Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

Annual report 2012-2013 - Grasim

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MANAGEMENT DISCUSSION AND ANALYSIS<br />

<strong>Grasim</strong> Industries Limited - <strong>Annual</strong> Report <strong>2012</strong>-<strong>2013</strong><br />

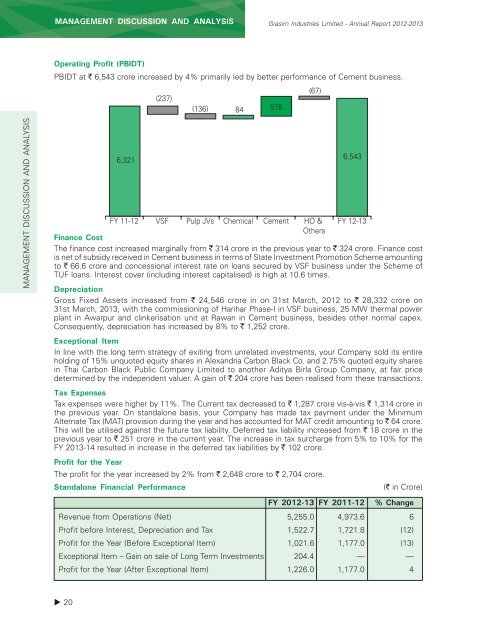

Operating Profit (PBIDT)<br />

PBIDT at ` 6,543 crore increased by 4% primarily led by better performance of Cement business.<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Finance Cost<br />

The finance cost increased marginally from ` 314 crore in the previous year to ` 324 crore. Finance cost<br />

is net of subsidy received in Cement business in terms of State Investment Promotion Scheme amounting<br />

to ` 66.6 crore and concessional interest rate on loans secured by VSF business under the Scheme of<br />

TUF loans. Interest cover (including interest capitalised) is high at 10.6 times.<br />

Depreciation<br />

Gross Fixed Assets increased from ` 24,546 crore in on 31st March, <strong>2012</strong> to ` 28,332 crore on<br />

31st March, <strong>2013</strong>, with the commissioning of Harihar Phase-I in VSF business, 25 MW thermal power<br />

plant in Awarpur and clinkerisation unit at Rawan in Cement business, besides other normal capex.<br />

Consequently, depreciation has increased by 8% to ` 1,252 crore.<br />

Exceptional Item<br />

In line with the long term strategy of exiting from unrelated investments, your Company sold its entire<br />

holding of 15% unquoted equity shares in Alexandria Carbon Black Co. and 2.75% quoted equity shares<br />

in Thai Carbon Black Public Company Limited to another Aditya Birla Group Company, at fair price<br />

determined by the independent valuer. A gain of ` 204 crore has been realised from these transactions.<br />

Tax Expenses<br />

Tax expenses were higher by 11%. The Current tax decreased to ` 1,287 crore vis-à-vis ` 1,314 crore in<br />

the previous year. On standalone basis, your Company has made tax payment under the Minimum<br />

Alternate Tax (MAT) provision during the year and has accounted for MAT credit amounting to ` 64 crore.<br />

This will be utilised against the future tax liability. Deferred tax liability increased from ` 18 crore in the<br />

previous year to ` 251 crore in the current year. The increase in tax surcharge from 5% to 10% for the<br />

FY <strong>2013</strong>-14 resulted in increase in the deferred tax liabilities by ` 102 crore.<br />

Profit for the Year<br />

The profit for the year increased by 2% from ` 2,648 crore to ` 2,704 crore.<br />

Standalone Financial Performance<br />

(` in Crore)<br />

FY <strong>2012</strong>-13 FY 2011-12 % Change<br />

Revenue from Operations (Net) 5,255.0 4,973.6 6<br />

Profit before Interest, Depreciation and Tax 1,522.7 1,721.8 (12)<br />

Profit for the Year (Before Exceptional Item) 1,021.6 1,177.0 (13)<br />

Exceptional Item – Gain on sale of Long Term Investments 204.4 — —<br />

Profit for the Year (After Exceptional Item) 1,226.0 1,177.0 4<br />

20