Host Marriott 2004 Annual Report - Host Hotels & Resorts, Inc

Host Marriott 2004 Annual Report - Host Hotels & Resorts, Inc

Host Marriott 2004 Annual Report - Host Hotels & Resorts, Inc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

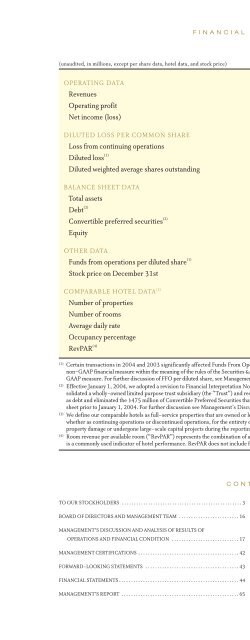

FINANCIAL HIGHLIGHTS<br />

(unaudited, in millions, except per share data, hotel data, and stock price) <strong>2004</strong> 2003 2002<br />

OPERATING DATA<br />

Revenues $ 3,640 $ 3,288 $ 3,345<br />

Operating profit 407 299 417<br />

Net income (loss) — 14 (16)<br />

DILUTED LOSS PER COMMON SHARE<br />

Loss from continuing operations $ (.31) $ (.97) $ (.39)<br />

Diluted loss (1) $ (.12) $ (.07) $ (.19)<br />

Diluted weighted average shares outstanding 337.3 281.0 263.0<br />

BALANCE SHEET DATA<br />

Total assets $ 8,421 $ 8,592 $ 8,316<br />

Debt (2) 5,523 5,486 5,638<br />

Convertible preferred securities (2) — 475 475<br />

Equity 2,395 2,136 1,610<br />

OTHER DATA<br />

Funds from operations per diluted share (1) $ .77 $ .99 $ 1.09<br />

Stock price on December 31st 17.30 12.32 8.85<br />

COMPARABLE HOTEL DATA (3)<br />

Number of properties 103 103<br />

Number of rooms 52,063 52,183<br />

Average daily rate $149.64 $145.42<br />

Occupancy percentage 71.9% 69.0%<br />

RevPAR (4) $107.66 $100.35<br />

(1)<br />

Certain transactions in <strong>2004</strong> and 2003 significantly affected Funds From Operations (FFO) per diluted share and loss per share. FFO per diluted share is a<br />

non-GAAP financial measure within the meaning of the rules of the Securities & Exchange Commission and, accordingly, has been reconciled to the comparable<br />

GAAP measure. For further discussion of FFO per diluted share, see Management’s Discussion and Analysis of Results of Operations and Financial Condition.<br />

(2)<br />

Effective January 1, <strong>2004</strong>, we adopted a revision to Financial Interpretation No. 46 “Consolidation of Variable Interest Entities” (FIN 46R). As a result, we deconsolidated<br />

a wholly-owned limited purpose trust subsidiary (the “Trust”) and recorded the $492 million Convertible Subordinated Debentures issued by the Trust<br />

as debt and eliminated the $475 million of Convertible Preferred Securities that were previously classified in the mezzanine section of our consolidated balance<br />

sheet prior to January 1, <strong>2004</strong>. For further discussion see Management’s Discussion and Analysis of Results of Operations and Financial Condition.<br />

(3)<br />

We define our comparable hotels as full-service properties that are owned or leased by us and the operations of which are included in our consolidated results,<br />

whether as continuing operations or discontinued operations, for the entirety of the reporting periods being compared, and that have not sustained substantial<br />

property damage or undergone large-scale capital projects during the reporting periods being compared.<br />

(4)<br />

Room revenue per available room (“RevPAR”) represents the combination of average daily room rate charged and the average daily occupancy achieved, and<br />

is a commonly used indicator of hotel performance. RevPAR does not include food and beverage or other ancillary revenues generated by the property.<br />

CONTENTS<br />

TO OUR STOCKHOLDERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3<br />

BOARD OF DIRECTORS AND MANAGEMENT TEAM . . . . . . . . . . . . . . . . . . . . . . . . . 16<br />

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF<br />

OPERATIONS AND FINANCIAL CONDITION . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17<br />

MANAGEMENT CERTIFICATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42<br />

FORWARD-LOOKING STATEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43<br />

FINANCIAL STATEMENTS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44<br />

MANAGEMENT’S REPORT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 65<br />

MANAGEMENT’S REPORT ON INTERNAL CONTROL OVER<br />

FINANCIAL REPORTING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .65<br />

REPORTS OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING<br />

FIRM ON INTERNAL CONTROL OVER FINANCIAL<br />

REPORTING AND MANAGEMENT’S ASSESSMENT<br />

AND ON THE CONSOLIDATED FINANCIAL STATEMENTS . . . . . . . . . . . . . . . . 66<br />

SELECTED FINANCIAL DATA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67<br />

HOST MARRIOTT PORTFOLIO . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 68<br />

DIRECTORS, OFFICERS AND MANAGEMENT TEAM . . . . . . INSIDE BACK COVER<br />

CORPORATE INFORMATION . . . . . . . . . . . . . . . . . . . . . . . . . . . . INSIDE BACK COVER