic <strong>and</strong> financial risks wane, in part thanks to policy<br />

actions in major countries, Japanese households are likely to resume diversifying their<br />

portfolios into foreign currency denominated assets, weighing down the yen.<br />

We continue to expect the British pound to be one of the weakest of the G10 currencies in<br />

2008. While markets currently are discounting an easing cycle, we expect growth is likely<br />

to undershoot MPC forecasts, thus opening up scope for an extended easing cycle, even<br />

with the short-term inflation worries.<br />

Led by the renminbi, emerging Asian currencies continued to gain ground during the<br />

past month. A broad pickup in inflation has generated incentives for central banks<br />

across the region to tolerate greater exchange rate flexibility — especially for the<br />

Taiwanese dollar <strong>and</strong> Vietnamese dong. We continue to expect emerging Asian<br />

currencies to lead the next leg of U.S. dollar weakness. However, we also warn<br />

against excessive optimism regarding the outlook of Asian currencies, given that the<br />

expected slowing in exports will likely add caution to currency policymaking. We<br />

maintain our expectation of 7.5% renminbi appreciation against the USD, which is<br />

less aggressive than market expectations.<br />

We continue to favor the AUD among commodity currencies. Markets could be<br />

surprised by the extent to which the Reserve Bank of Australia (RBA) tightens<br />

monetary policy in coming months. We project a tightening of at least 50 basis points<br />

by May. Indeed, further tightening beyond that could be required to ensure inflation<br />

returns to the 2%-3% target zone. Along with rising interest rates, gains in key<br />

Australian commodity prices, as indicated by the recent 65% price rise in iron ore<br />

exports to Japan for the coming financial year, should continue to provide the AUD<br />

with fundamental support.<br />

In the near term, the NZD should remain in a range, as the Reserve Bank of New<br />

Zeal<strong>and</strong> (RBNZ) holds monetary policy steady, balancing the inflation risks from<br />

higher dairy prices <strong>and</strong> a tight labor market against clear signs of a slowdown in the<br />

housing sector. The CAD is also likely to remain range-bound in the near term, with<br />

some modest retreat from parity amid a slowing Canadian economy, ongoing financial<br />

market strains, <strong>and</strong> tighter credit conditions. While the BoC is now expected to lower<br />

policy rates by 100 basis points by midyear, this will only match the expected easing in<br />

the United States. As a result, continued commodity price strength <strong>and</strong> the weak U.S.<br />

economic outlook argue against a meaningful depreciation of the CAD.<br />

The Swiss franc (CHF) has been a star performer so far this year, rising about 4% in<br />

trade-weighted terms, <strong>and</strong> it is likely to remain strong. Markets have scaled back the<br />

amount of Swiss National Bank (SNB) easing priced in for the second <strong>and</strong> third<br />

quarters, as the economy holds up better than expected <strong>and</strong> inflation remains above the<br />

14

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

SNB’s 2% target ceiling. Therefore, the SNB will likely keep rates on hold in coming<br />

months, unless the CHF rises more sharply. The outlook for the CHF also should be<br />

reinforced by the currency’s longst<strong>and</strong>ing safe-haven status, with a strong <strong>and</strong> positive<br />

correlation between equity market volatility <strong>and</strong> the trade-weighted CHF.<br />

While the Norges Bank has recently expressed concerns about money market strains<br />

<strong>and</strong> heightened global economic uncertainty, we still expect further monetary policy<br />

tightening to combat inflation risks amid heightened capacity pressures <strong>and</strong><br />

accelerating wages. Oil prices are a double-edged sword for the NOK. Recent high<br />

prices have supported the NOK, but the sharp rise over the past year also raises the<br />

risk of a correction. In Sweden, the Riksbank is expected to keep rates steady near<br />

term, following the surprise rate hike in February. The next move is likely to be a cut<br />

around yearend to offset the negative effects from the credit crisis <strong>and</strong> weakening U.S.<br />

<strong>and</strong> global economic growth. But interest rate spreads remain in the SEK’s favor.<br />

