In 2003, the retail industry is set to experience ... - Kadin Indonesia

In 2003, the retail industry is set to experience ... - Kadin Indonesia

In 2003, the retail industry is set to experience ... - Kadin Indonesia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Development of Retail <strong>In</strong>dustry in <strong>In</strong>donesia<br />

Tulus Tambunan<br />

Recent Development<br />

The evaluation of development of <strong>the</strong> <strong>retail</strong> <strong>industry</strong> in <strong>In</strong>donesia shows that <strong>the</strong> <strong>industry</strong> has been developed<br />

in a 10 year-cycle, and its long period of development can be divided in<strong>to</strong> subsequent stages. However, th<strong>is</strong><br />

cycle tends <strong>to</strong> shorten due <strong>to</strong> many fac<strong>to</strong>rs, such as <strong>the</strong> rapid increase of income per capita, global trade and<br />

financial liberalization, and technological progress. The development cycle of <strong>the</strong> <strong>industry</strong> <strong>is</strong> given as follows.<br />

Before 1960s, <strong>the</strong>re was <strong>the</strong> ep<strong>is</strong>ode of traditional <strong>retail</strong>ers or independent (small) traders. <strong>In</strong> <strong>the</strong> 1960s <strong>the</strong>re<br />

was <strong>the</strong> period when modern <strong>retail</strong> was introduced marked by <strong>the</strong> opening of <strong>the</strong> first department s<strong>to</strong>re<br />

SARINAH in JL. MH Thamrin (Central Jakarta). During <strong>the</strong> 1970s-1980s, it was <strong>the</strong> first expansion era of<br />

modern <strong>retail</strong> with <strong>the</strong> emergence of many supermarkets, department s<strong>to</strong>res and groceries such as Matahari,<br />

Hero, Golden Truly, Pasar Raya dan Ramayana; it was also <strong>the</strong> era of development of drug s<strong>to</strong>res.<br />

<strong>In</strong> <strong>the</strong> early 1980s, shopping malls were limited <strong>to</strong> Sarinah, Ratu Plaza, Gajah Mada Plaza, Blok M and<br />

Pasar Baru. Since <strong>the</strong>n, major shopping malls have been constructed all over <strong>to</strong>wn. The growing middle class<br />

has been flocking <strong>to</strong> <strong>the</strong> shopping malls in recent years <strong>to</strong> buy an ever growing variety of consumer goods.<br />

Foreign department chains such as Metro (Singapore), Sogo (Japan) and Marks & Spencer's (UK) have tested<br />

<strong>the</strong> waters by opening outlets in prestigious malls.<br />

<strong>In</strong> <strong>the</strong> 1990s, it was <strong>the</strong> second expansion era of modern <strong>retail</strong> or <strong>the</strong> era of development of Convenience<br />

S<strong>to</strong>re (C-S<strong>to</strong>re), High Class Department S<strong>to</strong>re, Branded Boutique (high fashion) and Cash and Carry. The<br />

development of C-s<strong>to</strong>re was marked by <strong>the</strong> rapid growth of <strong>In</strong>domaret dan AMPM. The development of High<br />

Class department S<strong>to</strong>re and High Fashion Outlet was marked by <strong>the</strong> entrance of SOGO, Metro, Seibu,Yaohan,<br />

Mark & Spencer and various o<strong>the</strong>r high fashion outlets. The development of Cash and Carry was marked by <strong>the</strong><br />

establ<strong>is</strong>hment of Makro, followed by local <strong>retail</strong>ers with <strong>the</strong> same form such as GORO, <strong>In</strong>dogrosir and Alfa.<br />

Most malls have a good <strong>retail</strong> mix with several anchor department s<strong>to</strong>res, small clothing boutiques,<br />

stationery/book s<strong>to</strong>res, framers, <strong>to</strong>y s<strong>to</strong>res, household furn<strong>is</strong>hings and even car dealers. V<strong>is</strong>it <strong>the</strong> various malls <strong>to</strong><br />

familiarize yourself with <strong>the</strong> s<strong>to</strong>res available. The information desk near <strong>the</strong> main entrance often has a brochure<br />

or l<strong>is</strong>ting of all <strong>the</strong> s<strong>to</strong>res in <strong>the</strong> mall. Malls are not only a place <strong>to</strong> shop, but increasingly, a recreation site with<br />

clean, air-conditioned environment. Movie <strong>the</strong>aters, ice-skating rinks, arcades, laser tag, simulated rock<br />

climbing, simula<strong>to</strong>r rides, coin-operated children's rides, food courts and restaurants abound. Families can<br />

entertain <strong>the</strong>ir kids and have a nice meal or snack. They can find various restaurants featuring <strong>In</strong>donesian, Asian<br />

and western menus; from snacks <strong>to</strong> fast food <strong>to</strong> family restaurants.<br />

Th<strong>is</strong> <strong>is</strong> also <strong>the</strong> period when <strong>the</strong> development of <strong>retail</strong> in <strong>In</strong>donesia was hit by <strong>the</strong> 1997/98 economic cr<strong>is</strong><strong>is</strong><br />

followed by <strong>the</strong> May 1998 riot. However, since <strong>the</strong> 1998 liberalization in which <strong>In</strong>donesia has opened its<br />

economy for foreign investment in <strong>retail</strong> activities, <strong>the</strong> <strong>industry</strong> got a positive impulse, <strong>the</strong> <strong>industry</strong> has been<br />

booming significantly as <strong>the</strong> entrance of foreign <strong>retail</strong>ers has been growing rapidly, started first in big cities like<br />

Jakarta and Surabaya and <strong>the</strong>n expanding <strong>to</strong> medium cities like Semarang and Yogyakarta.<br />

1

Th<strong>is</strong> rapid expansion of foreign <strong>retail</strong>ers accompanied with strong domestic consumption was <strong>the</strong> most<br />

important driving force behind <strong>the</strong> smooth recovery of <strong>the</strong> <strong>In</strong>donesian <strong>retail</strong> sec<strong>to</strong>r after severe damage during<br />

<strong>the</strong> 1998 riot. According <strong>to</strong> <strong>the</strong> Association of <strong>In</strong>donesian Retail Companies (APRINDO), <strong>the</strong> estimated cost of<br />

<strong>the</strong> riot damage was around Rp2.5 trillion. APRINDO has estimated that <strong>In</strong>donesians spent about Rp200 trillion<br />

on <strong>retail</strong> products in 2000 and <strong>the</strong> sec<strong>to</strong>r grew more than 20% in 2001. Some Rp35 trillion of th<strong>is</strong> went <strong>to</strong><br />

modern <strong>retail</strong> outlets, including Hero prem<strong>is</strong>es and Rp165 trillion was spent at traditional markets and<br />

community shops. <strong>In</strong> 2002, <strong>to</strong>tal sales of <strong>In</strong>donesia's <strong>retail</strong> sec<strong>to</strong>r amounted <strong>to</strong> approximately $4 billion, which<br />

generated by some 5,000 <strong>retail</strong> outlets. <strong>In</strong> terms of growth rate, in <strong>the</strong> fourth quarter of that year, <strong>the</strong> <strong>retail</strong> sec<strong>to</strong>r<br />

reg<strong>is</strong>tered only 3% growth. <strong>In</strong> <strong>the</strong> first quarter of <strong>2003</strong>, <strong>the</strong> sec<strong>to</strong>r <strong>experience</strong>d modest growth of only 4%<br />

compared <strong>to</strong> <strong>the</strong> same period in 2002. <strong>In</strong> many years before, <strong>the</strong> growth for th<strong>is</strong> quarter was typically at least<br />

20%. Due <strong>to</strong> <strong>the</strong> decrease in consumer expenditure and increase in operating costs, namely <strong>the</strong> increases in<br />

electricity, fuel, and telephone charges in <strong>2003</strong>, <strong>the</strong> sec<strong>to</strong>r was expected <strong>to</strong> <strong>experience</strong> a slower growth of 3<br />

percent in <strong>2003</strong>. For 2005, APRINDO predicts that <strong>the</strong> <strong>In</strong>donesian <strong>retail</strong> market will pick up and book an<br />

estimated sales turnover of $8.75 billion.<br />

O<strong>the</strong>r than increasing costs, <strong>the</strong> <strong>retail</strong> sec<strong>to</strong>r had faced a few barriers throughout 2002 and <strong>2003</strong>. There were<br />

several bombings, natural d<strong>is</strong>asters and regional <strong>is</strong>sues that d<strong>is</strong>couraged consumers from spending. The Bali<br />

bombing in Oc<strong>to</strong>ber 2002 and JW Marriott Hotel bombing on 5 August <strong>2003</strong> have d<strong>is</strong>couraged people from<br />

venturing in<strong>to</strong> public places, especially shopping centres and malls. The extra tight security checks at <strong>the</strong>se<br />

places proved a negative fac<strong>to</strong>r among consumers, who tended <strong>to</strong> stay at home. The same conditions were also<br />

evident particularly in major cities such as Jakarta and Medan, and compounded by <strong>the</strong> SARS (Severe Acute<br />

