Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES FORMING PART OF THE<br />

FINANCIAL STATEMENTS<br />

<strong>Grasim</strong> Industries Limited - <strong>Annual</strong> Report <strong>2012</strong>-<strong>2013</strong><br />

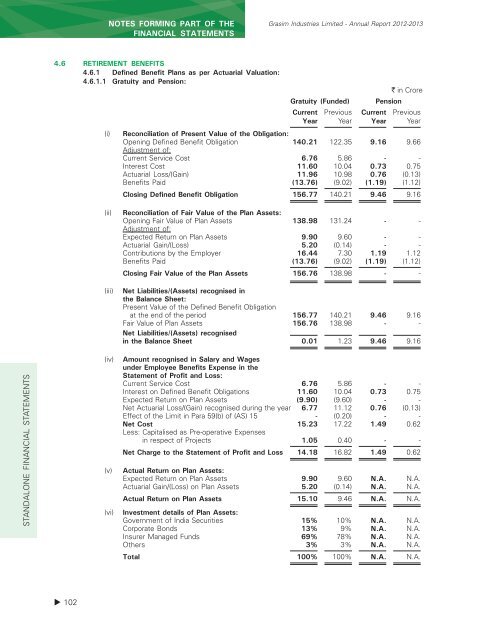

4.6 RETIREMENT BENEFITS<br />

4.6.1 Defined Benefit Plans as per Actuarial Valuation:<br />

4.6.1.1 Gratuity and Pension:<br />

(i)<br />

` in Crore<br />

Gratuity (Funded) Pension<br />

Current Previous Current Previous<br />

Year Year Year Year<br />

Reconciliation of Present Value of the Obligation:<br />

Opening Defined Benefit Obligation 140.21 122.35 9.16 9.66<br />

Adjustment of:<br />

Current Service Cost 6.76 5.86 - -<br />

Interest Cost 11.60 10.04 0.73 0.75<br />

Actuarial Loss/(Gain) 11.96 10.98 0.76 (0.13)<br />

Benefits Paid (13.76) (9.02) (1.19) (1.12)<br />

Closing Defined Benefit Obligation 156.77 140.21 9.46 9.16<br />

(ii)<br />

(iii)<br />

Reconciliation of Fair Value of the Plan Assets:<br />

Opening Fair Value of Plan Assets 138.98 131.24 - -<br />

Adjustment of:<br />

Expected Return on Plan Assets 9.90 9.60 - -<br />

Actuarial Gain/(Loss) 5.20 (0.14) - -<br />

Contributions by the Employer 16.44 7.30 1.19 1.12<br />

Benefits Paid (13.76) (9.02) (1.19) (1.12)<br />

Closing Fair Value of the Plan Assets 156.76 138.98 - -<br />

Net Liabilities/(Assets) recognised in<br />

the Balance Sheet:<br />

Present Value of the Defined Benefit Obligation<br />

at the end of the period 156.77 140.21 9.46 9.16<br />

Fair Value of Plan Assets 156.76 138.98 - -<br />

Net Liabilities/(Assets) recognised<br />

in the Balance Sheet 0.01 1.23 9.46 9.16<br />

STANDALONE FINANCIAL STATEMENTS<br />

(iv)<br />

(v)<br />

(vi)<br />

Amount recognised in Salary and Wages<br />

under Employee Benefits Expense in the<br />

Statement of Profit and Loss:<br />

Current Service Cost 6.76 5.86 - -<br />

Interest on Defined Benefit Obligations 11.60 10.04 0.73 0.75<br />

Expected Return on Plan Assets (9.90) (9.60) - -<br />

Net Actuarial Loss/(Gain) recognised during the year 6.77 11.12 0.76 (0.13)<br />

Effect of the Limit in Para 59(b) of (AS) 15 - (0.20) - -<br />

Net Cost 15.23 17.22 1.49 0.62<br />

Less: Capitalised as Pre-operative Expenses<br />

Less: in respect of Projects 1.05 0.40 - -<br />

Net Charge to the Statement of Profit and Loss 14.18 16.82 1.49 0.62<br />

Actual Return on Plan Assets:<br />

Expected Return on Plan Assets 9.90 9.60 N.A. N.A.<br />

Actuarial Gain/(Loss) on Plan Assets 5.20 (0.14) N.A. N.A.<br />

Actual Return on Plan Assets 15.10 9.46 N.A. N.A.<br />

Investment details of Plan Assets:<br />

Government of India Securities 15% 10% N.A. N.A.<br />

Corporate Bonds 13% 9% N.A. N.A.<br />

Insurer Managed Funds 69% 78% N.A. N.A.<br />

Others 3% 3% N.A. N.A.<br />

Total 100% 100% N.A. N.A.<br />

102