Also, while periods of financial instability normally do not favor the SEK, the SEK<br />

should strengthen again once the dust settles in financial markets.<br />

Currencies across CEEMEA continue to feel the effects of conflicting forces. Amid<br />

ongoing financing concerns, currencies of external deficit countries such as South Africa<br />

<strong>and</strong> Romania remain under pressure relative to the EUR. Inflationary pressures across the<br />

region, however, continue to put upward pressure on domestic interest rates, providing<br />

some support to currencies of countries with better economic prospects, including Pol<strong>and</strong>,<br />

Israel, <strong>and</strong> Slovakia. Slovakia is also experiencing capital inflows in anticipation of a<br />

revaluation of the koruna’s central parity against the EUR next quarter as part of the euroadoption<br />

process. Hungary, by ab<strong>and</strong>oning its b<strong>and</strong>, reversed much of its January selloff.<br />

Latin American currencies have so far shown no vulnerability to deteriorating global<br />

prospects. In fact, with the United States cutting rates <strong>and</strong> commodity prices making<br />

new highs, Latin currencies have continued to appreciate. Inflationary challenges in<br />

Chile, Peru, <strong>and</strong> Colombia will likely keep those central banks vigilant, with a bias<br />

toward maintaining a hawkish discourse, <strong>and</strong> possibly even hiking rates. Rate cuts are<br />

likely in Mexico, but not until September, given the likelihood that yearly inflation will<br />

increase above the top of Banxico’s b<strong>and</strong> during most of the second quarter.<br />

Figure 20. Currency Recommendations, as of Feb 28, 2008<br />

Current<br />

3-Month<br />

Forecast<br />

Annual Return vs<br />

FWD Implied Vol.<br />

12-Month<br />

Forecast<br />

Annual Return vs<br />

FWD Implied Vol.<br />

United States NA NA NA NA NA NA NA<br />

Japan 106 105 1.9 10.7 112 -7.2 9.6<br />

Euro Area 1.51 1.52 4.1 9.1 1.46 -2.1 8.8<br />

Canada 0.98 1.02 -14.4 11.6 1.04 -5.2 10.9<br />

Australia 0.94 0.94 3.5 13.1 0.89 -0.7 12.7<br />

New Zeal<strong>and</strong> 0.81 0.80 -6.3 14.8 0.74 -3.6 14.8<br />

Norway 5.20 4.92 25.3 12.2 4.94 8.2 11.8<br />

Sweden 6.20 6.02 13.0 11.8 6.35 -0.5 11.3<br />

Switzerl<strong>and</strong> 1.06 1.05 4.7 10.0 1.03 2.7 9.0<br />

United Kingdom 1.98 1.96 -1.7 8.6 1.93 -0.4 8.5<br />

China 7.11 7.02 -5.2 3.4 6.62 -2.2 4.9<br />

India 39.9 38.7 12.7 6.0 37.2 7.7 6.4<br />

Korea 938 960 -8.8 5.3 887 6.0 4.9<br />

Pol<strong>and</strong> 2.33 2.39 -7.6 11.0 2.43 -0.7 10.5<br />

Russia 24.1 24.0 3.7 5.9 24.5 1.4 6.7<br />

South Africa 7.56 7.83 -5.5 19.6 8.07 2.2 19.3<br />

Turkey 1.18 1.23 -3.9 14.1 1.31 1.9 16.2<br />

Brazil 1.67 1.80 -23.7 13.6 1.83 -2.6 14.6<br />

Mexico 10.7 10.9 -2.3 5.3 11.0 1.6 6.6<br />

Source: Citi.<br />

15

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

<strong>Global</strong> Equity <strong>Strategy</strong><br />

Robert Buckl<strong>and</strong><br />

011-44-20-7986-3947<br />

robert.buckl<strong>and</strong><br />

@citi.com<br />

Our economics colleagues now forecast recessionary conditions in the United States.<br />

What have previous U.S. recessions meant for global corporate earnings <strong>and</strong> stock<br />

prices <strong>and</strong> what are the implications for the current situation<br />