Respira<strong>to</strong>ry Syndrome) outbreak.<br />

However, since many years <strong>the</strong> major <strong>retail</strong>ers in <strong>In</strong>donesia have been planning big expansions of <strong>the</strong>ir<br />

businesses <strong>to</strong> get a larger chunk of <strong>the</strong> country's expanding economy. Alfamart, a minimarket opera<strong>to</strong>r since<br />

1999, <strong>is</strong> leading <strong>the</strong> charge by planning <strong>to</strong> increase its outlets by 80% from 1,000 <strong>to</strong> 1,800 locations in <strong>the</strong><br />

country. The company's ultimate goal <strong>is</strong> <strong>to</strong> establ<strong>is</strong>h between 5,000 and 10,000 mini-markets in <strong>In</strong>donesia. The<br />

dec<strong>is</strong>ion <strong>to</strong> expand, according <strong>to</strong> Alfamart managing direc<strong>to</strong>r Pudjian<strong>to</strong>, will eventually sideline traditional<br />

s<strong>to</strong>res. Competi<strong>to</strong>r <strong>In</strong>domaret, meanwhile, has also revealed its plans <strong>to</strong> open 600 more outlets, boosting its<br />

s<strong>to</strong>res <strong>to</strong> 1,600. 1<br />

Any expansion will be less appealing <strong>to</strong> <strong>retail</strong>ers, yet <strong>the</strong> growing competition will force <strong>the</strong>se <strong>retail</strong>ers <strong>to</strong><br />

maintain such a strategy especially in sec<strong>to</strong>rs such as supermarkets, convenience s<strong>to</strong>res and hypermarkets. <strong>In</strong><br />

addition, <strong>the</strong> <strong>retail</strong> <strong>industry</strong> can take advantage of continuing property development, especially in terms of<br />

shopping centres, trade centres and malls. These new constructions will definitely result in greater <strong>retail</strong> sales<br />

area <strong>to</strong> many <strong>retail</strong> formats.<br />

Supermarkets and hypermarkets have also been planning <strong>to</strong> expand <strong>the</strong>ir presence, with one of <strong>the</strong> opera<strong>to</strong>rs,<br />

Hypermart, looking <strong>to</strong> triple its outlets <strong>to</strong> 18 in 2004-2005. According <strong>to</strong> AC Nielsen, <strong>the</strong> number of <strong>retail</strong><br />

outlets in <strong>In</strong>donesia, which was estimated <strong>to</strong> be 1.75 million, <strong>is</strong> <strong>the</strong> second-biggest in <strong>the</strong> Asia Pacific after<br />

1 Th<strong>is</strong> information came during interviews conducted by <strong>the</strong> author with some member staffs of APRINDO during <strong>2003</strong>-2004.<br />

2

China with 3.2 million. Based on a study by MasterCard <strong>In</strong>ternational in early 2004, <strong>In</strong>donesia was forecast <strong>to</strong><br />

<strong>to</strong>p <strong>the</strong> year-on-year <strong>retail</strong> sales growth for <strong>the</strong> first semester with 16.9% <strong>to</strong> China's 12.75%. 2<br />

APRINDO has estimated that <strong>to</strong>tal <strong>retail</strong> sales in 2004 reached about Rp 300 trillion (US.6 billion), and <strong>is</strong><br />

predicted <strong>to</strong> grow by between 15% and 20% in 2005. APRINDO data shows that sales in 2,720 modern s<strong>to</strong>res<br />

nationwide <strong>experience</strong>d a 28% growth from Rp 35 trillion in <strong>2003</strong> <strong>to</strong> Rp 45 trillion in 2004. Although spending<br />

increased at both traditional and modern <strong>retail</strong>ers, <strong>the</strong> growth at modern <strong>retail</strong>ers was predicted 12% higher than<br />

at traditional markets. According <strong>to</strong> APRINDO, at <strong>the</strong> current growth rates, <strong>the</strong> market share of traditional<br />

s<strong>to</strong>res, currently at 70%, would drop by 2% per year. The most recent data from AC Nielsen revealed that <strong>the</strong><br />

share of consumer spending at modern markets has increased by 40% from 21.8% in 2000 <strong>to</strong> 30.4% in 2004. 3<br />

Based on data from Central Bureau of Stat<strong>is</strong>tics (BPS), in 2000, <strong>In</strong>donesian consumers spent about US$100<br />

per person per year for consumption in traditional <strong>retail</strong>, or about Rp150 trillion based on current exchange rate<br />

of <strong>the</strong> rupiah and <strong>to</strong>tal population. 4 While, for consumption in modern <strong>retail</strong>, based on information from<br />

APRINDO, <strong>to</strong>tal spending in <strong>the</strong> same year reached Rp 25 trillion, So, in that year, <strong>to</strong>tal <strong>retail</strong> consumption<br />

expenditure was Rp.175 trillion. 5<br />

Although <strong>retail</strong> sec<strong>to</strong>r, especially <strong>the</strong> modern one, has been growing very fast in <strong>In</strong>donesia, according <strong>to</strong><br />

Euromoni<strong>to</strong>r data in 2000, 6 <strong>the</strong> <strong>retail</strong> outlet intensity or <strong>to</strong>tal units per 1,000 persons in <strong>the</strong> country <strong>is</strong> lower than<br />

in some smaller neighbor countries such Malaysia and Thailand, but higher than that in e.g. Singapore (Chart 1).<br />

Th<strong>is</strong> difference may be attributed not only <strong>to</strong> income per capita, but also country size, condition of<br />

infrastructure, regulations and many o<strong>the</strong>rs.<br />

Chart 1. <strong>In</strong>tensity of Retailers in a number of countries, 2000 (units per 1,000 persons)<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Thailand<br />

China<br />

Japan<br />

Ne<strong>the</strong>rlands<br />

Malaysia<br />

<strong>In</strong>donesia<br />

Singapore<br />

Hong Kong<br />

Germany<br />

Australia<br />

<strong>In</strong>dia<br />

UK<br />

USA<br />

Philippine<br />

Source: McGoldrick (2002)<br />

2 APRINDO.<br />

3 Jakarta Post, 4 August 2005.<br />

4 B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia, 7-9-2001.<br />

5 Hendri Ma’ruf (2005), Pemasaran Ritel (Retail Marketing), Jakarta: PT Gramedia Pustaka Utama.<br />

6 Peter McGoldrick (2002), Retail Marketing, New York: McGraw-Hill Education.<br />

3

There are currently more than 527 supermarkets in <strong>In</strong>donesia, most of <strong>the</strong>m in Jakarta, <strong>the</strong> greater Jakarta<br />

area (Botabek) and Surabaya. However, with a <strong>to</strong>tal population of some 208 million people, supermarket<br />

penetration remains very limited, representing only one supermarket for nearly 500,000 people. 7<br />

Overview of <strong>retail</strong> sec<strong>to</strong>r in a report called <strong>In</strong>donesian Food & Beverage Retail Report from <strong>the</strong> Canadian<br />

Embassy in Jakarta in March 2000 gives number and location of supermarkets/mini-market in Jakarta (Center,<br />

South, East, West and North) before <strong>the</strong> cr<strong>is</strong><strong>is</strong>. As can be seen in Chart 2, supermarket has expanded more<br />

rapidly than minimarket, although <strong>the</strong> difference varies between region within <strong>the</strong> city. According <strong>to</strong> th<strong>is</strong> report,<br />

Jakarta had 313 outlets of supermarket and mini-markets before <strong>the</strong> cr<strong>is</strong><strong>is</strong>. Of <strong>the</strong>se were 185 supermarkets and<br />

