A multi-factor model for the valuation and risk management of ...

A multi-factor model for the valuation and risk management of ...

A multi-factor model for the valuation and risk management of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

deposit premium<br />

Histogram F1 IRE<br />

nsim=100, nsimchol=100, hor=40, time=165.6434, sc=0, withdrawal=0.15<br />

20<br />

10<br />

Big 4 average<br />

Medium-sized average<br />

0<br />

-5 -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5<br />

IRE<br />

Histogram F2 IRE<br />

nsim=100, nsimchol=100, hor=40, time=165.6434, sc=0, withdrawal=0.15<br />

20<br />

10<br />

0<br />

-5 -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5<br />

IRE<br />

Histogram F3 IRE<br />

nsim=100, nsimchol=100, hor=40, time=165.6434, sc=0, withdrawal=0.15<br />

20<br />

10<br />

0<br />

-5 -4.5 -4 -3.5 -3 -2.5 -2 -1.5 -1 -0.5<br />

IRE<br />

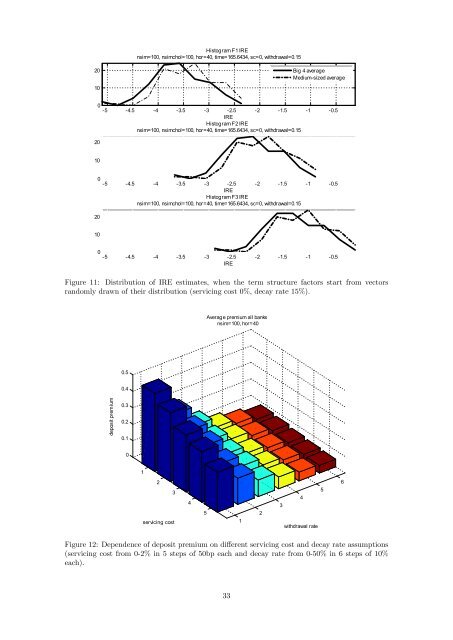

Figure 11: Distribution <strong>of</strong> IRE estimates, when <strong>the</strong> term structure <strong>factor</strong>s start from vectors<br />

r<strong>and</strong>omly drawn <strong>of</strong> <strong>the</strong>ir distribution (servicing cost 0%, decay rate 15%).<br />

Average premium all banks<br />

nsim=100, hor=40<br />

0.5<br />

0.4<br />

0.3<br />

0.2<br />

0.1<br />

0<br />

1<br />

2<br />

3<br />

servicing cost<br />

4<br />

5<br />

1<br />

2<br />

5<br />

4<br />

3<br />

withdrawal rate<br />

6<br />

Figure 12: Dependence <strong>of</strong> deposit premium on di¤erent servicing cost <strong>and</strong> decay rate assumptions<br />

(servicing cost from 0-2% in 5 steps <strong>of</strong> 50bp each <strong>and</strong> decay rate from 0-50% in 6 steps <strong>of</strong> 10%<br />

each).<br />

33