Annual Report 2012.pdf - Karo Bio

Annual Report 2012.pdf - Karo Bio

Annual Report 2012.pdf - Karo Bio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes<br />

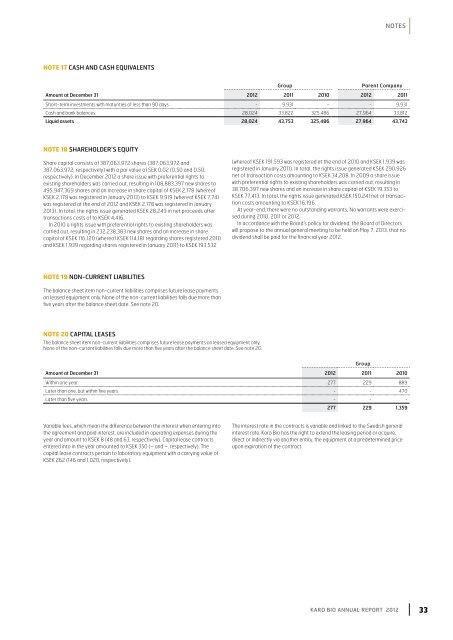

NOTe 17 CASH AND CASH EQUIVALENTS<br />

Group Parent Company<br />

Amount at December 31 2012 2011 2010 2012 2011<br />

Short-term investments with maturities of less than 90 days - 9,931 - - 9,931<br />

Cash and bank balances 28,024 33,822 325,486 27,964 33,812<br />

Liquid assets 28,024 43,753 325,486 27,964 43,743<br />

NOTE 18 SHAREHOLDER’S EQUITY<br />

Share capital consists of 387,063,972 shares (387,063,972 and<br />

387,063,972, respectively) with a par value of SEK 0.02 (0.50 and 0.50,<br />

respectively). In December 2012 a share issue with preferential rights to<br />

existing shareholders was carried out, resulting in 108,883,397 new shares to<br />

495,947,369 shares and an increase in share capital of KSEK 2,178 (whereof<br />

KSEK 2,178 was registered in January 2013) to KSEK 9,919 (whereof KSEK 7,741<br />

was registered at the end of 2012 and KSEK 2,178 was registered in January<br />

2013). In total, the rights issue generated KSEK 28,249 in net proceeds after<br />

transactions costs of to KSEK 4,416.<br />

In 2010 a rights issue with preferential rights to existing shareholders was<br />

carried out, resulting in 232,238,383 new shares and an increase in share<br />

capital of KSEK 116,120 (whereof KSEK 114,181 regarding shares registered 2010<br />

and KSEK 1,939 regarding shares registered in January 2011) to KSEK 193,532<br />

(whereof KSEK 191,593 was registered at the end of 2010 and KSEK 1,939 was<br />

registered in January 2011). In total, the rights issue generated KSEK 290,926<br />

net of transaction costs amounting to KSEK 34,208. In 2009 a share issue<br />

with preferential rights to existing shareholders was carried out, resulting in<br />

38,706,397 new shares and an increase in share capital of KSEK 19,353 to<br />

KSEK 77,413. In total, the rights issue generated KSEK 150,241 net of transaction<br />

costs amounting to KSEK 16,196.<br />

At year-end, there were no outstanding warrants. No warrants were exercised<br />

during 2010, 2011 or 2012.<br />

In accordance with the Board’s policy for dividend, the Board of Directors<br />

will propose to the annual general meeting to be held on May 7, 2013, that no<br />

dividend shall be paid for the financial year 2012.<br />

NOTe 19 NON-CURRENT LIABILITIES<br />

The balance sheet item non-current liabilities comprises future lease payments<br />

on leased equipment only. None of the non-current liabilities falls due more than<br />

five years after the balance sheet date. See note 20.<br />

NOTE 20 CAPITAL LEASES<br />

The balance sheet item non-current liabilities comprises future lease payments on leased equipment only.<br />

None of the non-current liabilities falls due more than five years after the balance sheet date. See note 20.<br />

Group<br />

Amount at December 31 2012 2011 2010<br />

Within one year 277 229 889<br />

Later than one, but within five years - - 470<br />

Later than five years - - -<br />

277 229 1,359<br />

Variable fees, which mean the difference between the interest when entering into<br />

the agreement and paid interest, are included in operating expenses during the<br />

year and amount to KSEK 8 (48 and 63, respectively). Capital lease contracts<br />

entered into in the year amounted to KSEK 350 (– and –, respectively). The<br />

capital lease contracts pertain to laboratory equipment with a carrying value of<br />

KSEK 262 (146 and 1,020, respectively).<br />

The interest rate in the contracts is variable and linked to the Swedish general<br />

interest rate. <strong>Karo</strong> <strong>Bio</strong> has the right to extend the leasing period or acquire,<br />

direct or indirectly via another entity, the equipment at a predetermined price<br />

upon expiration of the contract.<br />

KARO BIO <strong>Annual</strong> <strong>Report</strong> 2012 33