128 mini-market outlets. There were around 940 supermarkets nationwide. South Jakarta had <strong>the</strong> largest number<br />

with 88 outlets and North Jakarta <strong>the</strong> smallest number with 44 outlets. Before <strong>the</strong> May riots in 1998, joint<br />

ventures with foreign opera<strong>to</strong>rs were a r<strong>is</strong>ing trend, as <strong>In</strong>donesian <strong>retail</strong>ers sought technical and managerial<br />

expert<strong>is</strong>e from abroad. Most notables are Hero's strategic alliance with Dairy Farm <strong>In</strong>ternational Holdings of<br />

Hong Kong. <strong>In</strong> May 1998, rioters turned on <strong>retail</strong> s<strong>to</strong>res in <strong>the</strong> cities, causing immense damage. No less than 36<br />

supermarket outlets and 9 wholesale s<strong>to</strong>res were burned and looted by rioters. Al<strong>to</strong>ge<strong>the</strong>r, leading <strong>retail</strong>ers<br />

suffered an estimated US$414 million in damages, not including losses endured by countless smaller s<strong>to</strong>res.<br />

Some Opera<strong>to</strong>rs got back on <strong>the</strong>ir feet quickly. Hero Supermarket, one of <strong>the</strong> biggest <strong>retail</strong>ers, managed <strong>to</strong> resupply<br />

its looted s<strong>to</strong>res just hours after <strong>the</strong> riots with <strong>the</strong> aid of its central d<strong>is</strong>tribution partner, David's Asia. <strong>In</strong><br />

view of future trouble, reopening supermarkets also changed <strong>the</strong>ir s<strong>to</strong>cking system by ordering limited supplies<br />

weekly, ra<strong>the</strong>r than monthly as before.<br />

Chart 2. Supermarket and Minimarket in Jakarta by Region, 2000<br />

Source: APRINDO<br />

8<br />

Fur<strong>the</strong>r, based on data from AC Nielsen, Chart 3 shows <strong>retail</strong> market share in <strong>In</strong>donesia for <strong>the</strong> period May<br />

2002-April <strong>2003</strong>. As can be seen, <strong>the</strong> share of West Java (including Depok, Bogor, Tangerang and Bekasi) was<br />

<strong>the</strong> highest at 20.7%, followed by Central Java 16.3%, East Java 15.9%, Jakarta (DKI) 15.0%, North Sumatra<br />

11.0%, South Sumatra 7.8%, and o<strong>the</strong>r regions 13.4%. Th<strong>is</strong> figure suggests that <strong>the</strong> d<strong>is</strong>tribution of <strong>retail</strong>,<br />

7 APRINDO<br />

8<br />

B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia, 14-8-<strong>2003</strong>.<br />

4

especially modern outlets, <strong>is</strong> mainly concentrated in <strong>the</strong> west part of <strong>the</strong> country. Th<strong>is</strong> relates <strong>to</strong> <strong>the</strong> fact that <strong>the</strong><br />

larger portion of <strong>the</strong> country’s population <strong>is</strong> found in that part, which <strong>is</strong> also much more developed with higher<br />

income per capita compared <strong>to</strong> <strong>the</strong> eastern part of <strong>the</strong> country. Especially, people with high purchasing power<br />

live in Bandung and in three d<strong>is</strong>tricts i.e. Bogor, Tangerang and Bekasi that surrounding Jakarta but located in<br />

<strong>the</strong> province of West Java. Th<strong>is</strong> makes West Java as <strong>the</strong> highest province in <strong>In</strong>donesia with respect <strong>to</strong> <strong>the</strong><br />

national share of <strong>retail</strong> market.<br />

Chart 3: National Share of Retail Market by Region in <strong>In</strong>donesia: May 2002-April <strong>2003</strong><br />

25<br />

20<br />

15<br />

%<br />

10<br />

5<br />

0<br />

West Java<br />

Central<br />

Java<br />

East Java DKI North<br />

Sumat ra<br />

Sout h<br />

Sumat ra<br />

O<strong>the</strong>rs<br />

Source: AC Nielsen<br />

The 1998 Liberalization Policies and <strong>the</strong> Growth of Modern Retailers<br />

H<strong>is</strong><strong>to</strong>rically, foreign companies in <strong>In</strong>donesia had been prohibited by law from d<strong>is</strong>tributing <strong>the</strong>ir own<br />

products, and both <strong>retail</strong> and d<strong>is</strong>tribution remain closed <strong>to</strong> foreign investment. Many new players, however,<br />

have entered <strong>the</strong> <strong>retail</strong> market, despite th<strong>is</strong> prohibition. <strong>In</strong> light of <strong>the</strong> prohibition on direct investment, foreign<br />

involvement in <strong>retail</strong> <strong>is</strong> limited <strong>to</strong> licensing and franch<strong>is</strong>ing. The products of manufacturing or processing<br />

companies in which foreigners own equity may be sold at <strong>the</strong> wholesale level, generally unders<strong>to</strong>od <strong>to</strong> permit<br />

sales only <strong>to</strong> d<strong>is</strong>tribu<strong>to</strong>rs. The rules on d<strong>is</strong>tribution by foreign companies were relaxed through a series of laws<br />

in 1987, 1989 and 1996. Foreign manufacturing joint ventures may now <strong>set</strong> up a separate joint venture<br />

d<strong>is</strong>tribution company in which a majority of <strong>the</strong> equity may be held by <strong>the</strong> foreign party and may also import<br />

complementary goods produced by overseas parties <strong>to</strong> complement <strong>the</strong>ir own product lines. Such products may<br />

be sold in addition <strong>to</strong> <strong>the</strong> companies' locally produced products. However, restrictions still ex<strong>is</strong>t, and <strong>the</strong><br />

<strong>In</strong>donesian market remains in many ways closed <strong>to</strong> foreign d<strong>is</strong>tribution and trade.<br />

Only short after <strong>the</strong> cr<strong>is</strong><strong>is</strong>, <strong>the</strong> <strong>In</strong>donesian government launched a new regulation, as part of <strong>the</strong> original<br />

letter of intent commitment with <strong>the</strong> <strong>In</strong>ternational Monetary Fund, which allowed foreign <strong>retail</strong>ers for <strong>the</strong> first<br />

time ever <strong>to</strong> open <strong>the</strong>ir own s<strong>to</strong>res in <strong>In</strong>donesia. Th<strong>is</strong> new regulation <strong>is</strong> contained in a dec<strong>is</strong>ion of <strong>the</strong> <strong>In</strong>vestment<br />

Min<strong>is</strong>ter No. 99 in 1998 and Government Decree in 1999. According <strong>to</strong> <strong>the</strong> Decree 99, <strong>the</strong> <strong>retail</strong> and wholesale<br />

sec<strong>to</strong>rs in <strong>In</strong>donesia are open <strong>to</strong> large - and medium - scale investment as long as <strong>the</strong> foreign inves<strong>to</strong>r (FDI)<br />

enters in<strong>to</strong> an equity "partnership" with local small enterpr<strong>is</strong>es (SEs). <strong>In</strong> th<strong>is</strong> case, SEs must hold at least 20% of<br />

<strong>the</strong> shares in <strong>the</strong> FDI companies. The decree also says that <strong>In</strong>donesian inves<strong>to</strong>r's shareholding must increase<br />

gradually.<br />

5

When a now-equity partnership entered in<strong>to</strong> between <strong>the</strong> FDI companies and <strong>the</strong> SEs, such as under a<br />

general trading agency, or sub-contracting arrangement, <strong>the</strong>re <strong>is</strong> no restriction on <strong>the</strong> percentage of shares that<br />

may be held by <strong>the</strong> foreign inves<strong>to</strong>r. It could 100% percent foreign owned. <strong>In</strong> both types of partnerships, <strong>the</strong><br />

foreign inves<strong>to</strong>r <strong>is</strong> required <strong>to</strong> "foster" <strong>the</strong> SEs through ass<strong>is</strong>tance in area such as technology, marketing, human<br />

resources, business management and financing. 9<br />

Soon after th<strong>is</strong> liberalization policy, many large, modern foreign <strong>retail</strong>ers, which have been particularly<br />

active in <strong>the</strong> hypermarket sec<strong>to</strong>r, began <strong>to</strong> invest in <strong>In</strong>donesia, and competition in <strong>the</strong> <strong>In</strong>donesian <strong>retail</strong> <strong>industry</strong><br />

has been very steep. Although some foreign <strong>retail</strong>ers failed and closed down <strong>the</strong>ir outlets, many are successful<br />

and expanding <strong>the</strong>ir business. <strong>In</strong> <strong>In</strong>donesia, <strong>the</strong>re are no regulations governing where a <strong>retail</strong>er can establ<strong>is</strong>h<br />

outlets. As a result, many large <strong>retail</strong>ers are strategically located in <strong>the</strong> heart of <strong>In</strong>donesia's big cities and<br />

compete directly with smaller <strong>retail</strong>ers.<br />

As a direct consequence of th<strong>is</strong> new regulation, traditional regional <strong>retail</strong>ers which dominate <strong>retail</strong> trade in<br />

certain regions in <strong>In</strong>donesia (especially big cities like Jakarta, Surabaya, Semarang, Yogyakarta, Bandung,<br />

