2010 Full Year Results Presentation - Antofagasta plc

2010 Full Year Results Presentation - Antofagasta plc

2010 Full Year Results Presentation - Antofagasta plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

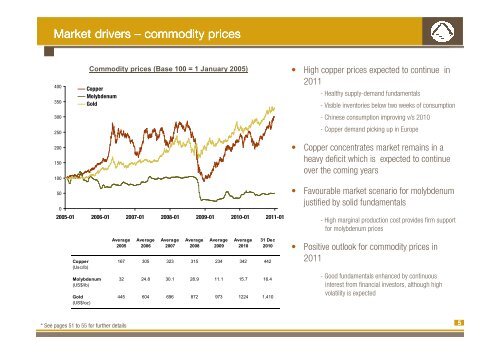

Market drivers – commodity prices<br />

400<br />

350<br />

300<br />

250<br />

Commodity prices (Base 100 = 1 January 2005)<br />

Copper<br />

Molybdenum<br />

Gold<br />

• High copper prices expected to continue in<br />

2011<br />

- Healthy supply-demand fundamentals<br />

- Visible inventories below two weeks of consumption<br />

- Chinese consumption improving v/s <strong>2010</strong><br />

- Copper demand picking up in Europe<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2005-01 2006-01 2007-01 2008-01 2009-01 <strong>2010</strong>-01 2011-01<br />

Average Average Average Average Average Average 31 Dec<br />

2005 2006 2007 2008 2009 <strong>2010</strong> <strong>2010</strong><br />

Copper 167 305 323 315 234 342 442<br />

(Usc/lb)<br />

Molybdenum 32 24.8 30.1 28.9 11.1 15.7 16.4<br />

(US$/lb)<br />

Gold 445 604 696 872 973 1224 1,410<br />

(US$/oz)<br />

• Copper concentrates market remains in a<br />

heavy deficit which is expected to continue<br />

over the coming years<br />

• Favourable market scenario for molybdenum<br />

justified by solid fundamentals<br />

- High marginal production cost provides firm support<br />

for molybdenum prices<br />

• Positive outlook for commodity prices in<br />

2011<br />

- Good fundamentals enhanced by continuous<br />

interest from financial investors, although high<br />

volatility is expected<br />

* See pages 51 to 55 for further details<br />

5