HSBC Brazil Sustainability Report 2011

HSBC Brazil Sustainability Report 2011

HSBC Brazil Sustainability Report 2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>HSBC</strong> <strong>Brazil</strong><br />

<strong>Sustainability</strong><br />

<strong>Report</strong> <strong>2011</strong><br />

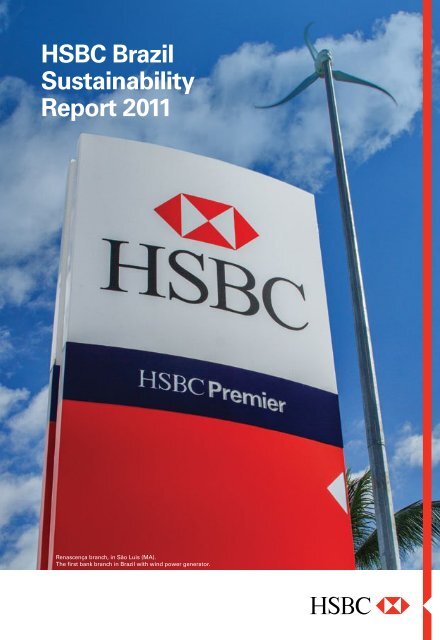

Renascença branch, in São Luis (MA).<br />

The first bank branch in <strong>Brazil</strong> with wind power generator.

Summary<br />

The mission of the<br />

sustainability area<br />

Message<br />

03 Message<br />

04 About the <strong>Report</strong><br />

08 <strong>Sustainability</strong> vision<br />

11 <strong>HSBC</strong> at a glance<br />

12 Performance in <strong>2011</strong><br />

12 Awards<br />

14 Corporate Governance<br />

17 Values and Principles<br />

18 Risk Management<br />

18 Commitments<br />

20 Economic Development<br />

22 Responsible Loan Concession<br />

26 Investments<br />

28 Financial Literacy<br />

30 Insurance<br />

32 Products<br />

36 <strong>Sustainability</strong> = People<br />

39 Employee Development<br />

42 Diversity<br />

44 Customers<br />

45 Suppliers<br />

46 Environment<br />

48 Footprint<br />

54 Sustainable Constructions<br />

58 <strong>HSBC</strong> Climate Partnership<br />

62 Instituto <strong>HSBC</strong> Solidariedade<br />

62 Message<br />

64 Community Development<br />

72 <strong>HSBC</strong> Volunteer Programme<br />

Collaborate towards<br />

the insertion of<br />

sustainability as<br />

a major practice into<br />

<strong>HSBC</strong>’s operations<br />

and businesses,<br />

adding value<br />

to customers<br />

and shareholders,<br />

and developing<br />

society at large.<br />

<strong>Sustainability</strong> is deeply embodied<br />

into <strong>HSBC</strong>’s business principles.<br />

Our role is to streamline all efforts<br />

towards strengthening our long-term<br />

operation pillars: the development of<br />

new businesses in response to future<br />

demands; management of our risks<br />

and opportunities, taking into account<br />

all socio-environmental impacts;<br />

promotion of a sustainable economy;<br />

enhancement of operational efficiency;<br />

construction of customer and employee<br />

trust in our trademark; and the practice<br />

of our values, aimed to always do<br />

the right thing. As the CEO of <strong>HSBC</strong><br />

<strong>Brazil</strong>, I have been closely following our<br />

advancements towards the attainment<br />

of our most important long-term goal:<br />

to insert environmental, social and<br />

economic impact management into<br />

the bank’s strategy and corporate<br />

governance. We all know that business<br />

should be done in the correct way.<br />

Profits should always be pursued based<br />

upon balanced business behaviours,<br />

so that society as a whole does not<br />

have to pay the price, either today or<br />

in the future. For ten years I have been<br />

an executive in <strong>HSBC</strong>. Now, at the<br />

highest position in the national structure<br />

of the company, I have the opportunity<br />

to contribute in a much more effective<br />

way to our successful trajectory. This is<br />

my commitment. <strong>HSBC</strong> has a story of<br />

over 140 years. Business perennity is<br />

the company’s most essential concern.<br />

This principle is reflected on our<br />

commitment to the sustainability of our<br />

commercial operations, management of<br />

environmental impacts, and contribution<br />

towards the development of<br />

communities where the bank operates.<br />

These core values are shared by <strong>HSBC</strong><br />

<strong>Brazil</strong>. Since the arrival of the company<br />

to the country 15 years ago, the<br />

bank’s strategies are grounded upon<br />

sustainable practices. This positioning<br />

has brought several challenges; but, at<br />

the same time, a stronger employeebased<br />

commitment. In past years, we<br />

have been steadily working towards<br />

the construction of a sustainabilityoriented<br />

internal culture. We firmly<br />

believe that people are the starting<br />

points of changes to come and<br />

results to be achieved. That’s why the<br />

qualification of our internal audience<br />

and the involvement of all areas in<br />

the discussion of sustainability are<br />

crucial actions towards unleashing<br />

new cultural perspectives. We do not<br />

want sustainability to be restricted to<br />

a group of experts within the bank. It<br />

has to be part of the commitments<br />

and decisions of all of us who work at<br />

<strong>HSBC</strong>. We triggered a process in order<br />

to get closer to our suppliers, so that<br />

they can apply for a future partnership<br />

with the bank based on socioenvironmental<br />

performance criteria.<br />

In <strong>HSBC</strong> Technology and Services<br />

area, leaders have been more and<br />

more involved in sustainability-related<br />

strategic decisions. Thanks to this<br />

commitment, we have implemented<br />

relevant employee engagement<br />

initiatives and ecoefficiency actions.<br />

One example is the considerable<br />

reduction in the use of paper in the<br />

company. In <strong>2011</strong> we re-inaugurated<br />

our new training centre. The centre<br />

has been projected and built in<br />

compliance with the world’s most<br />

rigid sustainability standards. In São<br />

Luis, Maranhão (northeast of <strong>Brazil</strong>),<br />

we launched our first sustainable<br />

branch, which counts on a wind<br />

power generator, <strong>HSBC</strong>’s first in the<br />

André Brandão, <strong>HSBC</strong> <strong>Brazil</strong> CEO.<br />

world and unheard of in <strong>Brazil</strong>ian bank<br />

branches. Initiatives such as this are<br />

milestones in the history of the bank<br />

and will serve as pilot plans for the<br />

replication of other similar projects.<br />

The greatest contribution of the facility,<br />

however, goes beyond the reduction<br />

of environmental impacts. In their<br />

everyday life, buildings like this one<br />

incorporate sustainability<br />

and consolidate the learning process<br />

of our internal audience.<br />

As a recognition to <strong>HSBC</strong><br />

works – a company that believes<br />

in sustainability and in socioenvironmental<br />

investments -,<br />

and also to all employees, who<br />

strongly act as volunteers, Instituto<br />

<strong>HSBC</strong> Solidariedade (IHS) became<br />

an associate to the United Nations<br />

Department of Public Information,<br />

being the first corporate-based NGO<br />

in the world to receive such status.<br />

This outstanding acknowledgement<br />

is a result of the Institute’s<br />

commitment to the sustainable<br />

development agenda. Now, the entity<br />

will contribute to the UN projects and<br />

objectives, mobilising society and<br />

strengthening the UN operations.<br />

The publication of this sustainability<br />

report aims to communicate,<br />

in a clear and transparent way,<br />

the accomplishments and challenges<br />

ahead. The strengthening of ties with<br />

our customers, suppliers, employees<br />

and society at large directly<br />

reverberates in the strengthening<br />

of our own operations.<br />

Have a nice reading!<br />

André Brandão,<br />

<strong>HSBC</strong> <strong>Brazil</strong> CEO<br />

2<br />

3

About the <strong>Report</strong><br />

The sustainability report is one of the<br />

major tools used by <strong>HSBC</strong> <strong>Brazil</strong> to inform<br />

