Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT DISCUSSION AND ANALYSIS<br />

<strong>Grasim</strong> Industries Limited - <strong>Annual</strong> Report <strong>2012</strong>-<strong>2013</strong><br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

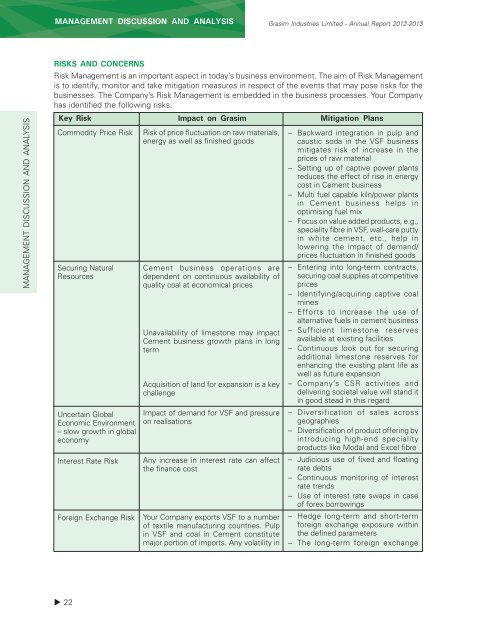

RISKS AND CONCERNS<br />

Risk Management is an important aspect in today’s business environment. The aim of Risk Management<br />

is to identify, monitor and take mitigation measures in respect of the events that may pose risks for the<br />

businesses. The Company’s Risk Management is embedded in the business processes. Your Company<br />

has identified the following risks:<br />

Key Risk Impact on <strong>Grasim</strong> Mitigation Plans<br />

Commodity Price Risk<br />

Securing Natural<br />

Resources<br />

Uncertain Global<br />

Economic Environment<br />

– slow growth in global<br />

economy<br />

Interest Rate Risk<br />

Foreign Exchange Risk<br />

Risk of price fluctuation on raw materials,<br />

energy as well as finished goods<br />

Cement business operations are<br />

dependent on continuous availability of<br />

quality coal at economical prices<br />

Unavailability of limestone may impact<br />

Cement business growth plans in long<br />

term<br />

Acquisition of land for expansion is a key<br />

challenge<br />

Impact of demand for VSF and pressure<br />

on realisations<br />

Any increase in interest rate can affect<br />

the finance cost<br />

Your Company exports VSF to a number<br />

of textile manufacturing countries. Pulp<br />

in VSF and coal in Cement constitute<br />

major portion of imports. Any volatility in<br />

– Backward integration in pulp and<br />

caustic soda in the VSF business<br />

mitigates risk of increase in the<br />

prices of raw material<br />

– Setting up of captive power plants<br />

reduces the effect of rise in energy<br />

cost in Cement business<br />

– Multi fuel capable kiln/power plants<br />

in Cement business helps in<br />

optimising fuel mix<br />

– Focus on value added products, e.g.,<br />

speciality fibre in VSF, wall-care putty<br />

in white cement, etc., help in<br />

lowering the impact of demand/<br />

prices fluctuation in finished goods<br />

– Entering into long-term contracts,<br />

securing coal supplies at competitive<br />

prices<br />

– Identifying/acquiring captive coal<br />

mines<br />

– Efforts to increase the use of<br />

alternative fuels in cement business<br />

– Sufficient limestone reserves<br />

available at existing facilities<br />

– Continuous look out for securing<br />

additional limestone reserves for<br />

enhancing the existing plant life as<br />

well as future expansion<br />

– Company’s CSR activities and<br />

delivering societal value will stand it<br />

in good stead in this regard<br />

– Diversification of sales across<br />

geographies<br />

– Diversification of product offering by<br />

introducing high-end speciality<br />

products like Modal and Excel fibre<br />

– Judicious use of fixed and floating<br />

rate debts<br />

– Continuous monitoring of interest<br />

rate trends<br />

– Use of interest rate swaps in case<br />

of forex borrowings<br />

– Hedge long-term and short-term<br />

foreign exchange exposure within<br />

the defined parameters<br />

– The long-term foreign exchange<br />

22