Earnings Impact<br />

Figure 21 plots U.S. <strong>and</strong> world ex-U.S. trailing earnings growth for the listed<br />

corporate sector, with shaded regions denoting U.S. recessions. Given reporting<br />

delays, earnings will tend to lag the economic data, so this series does not yet reflect<br />

the recent earnings collapse among financials.<br />

Earnings are much more volatile than real GDP given the impact of financial <strong>and</strong><br />

operational leverage. For example, annual U.S. earnings growth has ranged from<br />

-40% to +40% over a period when real U.S. GDP growth has ranged between -3% <strong>and</strong><br />

+8%. Although GDP seems to have become less volatile, corporate earnings have<br />

become more volatile. There is no sign of the “great moderation” here. Figure 21 also<br />

shows that world ex-U.S. earnings growth tracks U.S. earnings closely but with even<br />

greater volatility recently. The key message is clear. U.S. recessions have been bad<br />

news for the United States <strong>and</strong> world earnings.<br />

In the past, U.S. recessions have been associated with contractions of at least 20% in<br />

both U.S. <strong>and</strong> world ex-U.S. earnings. To put this into context, the IBES consensus<br />

expects U.S. <strong>and</strong> global earnings growth of 14% <strong>and</strong> 13%, respectively, in 2008. So,<br />

investors should prepare themselves for a period of earnings downgrades.<br />

U.S. Recessions <strong>and</strong> <strong>Global</strong> Equities<br />

If the United States is heading into recession, the outlook for global corporate<br />

earnings looks bleak. What does that mean for share prices<br />

Figure 22 shows that, on average, global earnings have fallen by 31% around U.S.<br />

recessions. Share prices have fallen by slightly more (36%). As for the current<br />

situation, the 15% share price decline from last July’s high suggests that, even though<br />

earnings are only just starting to roll over, global equities are already halfway through<br />

Figure 21. U.S. <strong>and</strong> World Ex-U.S. Earnings Growth (Percent),<br />

1990-2007<br />

Figure 22. World Market Price <strong>and</strong> Earnings Decline in U.S.<br />

Recessions (Percent), 1973-2007<br />

60<br />

60<br />

0<br />

0<br />

40<br />

40<br />

-10<br />

-10<br />

20<br />

20<br />

-20<br />

-20<br />

0<br />

0<br />

-30<br />

-30<br />

-20<br />

-20<br />

-40<br />

-40<br />

-40<br />

-60<br />

70 72 74 76 78 80 82 84 86 88 90 92 94 96 98 00 02 04 06 08<br />

US World ex-US<br />

-40<br />

-60<br />

-50<br />

-60<br />

Price<br />

Earnings<br />

Mid 70s Early 80s Early 90s Early 00s Average Now<br />

-50<br />

-60<br />

Note: Shaded regions denote recession. Sources: MSCI <strong>and</strong> Datastream.<br />

Sources: MSCI <strong>and</strong> Datastream.<br />

16

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

the selloff associated with a typical U.S. recession <strong>and</strong> are rapidly approaching the<br />

mild correction seen in the early 1980s (19%).<br />

Valuations<br />

Could it be that the recent fall in prices has already priced a U.S. recession into global<br />

equities It seems that the bear market associated with the last U.S. recession was as<br />

severe as it was because global equities traded at a record 35 times PE heading into<br />

the worst earnings slump in 40 years. Now, global equities trade on a much more<br />

reasonable 15 times trailing PE, similar to valuations at the bottom of the early 1990s<br />

correction. Even if earnings do fall significantly, current valuations look reasonable.<br />

We also point out that global equities entered each of the last two recessions with a<br />

major valuation bubble. In 1990, Japan traded on a PE of 52 times. In 2000, global<br />

Technology (TMT) traded on a PE of 65 times. Both accounted for around 40% of the<br />

total global market cap <strong>and</strong> then bore the brunt of the subsequent selloff. This spared<br />

the rest of the global equity market from the worst of the pain. It is difficult to point to<br />

any such obvious major valuation anomalies this time round. Emerging markets have<br />

performed strongly, but they are hardly in bubble territory.<br />

Interest Rates<br />

Thus, the current valuation case in favor of global equities is better than it was during<br />

the last recession but still probably not enough to counter the impact of major<br />

earnings downgrades. Perhaps it is still too early to buy back into equities — stick<br />

with defensive cash <strong>and</strong> government bonds instead.<br />

But there is a problem with this defensive strategy — interest rates are already low.<br />