Medan dan Makasar) are slowly being threatened by modern <strong>retail</strong> outlets, not only from abroad but also from<br />

domestic. Some of <strong>the</strong>se traditional <strong>retail</strong>ers are Sri Ratu and Rita in Central Java, Macan Yaohan and Maju<br />

Bersama in Medan, AdA in Semarang, and Yogya and Borma in Bandung. Th<strong>is</strong> traditional <strong>retail</strong> includes small<br />

"mom and pop" prov<strong>is</strong>ion shops, some of which are in markets. D<strong>is</strong>tribution channels are long and complex.<br />

Little imported product <strong>is</strong> carried by <strong>the</strong>se outlets except for fresh fruit and beef offal. An estimated 60% of<br />

imported fresh fruit goes through traditional markets.<br />

Consumer loyalty <strong>to</strong> traditional <strong>retail</strong> shops <strong>is</strong> still strong due <strong>to</strong> long tradition. However, modern <strong>retail</strong>ers<br />

with stronger capital, such as Hero and Matahari, are starting <strong>to</strong> expand <strong>to</strong> <strong>the</strong>se regions. These modern <strong>retail</strong>ers<br />

also have <strong>the</strong> advantage of up-<strong>to</strong>-date service, high technology systems and modern outlets, which are more<br />

attractive <strong>to</strong> <strong>the</strong> young consumers. While, <strong>the</strong> traditional <strong>retail</strong>ers have problems in expanding <strong>the</strong>ir business<br />

outside <strong>the</strong>ir terri<strong>to</strong>ry, such as Yogya, whose performance in Jakarta <strong>is</strong> moderate, compared <strong>to</strong> its strong<br />

position in Bandung.<br />

So, in <strong>In</strong>donesia now, two d<strong>is</strong>tinct categories of <strong>retail</strong>ers serving different consumers segments can be<br />

identified, i.e. modern <strong>retail</strong>ers, targeted <strong>the</strong> higher-income groups and expatriates offering wide selections of<br />

Western fresh and processed foods in a modern s<strong>to</strong>re environment while <strong>the</strong> o<strong>the</strong>r, i.e. traditional <strong>retail</strong>ers,<br />

serviced <strong>the</strong> lower-income up <strong>to</strong> <strong>the</strong> middle income families. The modern <strong>retail</strong> business in <strong>the</strong> country can<br />

fur<strong>the</strong>r be divided in<strong>to</strong> three parts namely hypermarket, supermarket and minimarket. Currently, such as<br />

Carrefour, Makro, Alfa, <strong>In</strong>do Grosir and Goro represent <strong>the</strong> hypermarket <strong>industry</strong>. For supermarket, <strong>the</strong><br />

representative players are Hero, Matahari, Ramayana Super indo, Gelael, Diamond, and many o<strong>the</strong>r<br />

supermarket surrounding Jakarta such as Bandung (West Java), Surabaya (East Java), and Denpasar (Bali).<br />

Minimarkets are numerous but represent by <strong>the</strong> large chains, <strong>In</strong>do Maret, Circle K, and Am-Pm.<br />

Modern <strong>retail</strong> s<strong>to</strong>res, especially hypermarkets and supermarkets offer a wide range of food and beverage<br />

products. Among <strong>the</strong>se which have achieved significant growth in annual sales include <strong>the</strong> following: infant<br />

9 According <strong>to</strong> th<strong>is</strong> new national investment policy, a FDI company cannot carry on both <strong>retail</strong> and wholesale activities concurrently.<br />

If a foreign inves<strong>to</strong>r w<strong>is</strong>hes <strong>to</strong> operate <strong>retail</strong> and wholesale business in <strong>In</strong>donesia, it would need <strong>to</strong> establ<strong>is</strong>h two separate FDI<br />

companies.<br />

6

milk formula (53%), cheese (51%), energy drinks (50%), snack foods (45%), liquid milk (40%), chocolate<br />

(39%), baby foods (35%), health foods (35%), sweetened condensed milk (35%), and b<strong>is</strong>cuits (28%). The<br />

modern <strong>retail</strong>ers are also concentrating on improving <strong>the</strong>ir marketing of quality fresh produce, a substantial<br />

portion of which <strong>is</strong> imported, as <strong>is</strong> exemplified by <strong>the</strong> number of fruit boutiques that have emerged. 10<br />

They are generally located as anchor s<strong>to</strong>res in shopping centers. An increasing number of <strong>In</strong>donesians are<br />

shopping at <strong>the</strong>se s<strong>to</strong>res, particularly affluent middle and upper income groups. These <strong>retail</strong>s s<strong>to</strong>res generally<br />

also contain in-s<strong>to</strong>re bakeries, café/food service area, and prepared meals. <strong>In</strong> addition, mini-markets and o<strong>the</strong>r<br />

shops, which carry a small range of convenience food items including fresh fruits, are found throughout<br />

<strong>In</strong>donesia’s major urban centers.<br />

Despite <strong>the</strong> growth in <strong>the</strong> modern <strong>retail</strong> sec<strong>to</strong>r, <strong>the</strong> majority of <strong>In</strong>donesians continue <strong>to</strong> shop at traditional<br />

s<strong>to</strong>res conveniently located <strong>to</strong> <strong>the</strong>ir homes or places of work. These s<strong>to</strong>res sell <strong>the</strong> commonly demanded food<br />

and beverage products, which are familiar <strong>to</strong> <strong>the</strong> majority of consumers. So, <strong>the</strong> traditional sec<strong>to</strong>r <strong>is</strong> expected <strong>to</strong><br />

continue <strong>to</strong> dominate <strong>the</strong> d<strong>is</strong>tribution system in <strong>the</strong> country for <strong>the</strong> foreseeable future.<br />

Rangkuti (2004) (see footnote 10) attempts <strong>to</strong> explain th<strong>is</strong> by looking at consumer purchasing habits in<br />

<strong>In</strong>donesia, that have changed dramatically following <strong>the</strong> 1998/99 economic cr<strong>is</strong><strong>is</strong> and continue <strong>to</strong> evolve. He<br />

has made <strong>the</strong> following generalizations about current consumer behavior:<br />

- purchasing more staple foods, ra<strong>the</strong>r than luxury items, and minimizing impulse buying;<br />

- extremely price conscious in <strong>the</strong>ir purchases and exhibiting less s<strong>to</strong>re and brand loyalty;<br />

- shopping more frequently for food and buying smaller quantities per shopping trip;<br />

- shifting purchases of some staple items <strong>to</strong> traditional outlets and shopping more frequently at d<strong>is</strong>count<br />

venues in <strong>the</strong> modern sec<strong>to</strong>r;<br />

- eating out less often; instead, shopping in supermarkets <strong>to</strong> eat at home;<br />

- buying smaller package sizes and placing less value on <strong>the</strong> quality and appearance of packaging;<br />

- buying local ra<strong>the</strong>r than imported products when sat<strong>is</strong>fac<strong>to</strong>ry local substitutes are available;<br />

- consuming more fresh food items;<br />

- less nutrition-conscious.<br />

<strong>In</strong> <strong>the</strong> modern <strong>retail</strong> sec<strong>to</strong>r, d<strong>is</strong>tribution channels will shorten. Large <strong>retail</strong>ers will increasingly import<br />