stakeholders on all economic, social<br />

and environmental management initiatives<br />

inserted in the bank’s operations.<br />

The parametres adopted by the<br />

bank come from the internationally<br />

awarded multistakeholder<br />

sustainability network, the<br />

Global <strong>Report</strong>ing Initiative (GRI),<br />

headquartered in Amsterdam,<br />

the Netherlands. The company<br />

works under the premise of<br />

developing management drivers and<br />

guidelines towards the elaboration<br />

of reports on economic, social and<br />

environmental performances.<br />

One of the main principles set up<br />

by GRI in the process of outlining<br />

and defining the subjects to be<br />

taken into account in the publication<br />

is the materiality process, in which<br />

the identification of relevant issues<br />

is drawn from the perspective<br />

of the company and the perception<br />

of society about the sector and<br />

about the company’s operations.<br />

This process complies with the<br />

AA1000 standard, which is mostly<br />

grounded on the engagement<br />

of stakeholders – such as<br />

customers, employees, suppliers,<br />

and civil society. The international<br />

norm establishes account rendering<br />

principles and processes, and<br />

ensures the quality of information<br />

reporting on social, environmental<br />

and financial aspects.<br />

<strong>HSBC</strong> invited representatives<br />

of its major stakeholders for<br />

presence-based meetings that were<br />

carried out in São Paulo and Curitiba,<br />

and counted on the participation<br />

of 63 people. The different aspect<br />

of the process compared to previous<br />

years was the creation of two<br />

multistakeholder panels, instead<br />

of specific panels for specific<br />

stakeholder groups.<br />

This model allowed audiences<br />

to share opinions and identify what<br />

was really important for the business<br />

through the exchange of several<br />

different perceptions.<br />

GRI Financial Services Sector<br />

Supplement Overview, Ethos-<br />

FEBRABAN Indicators, FEBRABAN’s<br />

Green Protocol Indicators, and<br />

Equator Principles highly contributed<br />

towards the vision of society. These<br />

documents enriched the materiality<br />

matrix by presenting issues and<br />

information deemed to be relevant<br />

to the sector. The internal axle<br />

was defined based on the bank’s<br />

protocols and internal policies,<br />

such as the <strong>HSBC</strong> Group’s global<br />

guidelines, the strategic planning,<br />

the set goals aimed to improve the<br />

company’s socio-environmental<br />

performance, and the operational<br />

focuses. Here, the perceptions<br />

Illustrative image<br />

4 5

and opinions of employees<br />

who took part in the panels<br />

were reported. The matrix below<br />

graphically shows how both<br />

visions have been correlated in<br />

the materiality definition process:<br />

the vertical axle presents external<br />

opinions (society); the horizontal axle<br />

shows internal opinions (company).<br />

Converged relevant issues in each<br />

one of these axles pointed out<br />

five material issues for <strong>HSBC</strong>. The<br />

bank decided to develop two other<br />

material issues, thus amounting<br />

seven issues (see graph below).<br />

<strong>HSBC</strong> self-affirms an A level.<br />

The company reports on all<br />

Materiality Matrix<br />

performance indicators deemed to<br />

be essential by the GRI guidelines.<br />

Specific indicators to the financial<br />

sector were also made available,<br />

as part of the GRI sectorial<br />

supplement. The content has been<br />

defined by the analysis of the most<br />

relevant issues pointed out by<br />

<strong>HSBC</strong> and its major stakeholders.<br />

Material issues are recorded<br />

in a priority order and specially<br />

highlighted throughout the report,<br />

guiding the whole content of the<br />

publication. Listed issues are given<br />

more attention and are graphically<br />

identified, according to the<br />

indications in the table at right.<br />

Converged relevant<br />

issues in each one<br />

of these axles pointed<br />

out five material<br />

issues for <strong>HSBC</strong>.<br />

The bank decided<br />

to develop two other<br />

material issues,<br />

thus amounting<br />

seven issues.<br />

Learn more about<br />

the key themes that<br />

guided the construction<br />

of this report<br />

Theme<br />

Social and environmental<br />

criteria for loans<br />

Ethics and Transparency<br />

Description<br />

Specific sectorial risk policies applied by the bank towards<br />

critical segments work as a parametre for loans and<br />

determine the company’s code of conduct.<br />

<strong>HSBC</strong> is grounded on values and principles that ensure<br />

total adherence to the company’s strategy and guarantee<br />

the effective achievement of business results. These<br />

values and principles also prevent the emergence<br />

of conflicts of interest.<br />

Where to find<br />

Responsible Loan Concession<br />

Corporate Governance<br />

Values and Principles<br />

Most relevant<br />

2,50<br />

External<br />

Sectorial commitments<br />

to sustainability<br />

Sectorial initiatives consolidate the bank’s positioning<br />

regarding formerly agreed commitments. UN Global<br />

Compact, Equator Principles and Principles for<br />

Responsible Investment are listed among them.<br />

Commitments<br />

Equator Principles<br />

Responsible Investments<br />

Work Environment<br />

Managing natural<br />

resources<br />

<strong>HSBC</strong> works towards reducing the impacts of its<br />

operations and to reach ecoefficiency goals. The present<br />

publication is a roadmap to the accomplishment of such<br />

objectives and to the management of natural resources.<br />

Footprint<br />

Next steps<br />

EXTERNAL FACTORS (society)<br />

1,25<br />

0,00<br />

0,00<br />

1,25<br />

INTERNAL FACTORS (company)<br />

Internal<br />

2,50<br />

Most relevant<br />

Education for<br />

sustainability<br />

and conscientious<br />

consumption<br />

Sustainable<br />

financial products<br />

Investments in<br />

social projects<br />

Financial awareness and literacy of all stakeholders<br />

become a strategic front towards the long-term survival<br />

of the business. Priorities include aligning customers<br />

with the conscientious use of money and educating<br />

employees on sustainability practices.<br />

<strong>Sustainability</strong> is inserted into the approval workflow<br />

of each new product. The process takes into account<br />

customers’ financial literacy levels, opportunities for<br />

reducing environmental impacts, and how sustainability<br />

practices differ from other initiatives.<br />

<strong>HSBC</strong>’s positioning as a relevant socio-environmental<br />

investor is consolidated by the actions of Instituto <strong>HSBC</strong><br />

Solidariedade. Social, environmental and economic<br />

actions and projects are promoted and supported<br />

by the entity in response to the country’s demands.<br />

Financial Literacy<br />

Education for sustainability<br />

Products<br />

Instituto <strong>HSBC</strong> Solidariedade<br />

Community Development<br />

6<br />

7

<strong>Sustainability</strong><br />

Vision<br />

Fostering transformation<br />

<strong>HSBC</strong> acknowledges the relevance of minimizing<br />

socio-environmental impacts of any human<br />