U.S. real rates have gone negative much earlier than in the early 1980s, 1990s, or<br />

2000s downturns. Not only do negative real rates help to reduce the severity of the<br />

U.S. recession, but they also undermine the attractiveness of cash as an asset class.<br />

The other obvious place to take refuge is government bonds. But value here also looks<br />

poor.<br />

Market Timing<br />

How do global equities perform around a U.S. recession Previously, the worst<br />

performance through the whole period has been in the first half. The best performance<br />

has been during the second half. What about now We start the clock ticking from<br />

January of this year. History suggests that the recession will last around a year. It also<br />

suggests that investors should not be in too much of a hurry to buy. Falling rates <strong>and</strong><br />

increasingly attractive valuations are not enough to counter the rising wave of bad<br />

economic <strong>and</strong> earnings news in the first half of the recession. At least the selloff this<br />

year is already approaching the average selloff for the first half, although it is still far<br />

from the worst.<br />

This supports our general suspicion that, despite aggressive Fed cuts <strong>and</strong> cheap<br />

valuations against government bonds, global equities may struggle to find a floor in<br />

the first half of this year as the barrage of poor economic <strong>and</strong> earnings news builds.<br />

Later in the year, the economic <strong>and</strong> earnings data should be just as bad (if not worse),<br />

but equity market expectations will be more realistic <strong>and</strong> the Fed’s magic will have<br />

had more time to work. This could leave global equities better placed later in the year<br />

to enjoy the rally traditionally seen in the second half of a U.S. recession.<br />

17

February 27, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Figure 23. Long-Term Forecasts (Calendar Average), as of Feb 28, 2008<br />

GDP CPI Short-Term Interest Rates<br />

2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012<br />

United States 1.6% 2.1% 2.7% 2.7% 2.7% 3.6% 2.0% 2.0% 2.0% 2.0% 2.35% 2.00% 3.50% 4.25% 4.25%<br />

Japan 1.9 1.7 2.0 2.0 1.2 0.7 0.3 0.5 0.6 2.3 0.56 0.88 1.38 1.75 2.00<br />

Euro Area 1.7 1.8 2.0 2.0 2.0 2.3 1.8 1.8 1.8 1.8 3.65 3.50 3.75 3.75 3.75<br />

Canada 1.0 1.5 2.2 2.4 2.5 1.4 2.0 2.0 2.1 2.1 3.15 3.00 3.25 3.50 3.50<br />

Australia 2.7 3.4 3.5 3.3 3.3 3.3 2.8 2.5 2.5 2.5 7.45 7.05 6.00 5.50 5.50<br />

New Zeal<strong>and</strong> 2.1 2.0 3.0 3.0 3.0 2.8 2.4 2.3 2.3 2.3 8.25 7.80 7.00 6.75 6.50<br />

Germany 1.6 1.9 2.1 1.7 1.7 1.8 1.6 1.6 1.5 1.5<br />

France 1.6 1.6 2.0 2.3 2.3 2.2 1.4 1.6 1.6 1.5<br />

Italy 0.8 1.4 1.2 1.3 1.2 2.5 1.8 1.9 1.8 1.7<br />

Spain 2.1 2.2 2.1 2.2 2.1 3.4 2.3 2.4 1.7 1.8<br />

Norway 4.0 3.0 2.5 2.5 2.5 3.4 2.5 2.5 2.5 2.5<br />

Sweden 2.3 2.2 2.3 2.3 2.3 3.4 2.3 2.1 2.1 2.0<br />

Switzerl<strong>and</strong> 2.2 2.0 2.2 2.0 1.9 1.5 0.8 1.1 0.8 0.8 2.90 3.00 3.00 3.00 3.00<br />

United Kingdom 1.7 1.9 2.6 2.8 2.9 2.5 2.0 2.2 1.9 2.1 4.75 4.30 4.90 5.00 5.25<br />