(particularly produce) directly from foreign exporters, or will be supplied directly by local manufacturers and<br />

fresh produce producers. They will put in place central warehousing and d<strong>is</strong>tribution systems in <strong>the</strong> big cities,<br />

utilizing modern technology and equipment. They will open more outlets in cities on Java outside of Jakarta <strong>to</strong><br />

make <strong>the</strong>se systems efficient. Adequate infrastructure <strong>is</strong> a major problem on <strong>the</strong> o<strong>the</strong>r <strong>is</strong>lands. For example, a<br />

period of two weeks often lapses between order placement and delivery (see footnote 10). Comparable changes<br />

will also occur in <strong>the</strong> traditional sec<strong>to</strong>r. National d<strong>is</strong>tribu<strong>to</strong>rs are <strong>set</strong>ting up central d<strong>is</strong>tribution systems <strong>to</strong><br />

10 Fahwani Y. Rangkuti (2004), “<strong>In</strong>donesia Retail Food Sec<strong>to</strong>r Report 2004”, USDA Foreign Agricultural Service, Gain Report,<br />

December, Jakarta; U.S. Embassy.<br />

7

expand direct delivery <strong>to</strong> traditional market outlets. More direct delivery by manufacturers <strong>to</strong> traditional <strong>retail</strong><br />

outlets <strong>is</strong> anticipated.<br />

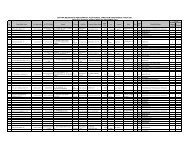

Based on information from Alfa homepage, as shown in Table 1, in 1996, <strong>the</strong> ratio between number of<br />

modern <strong>retail</strong> outlets and that of traditional ones was around 25% and in 1998, it declined due <strong>to</strong> <strong>the</strong> May 1998<br />

riot, and in 1999, it went up again <strong>to</strong> 33.3%. As <strong>the</strong> <strong>In</strong>donesian economy has recovered from <strong>the</strong> 1997/1998<br />

cr<strong>is</strong><strong>is</strong> and <strong>the</strong> real income per capita in <strong>the</strong> country has been increasing annually since <strong>the</strong> negative growth of<br />

GDP in 1998 by more than 13%, <strong>the</strong> ratio of modern-traditional <strong>retail</strong> in <strong>In</strong>donesia in recent years was expected<br />

<strong>to</strong> be much higher than that in 1999.<br />

Table 1: Development of Modern and Traditional Retail in <strong>In</strong>donesia (unit)<br />

Tahun Modern <strong>retail</strong> Trad<strong>is</strong>ional <strong>retail</strong><br />

1996 11 44<br />

1997 12 50<br />

1998 9 32<br />

1999 10 30<br />

Source : Alfa Retailindo, Tbk (homepage).<br />

Data from AC Nielsen, 11 as shown in Table 2, <strong>the</strong> share of traditional <strong>retail</strong> outlet <strong>is</strong> still larger than that of<br />

modern one, but declining, while that of <strong>the</strong> modern one continued <strong>to</strong> increase annually during <strong>the</strong> period under<br />

review. Th<strong>is</strong> does not come as a surpr<strong>is</strong>e for two reasons. First, as presented in Table 3, Henri<br />

Ma’ruf’s 12 estimates that <strong>to</strong>tal revenue of traditional <strong>is</strong> much higher that that of modern <strong>retail</strong>s. Second,<br />

according <strong>to</strong> AC Nielson, 13 modern <strong>retail</strong> in <strong>In</strong>donesia has 5,079 outlets as compared <strong>to</strong> 1,745,589 traditional<br />

outlets.<br />

Table 2: Market share of traditional and modern <strong>retail</strong> outlets in <strong>In</strong>donesia (not end year position (%)<br />

2000 2001 2002 <strong>2003</strong><br />

Hyper-/supermarket<br />

Minimarket<br />

Traditional market<br />

16.7<br />

3.4<br />

79.8<br />

20.5<br />

4.6<br />

74.9<br />

20.2<br />

4.9<br />

74.9<br />

21.1<br />

5.1<br />

73.8<br />

Source: AC Nielsen<br />

Data from Euromoni<strong>to</strong>r in 2000 show that <strong>to</strong>p five (5) <strong>retail</strong>ers in <strong>In</strong>donesia own about 4.7% of <strong>to</strong>tal<br />

national <strong>retail</strong> trade. 14 With <strong>the</strong> estimation in Table 3 that <strong>to</strong>tal <strong>retail</strong> trade in <strong>In</strong>donesia in that year reached about<br />

Rp 182.2 trillion, <strong>the</strong>se five big <strong>retail</strong>ers have thus a <strong>to</strong>tal revenue of Rp 8.56 trillion. <strong>In</strong> that year, all<br />

hypermarkets and supermarkets as <strong>the</strong> big and modern <strong>retail</strong>ers have market share of 16.7% or a <strong>to</strong>tal revenue of<br />

Rp 30.5 trillion. <strong>In</strong> <strong>2003</strong>, <strong>the</strong>se two big <strong>retail</strong>ers occupied 21.1% market share in <strong>In</strong>donesia or equivalent <strong>to</strong> Rp<br />

56.1 trillion. Besides <strong>the</strong>se two big <strong>retail</strong>ers that enjoyed market share increases, minimarket also <strong>experience</strong>d<br />

an increase in its market share in <strong>the</strong> same year, from 3.4% in 2000 <strong>to</strong> 5.1% in <strong>2003</strong>, or in rupiah value from Rp<br />

6.2 trillion <strong>to</strong> Rp 13.6 trillion.<br />

11 B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia (“Arah B<strong>is</strong>n<strong>is</strong> & Politik”), December <strong>2003</strong>.<br />

12 See footnote 5.<br />

13 B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia, 20-8-2004.<br />

14 .See footnote 6.<br />

8

Table 3: Total revenues of traditional and modern <strong>retail</strong> outlets in <strong>In</strong>donesia (Rp trillion)<br />

2000 2001 2002 <strong>2003</strong><br />

Hyper-/supermarket 30.5 46.3 48.8 56.1<br />

Minimarket 6.2 10.4 11.8 13.6<br />

Traditional market 145.5 169.2 181.1 196.3<br />

Total 182.2 226.0 241.8 266.0<br />

Source: Henri Ma’ruf (2005).<br />

As compar<strong>is</strong>on, based on estimation of a research institute in Jakarta, by <strong>the</strong> end of 2001, <strong>to</strong>tal consumption<br />

expenditure in modern <strong>retail</strong> outlets was about Rp36.7 trillion. According <strong>to</strong> th<strong>is</strong> institute, modern <strong>retail</strong> in <strong>the</strong><br />

country will increase by around 23%-26% per year in 2005. 15<br />

Traditional <strong>retail</strong>, on <strong>the</strong> o<strong>the</strong>r hand, in <strong>the</strong> form of warung, shop and market, <strong>experience</strong>d a decline in its<br />

share during <strong>the</strong> same year from 79.8% <strong>to</strong> 73.8%, although in term of rupiah value, its revenue increased from<br />

Rp 145.5 trillion <strong>to</strong> Rp 196.3%.<br />

<strong>In</strong> overall, Table 3 shows that during that period <strong>the</strong> <strong>to</strong>tal growth of revenues of hyper-/supermarket and<br />

minimarket <strong>is</strong> much higher than that of traditional market, i.e. 83.9% and 119.4%, respectively, versus 34.9%.<br />

Although, <strong>to</strong>tal annual revenue of traditional <strong>retail</strong> <strong>is</strong> still higher<br />

16<br />

Fur<strong>the</strong>r, and more interestingly, based on AC Nielsen data, <strong>the</strong> next two figures, Charts 4 and 5 indicate<br />

that Jakarta <strong>is</strong> <strong>the</strong> region where <strong>the</strong> modern <strong>retail</strong>ers enjoyed <strong>the</strong> highest share in <strong>to</strong>tal national <strong>retail</strong> trade and in<br />

growth. Th<strong>is</strong> does not come as a surpr<strong>is</strong>e since <strong>the</strong> country’s wealth <strong>is</strong> concentrated in th<strong>is</strong> capital. Moreover,<br />

modern <strong>retail</strong>’s consumers in Jakarta are not only <strong>the</strong> city’s residents but also from <strong>the</strong> city’s surrounding<br />

growing d<strong>is</strong>tricts like Bogor, Tangerang, Bekasi and Depok.<br />

Chart 4. Share of Modern Retail in Total Sale by Region, May 2002-April <strong>2003</strong><br />