activity; at the same time, the bank recognises<br />

that companies, governments and people must<br />

be responsible for the achievement of such goal.<br />

In accordance with this guideline,<br />

the bank’s actions seek to unleash<br />

cultural changes capable of<br />

encouraging its value chain to<br />

embody good practices, so that<br />

society as a whole can be positively<br />

influenced. <strong>HSBC</strong>’s sustainability<br />

strategy is connected with its<br />

values and principles. The bank<br />

makes continuous efforts towards<br />

disseminating sustainability into<br />

all operation areas, taking advantage<br />

of opportunities, awakening<br />

interest on the issue, strengthening<br />

relationships, working towards people<br />

awareness, and educating employees<br />

on the connectedness among<br />

the social, environmental and<br />

economic dimensions.<br />

The bank is also focused on<br />

the consolidation of transversal<br />

behaviours in the organisation’s<br />

structure, aiming to turn speeches<br />

into concrete actions and effectively<br />

putting the sustainability issue into<br />

practice. Attitude, value adding,<br />

transformation, innovation,<br />

and most especially, people,<br />

are the words that guide the bank<br />

in the development of its activities.<br />

As a result of this positioning,<br />

Corporate <strong>Sustainability</strong> area<br />

is no longer just a support department<br />

bound to the co-ordination of actions<br />

and execution of projects. It becomes<br />

a counselor that employs its expertise<br />

to orient, provide subsidies and also<br />

to assess whether or not proposals<br />

are aligned with <strong>HSBC</strong>’s sustainability<br />

strategy. Several achievements<br />

substantiate this guideline.<br />

The volunteer engagement<br />

of 15% of staff; the composition<br />

of sustainability Work Groups<br />

in several areas; technological<br />

efficiency projects, such as the<br />

Thin Client; the construction<br />

of the Renascença Branch; and<br />

the restoration of the Training<br />

Centre (CETRE) are clear evidences<br />

of the bank’s vanguard evolution<br />

in the sustainability path.<br />

In addition to other commitments<br />

taken on in past years - including<br />

socio-environmental risk<br />

management for consumer<br />

credit and the adoption of socioenvironmental<br />

criteria to monitor<br />

the performance of suppliers –<br />

<strong>HSBC</strong>’s sustainability strategies<br />

are also grounded on clear and<br />

transparent communication of<br />

actions and results, as well as on<br />

investments in socio-environmental<br />

and corporate volunteering projects.<br />

Based upon the responsible<br />

management of economic, social<br />

and environmental impacts, the<br />

bank operates its businesses<br />

focused on long-term success.<br />

“<strong>Sustainability</strong> must<br />

lie at the heart of any<br />

business if it is to<br />

achieve the long-term<br />

success that allows<br />

it to contribute to the<br />

economic well-being<br />

of society.”<br />

Douglas Flint,<br />

<strong>HSBC</strong> Group’s Chairman<br />

Renascença sustainable branch, in São Luis (MA).<br />

Renascença sustainable branch, in São Luis (MA).<br />

8 9

<strong>HSBC</strong>’s<br />

sustainability<br />

strategy<br />

COMMUNITY<br />

Investment in 3 focus:<br />

Education, Environment<br />

and Community<br />

Volunteer Programme:<br />

Employee engagement<br />

ECONOMIC<br />

Products and services that<br />

associate income generation to<br />

social and environmental solutions<br />

Economically viable<br />

Socially just<br />

Environmentally correct<br />

<strong>Sustainability</strong> as a<br />

business opportunity<br />

ENVIRONMETAL<br />

Direct impacts:<br />

Footprint Management<br />

(water, energy, waste, CO ²<br />

)<br />

Indirect impacts:<br />

Risk Management,<br />

Credit Assessment,<br />

Partners, Certification<br />

<strong>HSBC</strong> Triple<br />

Bottom Line<br />

<strong>HSBC</strong> at a glance<br />

Focus on business<br />

<strong>HSBC</strong> is one of the world’s largest banking<br />

and financial services organisations.<br />

<strong>HSBC</strong> is one of the largest banking<br />

and financial services conglomerates<br />

in the world. Headquartered in<br />

London, the group’s international<br />

network is comprised of around<br />

7,200 offices in over 80 countries and<br />

territories in Europe, the Asia-Pacific<br />

region, the Americas, the Middle<br />

East and Africa. With listings on<br />

the London, Hong Kong, New York,<br />

Paris and Bermuda stock exchanges,<br />

shares in <strong>HSBC</strong> Holdings are held<br />

by over 221,000 shareholders in 127<br />

countries. In <strong>Brazil</strong>, the company has<br />

been operating since 1997 and is<br />

now present in 545 municipalities,<br />

providing assistance to over<br />

5.1 million people and 450,000<br />

Palácio Avenida, <strong>HSBC</strong> <strong>Brazil</strong> headquarters and one of the Curitiba (PR) Christmas post cards.<br />

companies in all regions of the<br />

country in the following segments:<br />

retail, commerce, corporate (large<br />

companies), investment, and private<br />

bank (high net worth individual).<br />

<strong>HSBC</strong> <strong>Brazil</strong>’s Administrative Centres<br />

are located in São Paulo and Curitiba.<br />

Information related to <strong>2011</strong>.<br />

Responsible profits<br />

<strong>HSBC</strong> is in the vanguard of<br />

<strong>Brazil</strong>ian banks owning tailor-made,<br />

sustainability-based loan policies.<br />

Similar attention is given to the<br />

Asset Management area.<br />

The company counts on<br />

a sustainability rating for the<br />

assessment and classification<br />

of environmental, social and<br />

corporate governance assets.<br />

<strong>HSBC</strong>’s operations are<br />

managed through the<br />

application of several<br />

indicators.<br />

The bank counts on clear-cut<br />

tools, such as the Balanced<br />

Scorecard (BSC) and the Key<br />

Performance Indicators (KPI).<br />

These methodologies monitor the<br />

company’s goals, as well as the<br />

results of sustainability-focused<br />

actions. In order to ensure the<br />

achievement of such goals, the<br />

<strong>Sustainability</strong> Committee (more<br />

information on the Corporate<br />

Governance chapter) gathers<br />

periodically. These meetings<br />

allow <strong>HSBC</strong> to ratify the insertion<br />

of sustainability into the bank’s<br />

corporate governance.<br />

10 11

International Awards<br />

<strong>HSBC</strong> presence in <strong>Brazil</strong><br />

867 branches<br />

390 mini-branches<br />

1,059 electronic customer<br />

service units<br />

2,522 self-service facilities<br />

5,284 cash machines<br />

Deployed services<br />

Current accounts<br />

Credit and debit cards<br />

Investment funds<br />

Pension funds<br />

Insurance and retirement plans<br />

Capital markets<br />

Exchange/international<br />

transactions<br />

Payments and cash<br />

management<br />

Treasury service management<br />

Direct consumer credit and<br />

personal loan services to low<br />

income population made by<br />

Losango, a subsidiary<br />

of <strong>HSBC</strong> <strong>Brazil</strong>.<br />

Performance in <strong>2011</strong><br />

At the end of <strong>2011</strong>, <strong>HSBC</strong> <strong>Brazil</strong><br />