China 10.5 10.0 10.5 9.8 9.0 5.0 4.0 4.2 3.5 4.0 7.7 7.7 8.0 8.0 8.3<br />

India 8.3 8.5 8.7 9.5 9.5 4.3 4.0 4.0 4.0 3.5 6.0 6.0 6.0 5.5 5.5<br />

Korea 4.6 4.8 4.8 4.8 4.8 3.3 2.5 2.5 2.5 2.5 4.9 5.0 5.2 5.3 5.3<br />

Pol<strong>and</strong> 5.0 4.7 5.2 5.9 5.5 4.2 3.0 2.3 2.5 2.7 5.5 5.5 5.5 5.5 5.5<br />

Russia 6.6 6.5 6.5 6.5 6.6 12.9 8.9 7.0 5.9 4.8 11.0 9.5 8.3 7.5 6.8<br />

South Africa 3.5 4.3 5.3 5.1 5.5 6.1 5.4 5.5 5.0 5.2 10.3 8.9 9.0 9.3 9.0<br />

Turkey 4.2 5.2 5.8 6.0 6.2 7.8 6.5 5.1 4.5 4.2 16.3 13.8 11.1 10.0 9.2<br />

Brazil 4.4 4.0 4.0 4.0 4.0 4.7 4.5 4.1 4.0 3.7 11.3 10.5 9.8 9.3 8.5<br />

Mexico 2.9 3.7 4.1 3.8 4.3 3.9 3.5 3.2 3.1 3.1 7.3 6.5 6.5 6.5 6.5<br />

Note: For Norway, mainl<strong>and</strong> GDP. For India inflation forecast is for WPI.<br />

Source: Citi forecasts.<br />

18

February 27, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Figure 24. Long-Term Forecasts (Calendar Average), as of Feb 28, 2008<br />

Ten-Year Yields Exchange Rate vs. U.S. Dollar Exchange Rate vs. Euro<br />

2008 2009 2010 2011 2012 2008 2009 2010 2011 2012 2008 2009 2010 2011 2012<br />

United States 3.75% 4.25% 4.75% 5.00% 5.00% NA NA NA NA NA 1.50 1.45 1.47 1.50 1.52<br />

Japan 1.68 1.90 2.50 2.75 2.25 108 110 100 95 95 162 160 147 143 144<br />

Euro Area a 4.05 4.40 4.40 4.40 4.40 1.50 1.45 1.47 1.50 1.52 NA NA NA NA NA<br />

Canada 3.91 4.41 4.75 4.90 4.90 1.04 1.06 1.08 1.13 1.15 1.56 1.54 1.59 1.70 1.75<br />

Australia b 6.35 6.40 6.75 6.50 6.50 0.92 0.87 0.82 0.78 0.78 1.63 1.67 1.79 1.92 1.95<br />

New Zeal<strong>and</strong> c 6.35 6.30 6.75 6.75 6.75 0.77 0.72 0.69 0.66 0.65 1.95 2.01 2.13 2.27 2.34<br />

Denmark 4.10 4.45 4.45 4.45 4.45 NA NA NA NA NA NA NA NA NA NA<br />

Norway 4.85 5.30 5.20 5.10 5.10 4.99 5.00 4.90 4.74 4.61 7.48 7.25 7.21 7.11 7.01<br />

Sweden 4.25 4.65 4.65 4.65 4.65 6.13 6.31 6.16 6.00 5.92 9.20 9.15 9.05 9.00 9.00<br />

Switzerl<strong>and</strong> 3.20 3.50 3.50 3.50 3.50 1.04 1.11 1.10 1.08 1.06 1.56 1.61 1.62 1.62 1.61<br />

United Kingdom d 4.75 5.10 5.10 5.10 5.10 1.95 1.93 2.10 2.17 2.20 0.77 0.75 0.70 0.69 0.69<br />

China e 4.1 4.0 4.5 5.0 5.5 6.98 6.35 5.89 5.58 5.40 10.5 9.2 8.7 8.4 8.2<br />

India 7.3 7.5 7.5 7.0 7.0 38.5 36.0 35.0 33.0 31.0 57.8 52.2 51.5 49.5 47.1<br />