20<br />

18<br />

16<br />

14<br />

12<br />

%<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Jakarta<br />

North Sumatra<br />

Central Java<br />

South Sulawesi<br />

East Java<br />

West Java<br />

O<strong>the</strong>r provinces<br />

National<br />

Source: AC Nielsen<br />

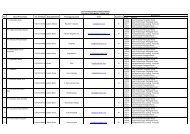

According <strong>to</strong> Rangkuti (2004) (see footnote 10), about 1.7 million traditional markets ex<strong>is</strong>t in <strong>In</strong>donesia,<br />

accounting for 73% of <strong>to</strong>tal d<strong>is</strong>tribution. Growth in <strong>the</strong> traditional sec<strong>to</strong>r <strong>is</strong> 5% per year, compared <strong>to</strong> 16%<br />

growth in <strong>the</strong> modern <strong>retail</strong> market. Although <strong>the</strong> traditional sec<strong>to</strong>r still dominates <strong>the</strong> <strong>retail</strong> food business,<br />

<strong>In</strong>donesia’s <strong>retail</strong> <strong>industry</strong> continues <strong>to</strong> evolve away from <strong>the</strong> traditional market and modest kiosk network <strong>to</strong><br />

modern hypermarkets and supers<strong>to</strong>res. The number of modern <strong>retail</strong> outlets (supermarkets, warehouse clubs,<br />

15 B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia, 13-11-2001.<br />

16<br />

B<strong>is</strong>n<strong>is</strong> <strong>In</strong>donesia, 14-8-<strong>2003</strong>.<br />

9

hypermarkets, wholesale, convenience s<strong>to</strong>res, etc.) increased about 36%, 19.5%, 148.3%, and 64.7% from<br />

1999-<strong>2003</strong>. Th<strong>is</strong> growth occurred at a time when many o<strong>the</strong>r segments of <strong>In</strong>donesia’s broader economy were<br />

stagnating. Big <strong>retail</strong>ers continue <strong>to</strong> expand and competition among <strong>the</strong> major <strong>retail</strong>ers remains fierce (Table 4).<br />

Table 5 presents a l<strong>is</strong>t of modern <strong>retail</strong>ers in <strong>In</strong>donesia by number and location.<br />

Chart 5. Percentage Growth of Modern Retail by Region, May 2002-April <strong>2003</strong><br />

30<br />

25<br />

20<br />

%<br />

15<br />

10<br />

5<br />

0<br />

Jakarta<br />

Central<br />

Java<br />

West Java East Java<br />

North<br />

Sumat ra<br />

Sout h<br />

Sumat ra<br />

O<strong>the</strong>r<br />

provinces<br />

Source: AC Nielsen<br />

Table 4. Number of <strong>retail</strong> outlets and sales 1999-<strong>2003</strong><br />

Source: Rangkuti (2004).<br />

10

Table 5. Modern Large- scale Retailers in <strong>In</strong>donesia, 2004 (November)<br />

Retailer Name & Market Type No. of outlets in 2004<br />

(November)<br />

Locations<br />

Alfa-supermarket 35 Bandung, Medan, Lampung, Surabaya,<br />

Semarang, Cirebon, Solo, Yogyakarta,<br />

Jember, Denpasar, Makassar, Malang,<br />

Jakarta, Bogor, Tangerang<br />

Alfa Grosir – wholesale 8 Jakarta, Bogor, Tangerang, Bandung,<br />

Surabaya, Semarang, Malang, Denpasar.<br />

Carrefour – hypermarket 14 Jakarta, Surabaya, Bandung, Palembang,<br />

Medan<br />

Club S<strong>to</strong>re – hypermarket 4 Jakarta, Medan<br />

Cosmo Japanese Food Center – supermarket 2 Jakarta, Medan<br />

Borma Pasar Swalayan – supermarket 12 Bandung<br />

D’Best – supermarket 4 Jakarta, Makassar<br />

Gelael – supermarket 9 Jakarta, Java, Bali, Sumatera, Sulawesi,<br />

Batam<br />

Giant – hypermarket 10 Jakarta, Tangerang, Bekasi, Cimangg<strong>is</strong>,<br />

Bandung, Surabaya<br />

Hero – supermarket 100 Jakarta, Java, Bali, Lombok, Sumatera,<br />

Kalimantan, Sulawesi, Papua Barat<br />

Hari-Hari Pasar Swalayan –supermarket 6 Jakarta<br />

<strong>In</strong>do Grosir – wholesale 6 Jakarta, Bandung, Yogyakarta, Surabaya<br />

Kem Chicks – supermarket 1 Jakarta<br />

Makro – wholesale 15 Bandung, Medan, Surabaya, Semarang,<br />

Solo, Bali, Makassar, Jakarta,<br />

Palembang, Pakanbaru.<br />

Matahari –supermarket 51 Jakarta, Java, Bali, Sumatera,<br />

Kalimantan, Sulawesi & Ambon.<br />

Market place – supermarket 2 Jakarta, Makassar<br />

Matahari – hypermarket 3 Tangerang<br />

Metro – supermarket 2 Jakarta<br />

Naga Pasar Swalayan – supermarket 7 Jakarta, Bekasi, Depok<br />

Nina Fair Price – supermarket 5 Surabaya<br />

Papaya – supermarket 3 Surabaya, Jakarta<br />

Ramayana – supermarket 75 Jakarta, Java, Bali, Batam, Sumatera,<br />

Kalimantan, Sulawesi, Nusa Tenggara<br />

Timur<br />

99 Ranch Market – supermarket 3 Jakarta<br />

Setiabudhi – supermarket 1 Bandung<br />

Sinar – supermarket 5 Surabaya<br />

Sogo – supermarket 5 Jakarta, Surabaya<br />

Super <strong>In</strong>do – supermarket 42 Jakarta, Bogor, Tangerang, Banten,<br />

Bekasi, Bandung, Surabaya, Palembang,<br />

Yogyakarta<br />

Tiara Dewata – supermarket 4 Bali<br />

Tragia – supermarket 5 Bali<br />

Yogya – supermarket 43 Jakarta, West Java<br />

Caswell’s Mom’s – specialty s<strong>to</strong>re 2 Jakarta, Bali<br />

Dijon food specialities – specialty s<strong>to</strong>re 1 Bali<br />

Gourmet Garage – specialty s<strong>to</strong>re 1 Bali<br />

Bali Deli – specialty s<strong>to</strong>re 1 Bali<br />

Pepi<strong>to</strong> supermarket – supermarket/specialty s<strong>to</strong>re 1 Bali<br />

Source: see Table 4.<br />

Mini-markets are also rapidly growing in popularity (Table 6). Th<strong>is</strong> <strong>is</strong> especially true in <strong>the</strong> cities outside of<br />

Jakarta. Mini-markets are essentially upgraded traditional "mom and pop" s<strong>to</strong>res. They carry essential staple<br />

goods, some frozen items, and fresh fruits. Low price <strong>is</strong> one of <strong>the</strong>ir selling points. Many mini-markets are<br />

located in housing estates and residential areas. Most chains of mini-markets have <strong>the</strong>ir own d<strong>is</strong>tribution<br />

11

facilities. Central purchasing takes place from importers or d<strong>is</strong>tribu<strong>to</strong>rs and items are delivered <strong>to</strong> a central<br />

warehouse or directly <strong>to</strong> s<strong>to</strong>res.<br />

Table 6. Modern Mini/Small-scale Retailers in <strong>In</strong>donesia, 2004 (November)<br />

Source: see Table 4.<br />

The presence of <strong>the</strong> modern <strong>retail</strong>ers, however, often violate Law No. 2/2002 <strong>is</strong>sued by <strong>the</strong> Jakarta<br />

admin<strong>is</strong>tration on private markets in <strong>the</strong> city, which regulates pricing policies, a minimum d<strong>is</strong>tance from<br />

traditional markets and cooperation with informal businesses. According <strong>to</strong> APRINDO, just as <strong>the</strong>y have done<br />

in <strong>the</strong> developed world, large-scale modern <strong>retail</strong>ers such as hypermarkets, which are taking over <strong>the</strong> <strong>to</strong>p end of<br />

<strong>the</strong> <strong>retail</strong> trade, with larger d<strong>is</strong>counts and prom<strong>is</strong>es of a one-s<strong>to</strong>p shopping <strong>experience</strong> <strong>to</strong> mushroom in major<br />

cities, are causing severe d<strong>is</strong>locations in <strong>the</strong> rest of <strong>In</strong>donesia's food chain, from smaller supermarkets down <strong>to</strong><br />

wet markets <strong>to</strong> <strong>the</strong> warungs where housewives sell cigarettes and candy out of <strong>the</strong>ir living room windows.<br />