presented a net income of<br />

R$ 1.35 billion – a 7% increase<br />

comparing to the previous year<br />

– and now the bank stands out<br />

as the fourth major operation<br />

of the <strong>HSBC</strong> Group worldwide.<br />

This result was impaired by<br />

the reduction of a recoverable<br />

amount of R$ 107 million<br />

related to a handful of global<br />

projects. Had this reduction not<br />

been taken into account, the<br />

company’s recurrent net income<br />

would have reached R$ 1.45<br />

billion – a 15% rise compared<br />

to the bank’s result in 2010.<br />

Total assets recorded an 8%<br />

increase, rising from R$ 121.4<br />

to R$ 130.9 billion. High net<br />

worth reached R$ 9.4 billion,<br />

representing a 17% increase<br />

to the R$ 8 billion recorded in<br />

2010 and displaying a 16.2%<br />

return. Such thriving performance<br />

was mainly influenced by both<br />

the 15% expansion in the<br />

credit portfolio, with special<br />

highlight given to commercial<br />

banking, and also by the<br />

bank’s growing shares<br />

in the international market.<br />

Awards<br />

In <strong>2011</strong>, <strong>HSBC</strong>’s operations achieved<br />

several acknowledgements.<br />

Here’s a list of recognitions.<br />

National Awards<br />

Ecologia e Ambientalismo <strong>2011</strong><br />

(Ecology and Environmentalism):<br />

The award is granted by the<br />

Curitiba City Council. The local<br />

public entity acknowledged <strong>HSBC</strong>’s<br />

Green Insurance product line,<br />

eco-efficiency initiatives and <strong>HSBC</strong><br />

Climate Partnership.<br />

Época Empresa Verde<br />

(Época Green Company):<br />

This important national magazine<br />

listed the bank in the top 20 leading<br />

companies in the field<br />

of environmental policies.<br />

Expressão de Ecologia<br />

(Expressão Ecology):<br />

Expressão Publishing House<br />

granted <strong>HSBC</strong> Insurance the award<br />

in the Ecologic Marketing category,<br />

recognising the company as one of<br />

the 11 cutting-edge enterprises in<br />

the sustainable management area.<br />

Ozires Silva de<br />

Empreendedorismo<br />

Sustentável (Ozires Silva of<br />

Sustainable Entrepreneurship):<br />

The award was granted by the<br />

university Instituto Superior<br />

de Administração e Economia<br />

(ISAE/FGV), in partnership with<br />

the communication group Grupo<br />

Paranaense de Comunicação<br />

(GRPCOM). <strong>HSBC</strong> Climate<br />

Partnership received an award<br />

in the Cultural Category for<br />

its contribution to all-embracing<br />

research on climate change<br />

and cultural transformations<br />

of society.<br />

Thomson Reuters<br />

Extel Survey <strong>2011</strong>:<br />

For two years in a row (2010<br />

and <strong>2011</strong>), <strong>HSBC</strong> Global Research<br />

team was acknowledged by the<br />

survey as the most prominent<br />

integrated team on climate<br />

change and renewable<br />

energies. Also in <strong>2011</strong>, the<br />

renewable energies analyst,<br />

Nick Robins – <strong>HSBC</strong>’s Director<br />

of the Climate Change Centre<br />

of Excellence – was ranked first<br />

(second in 2010) as the most<br />

renowned professional in this<br />

field. Collected in companies<br />

and individual investors,<br />

resulting data consolidated<br />

the survey as a major reference<br />

among investment banks and<br />

asset management enterprises.<br />

The survey acknowledges advisory<br />

companies, stockbrokers and<br />

investor relations teams working<br />

with European and Asian investors.<br />

Bloomberg Markets<br />

Magazine - World’s<br />

greenest banks:<br />

<strong>HSBC</strong> Group was ranked the 7 th<br />

greenest bank in the world, based<br />

on support for low carbon energy<br />

and the bank’s own operational<br />

efficiency performance.<br />

<strong>2011</strong> Highlights<br />

The <strong>Brazil</strong>-China Chamber of<br />

Commerce deemed <strong>HSBC</strong> <strong>Brazil</strong><br />

to be the foremost institution<br />

in the promotion of business<br />

development between both<br />

nations. The bank records a 9%<br />

participation in the business flows<br />

between both countries, a 40%<br />

increase comparing with 2010.<br />

<strong>HSBC</strong> <strong>Brazil</strong> investment funds<br />

sales recorded a 163% growth<br />

rate, 86% on property finance,<br />

26% on insurance, and 26% on<br />

card receivables (credit modality).<br />

The company’s base of Premier<br />

(high income segment) customers<br />

reported a 22% increase, reaching<br />

500,000 customers in the country.<br />

Losango, <strong>HSBC</strong> <strong>Brazil</strong>’s Sales<br />

Subsidiary, was once again ranked<br />

on the leading position in the<br />

Direct Consumer Credit (CDC)<br />

area, participating in 24%<br />

in the market share.<br />

12<br />

13

Corporate<br />

Governance<br />

Courageous integrity<br />

In harmony with the bank’s global strategy,<br />

<strong>HSBC</strong> <strong>Brazil</strong> seeks to identify new<br />

opportunities, while potential risks<br />

stemming from operations are minimised.<br />

<strong>HSBC</strong> <strong>Brazil</strong>’s corporate governance<br />

model ensures a high adherence<br />

level to the company’s strategies,<br />

and makes sure that business<br />

results are effectively pursued<br />

and achieved. The model also<br />

contributes to risk management<br />

processes in the local, regional<br />

and global settings.<br />

The Executive Committee (EXCO)<br />

is the bank’s highest governance<br />

body, responding to strategic and<br />

executive decisions. In <strong>2011</strong>,<br />

the body was comprised of 11 full<br />

members. From the beginning of<br />

2012 on, the executive body started<br />

counting on ten members, the<br />

president (and also the Group’s<br />

CEO) included. The group gathers<br />

together in a monthly basis.<br />

Ten other committees are<br />

connected to EXCO, thus<br />

safeguarding <strong>HSBC</strong> <strong>Brazil</strong>’s<br />

coporate governance process.<br />

The main committees are:<br />

Audit Committee<br />

Ensures the alignment of the<br />

bank’s practices with internal and<br />

external audit recommendations.<br />

Comprised of four full members,<br />

the Committee meets every three<br />

months and is sponsored by the<br />

executive director of the Internal<br />

Audit department.<br />

Cost Strategy Committee<br />

Implements strategies towards<br />

ensuring cost maximisation and<br />

efficiency. The Committee counts<br />

on 11 members and is headed by<br />

<strong>HSBC</strong>’s top executive. The group<br />

meets quarterly.<br />

Human Resources Committee<br />

<strong>HSBC</strong> <strong>Brazil</strong> is in charge of<br />

defining and formulating strategies<br />

for the following fields: labour<br />

relations, internal communication,<br />

compensation, training, and general<br />

HR issues. The Committee is also<br />

responsible for the dissemination<br />

of diversity-based principles<br />

and practices within the Group.<br />

Comprised of six members, the<br />

group gets together every month.<br />

The Sarbanes-Oxley Committee<br />

<strong>HSBC</strong> is globally complied with<br />

this United States’ legislation<br />

guideline, the Sarbanes-Oxley<br />

(SOx). The Committee guarantees<br />

that <strong>HSBC</strong> <strong>Brazil</strong> is in harmony with<br />

the international parametres, such<br />

as internal control mechanisms<br />

and disclosure of consolidated<br />

financial results. Comprised of 21<br />

members, the Committee meets<br />

Illustrative image<br />

14<br />

15

The very nature of <strong>HSBC</strong><br />

SUSTAINABILITY<br />

INTEGRATED<br />

FINANCIAL STRENGTH<br />

OPEN<br />

PERFORMANCE-<br />

CUSTOMER-<br />

FOCUS<br />

every month. The SOx was born<br />

under the premise of getting rid<br />

of accounting frauds. The group is<br />

also responsible for enhancing the<br />

credibility of organisations at the<br />

eyes of investors. The Committee<br />

establishes severe corporate<br />

governance and transparency<br />

criteria to financial reports of<br />

companies sharing the New York<br />

Stock Exchange Market.<br />

<strong>Sustainability</strong> Committee<br />

This is <strong>HSBC</strong>’s highest governance<br />

body for sustainability-related<br />

CONECTED<br />

COURAGEOUS<br />

INTEGRITY<br />

QUALITY<br />

RISK-MANAGEMENT<br />

DEPENDABLE<br />

issues. The group is comprised<br />

of the bank’s president and top<br />

executive directors from the<br />

following departments: <strong>HSBC</strong><br />

Technology and Services (HTS),<br />

Commercial Banking, RBWM<br />

(individuals), Losango, <strong>HSBC</strong> Global<br />

Technology, Human Resources, and<br />

Internal Communication. By holding<br />

periodical meetings, the team<br />

elaborates on actions to be carried<br />

out and performs a follow-up to<br />