Korea e 4.9 5.2 5.5 5.5 5.5 950 890 850 800 800 1425 1291 1250 1200 1216<br />

Pol<strong>and</strong> 5.9 5.7 5.5 5.5 5.4 2.41 2.43 2.32 2.21 2.12 3.61 3.52 3.42 3.32 3.22<br />

Russia 6.6 6.7 6.6 6.6 6.5 24.0 24.5 24.4 24.2 24.0 36.0 35.5 35.9 36.2 36.4<br />

South Africa 8.0 8.1 8.7 9.0 9.3 7.37 8.00 8.20 8.55 8.90 11.05 11.60 12.05 12.83 13.53<br />

Turkey NA NA NA NA NA 1.26 1.34 1.34 1.34 1.34 1.90 1.94 1.97 2.00 2.04<br />

Brazil 10.7 9.7 9.4 9.1 9.0 1.79 1.88 1.93 1.98 2.03 2.69 2.72 2.83 2.96 3.08<br />

Mexico 7.4 7.1 7.2 7.2 7.2 10.9 11.0 11.1 11.3 11.5 16.3 15.9 16.3 17.0 17.5<br />

a<br />

Ten-year bund yield. Exchange rate versus U.S. dollar shows US$/€ . b US$/A$. c US$/NZ$. d US$/£. e Five-year bond yield.<br />

Source: Citi forecasts.<br />

19

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Robert V. DiClemente<br />

(1-212) 816-9894<br />

robert.diclemente<br />

@citi.com<br />

Peter D’Antonio<br />

Christopher Wieg<strong>and</strong><br />

Steven Wieting<br />

United States<br />

Recessionary conditions may be unfolding in the U.S. economy as the slowdown appears<br />

to be spreading with reinforcement from harsh financial conditions. Policy efforts have<br />

aided liquidity, but credit availability has tightened <strong>and</strong> lower rates have failed to ease<br />

strains on capital markets. With housing activity still declining <strong>and</strong> joblessness creeping<br />

higher, headwinds are forming against a timely <strong>and</strong> sustained return to trend growth<br />

despite a prospective boost from recent fiscal action.<br />

Given the threat of an especially adverse dynamic, Fed officials have turned more<br />

aggressive, <strong>and</strong> are expected to lower the funds rate by another percentage point by<br />

midyear. Nonetheless, any end to rate cuts would likely first require some improvement in<br />

the financial setting, reflected in a revival of risk assets <strong>and</strong> signs that large overhanging<br />

imbalances in housing markets are beginning to clear.<br />

Figure 25. United States — <strong>Economic</strong> Forecast, 2007-09F<br />

<strong>Economic</strong> growth appears to have stalled, reflecting slowdowns in consumer <strong>and</strong> business<br />

spending <strong>and</strong> continued sharp declines in homebuilding. Although many industries exhibit<br />

solid finances <strong>and</strong> have not overreached in recent years, business caution has increased,<br />

mirroring the pronounced retreat in risk appetites among financial markets. Lower equity<br />

prices are threatening to compound pressures on consumers from declining home values<br />

<strong>and</strong> faltering job growth.<br />

The improvement in inflation measures has stalled, but continued Fed easing indicates that<br />

officials still see scope for easing price pressures later this year. Oncoming financial<br />

restraint on dem<strong>and</strong> along with rising slack <strong>and</strong> protracted housing weakness should<br />

impose stiff competitive pressures on firm pricing. As long as inflation expectations<br />

remain checked in this setting, we expect underlying inflation to recede somewhat, aiding<br />

