Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

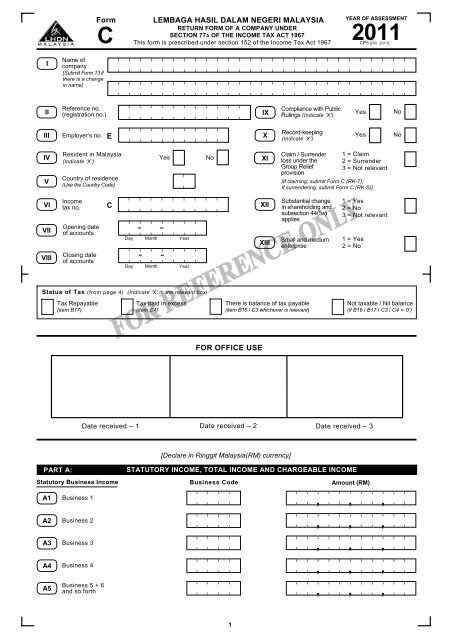

Name of<br />

I company<br />

[Submit Form 13 if >>>>>>>>>>>>>>>>>>>>>>>>><br />

there is a change<br />

in name)<br />

>>>>>>>>>>>>>>>>>>>>>>>>><br />

Reference no.<br />

Compliance with Public<br />

II (registration no.)<br />

IX<br />

Yes No<br />

Rulings (Indicate ‘X’)<br />

>>>>>>>>><br />

! !<br />

Record-keeping<br />

III Employer’s no. E<br />

X<br />

Yes No<br />

>>>>>>><br />

(Indicate ‘X’)<br />

! !<br />

Resident in Malaysia<br />

Claim / Surrender 1 = Claim<br />

IV Yes<br />

No<br />

XI<br />

(Indicate ‘X’)<br />

! !<br />

loss under the 2 = Surrender<br />

Group Relief 3 = Not relevant<br />

!<br />

provision<br />

Country of residence<br />

V [If claiming, submit Form C (RK-T);<br />

(Use the Country Code)<br />

<<br />

If surrendering, submit Form C (RK-S)]<br />

VI<br />

VII<br />

VIII<br />

Income<br />

tax no.<br />

Opening date<br />

of accounts<br />

Form<br />

C<br />

C<br />

LEMBAGA HASIL DALAM NEGERI MALAYSIA<br />

RETURN <strong>FORM</strong> OF A COMPANY UNDER<br />

SECTION 77A OF THE INCOME TAX ACT 1967<br />

This form is prescribed under section 152 of the Income Tax Act 1967<br />

>>>>>>><br />

>>>>><br />

XII<br />

<strong>2011</strong><br />

YEAR OF ASSESSMENT<br />

CP5 [Pin. <strong>2011</strong>]<br />

Substantial change 1 = Yes<br />

in shareholding and 2 = No<br />

subsection 44(5A) !<br />

applies 3 = Not relevant<br />

Day Month Year Small and medium 1 = Yes<br />

XIII<br />

enterprise 2 = No<br />

!<br />

Closing date<br />

of accounts >>>>><br />

Day Month Year<br />

Status of Tax (from page 4) (Indicate ‘X’ in the relevant box)<br />

Tax Repayable<br />

(item B17)<br />

Tax paid in excess<br />

(item C4)<br />

There is balance of tax payable<br />

(item B16 / C3 whichever is relevant)<br />

Not taxable / Nil balance<br />

(if B16 / B17 / C3 / C4 = ‘0’)<br />

FOR OFFICE USE<br />

Date received – 1 Date received – 2 Date received – 3<br />

PART A:<br />

Statutory Business Income<br />

[Declare in Ringgit Malaysia(RM) currency]<br />

STATUTORY INCOME, TOTAL INCOME AND CHARGEABLE INCOME<br />

Business Code<br />

A1 Business 1<br />

>><br />

A2 Business 2<br />

>><br />

A3 Business 3<br />

>><br />

A4 Business 4<br />

>><br />

A5<br />

Business 5 + 6<br />

and so forth >><br />

Amount (RM)<br />

_>>_>>_>><br />

, , ,<br />

_>>_>>_>><br />

, , ,<br />

_>>_>>_>><br />

, , ,<br />

_>>_>>_>><br />

, , ,<br />

_>>_>>_>><br />

, , ,<br />

1