social, economic and environmental<br />

goals. Specific work groups,<br />

gathered from different areas,<br />

EFICIENCY<br />

SPEED<br />

FOCUS<br />

Mandala - <strong>HSBC</strong> values<br />

and business principles<br />

are subordinated to this<br />

Committee. In the long-term,<br />

these groups aim to lead each<br />

business unit towards embodying<br />

sustainability into its strategic<br />

planning. Presently, five areas<br />

of the bank display sustainability<br />

work groups, namely: HTS, <strong>HSBC</strong><br />

Insurance, Personal Finance and<br />

Asset Management. In 2012,<br />

the Commercial Banking area<br />

is expected to outline actions<br />

towards the creation of<br />

a sustainability group.<br />

Whenever organisations’<br />

guidelines are grounded on values<br />

and principles, they can count<br />

on more accurate commercial<br />

decision-making and risk mitigation<br />

processes allowing for long-term,<br />

sustainable gains. The combination<br />

of business values and principles<br />

shapes <strong>HSBC</strong>’s character and holds<br />

up the bank’s strategies. <strong>HSBC</strong><br />

actions are endorsed by courageous<br />

integrity. In essence, it means<br />

that the bank has the courage of<br />

making decisions based upon what<br />

is correct, without compromising<br />

its integrity and ethical standards.<br />

In other words, our focus is on<br />

identifying, understanding and<br />

dealing with those risks in line with<br />

our agreed risk appetite. It also<br />

points to the responsibility each and<br />

every employee has of showing<br />

business values and principles in<br />

their relationship with customers,<br />

colleagues, regulatory bodies,<br />

and community at large. Strongly<br />

seen in the company’s major<br />

actions and practices, sustainability<br />

lies among the principles that<br />

integrate <strong>HSBC</strong>’s culture.<br />

Values<br />

Dependable and do the right thing<br />

Open to different ideas and cultures<br />

Conected to customers,<br />

communities, regulators,<br />

and to each other.<br />

Principles<br />

Financial strenght<br />

Risk management<br />

Speed<br />

Performance-focus<br />

Efficiency<br />

Quality<br />

Customer-focus<br />

Integrated<br />

<strong>Sustainability</strong><br />

Values and Principles<br />

Right after being hired, new<br />

employees attend a training process<br />

on <strong>HSBC</strong>’s Code of Conduct. The<br />

protocol shows <strong>HSBC</strong>’s specific<br />

behaviour guidelines whenever<br />

an employee is involved in any<br />

business or relationship with<br />

customers, suppliers or other<br />

stakeholders. Increased value<br />

for integrity, commitment to<br />

quality, reduction of bureaucracy,<br />

engagement towards the<br />

development of communities<br />

where the company operates, and<br />

promotion of sustainable socioenvironmental<br />

practices are set<br />

by the document as fundamental<br />

milestones to be respected.<br />

In compliance with the Group’s<br />

global policy, risk assessment<br />

processes are deployed in all units.<br />

One major objective is to prevent<br />

the bank’s structure from being<br />

used for money laundering or for<br />

funding illegal activities. <strong>HSBC</strong><br />

monitors all customer records and<br />

financial transactions; besides,<br />

any suspicious procedure can<br />

be identified by strict operational<br />

control systems and the systematic<br />

qualification of employees. No<br />

account whatsoever can be<br />

operated by anonymous customers<br />

or customers using fictitious<br />

names; moreover, in compliance<br />

with the <strong>Brazil</strong>ian Legislation, all<br />

records are periodically updated.<br />

At the emergence of any doubtful<br />

case, <strong>HSBC</strong> collaborates with<br />

investigations performed by<br />

official authorities and discloses<br />

all necessary information required<br />

by regulatory agencies, without<br />

disregarding customers’<br />

legal privacy boundaries.<br />

<strong>HSBC</strong>’s Procedures Manual<br />

establishes clear norms aimed to<br />

identify and deal with conflicts of<br />

interest of employees, customers<br />

and the company properly said.<br />

The bank adopts a contention<br />

and control system for all data<br />

exchanged among its several<br />

teams, in order to prevent any<br />

leak of information and preserve<br />

the confidentiality of processes<br />

that may deal with any suspicious<br />

customer. Besides ensuring the<br />

previously mentioned secrecy,<br />

a system called Chinese Wall<br />

was envisaged to promote<br />

a clear distinction between<br />

the financial institutions’ own<br />

resource administration and<br />

the management of resources<br />

belonging to third parties.<br />

“<strong>Sustainability</strong> governance<br />

in <strong>HSBC</strong> Brasil is very well<br />

organised. Our executive<br />

board is commited to<br />

conscious initiatives<br />

and constantly pushes<br />

employee engagement<br />

forward initiatives”.<br />

Marco Tavares,<br />

CTSO <strong>HSBC</strong> <strong>Brazil</strong><br />

16<br />

17

Risk Management<br />

In <strong>Brazil</strong>, both the CEO and the<br />

Executive Board are especially<br />

accountable for <strong>HSBC</strong>’s risk<br />

management. They count on<br />

the support of three Committees<br />

that respond to the protection<br />

of specific risks.<br />

The Risk Management<br />

Market Risk<br />

Consists of any chance of loss<br />

resulted from price fluctuations,<br />

once the asset portfolio can bring<br />

about tenor, currency and index<br />

mismatches. Exchange and interest<br />

rates, as well as the prices of<br />

shares and commodities, are also<br />

enrolled in this risk category.<br />

Committee ensures the<br />

formulation of specific policies to<br />

different risk categories, tracking<br />

down eventual problems and<br />

determining distinct actions in<br />

order to tackle emerging issues.<br />

Executives of the Operational Risk<br />

and Internal Control Committee<br />

are directly involved in the control<br />

and function of any operational<br />

risk. Finally, the Retail Credit Risk<br />

Operational Risk<br />

Each aspect of <strong>HSBC</strong> <strong>Brazil</strong>’s<br />

business processes presents<br />

a relevant operational risk, covering<br />

a wide array of issues, such as<br />

fraud-based losses, non-authorised<br />

activities, mistakes, omissions,<br />

lack of efficiency, and failures<br />

stemming from system downfalls<br />

or external events.<br />

Committee is in charge of the<br />

management and the performance<br />

of the retail portfolios, including<br />

personal finance services and<br />

small sized companies.<br />

The major risk categories monitored<br />

by <strong>HSBC</strong> <strong>Brazil</strong> are as follows:<br />

<strong>HSBC</strong> also counts on specific<br />

sectorial policies directed to critical<br />

segments, which defines the<br />

conduct guidelines to be adopted by<br />

the bank and serves as a parametre<br />

for consumer credit analysis.<br />

More information on the Responsible<br />

Loan Concession chapter<br />

Credit Risk<br />

Implies any financial loss-related risk<br />

whenever a clause in the contract is<br />

not complied with by the company<br />

or customer. Primarily emerging<br />

from loans, advanced payments<br />

or leasing contracts, the risk is<br />

also present in certain products<br />

registered in balancing accounts,<br />

such as derivatives’ warranties<br />

and reference values; <strong>HSBC</strong><br />

<strong>Brazil</strong>’s positioning regarding debt<br />

instruments is also listed as a credit<br />

risk. Among the risks <strong>HSBC</strong> <strong>Brazil</strong><br />

is exposed to, the credit risk is the<br />

one with the highest demand for<br />

regulatory capital.<br />

Commitments<br />

The Group <strong>HSBC</strong> is a signatory<br />

of the Global Compact, a United<br />

Nations initiative aimed to stimulate<br />

corporate social responsibility by<br />

means of ten universal principles<br />

encompassing human rights, labour<br />

rights, environmental protection,<br />

and actions against corruption. The<br />

bank also follows the Sullivan Global<br />

Principles guidelines, in an effort<br />

to promote policies that respect<br />

Illustrative image.<br />

human rights, comply with the law,<br />

and minimise economic, social and<br />

environmental impacts.<br />

<strong>HSBC</strong> <strong>Brazil</strong> achieved the SA8000<br />

certification, created by the UN<br />

Council on Economic Priorities<br />

in order to promote corporate<br />

accountability (more information<br />

in the Work Environment<br />

chapter). The Group also signed the<br />

International Finance Corporation’s<br />

Equator Principles (more information<br />