policy flexibility <strong>and</strong> shortening recession.<br />

2007 2008<br />

2007F 2008F 2009F 2Q 3Q 4Q 1QF 2QF 3QF 4QF<br />

GDP SAAR 3.8% 4.9% 0.6% -0.1% 0.9% 3.0% 2.2%<br />

YoY 2.2% 1.6% 2.1% 1.9 2.8 2.5 2.3 1.6 1.1 1.5<br />

Consumption SAAR 1.4 2.8 2.0 0.6 0.6 3.5 1.2<br />

YoY 2.9 1.6 1.8 2.9 3.0 2.5 1.7 1.5 1.7 1.5<br />

Business Investment SAAR 11.0 9.3 7.5 0.3 -1.2 -0.3 0.3<br />

YoY 4.8 3.0 0.7 4.1 5.1 7.4 7.0 3.9 1.5 -0.2<br />

Housing Investment SAAR -11.8 -20.5 -23.9 -23.9 -15.4 -6.4 -1.6<br />

YoY -16.9 -17.9 -0.2 -16.5 -16.5 -18.3 -20.2 -21.0 -17.7 -12.2<br />

Government SAAR 4.1 3.8 2.6 -1.2 1.4 1.7 2.0<br />

YoY 2.1 1.5 1.7 1.9 2.7 2.5 2.3 1.6 1.1 1.0<br />

Exports SAAR 7.5 19.1 3.9 4.9 5.1 5.6 5.1<br />

YoY 7.9 6.7 5.5 7.1 10.3 7.7 8.7 8.1 4.9 5.2<br />

Imports SAAR -2.7 4.4 0.3 0.3 -1.2 2.1 -0.8<br />

YoY 2.0 0.5 1.8 2.0 1.7 1.4 0.5 0.9 0.4 0.1<br />

CPI YoY 2.9 3.6 2.0 2.7 2.4 4.0 4.2 3.7 3.6 2.8<br />

Core CPI YoY 2.3 2.5 2.0 2.3 2.1 2.3 2.5 2.6 2.5 2.4<br />

Unemployment Rate % 4.6 5.4 5.9 4.5 4.7 4.8 5.1 5.3 5.6 5.7<br />

Govt Balance (Fiscal Year) % of GDP -1.1 -3.0 -3.0 — — — — — — —<br />

Assumed WTI Spot Price US$ 72.3 91.6 89.2 65.0 75.5 90.9 93.2 91.6 91.0 90.4<br />

Current Account US$bn -751 -693 -607 -756 -714 -748 -743 -700 -682 -647<br />

% of GDP -5.4 -4.8 -4.1 -5.5 -5.1 -5.3 -5.3 -4.9 -4.7 -4.4<br />

S&P 500 Profits (US$ Per Share) YoY -1.7 -0.6 5.0 9.4 -5.7 -19.2 -9.7 -11.5 1.8 22.4<br />

Notes: F Citi forecast. YoY Year-to-year percent change. SAAR Seasonally adjusted annual rate.<br />

Sources: Bureau of <strong>Economic</strong> Analysis, Bureau of Labor Statistics, I/B/E/S, Treasury Department, Wall Street Journal, <strong>and</strong> Citi.<br />

20

February 28, 2008<br />

<strong>Global</strong> <strong>Economic</strong> <strong>Outlook</strong> <strong>and</strong> <strong>Strategy</strong><br />

Kiichi Murashima<br />

(81-3) 5574-4730<br />

kiichi.murashima<br />

@nikkocitigroup.com<br />

Japan<br />

We expect Japan’s economic growth to stabilize near the potential growth rate of the<br />

economy (slightly below 2%) this year after a bumpy ride in 2007. Last year, higher input<br />

costs including energy costs, the resulting deterioration in the profit outlook for small<br />

firms, <strong>and</strong> the enforcement of the revised Building St<strong>and</strong>ard Law temporarily distorted<br />

economic growth. However, real GDP advanced at an annualized 3.7% in the fourth<br />

quarter, reflecting strong export <strong>and</strong> business investment growth.<br />

Major dem<strong>and</strong> components are likely to exp<strong>and</strong>. Private consumption will likely maintain<br />

modest but stable expansion on somewhat higher income growth in 2008. Business<br />

investment likely will increase amid capacity shortages <strong>and</strong> healthy profits at large firms,<br />

but investment at small firms should be soft. The negative impact of the revised Building<br />