Certainly, <strong>the</strong> hypermarkets are growing fast. They have become Asia's new hobbyhorse, self-service <strong>retail</strong><br />

outlets so big that with as much as 50,000 square feet under a single roof <strong>the</strong>y look like warehouses on <strong>the</strong><br />

outside. On <strong>the</strong> inside, <strong>the</strong>y sell everything from steaks <strong>to</strong> sandals, telev<strong>is</strong>ions <strong>to</strong> <strong>to</strong>othpicks, garden <strong>to</strong>ols <strong>to</strong><br />

sports equipment. It <strong>is</strong> estimated that hypermarkets will control close <strong>to</strong> 38.5 percent of <strong>the</strong> <strong>retail</strong> market space<br />

in <strong>the</strong> country by 2005 while supermarkets and department s<strong>to</strong>res are expected <strong>to</strong> contract <strong>to</strong> 29.6% from<br />

32.9%, Mini-markets are expected <strong>to</strong> expand <strong>to</strong> 4.7% from 4.2% as consumers use <strong>the</strong>m as pantries for day-<strong>to</strong>day<br />

incidental shopping.<br />

<strong>In</strong>donesia's <strong>In</strong>vestment and Banking Research Agency says 11 foreign big <strong>retail</strong>ers have <strong>set</strong> up operations in<br />

<strong>In</strong>donesia since 1998, with <strong>to</strong>tal <strong>retail</strong> outlets increasing from 780 outlets in 1998 <strong>to</strong> around 1400 outlets in<br />

2002. <strong>In</strong> fewer than five years Carrefour has opened 11 s<strong>to</strong>res, especially in Jakarta. Giant has so far establ<strong>is</strong>hed<br />

two outlets in while local incumbents like Alfa, Goro and Makro plan <strong>to</strong> double <strong>the</strong>ir presence in <strong>In</strong>donesia<br />

before 2007. PT Hero Supermarket Tbk, also <strong>the</strong> owner of Giant and Guardian Pharmacy and considered <strong>the</strong><br />

12

country's largest food and beverage <strong>retail</strong>er, intends <strong>to</strong> acquire Tops super market chain, with 22 outlets, for<br />

Rp111 billion (US$13.5 million) making it one of largest midsized chains, with 111 outlets throughout<br />

<strong>In</strong>donesia.<br />

The small and medium businesses, especially <strong>the</strong> traditional ones that have been dwarfed by hypermarkets<br />

and midsized chains like Hero and Alfa are worried about <strong>the</strong> growing competition <strong>the</strong>y face. <strong>In</strong> responding <strong>to</strong><br />

th<strong>is</strong> development, APRINDO has been pressing <strong>the</strong> government <strong>to</strong> impose a zoning law <strong>to</strong> regulate <strong>the</strong> number<br />

of both foreign and domestic <strong>retail</strong>ers running similar businesses in <strong>the</strong> same area, so <strong>to</strong> prevent overcrowding<br />

an already saturated marketplace. The association complains not only about major groups but also o<strong>the</strong>rs such<br />

as <strong>In</strong>domaret and Super <strong>In</strong>do. <strong>In</strong>domaret has 650 outlets around <strong>the</strong> country and Super <strong>In</strong>do has almost 60<br />

outlets in Jakarta and o<strong>the</strong>r cities such as Bandung, Yogyakarta, Surabaya and Palembang. Also, <strong>the</strong> National<br />

Committee for Healthy Competition (KPPU) has prevented <strong>the</strong> <strong>In</strong>domart chain from establ<strong>is</strong>hing new outlets<br />

near smaller independent <strong>retail</strong> players called 'warungs.'<br />

While <strong>the</strong> zoning laws are yet <strong>to</strong> be implemented, <strong>the</strong>re has already been a fair amount critic<strong>is</strong>m as <strong>to</strong> how<br />

<strong>the</strong> government would implement a fair zoning system similar <strong>to</strong> Europe's, which has a business zone system<br />

that was imposed several years ago after small traders and mom-and-pop shops complained about unfair<br />

practices of giant hypermarkets in <strong>the</strong>ir location. It becomes even more complicated when <strong>In</strong>donesia <strong>is</strong> supposed<br />

<strong>to</strong> follow in <strong>the</strong> tracks of <strong>the</strong> ASEAN Free Trade Agreement (AFTA) that <strong>is</strong> supposed <strong>to</strong> open up <strong>the</strong> local<br />

protected <strong>retail</strong> markets <strong>to</strong> foreign competition. Finding that balance between foreign investments and local<br />

interests <strong>is</strong> a difficult proposition for <strong>the</strong> government.<br />

Prospect for <strong>the</strong> future<br />

Growth of large <strong>retail</strong>ers such as supermarkets and hypermarkets, in <strong>In</strong>donesia <strong>is</strong> expected <strong>to</strong> continue. The<br />

number of mini-markets and o<strong>the</strong>r small s<strong>to</strong>res <strong>is</strong> also predicted <strong>to</strong> grow. The greatest expansion <strong>is</strong> anticipated<br />

on <strong>the</strong> <strong>is</strong>lands of Java and Bali. More mini-markets are expected <strong>to</strong> open in residential areas and cities outside of<br />

Jakarta. Th<strong>is</strong> growth of modern <strong>retail</strong>ers <strong>is</strong> being driven mostly by strong domestic consumption, which remains<br />

one of <strong>the</strong> only engines of overall economic growth in <strong>In</strong>donesia up <strong>to</strong> know. <strong>In</strong> <strong>In</strong>donesia, as elsewhere, <strong>the</strong><br />

growth of modern <strong>retail</strong> such as hypermarkets and supermarkets can be related <strong>to</strong> increased demand for <strong>the</strong><br />

services <strong>the</strong>y can provide, resulting from 17 :<br />

- rapid urbanization;<br />

- per capita income growth and <strong>the</strong> growth of a “middle class”;<br />

- increasing employment of women, with a consequent increase in <strong>the</strong> opportunity cost of <strong>the</strong>ir time.<br />

Families are said <strong>to</strong> be “cash rich, time poor” and th<strong>is</strong> has led <strong>to</strong> a demand for meals that are<br />

easier <strong>to</strong> prepare and for <strong>retail</strong> outlets that offer a wider range of prepared products. Th<strong>is</strong> trend has<br />

been enhanced by <strong>the</strong> development of new products that meet <strong>the</strong> needs of th<strong>is</strong> new market;<br />

- “westernization” of lifestyles, particularly among younger people;<br />

- demographic trends, with an increasing proportion of young people;<br />

17 Andrew W. Shepherd (2005), “The implications of supermarket development for horticultural farmers and traditional marketing<br />

systems in Asia”, Agricultural Management, Marketing and Finance Service FAO, Rome<br />

13

- growing use of credit cards, which in developing countries are rarely accepted by corner shops or<br />

traditional wet markets;<br />

- changes in family structure with (especially in Asia) a growing proportion of nuclear families and,<br />

even, one-person households, as opposed <strong>to</strong> extended families;<br />

- reduction of effective food prices for consumers because of supermarkets’ greater ability <strong>to</strong><br />

control costs through economies of scale, improved log<strong>is</strong>tics, etc. Th<strong>is</strong> may not, however, always apply<br />

<strong>to</strong> fresh produce;<br />

- growing access <strong>to</strong> refrigera<strong>to</strong>rs, allowing larger quantities of food <strong>to</strong> be s<strong>to</strong>red, and <strong>to</strong> cars, allowing<br />

shopping <strong>to</strong> be done away from <strong>the</strong> immediate vicinity of <strong>the</strong> home and for larger quantities <strong>to</strong> be<br />

purchased at any one time;<br />

- increased travel, exposing people in o<strong>the</strong>r regions <strong>to</strong> modern <strong>retail</strong>ing techniques in <strong>the</strong> USA and<br />

parts of Europe, <strong>to</strong> a wider range of products and, particularly for fresh fruits and vegetables, <strong>to</strong> <strong>the</strong><br />

possibility of being able <strong>to</strong> consume many products “out of season”.<br />