in the Responsible Credit chapter),<br />

as well as the UN Principles for<br />

Responsible Investment (more<br />

information in the Investments<br />

chapter). Last but not least, the<br />

company also complies with<br />

a number of guidelines practised<br />

by the financial sector, such as<br />

the Green Protocol, an initiative<br />

of the <strong>Brazil</strong>ian Federation of<br />

Banks (FEBRABAN) that seeks to<br />

implement a common sustainability<br />

agenda for the banking segment.<br />

In addition, <strong>HSBC</strong> is an associate<br />

of the <strong>Brazil</strong>ian Business Council<br />

(Cebds), and is actively represented<br />

in sectorial discussions by specific<br />

associations, such as the FEBRABAN,<br />

the <strong>Brazil</strong>ian Association of<br />

International Banks (ABBI), the National<br />

Confederation of Financial Institutions<br />

(CNF), and the <strong>Brazil</strong>ian Association<br />

of Entities in the Financial and<br />

Capital Markets (ANBIMA).<br />

18<br />

19

Economic<br />

Development<br />

Ensuring perennity<br />

<strong>HSBC</strong> acts ethically by developing<br />

responsible credit operation initiatives<br />

and providing the insertion of companies<br />

and customers into sustainability.<br />

The current development<br />

setting of the <strong>Brazil</strong>ian economy<br />

has led financial institutions<br />

to undergo intense social<br />

pressure concerning the coming<br />

challenges for the sector. In<br />

order to cope with such reality,<br />

the adoption of safer and more<br />

transparent credit operations and<br />

the financial literacy of customers<br />

towards fighting overindebtness<br />

can be turned into strategic<br />

frontlines that guarantee both<br />

the perennity and favourable<br />

performance of any given<br />

business. <strong>HSBC</strong>’s <strong>Sustainability</strong><br />

Risk Policy sets out consumer<br />

credit guidelines in accordance<br />

with the company’s operation<br />

segment. Added to that, the<br />

policy also stands out in the field<br />

of third party fund management.<br />

Currently, <strong>HSBC</strong> <strong>Brazil</strong> is one<br />

of the few <strong>Brazil</strong>ian banks to have<br />

its own methodology to assess<br />

the sustainability performance<br />

of companies that participate<br />

in investment funds.<br />

The bank seeks to make<br />

customers aware and<br />

increasingly encourages them<br />

towards responsibly using<br />

money. In the Financial Literacy<br />

field, for instance, Losango has<br />

been developing quite a relevant<br />

task as a way of mobilising<br />

the whole value chain towards<br />

adopting sustainable practices.<br />

Since 2010, employees of<br />

partnering agencies have<br />

been trained and prepared<br />

to make their customers aware<br />

of the rational use of loans,<br />

thus preventing overindebtness<br />

from occurring.<br />

Goals and<br />

Accomplishments<br />

in <strong>2011</strong><br />

Develop sustainability actions<br />

focusing corporate customers.<br />

The task follows the guidelines<br />

set in the Personal Finance and<br />

Insurance segments, whose<br />

sustainability objectives and<br />

goals are to be formalised.<br />

- Organisation of the Commercial<br />

Banking work group;<br />

- Support to seven corporate<br />

customer-related projects<br />

focusing education, environment<br />

and income generation.<br />

Illustrative image.<br />

Increase the amount of<br />

people trained by the Losango<br />

Sustainable Credit Programme,<br />

aimed to provide financial<br />

literacy to final consumers.<br />

- Launch of the Losango<br />

Training Portal to partnering<br />

agencies;<br />

- Over 14,000 employees have<br />

already attended the training<br />

programmes.<br />

Keep on sustainability risk<br />

training programmes to<br />

employees from Sales<br />

and Credit areas.<br />

- In <strong>2011</strong>, 918 employees<br />

attended the training<br />

programmes.<br />

In the Asset Management area,<br />

a larger group of companies<br />

will be assessed by the bank’s<br />

own sustainability assessment<br />

methodology, aiming to present<br />

a wider array of choices for<br />

companies indicated to the FIC<br />

<strong>Sustainability</strong> fund.<br />

- 57 companies were assessed<br />

in <strong>2011</strong> (65% of which have<br />

been previously contacted);<br />

the total amount of assessed<br />

companies now reaches 117.<br />

20<br />

21

Sectorial Policies update<br />

Goals<br />

for 2012<br />

Use the e-learning website<br />

to achieve 24,000 trained<br />

employees from Losango’s<br />

partnering agents;<br />

Apply the bank’s in-house<br />

sustainability assessment<br />

methodology in all<br />

investment funds. In 2012,<br />

all companies inserted into<br />

<strong>HSBC</strong>’s funds framework<br />

will be assessed.<br />

Trigger the implementation<br />

of the Climate Business<br />

strategy by training<br />

previously selected<br />

employees from sales<br />

areas; the goal is to enhance<br />

business volume.<br />

Expand the work group<br />

model and encompass<br />

Commercial Banking’s<br />

employees.<br />

Revise processes aimed<br />

to decrease the amount<br />

of letters sent by mail,<br />

as well as to upgrade the<br />

functionality standards<br />

of assistance channels<br />

as a strategy towards<br />

approaching customers<br />

and reducing environmental<br />

impacts.<br />

Responsible loan<br />

concession<br />

Critical segments require specific<br />

sectorial risk policies. That’s exactly<br />

what <strong>HSBC</strong> has for the segments<br />

of Mining and Metals, Chemical<br />

Industry, Fresh Water Infrastructure,<br />

Forestry and Forestry Products,<br />

Energy, and Defense Equipments.<br />

These sectors stand out as<br />

references for the bank’s analysis<br />

of any consumer credit programme.<br />

These sectorial policies will be<br />

employed regardless the financial<br />

amount of the transaction or the<br />

size of the company.<br />

The policies also settle <strong>HSBC</strong>’s<br />

conduct guidelines, including<br />

not tendering financial services<br />

to the producers of small arms,<br />

illegal wood extractors, or those<br />

companies whose operations<br />

are located in areas declared<br />

by Unesco (United Nations<br />

Educational, Scientific and<br />

Cultural Organisation)<br />

as World Heritage sites.<br />

Sectorial policies, moreover,<br />

set specific restrictions for the<br />

operations of the company in given<br />

countries and regions. <strong>Brazil</strong>, for<br />

instance, is a country that displays<br />

high risks in the forestry segment;<br />

hence, all loans in excess of<br />

US$ 15 million must also be<br />

endorsed by <strong>HSBC</strong>’s Global<br />

Risk Department in London. In<br />

addition to specific cases, such as<br />

the one just quoted, <strong>HSBC</strong> also<br />

ranks the sustainability risks of<br />

customers and projects inserted<br />

into the framework of its sectorial<br />

policies, regardless the financial<br />

volume of the transaction. For<br />

some companies, clauses that<br />

foresee their commitment to<br />

the development of action plans<br />

are clearly pointed out in the<br />

contract; from then on, the action<br />

plan becomes an indispensable<br />

requirement for either<br />

the confirmation or the<br />

maintenance of the loan.<br />

At <strong>HSBC</strong>, credit consumer<br />

complies with the <strong>Sustainability</strong><br />

Risk Policy. This guideline is<br />

based upon two assessment<br />

parametres – the sectorial policies<br />

and the Equator Principles (more<br />

information on the Equator<br />

Principles chapter). Each of<br />

them is comprised of specific<br />

risk analysis processes. A<br />

sustainability rating is applied for<br />

the assessment of all proposals,<br />

taking into account the company’s<br />

activity field, the amount of the<br />

loan, and the customer’s ability<br />

to comply with the sectorial<br />

policies. Throughout <strong>2011</strong>, <strong>HSBC</strong><br />

paid customers personal visits,<br />

aiming to present the bank’s<br />

<strong>Sustainability</strong> Risk Policy. Visited<br />

customers were selected either<br />

by the risk degree of the project or<br />

by their growing potential.<br />

In <strong>2011</strong>, the bank doubled the<br />

number of assessed customers<br />

comparing with 2010, when the<br />

<strong>Sustainability</strong> Risk Policy was<br />

launched in <strong>Brazil</strong>. Of the total<br />

amount of assessments, 10%<br />

did not follow the protocol. These<br />

customers were given a six-month<br />

deadline to meet the demands.<br />

“<strong>Brazil</strong> has a deep<br />

lack of infrastructure.<br />

Both opportunities<br />

and risks are<br />

abounding. Thus,<br />

it is crucial to select<br />