St<strong>and</strong>ard Law on housing has already come to an end. Finally, exports are likely to<br />

maintain slower but solid growth because Japan’s exports are now much more diversified<br />

than in the past. For example, exports to oil-producing countries alone are pushing up<br />

overall exports by almost three percentage points. Exports to Asia will likely slow<br />

gradually as the negative impact of the U.S. slowdown dampens growth in the region.<br />

Underlying inflation will likely remain low in 2008. While year-to-year changes in core<br />

CPI are expected to reach the 1% mark in coming months, this is mostly attributable to<br />

surging energy <strong>and</strong> manufactured food prices. Core inflation adjusted for energy <strong>and</strong> food<br />

will likely remain low against the backdrop of near-trend growth <strong>and</strong> persistent declines in<br />

unit labor costs. Core inflation probably will slip again to about 0.3% by the end of 2008.<br />

We expect the next rate hike by the Bank of Japan (BoJ) to be delayed until the end of<br />

2008 or early 2009. Continued uncertainties surrounding the U.S. economy <strong>and</strong> global<br />

financial markets, combined with ambiguity regarding domestic growth prospects, will<br />

likely continue to dissuade the BoJ from raising policy rates until after the release of its<br />

October economic outlook. BoJ Governor Fukui will step down in March, but the basic<br />

thrust of monetary policy (that is, policy normalization) will be maintained.<br />

Figure 26. Japan — <strong>Economic</strong> Forecast, 2007-09F<br />

2007 2008<br />

2007F 2008F 2009F 2Q 3Q 4Q 1QF 2QF 3QF 4QF<br />

Real GDP YoY 2.1% 1.9% 1.7% 1.7% 1.9% 1.8% 1.4% 2.2% 2.3% 1.9%<br />

SAAR -1.4 1.3 3.7 2.0 2.0 1.5 2.0<br />

Domestic Dem<strong>and</strong> YoY 1.0 1.2 1.4 0.7 0.8 0.4 0.2 1.2 1.7 1.6<br />

SAAR -1.9 -0.7 2.1 1.5 1.8 1.5 1.7<br />

Private Consumption YoY 1.5 1.0 1.3 1.1 2.0 1.1 0.8 0.9 1.1 1.1<br />

SAAR 0.7 0.5 0.8 1.0 1.3 1.2 1.0<br />

Business Investment YoY 2.5 4.2 2.5 0.4 0.7 2.1 3.0 5.3 5.2 3.1<br />

SAAR -6.0 4.5 12.1 2.1 2.9 4.0 3.4<br />

Housing Investment YoY -9.3 0.4 4.8 -3.0 -11.4 -21.4 -13.5 -5.0 6.1 17.8<br />

Public Investment YoY -2.3 -4.6 -3.3 -1.9 1.0 -1.8 -7.0 -4.7 -3.3 -3.3<br />

Exports YoY 8.7 6.6 4.2 7.9 8.6 10.8 8.5 8.2 5.8 3.9<br />

SAAR 4.6 12.1 12.1 5.5 3.3 2.4 4.3<br />

Imports YoY 1.7 1.9 3.0 1.4 1.5 1.9 1.4 1.5 2.3 2.6<br />

SAAR 2.2 -0.5 1.9 2.0 2.5 2.9 2.9<br />

Core CPI YoY 0.0 0.7 0.3 -0.1 -0.1 0.4 0.9 0.8 0.7 0.5<br />

Nominal GDP YoY 1.3 1.4 1.8 1.2 1.1 0.7 0.3 1.5 1.8 2.0<br />

Current Account ¥ tn 25.0 25.0 27.9 26.1 24.9 26.3 26.1 25.2 23.8 24.8<br />

% of GDP 4.8 4.8 5.2 5.1 4.8 5.1 5.0 4.8 4.5 4.7<br />

Unemployment Rate % 3.9 3.9 3.7 3.8 3.8 3.9 3.9 3.9 3.9 3.8<br />

Industrial Production YoY 2.9 2.3 2.5 2.3 2.7 2.8 3.0 3.4 1.7 1.2<br />

Corporate Profits (Fiscal Year) YoY 6.0 4.0 5.0<br />

General Govt. Balance (Fiscal Year) % of GDP -2.8 -3.0 -3.1<br />