However, in <strong>In</strong>donesia as in o<strong>the</strong>r Asian countries most households continue <strong>to</strong> use traditional <strong>retail</strong>ers<br />

for fruits and vegetables even though <strong>the</strong>y may use supermarkets for o<strong>the</strong>r products. There remains <strong>the</strong><br />

perception, and possibly <strong>the</strong> reality, that wet market supplies are fresher and often cheaper. Unless a<br />

consumer happens <strong>to</strong> live close <strong>to</strong> a supermarket, traditional markets are also more convenient for consumers<br />

accus<strong>to</strong>med <strong>to</strong> walking <strong>to</strong> make daily purchases of fruits and vegetables. Thus, <strong>the</strong> traditional <strong>retail</strong> sec<strong>to</strong>r in<br />

<strong>In</strong>donesia will continue <strong>to</strong> dominate <strong>In</strong>donesian food <strong>retail</strong>ing.<br />

Modern <strong>retail</strong> such as hypermarkets and supermarkets often lack a sufficient range of horticultural produce<br />

<strong>to</strong> encourage consumers <strong>to</strong> switch from wet markets, particularly outside of <strong>the</strong> major cities. Never<strong>the</strong>less, <strong>the</strong>y<br />

continue <strong>to</strong> make inroads because of <strong>the</strong>ir competitive prices, more reliable, if not better, quality and <strong>the</strong><br />

fact that <strong>the</strong>y offer “one-s<strong>to</strong>p” shopping.<br />

<strong>In</strong> th<strong>is</strong> new millennium, some trends have been emerged and some new trends will soon emerge that all will<br />

certainly affect <strong>the</strong> <strong>retail</strong> sec<strong>to</strong>r in <strong>In</strong>donesia. They include:<br />

- wave of entrance of foreign <strong>retail</strong>ers, especially in large sized and very modern outlets;<br />

- evolution in new forms of <strong>retail</strong>, e.g. e-<strong>retail</strong>ing;<br />

- more families with double income as both husband and wife work;<br />

- growth of satellite cities surrounding big cities;<br />

- increasing mobility and declining le<strong>is</strong>ure time;<br />

- house-keeper becomes more expensive;<br />

- growth in <strong>the</strong> use of household PC and more use of internet;<br />

- progress in technology and increase in <strong>the</strong> use of Handphone-PDA.<br />

14

Appendix<br />

Hero 18<br />

<strong>In</strong>donesia's largest supermarket chain PT Hero Supermarket plans <strong>to</strong> open three hypermarkets on <strong>the</strong><br />

outskirts of Jakarta th<strong>is</strong> year <strong>to</strong> stem a steady drop in <strong>the</strong> chain's market share against very strong competition<br />

from foreign <strong>retail</strong>ers. Founded in 1971, PT HERO SUPERMARKET, a publicly l<strong>is</strong>ted company on <strong>the</strong> Jakarta<br />

S<strong>to</strong>ck Exchange, continues its unprecedented expansion and growth as <strong>In</strong>donesia's pre-eminent food <strong>retail</strong>er.<br />

HERO supermarkets have cons<strong>is</strong>tently out-performed <strong>the</strong> rapidly expanding <strong>In</strong>donesian market,and <strong>the</strong><br />

company has remained <strong>the</strong> <strong>industry</strong> leader since <strong>the</strong> early-1980's,with a current domestic share of over 40%.<br />

Hero already covers Jakarta and o<strong>the</strong>r major centers of population in <strong>the</strong> regions with its 90 supermarkets, 25<br />

convenience s<strong>to</strong>res, and 38 pharmacies. The supermarkets bring in some 90% of sales revenue from a wide<br />

range of fresh food, groceries, and electronic goods. <strong>In</strong> <strong>the</strong> first nine months of 2002 sales rose 19% <strong>to</strong> Rp667<br />

trillion (about US$74.8 billion) but soaring costs, particularly after a 15% hike in electricity prices, have taken<br />

<strong>the</strong>ir <strong>to</strong>ll.<br />

Carrefour 19<br />

France's Carrefour, <strong>the</strong> world's second-largest <strong>retail</strong>er, <strong>is</strong> active in eight countries in Asia, including China,<br />

where it <strong>is</strong> ranked as <strong>the</strong> leading foreign d<strong>is</strong>tribu<strong>to</strong>r. The favoured s<strong>to</strong>re format <strong>is</strong> <strong>the</strong> hypermarket. Total<br />

Carrefour outlets in Asia was 112 and increased <strong>to</strong> 127 in 2002 (see table below). <strong>In</strong> <strong>2003</strong> Carrefour opened its<br />

first d<strong>is</strong>count s<strong>to</strong>res under <strong>the</strong> Dia fascia in China followed by supermarkets in 2004.<br />

Carrefour <strong>to</strong>ok <strong>the</strong> plunge and entered <strong>In</strong>donesia at <strong>the</strong> height of <strong>the</strong> 1997/98 economic cr<strong>is</strong><strong>is</strong>. Carrefour<br />

opened its first two outlets when, in June 1998, <strong>the</strong> <strong>In</strong>donesian government eliminated many restrictions on<br />

foreign <strong>retail</strong> operations. It was closely followed by ano<strong>the</strong>r giant French player, Continent, with three outlets.<br />

When <strong>the</strong> French parent companies merged in a $16.5 billion deal under <strong>the</strong> name Carrefour, Continent s<strong>to</strong>res<br />

d<strong>is</strong>appeared, leaving five Carrefour outlets. After <strong>the</strong> merger, <strong>the</strong> number of Carrefour's outlets in Jakarta has<br />

now increased <strong>to</strong> seven, with approximately 3,500 employees, or about 400-450 employees per outlet.<br />

Number of Carrefour Hypermarket Outlets in Asian Countries, 2001-2002<br />

Country<br />

Period<br />

2001 2002<br />

Taiwan<br />

China<br />

Japan<br />

Korea<br />

Thailand<br />

Malaysia<br />

<strong>In</strong>donesia<br />

Singapore<br />

Hong Kong<br />

26<br />

27<br />

3<br />

22<br />

15<br />

6<br />

8<br />

1<br />

4<br />

28<br />

32<br />

4<br />

25<br />

17<br />

6<br />

10<br />

1<br />

4<br />

Asia Total<br />

Source: Carrefour.<br />

112<br />

127<br />

18 APRINDO.<br />

19 Carrefour: Company profile (Publ<strong>is</strong>hed May <strong>2003</strong>), Seneca House, Buntsford Hill Business Park, Bromsgrove, Worcs, B60 3DX,<br />

UK<br />

15

Makro<br />

Makro Asia arrived on <strong>the</strong> scene in <strong>In</strong>donesia in 1991 under a management-cooperation agreement with SHV<br />

Holdings in <strong>the</strong> Ne<strong>the</strong>rlands. The first outlet opened in Jakarta in September 1992 and in <strong>the</strong> next four years<br />

nine s<strong>to</strong>res were opened. During <strong>the</strong> 1998 riots Makro lost one s<strong>to</strong>re but that has been reopened and <strong>the</strong>y have<br />

since have opened three more s<strong>to</strong>res: in Semarang, Surabaya and Medan. The company opened its first outlet 30<br />

years ago in 1972 and went public once <strong>the</strong>y owned 24 supermarkets. Hero used <strong>the</strong> money <strong>to</strong> pay back bank<br />

loans and launch an aggressive campaign of expansion but only with supermarkets. Last year Hero opened its<br />

first ever hypermarkets - one outside Surabaya, <strong>In</strong>donesia's second-largest city, and ano<strong>the</strong>r outside Jakarta.<br />

Makro <strong>is</strong> also expanding, with about two or three new outlets a year. Its president direc<strong>to</strong>r, Simon Collins,<br />

said that from <strong>the</strong> very beginning, <strong>the</strong> aim has been <strong>to</strong> join forces and grow <strong>to</strong>ge<strong>the</strong>r with <strong>In</strong>donesia's small-<strong>to</strong>medium-scale<br />

businesses.<br />

Makro has many domestic small and medium-sized businesses as its suppliers though Hero has for long been<br />

using th<strong>is</strong> style of win-win alliance <strong>to</strong> cut down on d<strong>is</strong>tribution and networking costs, particularly with fresh<br />

produce.<br />

Tesco<br />

Tesco (UK) <strong>is</strong> rumored <strong>to</strong> be ready <strong>to</strong> move in<strong>to</strong> <strong>In</strong>donesia, Starmart, a convenience s<strong>to</strong>re chain, have 38<br />

s<strong>to</strong>res in prime locations within Greater Jakarta and Giant (US) has already opened a hypermarket in Jakarta.<br />

The latter group has been highly successful in Malaysia and Singapore.<br />

16