projects that<br />

effectively generate<br />

improvements<br />

to the country”.<br />

Ildefonso Netto,<br />

Chief Risk Officer (CRO)<br />

In 2010, the Group <strong>HSBC</strong> has<br />

accomplished an extensive review<br />

of Energy Sector Policy. In <strong>2011</strong>,<br />

the bank successfully implemented<br />

one of the first policies amongst<br />

financial institutions to cover coalfired<br />

power, oil sands and nuclear<br />

power industries, which were<br />

welcomed by many stakeholders,<br />

including customers. In <strong>Brazil</strong>,<br />

customers working in the energy<br />

segment were also approached. In<br />

<strong>2011</strong>, the Metals & Mining policy<br />

guidelines were also updated.<br />

Equator Principles<br />

The Equator Principles were made<br />

to ensure that large-scale projects<br />

are developed and executed<br />

without generating any negative<br />

impact to local communities and<br />

the environment. At <strong>HSBC</strong>, these<br />

principles are applied for project<br />

funding and financial advising<br />

processes that reach a capital cost<br />

equal to or over US$ 10 million.<br />

Since 2003, the Equator Principles<br />

guide all loan transactions for new<br />

projects supported by the bank.<br />

Training: a permanent process<br />

In order to identify risks<br />

and opportunities, <strong>HSBC</strong>’s<br />

managers take responsibility<br />

for acknowledging customers’<br />

sustainability practices. As a way<br />

of having them prepared to<br />

respond to such demands, the<br />

bank provides a permanent training<br />

environment. In order to carry on<br />

the development process initiated<br />

in 2010, 149 people received<br />

presence-based training in <strong>2011</strong>.<br />

As a way of facilitating this work,<br />

<strong>HSBC</strong> created an e-learning tool<br />

on sustainability-related risks. The<br />

Equator Principles, the <strong>Sustainability</strong><br />

Risk Management, and the sectorial<br />

policy-based credit approval process<br />

are among the addressed issues.<br />

The target audience is comprised<br />

of business managers, credit analysts<br />

and employees from the Compliance,<br />

Commercial Banking, Project<br />

Financing, and Insurance areas.<br />

In <strong>2011</strong>, 918 employees attended<br />

remote training programmes.<br />

Microcredit<br />

In partnership with Banco do<br />

Nordeste, <strong>HSBC</strong> implements<br />

microcredit operations. By means<br />

of the Crediamigo programme, the<br />

partner bank ensures credit access<br />

to thousands of small entrepreneurs<br />

in formal and informal sectors<br />

of economy. Loans can be required<br />

by individuals or groups of people<br />

who conjointly share the commitment<br />

of paying for installment obligations.<br />

Crediamigo is inserted into the Federal<br />

Government’s National Microcredit<br />

Programme. The programme was<br />

launched in August <strong>2011</strong> in order<br />

to meet the financial needs of<br />

citizens who own small businesses.<br />

Seventy percent of Banco do<br />

Nordeste’s current available<br />

credit line aimed to microcredit<br />

operations are supplied by <strong>HSBC</strong>.<br />

<strong>HSBC</strong> has also set a partnership<br />

with a Latin American institution<br />

called Acción Internacional,<br />

a reference in loan programmes<br />

for small entrepreneurs.<br />

The commercial relationship,<br />

conjointly co-ordinated by the<br />

MME (middle market enterprises)<br />

Platform and the Global Asset<br />

Management, was launched in<br />

February <strong>2011</strong>, and is harmonised<br />

with the bank’s strategy of providing<br />

financial services that meet up the<br />

demands of microfinance institutions.<br />

22<br />

23

Access to<br />

fresh water<br />

Levering good<br />

practices<br />

<strong>HSBC</strong> is always mindful<br />

of creating business<br />

opportunities together<br />

with customers<br />

who develop socioenvironmental-oriented<br />

projects. In compliance<br />

with such guideline, the<br />

bank released a loan<br />

reaching R$ 10 million<br />

to Águas do Amazonas<br />

(Amazonas’ Water). The<br />

company is accountable<br />

for the basic sanitation<br />

and water treatment<br />

in the city of Manaus,<br />

Amazonas. The purpose<br />

of the loan was to<br />

enhance the impact of<br />

the company’s water<br />

treatment project, as well<br />

as to universalise the<br />

distribution of fresh<br />

water in the city.<br />

Águas do Amazonas<br />

works towards ensuring<br />

the distribution of high<br />

quality fresh water in<br />

the municipality of<br />

Manaus. The water<br />

that supplies the city<br />

springs from Rio Negro,<br />

a river with acid, dark,<br />

undrinkable water. The<br />

education of inhabitants<br />

towards conscientious<br />

consumption practices<br />

is also part of the<br />

partnership programme.<br />

Illustrative image.<br />

Shifting to a lowcarbon<br />

economy<br />

Last year, <strong>HSBC</strong> deployed<br />

a global strategy aimed to<br />

stimulate special loans for<br />

companies who collaborate<br />

on carbon emission mitigation<br />

activities and programmes,<br />

and who join actions aimed<br />

to fight climate change, the<br />

so-called Climate Business.<br />

In <strong>Brazil</strong>, Densevix was the<br />

first company to apply for such<br />

positioning. The company has<br />

been building three wind power<br />

parks in the city of Brotas de<br />

Macaúbas, Bahia (northeast of<br />

<strong>Brazil</strong>). The total amount of the<br />

operation reached R$ 84.6 million.<br />

Densevix was created in 1995 and<br />

develops business opportunities<br />

related to renewable energy<br />

infrastructure and projects.<br />

“We’re focused on funding<br />

renewable energy-based<br />

projects. This strategy is<br />

called Climate Business. Our<br />

personnel have been trained<br />

towards following this track.<br />

Our employees need to talk<br />

One of the major goals of <strong>HSBC</strong>’s<br />

<strong>Sustainability</strong> Risk Policy is to<br />

provide its stakeholders with<br />

improvement. This positioning<br />

was shown in <strong>2011</strong>, when the<br />

bank sponsored a company in<br />

the gold mining segment. During<br />

the loan analysis process, <strong>HSBC</strong><br />

observed that the company was<br />

not a signatory of the International<br />

Cyanide Management Code, in<br />

accordance with the demand of<br />

<strong>HSBC</strong>’s Mining Sectorial Policy.<br />

The adherence to the Code must<br />

be voluntary, and is part of a<br />

programme that aims to safely deal<br />

with cyanide in gold production<br />

processes. Instead of ceasing the<br />

relationship with the customer,<br />

<strong>HSBC</strong> adopted a partnering attitude.<br />

An independent advisory company<br />

was hired by the bank in order to<br />

orient the company towards the<br />

adoption of the code. In addition<br />

to minimising the sustainability<br />

risk of the operation, <strong>HSBC</strong> also<br />

strengthened its commercial<br />

presence.<br />

to customers and carry on<br />

the sustainability speech, thus<br />

maximising funding processes<br />

for solar energy, wind power,<br />

among others.”<br />

Fernando Freiberger,<br />

Head of <strong>HSBC</strong> Corporate<br />

24 25

Investments<br />

Aiming to motivate the adoption<br />

of improved social, environmental<br />

and corporate governance practices,<br />

as well as to channel investments<br />

towards prominent companies<br />

in the market, <strong>HSBC</strong> applies<br />

the sustainability rating, a tool<br />

developed by the bank to guide<br />

third party funds’ management<br />

processes. The following three<br />

aspects inserted into the analysis<br />

of risks and opportunities are taken<br />

into account in the methodology:<br />

Environment: environmental<br />

management system,<br />

development of ecoefficiency<br />

programmes, environmental<br />

security, biodiversity, climate<br />

changes, and adoption of<br />

environmental criteria for<br />

suppliers’ hiring processes.<br />

Social: relationship of the<br />

company with employees and<br />

suppliers, participation in the<br />

local community, and quality of<br />

the commercialised product.<br />

Corporate Governance:<br />

transparency, ethics, market<br />

relationship, history of the<br />

company, internal controls, and<br />

protection of minority investors.<br />

The company’s assessment<br />

has to be validated by a specific<br />

committee comprised of the bank’s<br />

analysts and executives. By the end<br />

of <strong>2011</strong>, 110 companies had already<br />

been assessed. <strong>HSBC</strong> approached<br />

the majority of the companies<br />

by means of presence-based<br />

meetings or phone calls, aiming to<br />

encourage them towards adopting<br />

sustainability strategies, as well<br />

as searching for any information<br />

missing in the analysis process.<br />

In <strong>2011</strong>, the bank employed the<br />

methodology in the launch<br />

of three investment funds:<br />

FI SRI Stocks, FIC <strong>Sustainability</strong><br />

Stocks, and FI SRI 20 Performance<br />

Private Credit Fixed Income.<br />

These funds gather companies<br />

that achieve fine results in all<br />

three aspects and who also<br />

show attractive finance-based<br />

risk-return relationship.<br />

More information on<br />

the Products chapter<br />

Companies operating in segments<br />

such as alcoholic beverages,<br />

tobacco and the defense industry<br />

are not allowed to take part in the<br />

funds. Besides, an Advisory Council<br />

comprised of market professionals<br />

with solid experience in sustainabilityrelated<br />

issues guides all investment<br />

decisions. The Council has veto<br />

powers over potential insertions into<br />

the fund portfolio. In 2012, <strong>HSBC</strong><br />

aims to expand the assessment of<br />

socio-environmental and corporate<br />

governance aspects to all the funds<br />

made available by the bank.<br />

“Our investment<br />

analysis encompasses<br />

the company’s<br />

organisational profile,<br />

corporate governance,<br />

and social role within<br />

the context it operates.<br />

Our investment<br />

process is more and<br />

more grounded on<br />

this background. This<br />

economy-financebased,<br />

sustainabilityfocused<br />

analysis is<br />

named ‘integration’”.<br />

Pedro Bastos,<br />

Regional CEO, <strong>HSBC</strong> Global<br />

Asset Management<br />

Illustrative image.<br />

26<br />

27

Responsible investment<br />

Financial literacy<br />

<strong>HSBC</strong> is also a signatory<br />

of the Principles for Responsible<br />

Investment (PRI), developed<br />

by investors in partnership with<br />

the United Nations Environmental<br />

Programme’s Financial Initiative<br />

(Unep-FI). The PRI highlights<br />

contents related to the insertion<br />

of social, environmental and<br />

corporate governance criteria<br />

into investment decisions.<br />

<strong>HSBC</strong> co-ordinates the PRI’s<br />

Engagement Group. Whose major<br />

goal is to gather investors together<br />

and promote positive changes<br />

in the sustainability management<br />

of investing companies. In <strong>2011</strong>,<br />

the group focused on the<br />

mobilisation of companies towards<br />

improving the reporting level<br />

of their sustainability information.<br />

<strong>HSBC</strong> is also a strong voice in<br />

the Latin American Sustainable<br />

Finance Forum (LASFF), an initiative<br />

taken by the Fundação Getulio<br />

Vargas and the International<br />

Finance Corporation (IFC) that<br />

aims to promote sustainability<br />

practices and undertakings in<br />

the financial segment. <strong>HSBC</strong>’s<br />

accountability concerning these<br />

aspects is quite recognised in<br />

the segment. The bank’s Global<br />

Asset Management is a highlight.<br />

It is ranked among the top three<br />

best resource management<br />

actions in <strong>Brazil</strong> towards the<br />

adoption of sustainability criteria<br />

for investments. The conclusion<br />

was drawn by Mercer Consulting<br />

in a survey supported by the<br />

International Finance Corporation,<br />

the private arm of the World Bank.<br />

The Sustainable Credit Programme<br />

is one of <strong>HSBC</strong>’s financial literacy<br />

initiatives. Losango, <strong>HSBC</strong>’s sales<br />

affiliate, started developing the<br />

programme in 2009 by launching a<br />

sustainable credit project directed<br />

to the financial literacy of partnering<br />

agencies. The goal is to prepare<br />

and stimulate salespeople towards<br />

being aware of their customers’<br />

needs, and to offer adequate<br />

personalised products and credit<br />

to their income profile. Since then,<br />

Losango has been focusing on the<br />

creation of training programmes<br />

for partners. In <strong>2011</strong>, the company<br />

devised an Online Training portal,<br />

which enhanced the reach of<br />

the work and began to present<br />

fast-track, standardised training<br />

programmes directed to employees<br />

from partnering credit agencies<br />

all around the nation. Altogether,<br />

14,000 agents have already<br />

been trained. The goal for 2012<br />

is to reach 10,000 other people.<br />

Losango is also committed to the<br />

reinforcement of communication<br />

with the final consumer. The<br />

company’s website will bring a<br />

digital manual containing advices<br />

and cares to be taken at the time<br />

of contracting loans. The material<br />

will also be distributed to Losango’s<br />

affiliates and other partnering<br />

agencies all around <strong>Brazil</strong>.<br />

Losango operations<br />

count on over 20,000<br />

accredited agencies<br />

in 2,300 municipalities<br />

and receive 10 million<br />

credit proposals<br />

each year.<br />

Practising financial<br />

literacy<br />

Junior Achievement is <strong>HSBC</strong>’s<br />

partner in the creation and<br />

execution of financial literacy<br />

programmes. Sponsored by<br />

private companies, Junior<br />

Achievement is the world’s<br />

largest and most experienced<br />

organisation in the fields of<br />

practical business literacy,<br />

economy and entrepreneurship.<br />

The global partnership with<br />

<strong>HSBC</strong> started in 2009 in 15<br />

countries, including <strong>Brazil</strong>.<br />

In <strong>2011</strong>, <strong>HSBC</strong> <strong>Brazil</strong> provided<br />

support to a Financial Literacybased<br />

programme called Mais<br />

Focus on the customer<br />

Customer-focused actions carried<br />

out by Losango go beyond the<br />

simple offer of sustainable credit. In<br />

<strong>2011</strong>, after participating in a survey<br />

carried out by the Consumidor<br />

Moderno magazine – performed<br />

with 1,389 consumers in six<br />

<strong>Brazil</strong>ian states – Losango was<br />

appointed as the company that<br />

most respects its consumers in the<br />

national Financial Sector.<br />

The survey evaluated the<br />

experience of customers in<br />

issues such as assistance, prices,<br />

payment method, and respect to<br />

the consumer’s rights code. In the<br />

same year, Losango’s call centres<br />

received over five million calls. From<br />

these, 95% of complaints were<br />

solved after the first contact.<br />

que Dinheiro (More Than Money).<br />

The initiative focuses on students<br />

from 5 th through 7 th grades of Primary<br />

School. <strong>HSBC</strong>’s employees<br />

volunteer to the programme.<br />

For this purpose, they are trained<br />

by Junior Achievement in order<br />

to effectively apply the programme<br />

in public schools located in<br />

the surroundings of the bank’s<br />

administrative centres. The goal is<br />

to provide these young people with<br />

support towards a clearer vision<br />

of the business world, leading them<br />

to reflect on conscientious<br />

consumption practices and<br />

“Losango has been a<br />

leading company in its<br />

segment for 41 years<br />

now. Our major goal<br />

is to offer ideal credit<br />

standards that fit each<br />

customer’s profile. We<br />

constantly encourage a<br />

respectful environment<br />

towards customers,<br />

taking into account both<br />

their consumption needs<br />

to more deeply understand<br />

personal finance processes.<br />

The programme was first<br />

implemented in 2009 and four<br />

new <strong>Brazil</strong>ian cities are selected<br />

to enter the project each year. In<br />

<strong>2011</strong>, São Paulo (SP), Rio de Janeiro<br />

(RJ), Curitiba (PR) and Cuiabá (MT)<br />

hosted the programme, reaching<br />

1,115 students and involving 98<br />

volunteers. In 2012, the initiative<br />

will take place in São Paulo (SP),<br />

Rio de Janeiro (RJ), Curitiba (PR)<br />

and Rondonópolis (MT).<br />

and credit worthiness.<br />

The Sustainable Credit<br />

Project cause salespeople<br />

to be extra motivated<br />

towards getting to<br />

know their customers<br />

in a deeper way, and<br />

this leads Losango to<br />

provide partners and final<br />

consumers with tailormade<br />

credit solutions.”<br />

Hilgo Gonçalves,<br />

CEO of Losango<br />

“More Than Money is a simple<br />

and playful programme aimed<br />

to awaken in 5 th and 7 th grade<br />

students an awareness status<br />

concerning their consumption<br />

actions and their dealing with<br />

money. All information they<br />

gather in training sessions<br />

are transmitted to their parents<br />

or caregivers at home, causing<br />

families to rethink their financial<br />

management. It’s a great learning<br />

opportunity for both <strong>HSBC</strong>’s<br />

volunteers, who teach on<br />